2023

National

Trade Survey

Working for business.

Working for Australia

Telephone 02 6270 8000 | Email [email protected] | Website www.acci.com.au

Media Enquiries

Telephone 02 6270 8020 | Email [email protected]

Canberra Office

Commerce House

Level 3, 24 Brisbane Avenue

Barton ACT 2600

PO BOX 6005

Kingston ACT 2604

Melbourne Office

Level 3, 150 Collins Street

Melbourne VIC 3000

Perth Office

Bishops See

Level 5, 235 St Georges Terrace

Perth WA 6000

ABN 85 008 391 795

© Australian Chamber of Commerce and Industry 2023

This work is copyright. No part of this publication may be reproduced or used in any way without acknowledgement to the Australian

Chamber of Commerce and Industry.

Disclaimers & Acknowledgements

The Australian Chamber of Commerce and Industry (ACCI) has taken reasonable care in publishing the information contained in this

publication but does not guarantee that the information is complete, accurate or current. In particular, ACCI is not responsible for the

accuracy of information that has been provided by other parties. The information in this publication is not intended to be used as the

basis for making any investment decision and must not be relied upon as investment advice. To the maximum extent permitted by law,

ACCI disclaims all liability (including liability in negligence) to any person arising out of use or reliance on the information contained in

this publication including for loss or damage which you or anyone else might suffer as a result of that use or reliance.

4

5

6

8

10

12

13

14

16

18

Contents

03

About

Foreword

Company profile

Key trade markets

Managing international market risks

Trade challenges

Trade administration

Trade support services

Trade agreements

ACCI's recommendations

Barriers to starting importing or exporting

7

Where do business get information about new international trade opportunities

16

16

17

17

15

ACCI 2023 National Trade Survey

Goods traders - experiences obtaining trading documents

Goods and services traders - experiences with trade administration organisations

Impact of trade agreements for business

Usefulness of existing trade agreements

Support for current Australian Government trade negotiations

Trade negotiation priorities

13

13

Australian Chamber of Commerce and

Industry (ACCI)

04

Australian Centre for International Trade

and Investment (ACITI)

ANZ provides world-class banking solutions for

which we are highly awarded. We aim to be the

best bank in the world for customers driven by

regional trade and capital flows; providing support

to local and global businesses looking to connect

with growth opportunities across Asia Pacific and

beyond.

We help our customers capitalise on the

movement of money and goods across the region

by leveraging our extensive network of banking

specialists and experts spanning 30+ markets

around the world, including an on-the-ground

presence in 13 markets across Asia.

Our banking solutions are tailored to suit your

needs on a local, regional or global level. We

harness the power of innovation and technology

to bring you fast, secure and world-class digital

platforms. Bank with us and you’ll be partnered

with a dedicated ANZ relationship team that will

connect you to our thought leaders and banking

specialists across ANZ.

About

The Australian Chamber of Commerce and

Industry represents hundreds of thousands of

businesses in every state and territory, and across

all industries. Ranging from small and medium

enterprises to the largest companies, our network

employs millions of people. In all, ACCI represents

more than 400,000 businesses in its network.

We also bring the voice of Australian business to

the international forums where policies are made,

as the exclusive Australian partner of the

International Chamber of Commerce, Business at

OECD, the International Organisation of

Employers and regional organisations across the

Indo-Pacific.

ACCI strives to make Australia the best place in

the world to do business – so that Australians

have the jobs, living standards and opportunities

to which they aspire.

We seek to create an environment in which

businesspeople, employees and independent

contractors can achieve their potential as part of a

dynamic private sector. We encourage

entrepreneurship and innovation to achieve

prosperity, economic growth and jobs.

We focus on issues that impact on business,

including economics, trade, workplace relations,

work health and safety, and employment,

education and training.

We advocate for Australian business in public

debate and to policy decision-makers, including

ministers, shadow ministers, other members of

parliament, ministerial policy advisers, public

servants, regulators and other national agencies.

We represent the broad interests of the private

sector rather than individual clients or a narrow

sectional interest.

The Australian Centre for International Trade and

Investment is an independent not-for-profit,

nonpartisan organisation. It is dedicated to

advancing Australia's international economic

engagement by facilitating access to information,

fostering networks across business, government,

academe and civil society, and conducting and

promoting research and analysis on trade and

investment issues of national importance.

ANZ

Andrew McKellar

Chief Executive Officer, ACCI

Foreword

05

The Australian Centre for International Trade and

Investment (ACITI) is pleased to partner with ACCI

in delivering the sixth National Trade Survey.

The survey was undertaken as Australia’s trading

businesses confront the ongoing fall out of the

economic impacts of COVID-19 measures, high

inflation and rising interest rates, tight labour

markets, supply chains yet to find a new normal,

war in Ukraine, emissions reduction measures,

major transitions in energy markets, and ongoing

geostrategic tensions between the United States

and China.

The standout finding from ACCI’s sixth National

Trade Survey is the ingenuity and perseverance of

Australia’s trading businesses in navigating the

challenges thrown at them over the past three

and a half years. While government and industry

association support helped, the unique

operations of each business required them to

innovate and adapt as circumstances changed.

Australian trading businesses proved themselves

adept at managing risks and uncertainty.

The 2023 National Trade Survey reflects the views

of a representative sample of small, medium and

large businesses, from all of Australia’s states and

territories. It includes the views of goods and

services trading businesses from all of the major

traded sectors.

This year’s survey reinforced a number of findings

from earlier surveys but also includes new

findings that show trading businesses responding

and adapting to the new international trade

environment.

ACCI is the voice of Australian business, both in

Australia and internationally.

In addition to our deep connection to Australian

businesses in every state and territory and across

the Australian economy, ACCI brings the voice of

Australian business through our partnerships

with the International Chamber of Commerce,

Business at OECD, the International Organisation

of Employers and regional organisations across

the Indo-Pacific.

This year’s National Trade Survey – the sixth ACCI

has conducted – makes for interesting reading for

business, policy-makers and all Australians.

In these challenging times, it has never been

more important to have a read on what is

happening in the real economy. Our network

provides an unrivalled view of these issues.

For the first time, this year’s survey asked

specifically about how firms are managing their

international market risk.

While some findings are new – such as the shift

towards the United States as a priority market for

respondents – other findings confirm the reality

we know instinctively: Australia’s businesses are

dynamic, adaptive and proactive in seeking to

manage the particular headwinds in their

industries.

But it also reveals that there is more that can be

done to make the most of Australia’s trading eco-

system. ACCI will be a constructive voice for

business to make the most of these

opportunities. In that spirit, this document sets

out five broad themes we can work together on.

Lastly, we thank ANZ for their support in making

this project possible. ANZ is a partner for

Australian businesses right throughout the

economy, and a fitting partner for ACCI in

bringing the voice of Australian business to life

through this project.

