Customer Manual:

International Registration

Plan (IRP)

Washington State

Department of Licensing

dol.wa.gov

We are committed to providing equal access to our services.

For information visit dol.wa.gov/access (TDD/TYY call 711).

January 2021

1

Table of Contents

General Information and Introduction ....................................................................................................................... 3

New Accounts ............................................................................................................................................................

5

Cab Cards and License Plates .................................................................................................................................... 6

IRP Applications & Instructions ................................................................................................................................ 7

Completing the Mileage by Jurisdiction .................................................................................................................... 9

Renewals .................................................................................................................................................................. 10

Federal Heavy Vehicle Use Tax (Form 2290) ......................................................................................................... 12

Name Change, Unladen Weight Permit, Misc. Fuel Types ..................................................................................... 12

Trip Permits ............................................................................................................................................................. 13

IRP Jurisdictional Registration Information ............................................................................................................ 15

Washington Vehicle Registration Fees .................................................................................................................... 17

State of Washington – License Fees (Gross Weight) Schedule A ........................................................................... 18

State of Washington – License Fees (Combined Gross Weight) Schedule B .......................................................... 20

State of Washington Freight Fees (Gross Weight) Schedule A - FRT .................................................................... 22

State of Washington Freight Fees (Gross Weight) Schedule B - FRT ..................................................................... 23

Addresses and Telephone Numbers for IRP Jurisdictions ....................................................................................... 25

Additional DOL numbers and Commercial Vehicle Agencies ................................................................................ 27

Performance and Registration Information Systems Management (PRISM) .......................................................... 28

Additional Information ............................................................................................................................................ 29

Glossary of Terms .................................................................................................................................................... 31

2

3

General Information

Department of Licensing (DOL), Motor Carrier Services

Field office locations

Office hours: 8:30 a.m. to 4:30 p.m. PST Monday - Friday

Olympia Counter

405 Black Lake Blvd SW

Olympia, WA 98502

Vancouver Counter

1301 NE 136th Ave

Vancouver, WA 98663

H

eadquarters:

Phone: (360) 664-1858

Fax: (360) 570-7829

Email: MotorCarrierSe[email protected]

Office hours: 8:00 a.m. to 4:30 p.m. PST Monday - Friday

DOL

website: dol.wa.gov

Online system PRFT – Taxpayer Access Point (TAP): https://wadolprft.gentax.com/TAP/_/

International Registration Plan (IRP) website: https://www.irponline.org/

Mai

ling address

with

payments and supporting documents:

Department of Licensing

Prorate and Fuel Tax Services

PO Box 9048

Olympia, WA 98507-9048

Mai

ling address for documents

without

payments:

Department of Licensing

Prorate and Fuel Tax Services

PO Box 9228

Olympia, WA 98507-9228

Days closed - Use the next business day if the holiday falls on a week day.

New Year’s Day January 1

Martin Luther King Jr.’s Birthday 3rd Monday in January

Presidents’ Day 3rd Monday in February

Memorial Day Last Monday in May

Independence Day July 4

Labor Day 1st Monday in September

Veteran’s Day November 11

Thanksgiving 4th Thursday in November and the day after Thanksgiving Day

Christmas December 25

Introduction

What

is the International Registration Plan (IRP)?

IRP is an interstate agreement that allows payment of license fees based on fleet miles operated in various member

jurisdictions. The plates issued through this plan allow you to operate through other member jurisdictions. The other

jurisdictions have fees which are paid through your base jurisdiction.

4

T

o be an IRP member, you must have a power unit that is used or intended for use in two or more jurisdictions. The

power unit must be used for the transportation of persons for hire or designed, used, or maintained primarily for the

transportation of property.

T

he following jurisdictions are members of IRP

Alabama

Florida

Manitoba

New Brunswick

Oklahoma

Tennessee

Alberta

Georgia

Maryland

New Hampshire

Ontario

Texas

Arizona

Idaho

Massachusetts

New Jersey

Oregon

Utah

Arkansas

Illinois

Michigan

New Mexico

Pennsylvania

Vermont

British

Columbia

Indiana

Minnesota

New York

Prince Edward

Island

Virginia

California

Iowa

Mississippi

Newfoundland

and Labrador

Quebec

Washington

Colorado

Kansas

Missouri

North Carolina

Rhode Island

West Virginia

Connecticut

Kentucky

Montana

North Dakota

Saskatchewan

Wisconsin

Delaware

Louisiana

Nebraska

Nova Scotia

South Carolina

Wyoming

Dist. of

Columbia

Maine

Nevada

Ohio

South Dakota

Who can apply?

T

o apply for IRP in Washington, you must be a Washington resident or have an established place of business in

Washington. Proof is required for both and you must meet the following additional requirements:

•

Vehicles operating over 12,001 pounds

•

Vehicles having three or more axles regardless of weight

•

Vehicles used in combination exceeding 12,001 pounds

What is a non-apportionable vehicle?

Non-apportionable vehicles are: recreational vehicles, vehicles displaying restricted plates, or government owned

vehicles.

H

ow do I license my vehicle for travel into Alaska?