Dr Prudence Gordon

Executive Director, ACITI

ACCI 2023 National Trade Survey

06

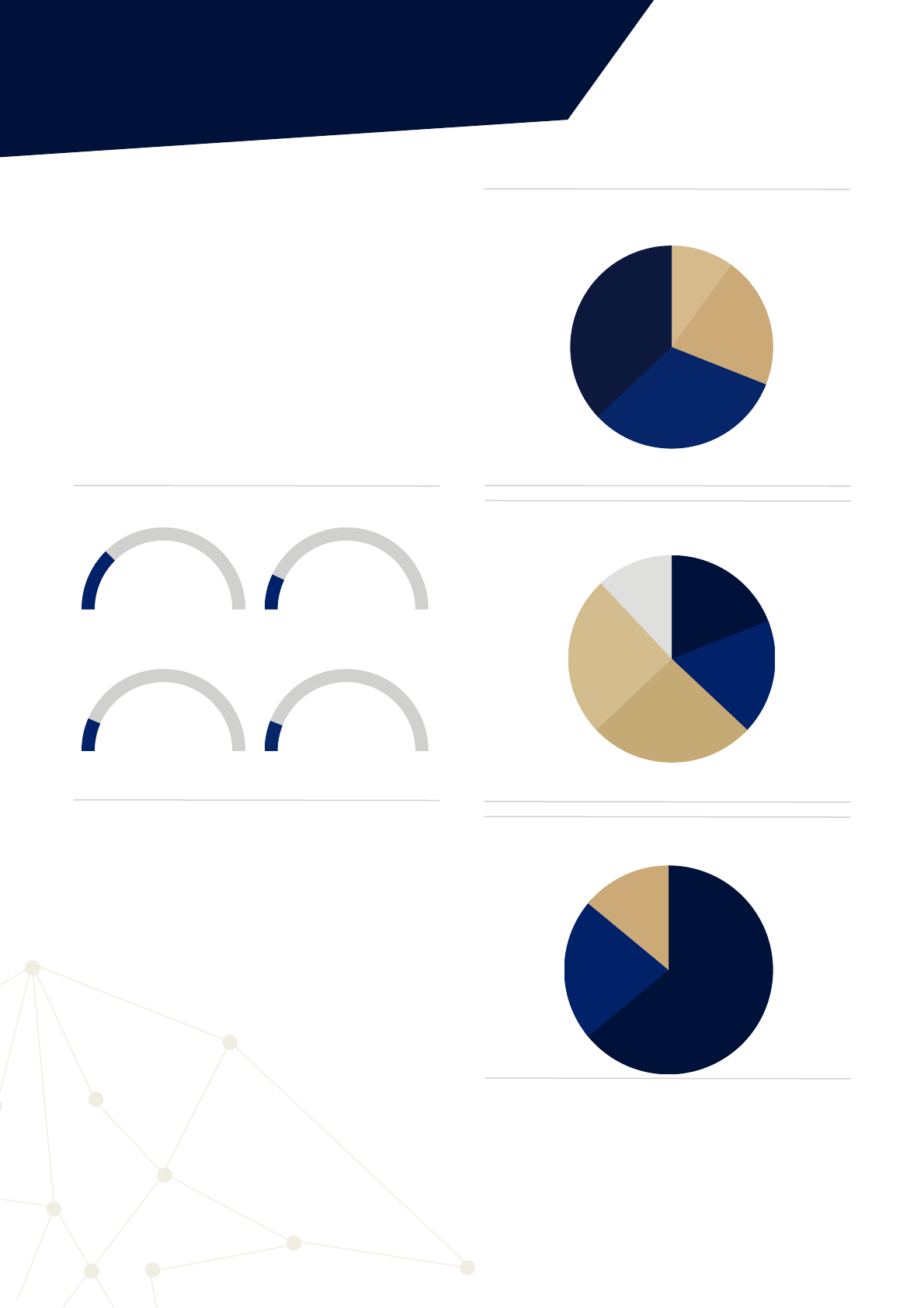

20 to 199

37%

5 to 19

32%

1 to 4

21%

200 or more

10%

$2m to $10m

26%

$10m to $100m

25%

< $500,000

19%

$500,000 to $2m

18%

> $100m

12%

Goods

64%

Services

22%

Goods and services

14%

Company profile

ACCI’s 2023 National Trade Survey presents the

perspectives and concerns of a broad cross-

section of Australian international trading

businesses. It represents the views of small,

medium and large businesses, from all Australian

states and territories, and across goods and

services businesses in all major traded sectors.

The survey was completed by 154 companies and

follow-up qualitative interviews were conducted

with 10 of those companies.

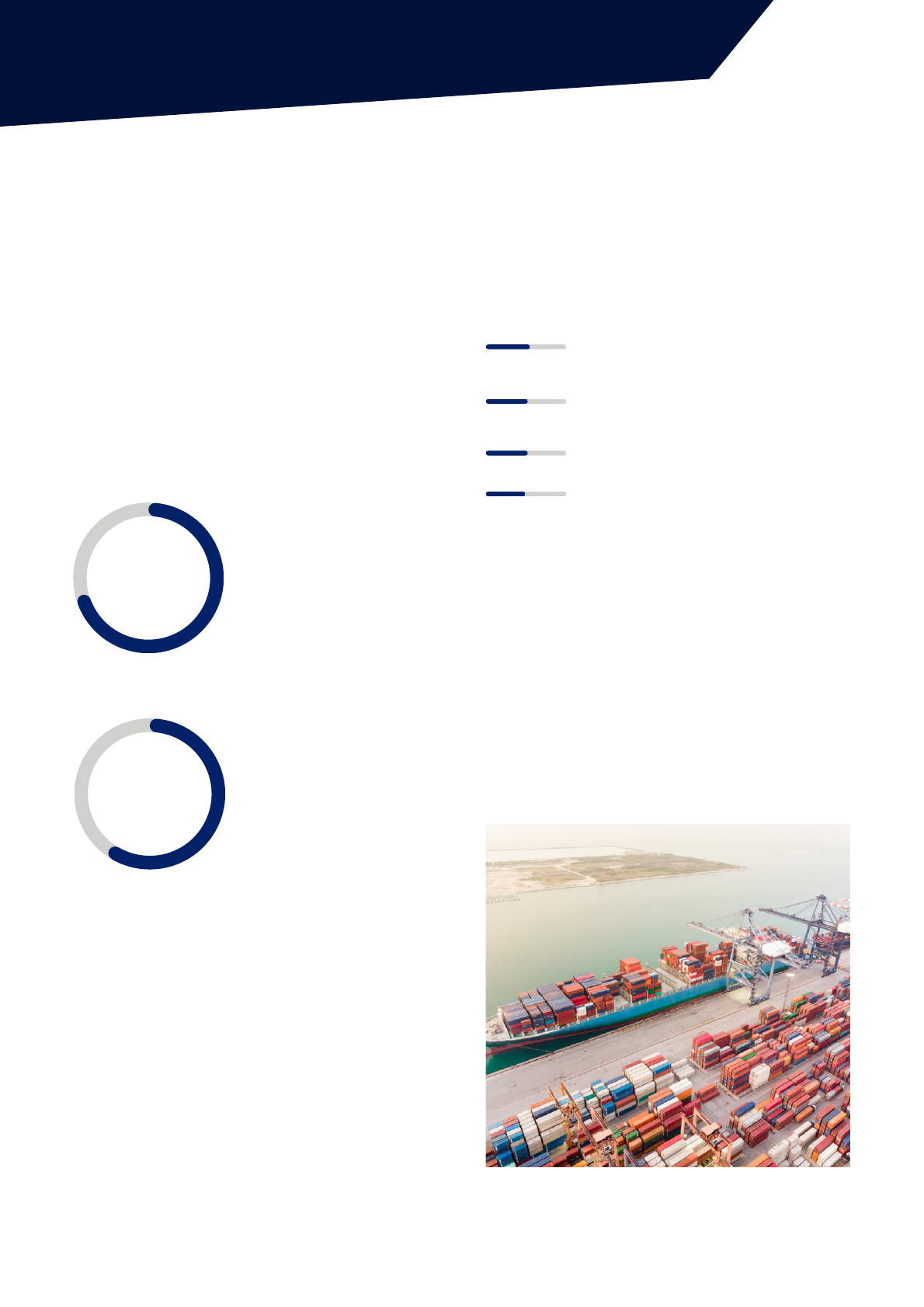

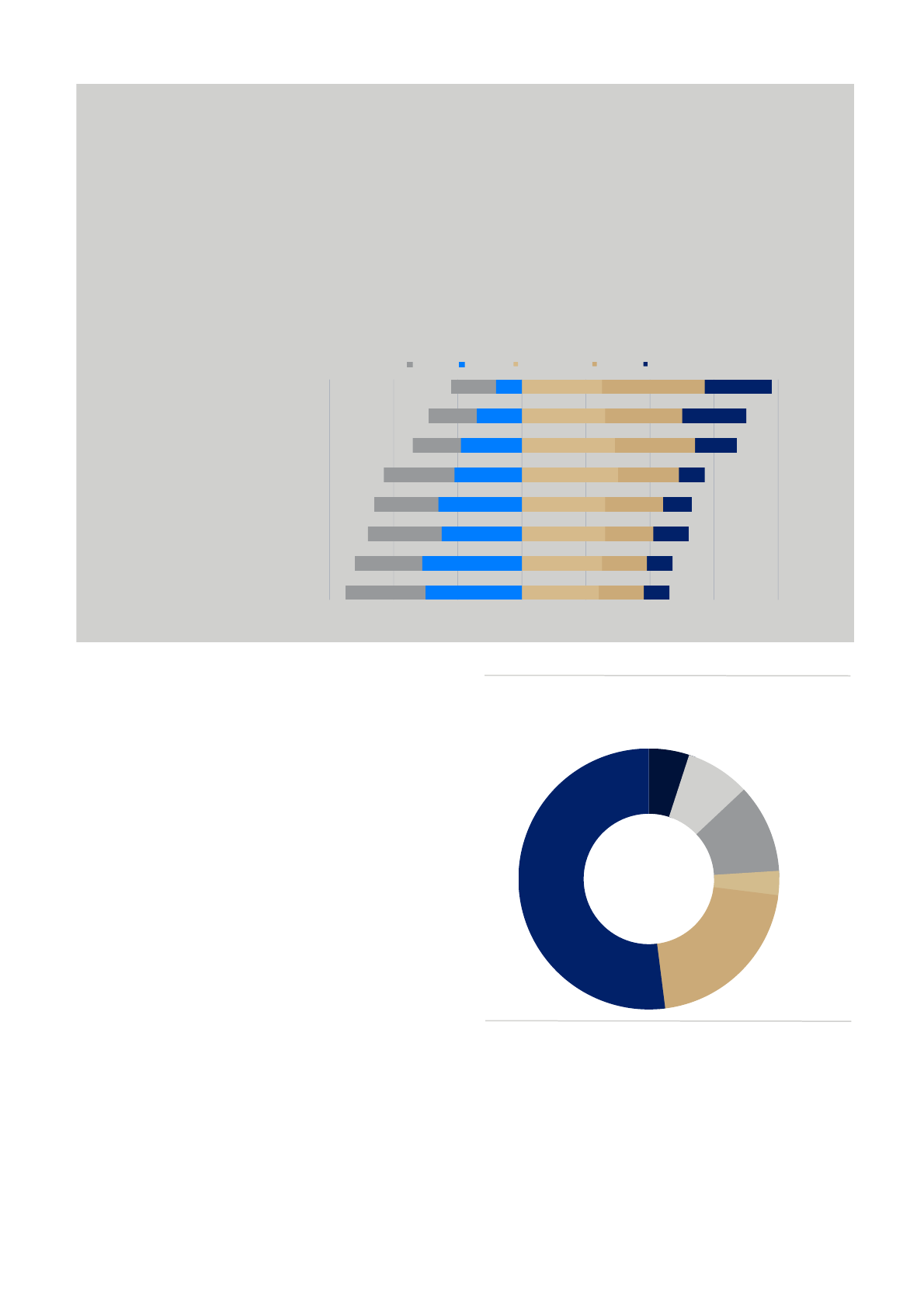

Company size by number of employees

Company size by turnover (AUD)

Types of product traded

25% 14%

13% 12%

Manufacturing Agriculture

Wholesale trade

Professional services

Retail trade, construction, tourism, mining,

transport, postal and warehousing,

accommodation and food services, financial

services, education and training, legal or dispute

resolution services, information media and

telecommunications, administrative and support

services, and arts and recreation services are also

reflected in the data.

Sectors

07

Barriers to starting importing or exporting

This year, the survey sought information from companies that either had engaged in trade before but

were no longer trading internationally and those that had never traded, to gain insights on key barriers

to going global. Fifteen per cent of respondents fall within this category.

Major reasons provided by these businesses are:

State or territory of primary operations

VIC

23%

NSW

21%

QLD

19%

WA

13%

ACT

8%

TAS

7%

SA

6%

NT

3%

How businesses engage in international trade

We don't have enough information on how to trade in

international markets

Estimated returns do not justify the investment

The business is profitable enough without needing to

access international markets

The business tried to import/export and found it too

difficult

International trade is too risky

I’ve avoided getting into export just

because of all the heartache and pain

that goes along with that … the quality

assurance, compliance, the regulations,

any of those sort of problems, we just

don’t have the bandwidth to deal with

that sort of stuff.

Small manufacturer, South East Queensland

For some, the challenges of international trade

were perceived to be too great.