•

If your base registration is in Washington, you must purchase a trip permit or pay full Alaska registration fees.

•

Full registration or trip permits can be purchased at Alaska Division of Motor Vehicle offices or Alaska Ports of

Entry by presenting your current vehicle registration and payment of proper fees.

Applying for Washington IRP Account (Prorate)

Titlin

g for IRP Accounts

All vehicles added to a Washington IRP account must have the title in the exact legal name of the IRP account holder.

Either your County Auditor or an authorized local licensing agent can process vehicle titling. If you have questions

regarding titling (forms, procedures, Declaration of Use Tax), contact your County Auditor or local licensing agent.

Please inform them you are licensing with the IRP office to ensure appropriate licensing.

Fl

eets

A fleet is a truck or multiple trucks registered to an IRP account for a specific registration period. You could have more

than one fleet. Each fleet will get a specific registration number that corresponds to the expiration date. All of your docu-

mentation will have fleet numbers.

5

Registration Options for Owner-Operators who Lease Their Vehicles to Motor Carriers

Owner-Operator as the IRP account holder

The vehicle’s title and registration must have the exact legal name of the owner-operator. They will be responsible for

vehicle registration, establishing, and maintaining records for vehicles licensed through IRP.

Ca

rrier (Lessee) as the IRP account holder

The vehicle’s title and registration must have the exact legal name of the carrier, listed as the lessee, and the owner-

operator, listed as the lessor. The carrier will be responsible for vehicle registration, establishing, and maintaining records

for vehicles licensed through IRP.

Payments

What type of payments are accepted?

You may open an electronic account in TAP

– PRFT Taxpayer Access Point and pay online using your checking or

savings account information. You may also mail payments by check, money order, or cashier’s check. If paying in person,

you may use debit cards, credits cards, cash or personal/business check. Fees apply when using debit or credit cards.

Ar

e partial payments allowed?

Partial payments will be accepted, but credentials may not be issued until payment in full is received.

New Accounts

New account requirements:

• Registered with

the Secretary of State, if applicable

• Active UBI number from the Department of Revenue

• Completed International Registration Plan (IRP) Application (report actual miles if applicable)

• Active and valid USDOT number with interstate authority, visit the Federal Motor Carrier Safety Administration

at www.fmcsa.dot.gov for more information

• Current Washington Validated Copy of Record or Registration Certificate

• Leased Vehicle Listing form and a copy of the lease agreement, if applicable

• Provide a current stamped copy of the Federal Heavy Vehicle Use Tax (Form 2290) for all vehicles over 55,000

GVW. For additional requirements, see the Federal Heavy Vehicle Use Tax section.

• Completed IRP Established Place of Business, Residency, or Change of Address form. Include three proofs of

residency as listed on the form.

Al

l documentation above is required to create a new account. To submit documents:

•

Create a new IRP account on TAP,

•

Supply the documents above by mail, or

•

Take them to the Olympia or Vancouver IRP offices

.

Your Motor Carrier ID Report (MCS-150) must be updated every 2 years and filed with the Federal Motor Carrier Safety

Administration (FMCSA). We do not update this form.

Will I be able to obtain temporary operating authority for my vehicle once I have applied for a license?

New accounts are not eligible to receive temporary operating authority unless the vehicle is currently fully licensed in

Washington.

What is an established place of business?

IRP, Inc., states, “Established Place of Business means a physical structure located within the Base Jurisdiction that is

owned or leased by the Applicant or Registrant and whose street address shall be specified by the Applicant or Registrant.

This physical structure shall be open for business and shall be staffed during regular business hours by one or more

persons employed by the Applicant or Registrant on a permanent basis (i.e., not an independent contractor) for the

purpose of the general management of the Applicant’s or Registrant’s trucking-related business (i.e., not limited to

6

credentialing, distance and fuel reporting, and answering telephone inquiries).”

T

he Applicant or Registrant need not have land line telephone service at the physical structure. Records concerning

the

Fleet shall be maintained at this physical structure (unless such records are made available in accordance with the

provisions of Section 1035). The Base Jurisdiction may accept information it deems pertinent to verify that an Applicant

or Registrant has an Established Place of Business within the Base Jurisdiction.

I

f your physical or mailing address, phone, fax, or email has changed, you will need to provide a new Established Place of

Business. You will find this form on our DOL website

(www.dol.wa.gov/forms/formsprft.html).

H

ousehold Goods Carrier

For household goods carriers, there is an option to register in the base jurisdiction of the service representative or the

household goods carrier. For more information about this, visit IRP, Inc., at www.irponline.org.

R

ecord keeping

Keep records of your mileage for each registered vehicle. For audit purposes, the records must be summarized monthly,

quarterly, annually and by fleet and by jurisdiction. The records must be kept for 3 years after the close of that application

registration year. This information will be reviewed if selected for an audit. Upon request of the Department, you must

make the records available.

T

hird party representative or Service Agent

This entity works for you the account holder, but is not an employee. When they provide or request documents and infor-

mation on your behalf, they must supply a signed copy of the Power of Attorney (POA). There is a POA

form located on

our website. If you are canceling your contract, mark this on the form and resubmit including the ending date of service.