ACCI 2023 National Trade Survey

Export

34%

Import

7%

Export and

import

27%

Neither

export nor

import

15%

Ancillary

support services

17%

38%

33%

19%

5%

5%

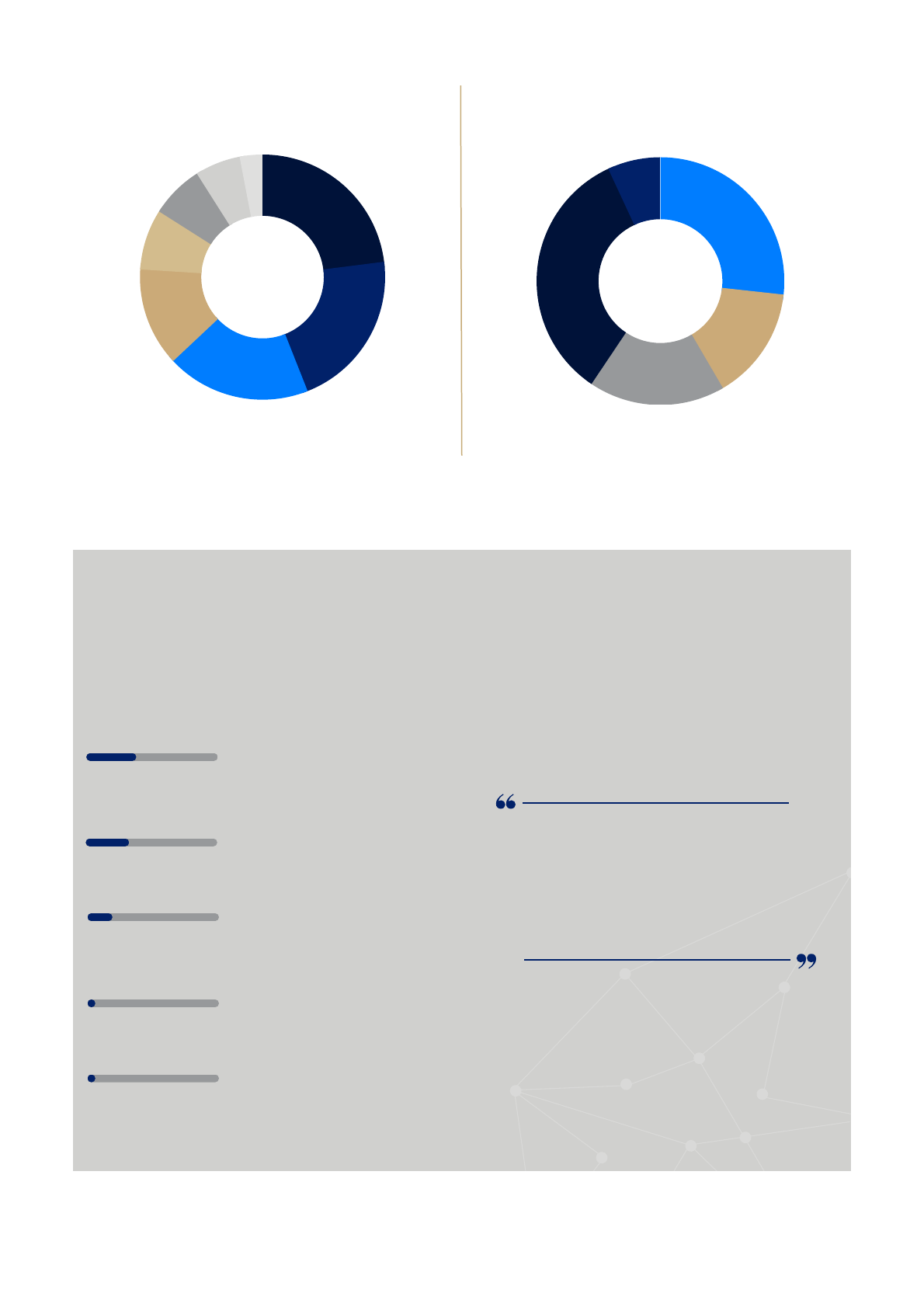

USA

China

Singapore

New Zealand

UAE

Japan

UK

Malaysia

India

Taiwan

Thailand

Hong Kong

Vietnam

Germany

South Korea

Indonesia

Canada

Mexico

Brazil

50%

40%

30%

20%

10%

0%

USA China Singapore New Zealand UAE

2014 2015 2016 2018 2021 2023

8

6

4

2

0

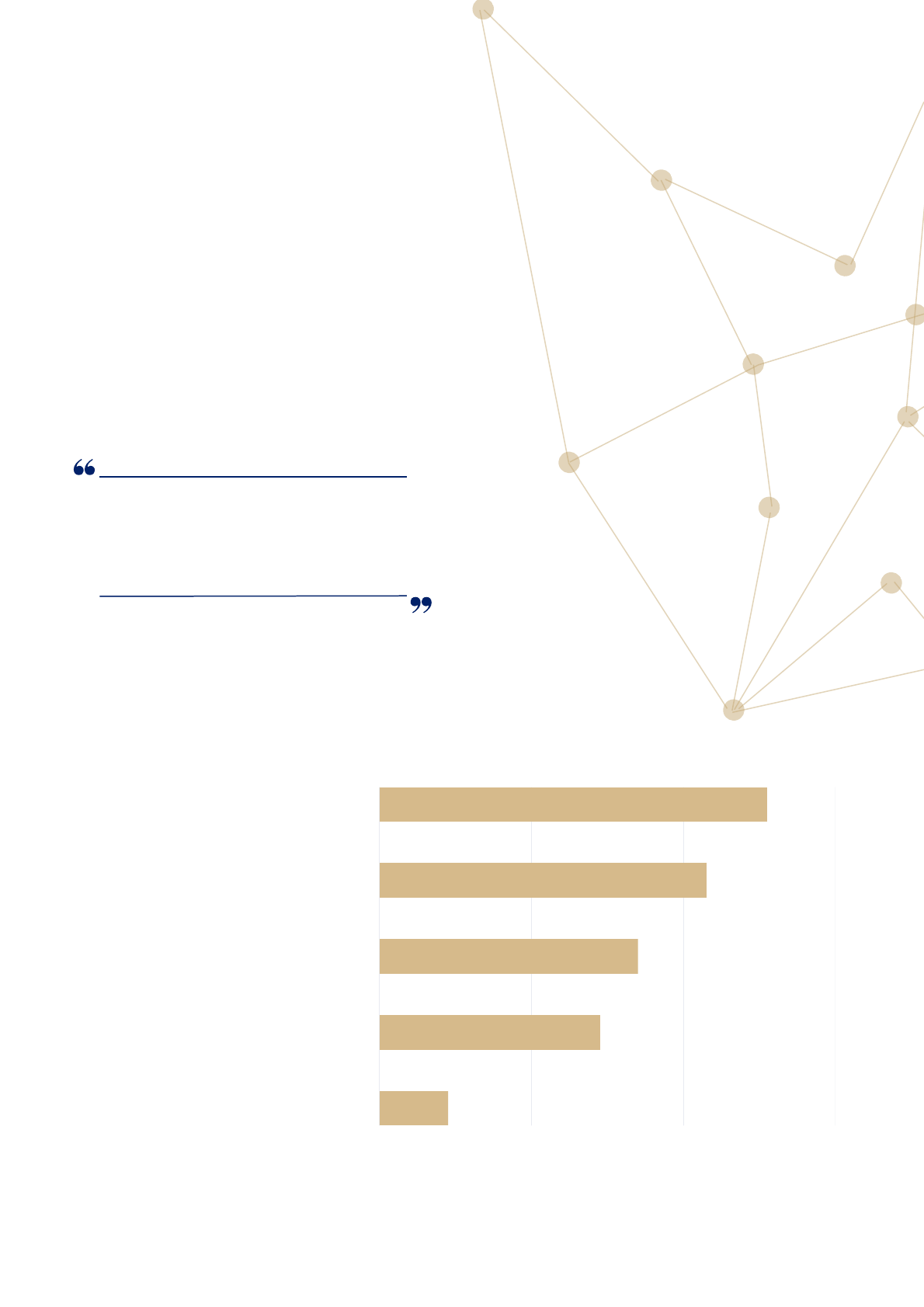

The survey asked respondents to list all markets

with which they trade.

For the first time, the United States has outstripped

China as the most common trade market for survey

respondents.

China topped the list in all previous National

Trade Surveys.

The fall in China’s ranking is noteworthy

considering China’s imposition of trade barriers in

2020 on a number of Australian exports including

barley, wine, coal, lobster and beef.

08

Key trade markets

Major markets in 2023

50

43

42

38

36

35

35 35

32

31

31

30

29

28

26

26

26

10

9

Ranking of markets over time

Ranking

0

2

4

6

8

09

ACCI 2023 National Trade Survey

Image

ACCI’s longitudinal data demonstrates the long-

term consistency in Australian key trade markets.

This data confirms that Australia’s trade relations

extend significantly beyond its current and

prospective Free Trade Agreement partners, including

in the Middle East, South Asia, Africa and South

America.

In addition to the 19 economies included in the

survey as options as export markets and/or

import sources, other markets listed by

respondents include: Argentina, Bahrain,

Bangladesh, Belgium, Brunei, Democratic

Republic of the Congo, Denmark, Egypt, Ethiopia,

Fiji, Finland, France, Guinea, Ghana, Italy, Iran,

Ireland, Jordan, Kiribati, Kuwait, Lebanon, Mali,

Mongolia, Morocco, Netherlands, New Caledonia,

Papua New Guinea, Pakistan, Peru, Philippines,

Qatar, Saudi Arabia, Spain, Solomon Islands, Sri

Lanka, Sweden, Switzerland, Tanzania, Trinidad

and Tobago, Turkey, Vanuatu and Yemen.

This diversity of trade markets, while indicative

only, reinforces the finding below that market

diversification was the most used strategy for

managing international market risk.

This breadth of Australian trade interests

potentially explains why the update and reform of

World Trade Organization agreements was the

most commonly selected top negotiation priority

for government according to survey respondents.

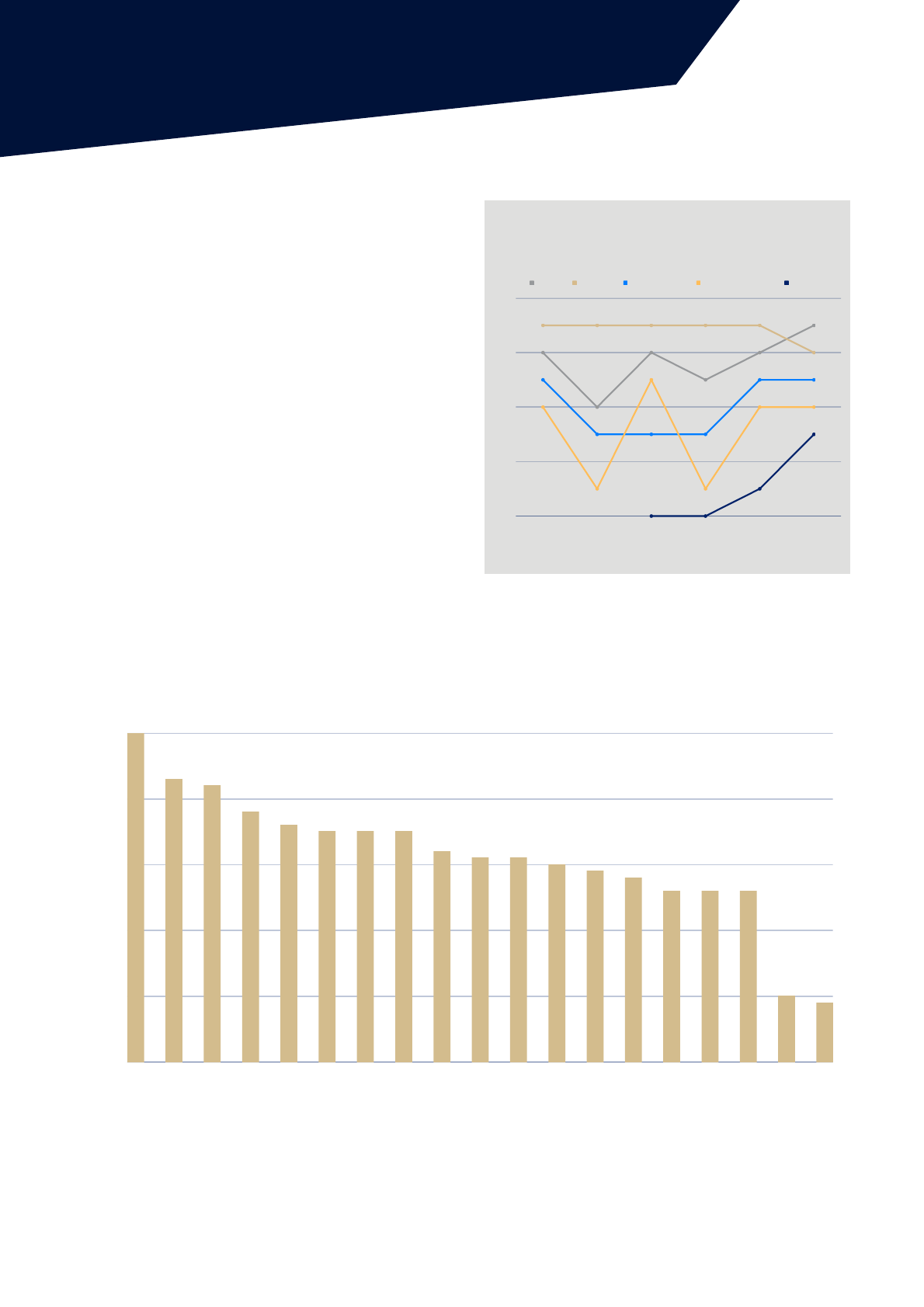

71%

60%

55%

52%

52%

49%

Image

This year’s survey included new questions seeking

insights on how trading businesses managed

international market and supply chain risks. These

questions were posed in light of the uncertainty

and disruption caused by COVID-19 measures,

geopolitical tensions and Chinese trade barriers,

and the real and potential impact of carbon

emissions reduction measures.

Geopolitical tensions and market diversification are

front of mind for Australian trade businesses.

Asked how concerned respondents were by the

need to diversify markets, geopolitical tensions

and proposed carbon border adjustment

mechanisms.

Managing international market risks

Fewer respondents identified preparing for

carbon border adjustment mechanisms as a

major or moderate concern (38 per cent). This will

be worth monitoring in future surveys. It may be

that this is a less pressing concern prior to the

European Union's CBAM entering into effect.

identified the need to diversify

markets as either a major

concern or moderate concern.

identified geopolitical

tensions as either a major

concern or moderate concern.

The survey suggests that Australian trading

businesses are proactive in seeking new customers

and markets to help manage international market

risk.