I

f choosing to use your own POA document, it must contain the following:

• Date of service

• Name of the person designated to act as the POA

• Address and signature of the person granting the POA (must be a corporate officer if business is a corporation)

• Name and address of the corporation or partnership

• Notarization of the signature of the person granting the POA

Cab Cards and License Plates

A

cab card is your registration and authority to operate in jurisdictions. The cab card takes the place of the Washington

validated copy of record (previously known as your registration) issued for your vehicle. Cab cards must be available in

the vehicle in any form that is fully legible to law enforcement. Photocopies, faxes, and digital images may be accepted.

Wh

en you receive your cab cards, please check the following information for accuracy:

• Vehicle information

• Jurisdictions and weights

• Name

• Expiration date

• USDOT number

If there are any errors, contact Motor Carrier Services immediately at (360) 664-1858. If all the information is correct,

sign the cab card where indicated.

A

ll Washington-based carriers will receive two license plates (for the front and rear of vehicle) for each power unit.

T

he plates must remain with the IRP account where they were issued and returned if a vehicle is deleted, sold, destroyed,

or removed from service. Neither the cab cards nor the plates are transferable to another person or vehicle, or transferred

when you sell the vehicle.

7

In certain circumstances, you can sign the cab card and provide it to the new owner or lessor, transferring any remaining

Washington license fee credit. The original cab card must be returned to the department when transferring the license fee

credit.

Transaction types

• Add or delete a vehicle

• Renew vehicle

• Change (Example: address, contact info., lease)

• Replace credentials (license plate, cab card, tabs)

• Increase or decrease gross weight

• Fleet transfer

Include t

he following information:

• Account number, Fleet number, Registration year

• Vehicle type

• Account name & DBA

• Type of operation

• Contact information

• Transaction type

• Business type

• Owner Equipment Number (OEN) and vehicle infor-

mation

• FEIN, UBI number, USDOT number

• Signature

Completing the International Registration Plan (IRP) Application

IRP account number

Enter your assigned 7-digit account number. If you are a new applicant, write “new” in

this area, or simply leave blank.

Fl

eet number

Enter the fleet number assigned to you. If you are a new applicant, write “new” in this

area, or simply leave blank.

R

eg year

Enter the current registration year for your application (this is normally the next year).

IR

P account

name & DBA

Your business’ legal name and DBA (doing business as) must be identical to your WA

validated copy of record.

P

hysical street address,

Enter the physical street address where the business is located including city, state, and

City, State, Zip

zip code. The business must be located in the base jurisdiction.

Mailing address

Enter the mailing address if different than the physical address including city, state, and

zip code.

C

ontact Person

Include name, telephone number, fax number, and email address

S

ervice Agent

Include name, address, telephone number, fax number, email address, and a copy of the

Power of Attorney, if applicable.

B

usiness type

Check only one business type which matches your business structure.

FEIN

Enter your 9-digit Federal Employer Identification number (FEIN).

UB

I

Enter the 9-digit Unified Business Identifier (UBI) number you received from the

Department of Revenue for operating as a business in Washington State.

USD

OT number

Enter your USDOT number (if available). This number is used to collect and monitor

owners and the vehicle’s safety fitness rating.

I

FTA number

Enter your Washington IFTA account number. If you are a new applicant, write “new”. If

leased to another Washington account, list the name and account number. If leased to an

out-of-state account, list the state abbreviation.

8

V

ehicle type

Check only one vehicle type.

T

ype of operation

Check one type of operation:

E

xempt commodity carrier (EX)

means any person operating a vehicle exempted from

the following:

a. Motor vehicles transporting exclusively United States mail, newspapers, or

periodicals.

b. Motor vehicles specially constructed for: towing disabled vehicles or wrecking and

not used in transporting goods for compensation.

c. Motor vehicles normally owned and operated by farmers in the transportation of

their own: farm, orchard, or dairy products (including livestock, plant or animal

wastes) from point of production to market.

Household Goods Carrier (HC)

means a carrier handling:

a. Personal effects and property used or to be used in a dwelling;

b. Furniture, fixtures, equipment, and property or stores, offices, museums, institutions,

hospitals or other establishments, when a part of the stock, equipment, or supply of

such stores, offices, museums, institutions, including objects of art, displays and

exhibits, which, because of their unusual nature or value, require the specialized

handling and equipment employed in moving household goods.

Private carrier (PC)

is a person who transports by his own motor vehicle, property

being bought or sold by that person.

For hire carrier (HH)

includes persons engaged in transportation of property for

compensation over the public highways of a state as brokers.

W

eight group number

Enter your assigned weight group number. If you are a new account, the IRP unit will

issue this number. In the table located on the form, enter the gross vehicle weight in

pounds for each jurisdiction you will be operating.

V

ehicle Information

Use this page to list the transaction type per vehicle and include the appropriate

(page 2 of IRP application) information based on the transaction.

Transaction type

Use the abbreviations for the types of transactions you can complete and include the

applicable documents that are listed:

•

Add a vehicle (A) – you will need the WA validated copy of record or registration,

Form 2290 (if purchased within 60 days no form is needed), lease agreement and the

leased vehicle listing (if applicable).