In response to the question of what measures

businesses are adopting to manage their

international market risk:

10

These findings suggest Australian trading

companies are highly active in seeking new

customers and markets to help manage

international market risk.

Other options adopted by trading businesses to

manage risk included expanding to direct to

consumer online sales, part paying the freight on

trial export shipments, covering the cost of

shipping in order to attract new buyers and

increased scrutiny of contract wording.

of respondents had increased marketing

in new international markets.

had increased marketing in existing

international markets.

had increased sales in Australia.

said they had developed new products

to help manage international market

risk.

A lot of our customers are going through like a

‘once bitten twice shy’. So many of them are

looking at onshoring. We’re seeing a lot more

projects that customers are willing to wear a

higher cost if they can guarantee local supply.

While Australian trade businesses are adaptive, their

options to adapt are often more constrained.

Options for managing the risks of supply chain

disruptions were more limited with 29 per cent of

respondents having no options for managing

international shipping and logistics supply chain

risks. The most used option was simply to pay

more for the services that were available.

Other options for managing supply chain

disruption noted by respondents included

sourcing inputs via the retail market at sometimes

double the price of normal supplies, and setting

up production and manufacturing facilities in the

destination market.

Small manufacturer, South East Queensland

0% 20% 40% 60%

Paid more to secure supply chain services

Found alternative supply chain services

Moved to supply/source from Australian customers/suppliers

None - no alternatives were available

Other

Managing international shipping and logistics-related supply chain risks

11

ACCI 2023 National Trade Survey

51

43

34

29

9

Minor concern No concern Moderate concern Major concern

-80% -60% -40% -20% 0% 20% 40% 60% 80%

Exchange rate too low

Migration levy

Subsidies for competitors

Commercial disputes

Corruption in international markets

Exchange rate too high

Intellectual Property disputes

Enforcing contracts

Skilled migration

Market entry/access

Progress on free trade agreements

Ability to service international markets

Red tape

New product development

Skills shortage

International competitiveness

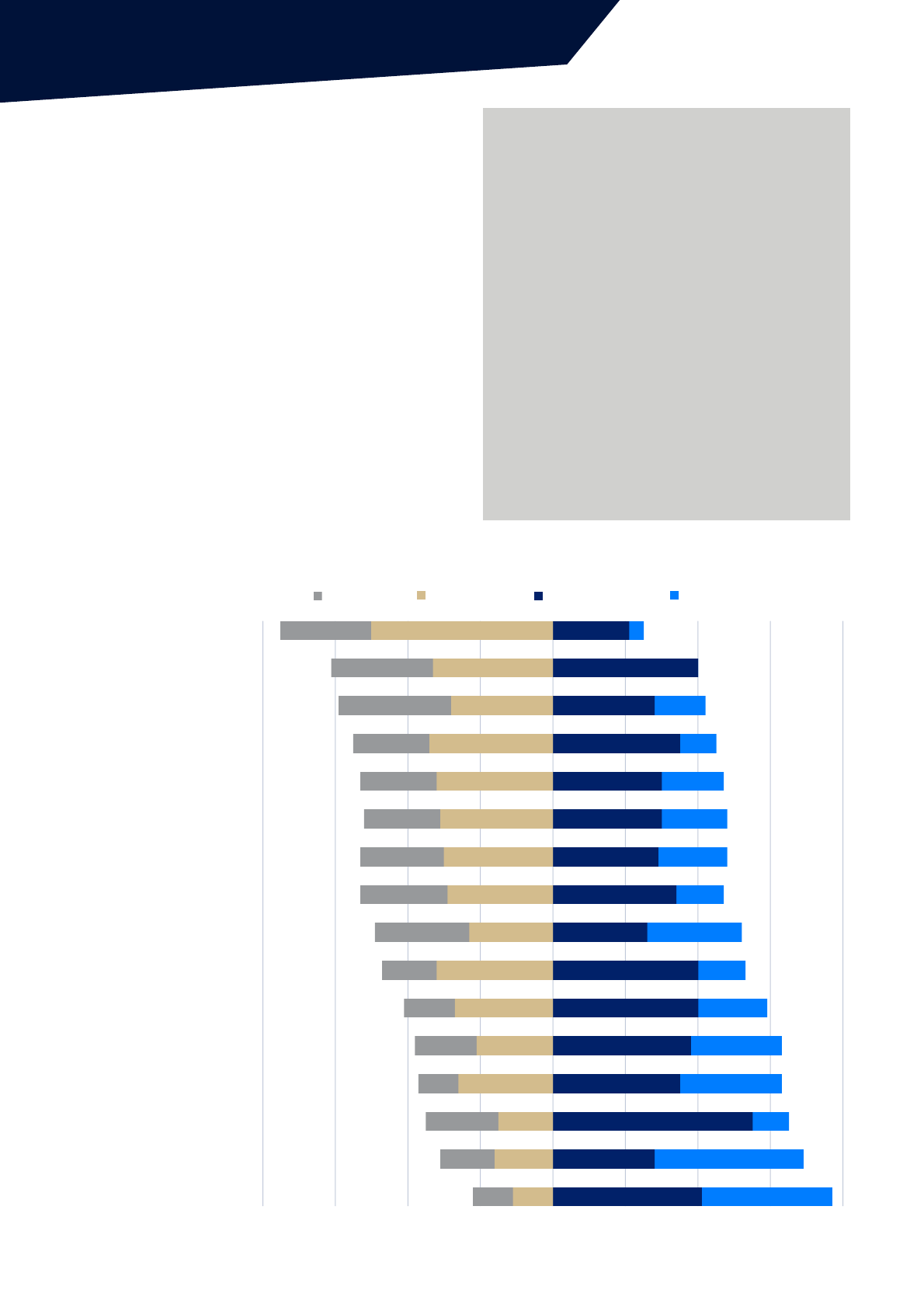

Past National Trade Surveys have provided

valuable information on the key challenges facing

Australian trading businesses.

Between 2014 and 2021, international

competitiveness was the principal trade concern

identified. The 2023 survey identified skills

shortages as the most significant major concern,

but international competitiveness was again

identified as the issue causing both major and

moderate concern for both goods and services

trading businesses.

International competitiveness remains the most

common concern of Australian trade businesses, but

skills shortages are most often cited as a major

concern.

Trade challenges

Key trade concerns impacting trading businesses - goods and services

Specifically for businesses trading in goods, supply

chain issues are the most common significant

concern, with 90 per cent of survey respondents

ranking shipping and logistics as a major or

moderate concern.

Customs and border crossing costs are the second

most cited concern (67 per cent), with non-tariff

barriers and tariffs on imports and exports also

identified as significant concerns.

The challenges of transporting goods across border

are well known, with the Simplified Trade System

Implementation Taskforce established to address

such barriers. At present, regulations that impact

cross-border goods movements are administered by

more than 28 federal government agencies.