•

Change (C) –

o

Equipment Number (OEN), no additional documents are needed.

o

Motor carrier responsible for safety USDOT, provide the new lease agreement

and a new leased vehicle listing.

o

Corrections to vehicle information provide documents for needed changes.

•

Delete (D) –

o

With credit, provide original signed cab card.

o

Without credit, no additional documents are needed.

•

Decrease (M) / Increase (M) GVW - no additional documents are needed.

•

Renewal (R) – Form 2290 (if applicable), agreement lease agreement and the leased

vehicle listing (if applicable), plus any other transaction types.

•

Fleet transfer (F) – original signed cab card “only sign when transferring credit”

line. Washington credit will only be given

O

wner equip #

Enter the owner equipment number (OEN/unit number)

you create

using alpha or

numeric characters. Each vehicle must have a unique number.

9

Vehicle identification

Enter the Vehicle Identification Number (VIN) located on the WA vehicle validated

copy of record or registration.

L

ic/Plt #

Enter the License Plate “Lic/Plt” number located on the WA validated copy of record or

registration if one is currently issued.

V

ehicle type

Enter the type of vehicle you are registering.

M

ake

Enter the “make” of the vehicle located on the WA validated copy of record or

registration.

Year

Enter the last two digits of vehicle model year.

F

uel

Enter the code described below for the type of fuel used in power units:

D

= Diesel,

G

= Gas,

P

= Propane,

LPG

= Natural gas,

CNG =

Compressed Natural Gas,

LNG =

Liquefied Natural Gas,

E =

Electric,

H

= Hybrid

U

nladen weight

Enter the exact empty scale weight of each vehicle in pounds located on the WA

validated copy of record or registration.

V

eh purchase price

Enter the purchase price located on the WA validated copy of record or registration, or

the taxable value for the vehicle used for titling.

D

eclared comb

Enter the declared gross weight (GVW) in 2,000 pound increments. i.e. 76,000,

gross wt

78,000, 80,000, or 82,000, exception to this is the maximum GVW of 105,500 should be

listed as 105,500. Kilograms are not accepted.

P

urchase date

Enter the month, day and year the vehicle was purchased.

A

xles Seats

Enter the number of axles, including the steering axle. For buses, enter the number of

seats, including the driver’s seat.

Lease date

Enter the month, day and year the lease was initiated, if applicable.

O

wner/Lessor if different

If the vehicle is owned by someone other than the registrant, enter the name of the

from registered

owner/lessor. If the registrant owns the vehicle, leave this column blank.

US

DOT carrier

Complete if long-term leasing (30 days or more) to a motor carrier, place the USDOT

number of the lessee motor carrier in this column. If short-term leasing (less than 30

days) to a motor carrier, enter your USDOT number.

C

arrier FEIN

Complete if long-term leasing (30 days or more) to a motor carrier, place the Federal

Employer Identification number (FEIN) of the lessee motor carrier in this column. If

short-term leasing (less than 30 days) to a motor carrier, enter your FEIN.

A

cknowledgment

By checking this box and signing

the application you declare you are knowledgeable

Check box

of the Federal Motor Carrier Safety Administration’s (FMCSA) and the State.

Si

gnature Your signature is required, and attests to your agreement to the IRP requirements.

Completing the Mileage by Jurisdiction

When do I need to use actual miles?

•

New accounts with actual miles from another jurisdictions during the mileage reporting period.

•

Existing accounts renewing for the year.

10

•

Existing accounts who are changing their business entity.

C

an I get a Temporary Authority on added vehicles?

Yes, as long as your account is in good standing and for new accounts if they are fully licensed. Renewals do not qualify

for Temporary Authority.

How do I delete a vehicle and receive credit?

• Return the original current cab card with your application; otherwise, credit will not be issued.

• Credit must be used within the same fleet and registration year.

• Credits are not transferable, refundable, or carried forward to the new registration year.

• Credits are not issued when less than $15.

Fees are refundable if:

•

There was a processing error identified in a timely manner.

•

Fees have been paid for vehicles deleted from the fleet before the beginning of the new registration year.

How do I increase GVW?

In the weight section, fill out the states you want to increase. The increase may not exceed the maximum weight for any

IRP jurisdiction. In the weight group number section, include the weight group number otherwise, write “new”.

Under vehicle information, indicate “M” for increased GVW in the “transaction type”, then complete the vehicle

information for each vehicle. Fill out a separate application for each weight group if increasing more than one vehicle into

different weight groups. Once the application is complete, we will issue a “Temporary Letter of Authority” to allow

immediate operation at the higher weight for vehicles with active IRP registrations.

H

ow do I decrease GVW?

You will not receive any credit for decreasing GVW. We will charge a $2 cab card fee for each vehicle that is affected.

Some jurisdictions do not allow a decrease in gross weight during the registration year. In the weight group number

section, include the weight group number otherwise, write “new”.

U

nder vehicle information, indicate “M” for decreased GVW in the “transaction type”, then complete the vehicle

information for each vehicle. Fill out a separate application for each weight group if decreasing more than one vehicle into

different weight groups.

Once the application is complete, we will issue a “Temporary Letter of Authority” to allow immediate operation at the

lower weight for vehicles with active IRP registrations.

Renewals

E

ach account must renew their IRP registration annually. It is important your account does not expire as Temporary Au-

thorities are not allowed at renewal. We will mail a renewal packet 90 days prior to your expiration date.

W

hat must I send in with my renewal?

•

Your validated IRS Federal Heavy Vehicle Use Tax (Form 2290), with the IRS stamp, for all vehicles over

55,000 GVW.

•

If applicable:

-

Validated copy of record (vehicle registration) for vehicles being added at renewal time.

-

IRP Established Place of Business, Residency, or Change of Address form.

-

Leased vehicle listing form and a copy of the lease agreement, if applicable.

How do I make changes on my renewal?

Changes can be made on the renewal paperwork or by using your TAP account.

11

Why does my renewal show some of my vehicles and not all of them?

Vehicles added after the printing of the renewal will not display on the mailed packet, but will be available on TAP.

Do I need to keep a copy of my renewal?

Yes, retain a copy of your renewal applications for each fleet for audit purposes.

Whi

ch mileage reporting do I use?

The reporting period is always July 1 to June 30.

For

all months except October, November, and December, the end of the reporting period (June 30) is always a year back

from the start of your registration period. For October, November, and December the end of the reporting period (June 30)

is in the same year as your registration period.

Ex

amples:

July (0701) fleet registration expiring in 2021 will have a starting registration date of July 1, 2020 and a reporting period

of July 1, 2018 to June 30, 2019.

October (1001) fleet registration expiring in 2021 will have a starting registration date of October 1, 2020 and a reporting

period of July 1, 2019 to June 30, 2020.