12

Challenges for goods businesses

No concern Minor concern

Trade administration

Goods traders – experiences obtaining trading documents

Trade documentation assists traders to access the benefits of trade agreements, enables passage of products

across borders and provide assurance about product quality. This survey asked respondents for experiences

in obtaining trade documentation and associated services. Owing to the diversity of products and their trade

documentation needs, the level of engagement varies considerably. Certificates of origin were ranked the

highest in terms of user experience, both under free trade agreements and for markets without them.

Z

Goods and services traders - Experiences with trade administration organisations

Respondents in both goods and services categories were also asked to rate their experience with a list of

government and non-government organisations providing trade administration services. Of those listed,

traders rated shipping and logistics companies most highly, ahead of government agencies.

13

ACCI 2023 National Trade Survey

-75% -50% -25% 0% 25% 50% 75%

Shipping and logistics companies

Department of Foreign Affairs and Trade

Department of Home Affairs (border protection/customs)

Courier companies

Australia Post

Department of Agriculture, Fisheries and Forestry

Department of Home Affairs (immigration)

-100% -75% -50% -25% 0% 25% 50%

Non-preferential Certificates of Origin

Trade agreement Certificates of Origin

Incoterms 2022

Pre-shipment Inspection Certificate

Department of Agriculture (AQIS) certificates

Certificates of Free Sale

Health certificates

Home Affairs

Non-tariff barriers

Consular legalisation / endorsement

Halal certificates

N/A

Poor Average Good

Excellent

ExcellentGoodAveragePoorN/A

Sometimes Often Always Rarely Never

-100% -75% -50% -25% 0% 25% 50% 75%

Chambers of commerce or industry associations

Austrade's Export Market Development Grants (EMDG) scheme

State government trade promotion agency

Austrade's trade missions

Austrade's digital services (export.business.gov.au)

Austrade's in-market Tailored Services

TradeStart program

DFAT 'Business Envoy' publication

EFA (formerly EFIC) trade finance products

14

Sometimes Often AlwaysRarely

Trade support services

Use of trade support services

Australian governments at the federal, state and

territory level, industry associations and

commercial providers invest significant resources

in supporting Australian businesses to identify

and capitalise on international trade

opportunities.

A key component of the National Trade Survey

has been to provide an indicator of the uptake

and value of these services for Australian

business.

Never

All past National Trade Surveys highlighted the large

number of respondents who never employed

government trade support services. The 2023 survey

reinforces this finding.

Use of trade support services

Between 57 and 77 per cent of respondents

indicated they never used federal government

trade support services. Forty-nine per cent

indicated they never used state and territory

government trade support services. Fifty-four per

cent of respondents said they sometimes, often

or always used trade support services provided

by chambers of commerce or industry

associations.

This finding would suggest there is scope to

amplify government investment in trade support

services to business by working more closely with

chambers of commerce and industry

associations.

N/A

52%

Neither easy nor difficult

21%

Easy

11%

Difficult

8%

Very difficult

5%

Very easy

3%

Never Rarely Sometimes Often Always

-60% -40% -20% 0% 20% 40% 60% 80%

Online

Private market visits

Industry associations

Austrade

State government agencies

Chambers of commerce

Newspapers/professional publications

Participating in trade missions

Ease of accessing trade finance

Sources of information on new international trade opportunities

Businesses draw upon a range of information sources when gathering market intelligence and

considering potential trade opportunities.

The findings suggest that businesses pursue new opportunities independently or with the

assistance of sector-specific information. Online resources remain the most commonly used

sources of information, with self-directed private market visits outranking participation in

government-arranged trade missions.

Where do businesses get information about new international trade opporunities?

15

ACCI 2023 National Trade Survey

Use of trade finance products

Specific trade finance products exist to finance

transactions and to assist businesses to manage

risks in their trading environment, particularly

when entering new and unfamiliar markets.

Relative to business loans, trade finance products

can provide access to cheaper debt, the ability to

finance a larger proportion of the overall

transaction and to free up business loans for

other operational or productive investments.

Notwithstanding business concerns about the

current international market risks demonstrated

in this survey. A majority of respondents to this

survey continue to consider trade finance

products inapplicable to their business.

This suggests that business loans continue to be

used instead and may indicate a knowledge gap

about the uses of trade finance products.

Trade agreements

Trade agreements assist business in multiple

ways. These include reducing and/or removing

tariffs and quotas and removing, simplifying or

harmonising trade administration and services

trade regulations. Trade agreements can increase

the accessibility of information on trade-related

regulations and processes, and establish

processes for resolving trade disputes.

The National Trade Survey provides a useful

indication of the value placed on trade

agreements by Australian trading businesses. A

consistent finding across the previous five

National Trade Surveys is that trade agreements

are not well understood by businesses but they

are keen to better understand them.

Impact of trade agreements for

business

Respondents were asked about the perceived

impact of trade agreements in terms of improved

market access, operational savings and increased

ability to employ.

The 2023 survey indicates wide variability in the

value placed on trade agreements by business. In

terms of the overall impact of Australia’s current

trade agreements on business, rated from 1

(lowest impact) to 5 (highest impact), with

respondents relatively evenly spread between the

5 rankings from lowest to highest impact.

16

-80% -60% -40% -20% 0% 20% 40% 60% 80%

Peru-Australia FTA

Australia-Chile FTA

Pacific Agreement on Closer Economic Relations (PACER)