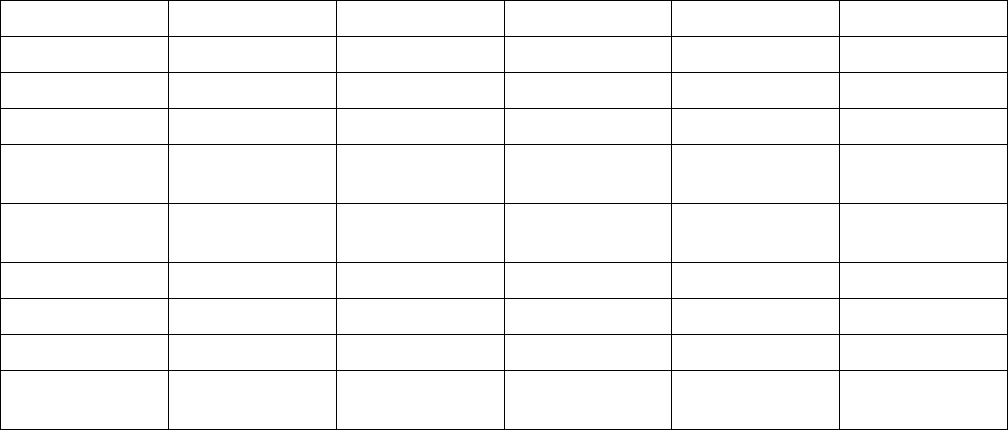

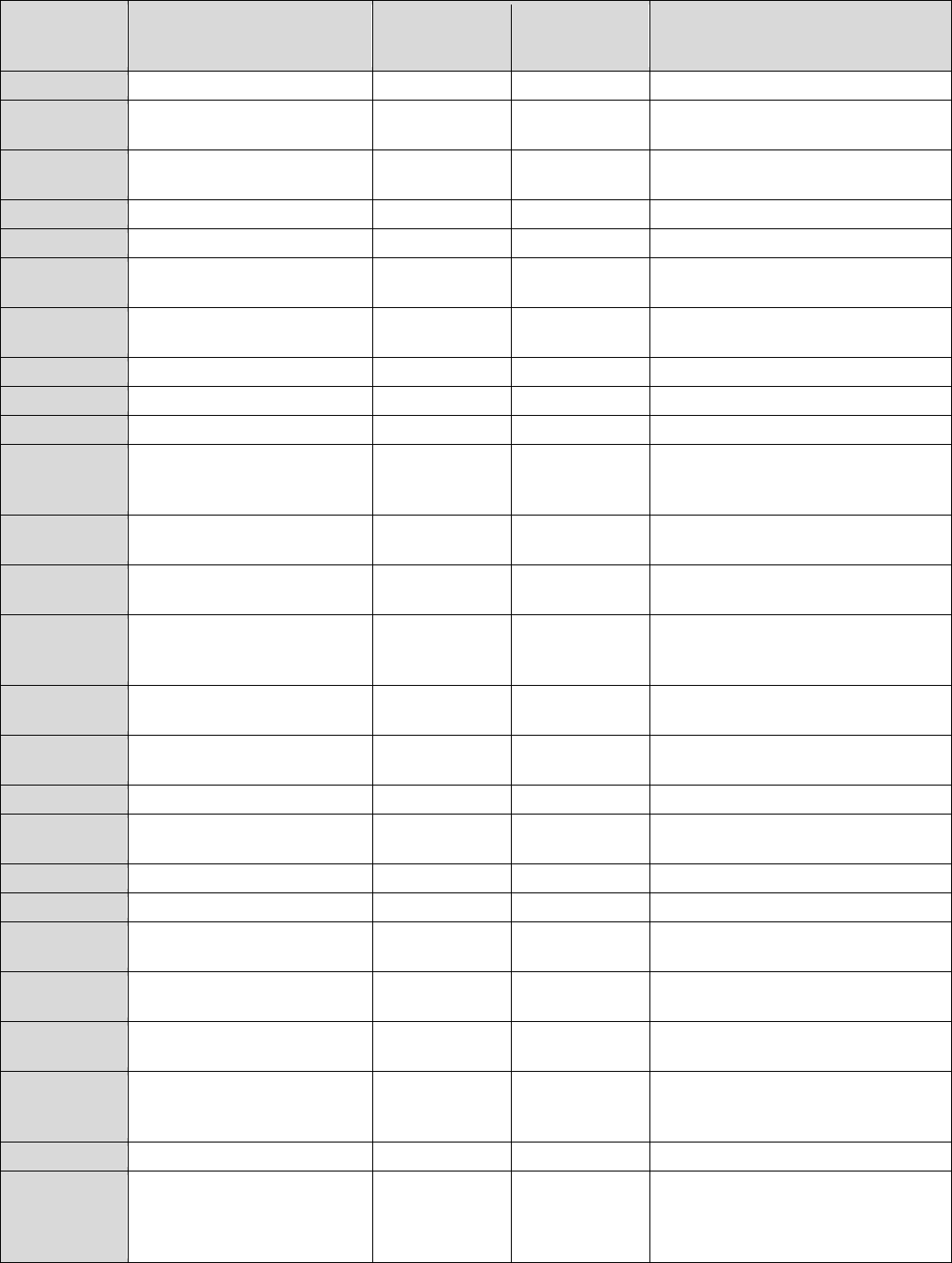

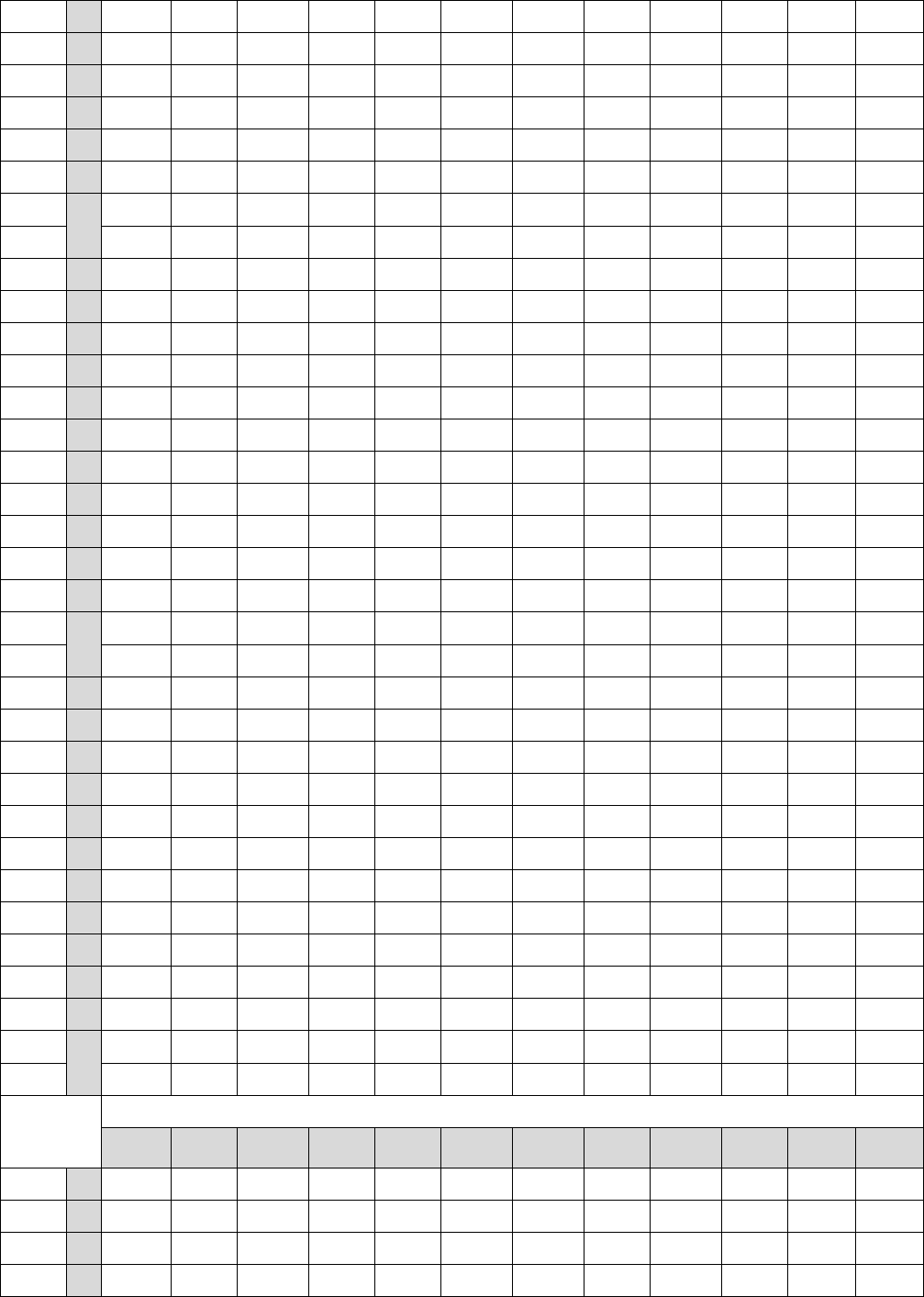

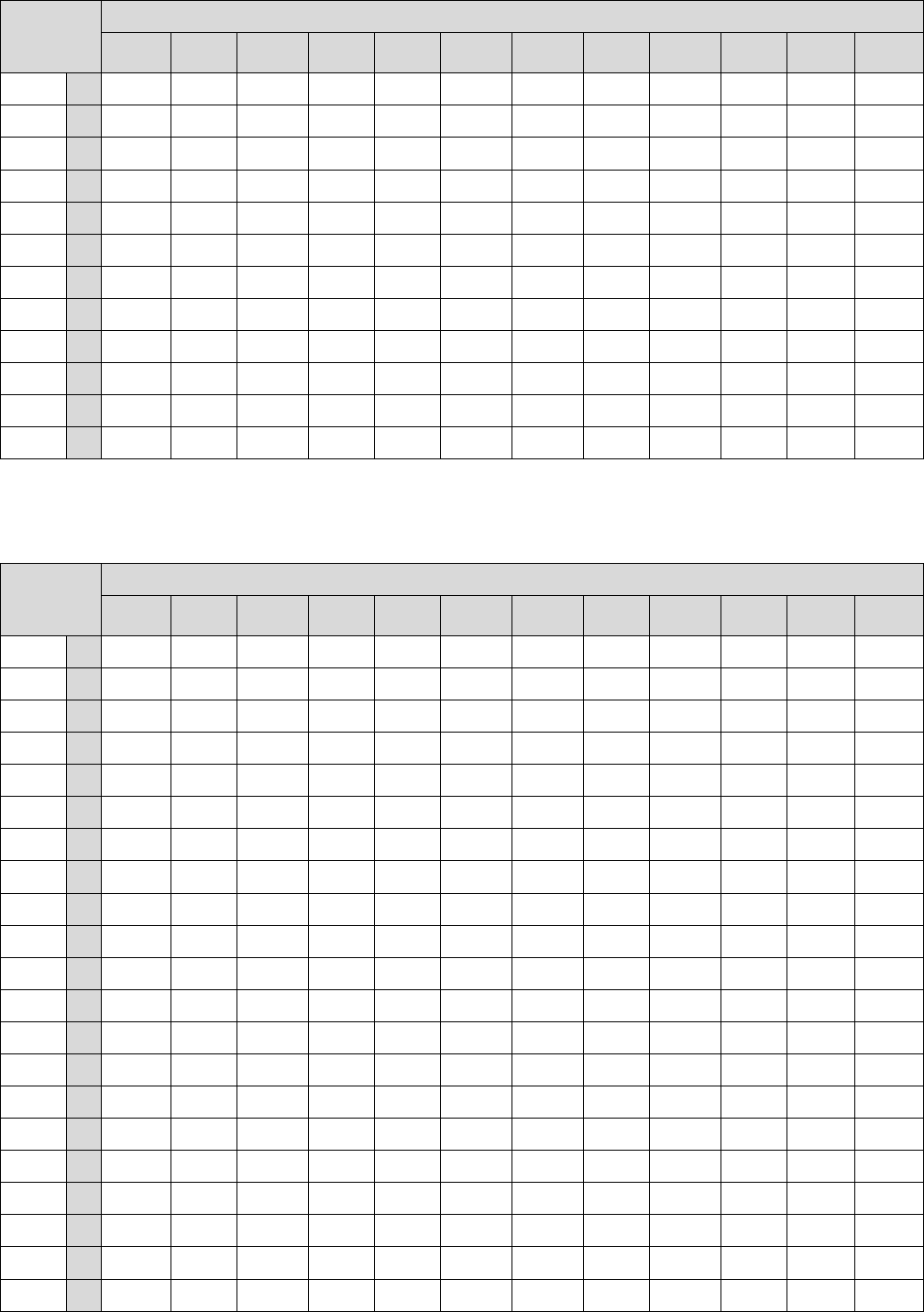

See the Mileage Reporting Period chart below to determine the reporting period.