Regional Comprehensive Economic Partnership Agreement

Australia-Singapore Digital Economy Agreement

Australia-Singapore Green Economy Agreement

Comprehensive and Progressive Agreement for Trans-Pacific Partnership

WTO Agreements

Australia-India Economic Cooperation and Trade Agreement

Indonesia-Australia Comprehensive Economic Partnership Agreement

Australia-New Zealand Closer Economic Relations Trade Agreement

Singapore-Australia FTA

Australia-Hong Kong FTA

Malaysia-Australia FTA

Australia-United States FTA

Japan-Australia Economic Partnership Agreement

Korea-Australia FTA

Thailand- Australia FTA

ASEAN-Australia-New Zealand FTA

China-Australia FTA

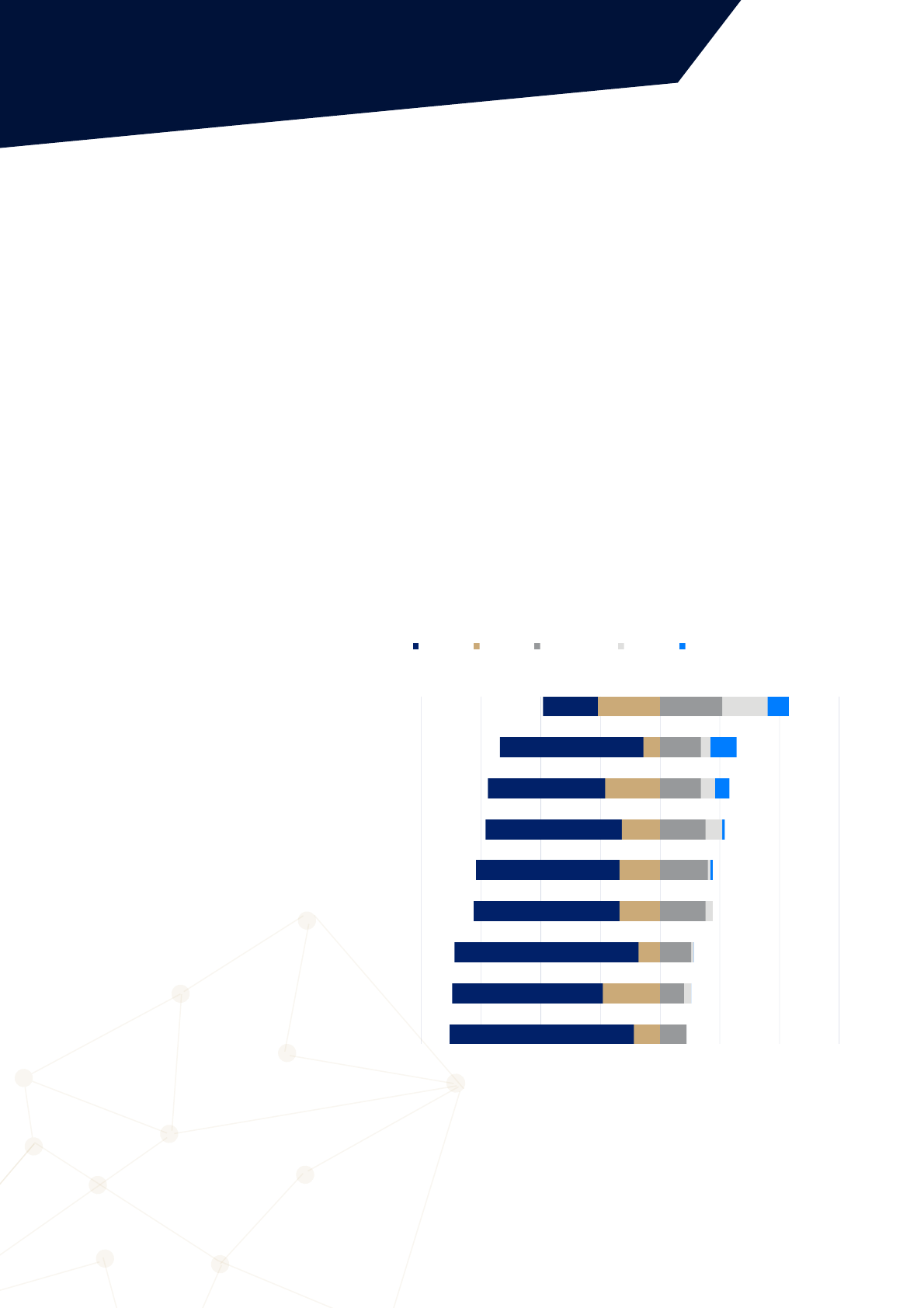

Usefulness of existing trade agreements

Usefulness of existing agreements

Reinforcing the findings of previous years, this

National Trade Survey finds that a large number

of respondents have either never heard of specific

trade agreements or do not find them useful.

In this category, the Peru-Australia Free Trade

Agreement ranks lowest with 41 per cent of

respondents having never heard of the agreement

and 35 per cent not finding it useful. In contrast,

63 per cent found the China-Australia Free Trade

Agreement either slightly (17 per cent), somewhat

(15 per cent) or very (31 per cent) useful.

The survey confirms that the perceived usefulness

of agreements broadly aligns with Australia’s

trade patterns. However, it suggests that

understanding of the usefulness of large

multilateral trade agreements – such as the

Regional Comprehensive Economic Partnership

(RCEP) and the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership

(CPTPP) – are lagging behind. ACCI’s own trade

agreement utilisation data confirms this finding.

The new free trade agreement with India, which

entered into force in December 2022, is showing

strong early signs of business awareness. Future

surveys will provide a stronger indication of actual

business experiences with the agreement.

Slightly useful Somewhat useful

Very useful

Not useful

Never heard of it

Support for current Australian Government trade negotiations

While understanding and awareness of trade agreements is low, and their usefulness rating variable,

respondents indicated relatively strong support for the negotiation of new trade agreements.

Australia’s current negotiations with the European Union ranked the highest with 64 per cent of

respondents indicating they were in favour of the negotiation.

Interestingly, 51 per cent of respondents were in favour of negotiations to update and reform the World

Trade Organization, a body generally poorly understood by Australian businesses.

Trade negotiation priorities

Respondents were also asked to rank 14 specific and general types of trade and investment

agreements they consider the Australian Government should prioritise.

The National Trade Survey confirms that the Australian Government’s current negotiation priorities are

aligned with those of Australian business.

Trade agreements with the European Union and the second tranche agreement with India ranked as

the first and third priorities overall.

However, it may be surprising that respondents selected update and reform of World Trade

Organization agreements as their second highest priority on average. Indeed, WTO reform and update

was the negotiation priority most often cited as respondents’ top priority. The highest negotiating

priorities not currently under negotiation by the Australian Government are with the Gulf Co-operation

Council and the United Arab Emirates.

Included for the first time in this survey were new, subject matter agreements such as green economy

and digital economy agreements. These generally rated lower and are currently less popular than

comprehensive preferential trade agreements for respondents, although this outcome is not surprising

considering the relative newness of these kinds of agreements. Future surveys will provide a useful

indication of the value of these kinds of agreements for business.

17

ACCI 2023 National Trade Survey

Support for new trade agreements

-50% -25% 0% 25% 50% 75%

Australia-European Union Free Trade Agreement

Australia-India Comprehensive Economic Cooperation Agreement

Australia-United Arab Emirates Comprehensive Economic Partnership Agreement

Update and reform of World Trade Organization agreements

Indo-Pacific Economic Framework

Australia-Gulf Cooperation Council Free Trade Agreement

No Don't know what this is Indifferent Yes

ACCI's recommendations

Take action to ease skills shortages

The 2023 National Trade Survey indicates how Australia can invest in a better trade future.

Skills shortages are the issue most often identified as a major concern for Australian trade businesses,

impacting on their ability to trade. Urgent action is needed to address chronic skills shortages.

Invest in our domestic productivity

International competitiveness is once again the top concern of Australian trading businesses. Addressing

inefficiency in our maritime shipping and logistics system, and addressing uncompetitive tax, workplace

relations and energy policy settings are vital to enhancing the position of Australian businesses in

competitive international markets.

Modernise our trade systems and reduce red tape

The Australian Government has invested heavily in the Simplified Trade System Implementation Taskforce –

we must see it deliver commercially meaningful results or risk being left behind our trading partners.

Make government support and information sources more accessible and relevant to

contemporary international market risks

The 2023 National Trade Survey shows that businesses are attuned to their need to diversify and adapt to

geopolitical tensions and supply chain disruptions. Nevertheless, the survey shows that there are

opportunities to rationalise the sources of government support so that businesses know where to access

the support they need when they need it.

Adopt a Team Australia approach to get Australia trading

Trade businesses value and trust the services they receive from chambers of commerce and industry

associations. Governments, chambers of commerce and industry associations can work together more

closely to ensure government supports and communicated effectively to trading businesses and to ensure

government advocacy meets genuine industry needs.

18

ACCI members

State and Territory Chambers

Industry Associations

19