Fleet

#

Registration Period

(Begin – Expire)

Mileage Reporting Period

(Preceding Year)

Fleet

#

Registration Period

(Begin – Expire)

Mileage Reporting Period

(Preceding Year)

0101

Jan 1, 2020 – Dec 31, 2020

July 2018 – June 2019

0101

Jan 1, 2021 – Dec 31, 2021

July 2019 – June 2020

0201

Feb 1, 2020 – Jan 31, 2021

July 2018 – June 2019

0201

Feb 1, 2021 – Jan 31, 2022

July 2019 – June 2020

0301

Mar 1, 2020 – Feb 28, 2021

July 2018– June 2019

0301

Mar 1, 2021 – Feb 28, 2022

July 2019 – June 2020

0401

Apr 1, 2020 – Mar 31, 2021

July 2018 – June 2019

0401

Apr 1, 2021 – Mar 31, 2022

July 2019 – June 2020

0501

May 1, 2020 – Apr 30, 2021

July 2018 – June 2019

0501

May 1, 2021 – Apr 30, 2022

July 2019 – June 2020

0601

Jun 1, 2020 – May 31, 2021

July 2018– June 2019

0601

Jun 1, 2021 – May 31, 2022

July 2019 – June 2020

0701

Jul 1, 2020 – Jun 30, 2021

July 2018 – June 2019

0701

Jul 1, 2021 – Jun 30, 2022

July 2019 – June 2020

0801

Aug 1, 2020 – Jul 31, 2021

July 2018 – June 2019

0801

Aug 1, 2021 – Jul 31, 2022

July 2019 – June 2020

0901

Sep 1, 2020 – Aug 31, 2021

July 2018 – June 2019

0901

Sep 1, 2021 – Aug 31, 2022

July 2019 – June 2020

1001

Oct 1, 2020 – Sep 30, 2021

July 2019 – June 2020

1001

Oct 1, 2021 – Sep 30, 2022

July 2020 – June 2021

1101

Nov 1, 2020– Oct 31, 2021

July 2019 – June 2020

1101

Nov 1, 2021 – Oct 31, 2022

July 2020 – June 2021

1201

Dec 1, 2020 – Nov 30, 2021

July 2019 – June 2020

1201

Dec 1, 2021– Nov 30, 2022

July 2020 – June 2021

When do

I display my new IRP Credentials?

Display credentials on the first day of your new registration period.

Is there a non-enforcement period for renewals?

No.

Can I change my registration month?

No.

12

Federal Heavy Vehicle Use Tax (FHVUT) Form 2290

I

s proof of payment of the FHVUT required?

Yes, except in the following circumstances:

•

Vehicles have been purchased within the last 60 days.

•

Vehicles have a GVW less than 55,000 pounds.

The

IRS requires this form to be filed and any taxes paid

. Also, it must be filed by the last day of the month following

the month of first use.

F

or example, a taxable vehicle is on a public highway for the first time in September. By October 31, a Form 2290 return

must be filed with the IRS with taxes paid.

W

hat documents must I submit to show proof of payment of my FHVUT?

An IRS-receipted Schedule 1 (Form 2290) which must include the VIN numbers for each vehicle in the fleet. For further

information, visit the IRS website.

Who do I contact with questions regarding my FHVUT?

You may call the IRS at (866) 699-4096 from 8:00 a.m. to 6:00 p.m. EST (5 a.m. to 3 p.m. PST). The IRS website is

https://www.irs.gov/

.

Name Change, Unladen Weight Permit, Misc. Fuel Types

N

ame Change

If you change your business name and keep the same FEIN, you may be able to just change the name on your IRP

account. We will need a letter from the IRS that your current FEIN has been assigned to the new name.

C

ontact:

•

FMCSA, for updating your USDOT

•

Secretary of State if changing your existing corporate (Inc.) name or limited liability company (LLC)

•

Department of Revenue, to update your UBI number

•

IRS

After completing the above, submit to PRFT:

•

The new Validated copy of record showing the new name, which is handled through your local county auditor,

agent or subagent; and,

•

A completed IRP Credential Replacement application

and fee.

B

usiness entity change

A change in ownership of a company is not a name change. If there is a change of ownership and you have a new FEIN,

the transaction is considered a new account. Review the information for New Accounts.

U

nladen Weight Permit (Hunter’s Permit)

An Unladen Weight Permit is a temporary registration issued by the base state to owner-operators moving from one

lessee-carrier to another. It is valid in other jurisdictions and allows the transportation of empty vehicles from one

company’s site to a different company’s site. Unladen Weight Permits, when issued, are for a ten-day period and there is

no fee for a permit issued by Washington. If any vehicle is operating with this permit and carrying a load, the permit will

become invalid and confiscated. Photocopies and faxes of the permit are acceptable.

M

iscellaneous fuel types: Propane, Butane, Natural Gas (Liquefied Petroleum Gases)

Washington-based vehicles powered by propane, butane or natural gas (LPG) and Compressed Natural Gas (CNG) must

display a decal issued by the Department as evidence that the annual fees were paid. This decal is presented as a

disclosure on your Washington cab card. You will be billed an annual prorated fee plus the Proportional Registration fees

and taxes. For current fees, visit IRP, Inc.

13

Trip Permits

T

rip permits are used for unlicensed vehicles or licensed vehicles who are not prorated to allow travel to other

jurisdictions. Trip permits may also be purchased and used for temporary weight increases, depending on the rules of

each jurisdiction.

The following information was accurate as of January 2021; updated information can be found at IRP, Inc. website or the

jurisdictional websites.

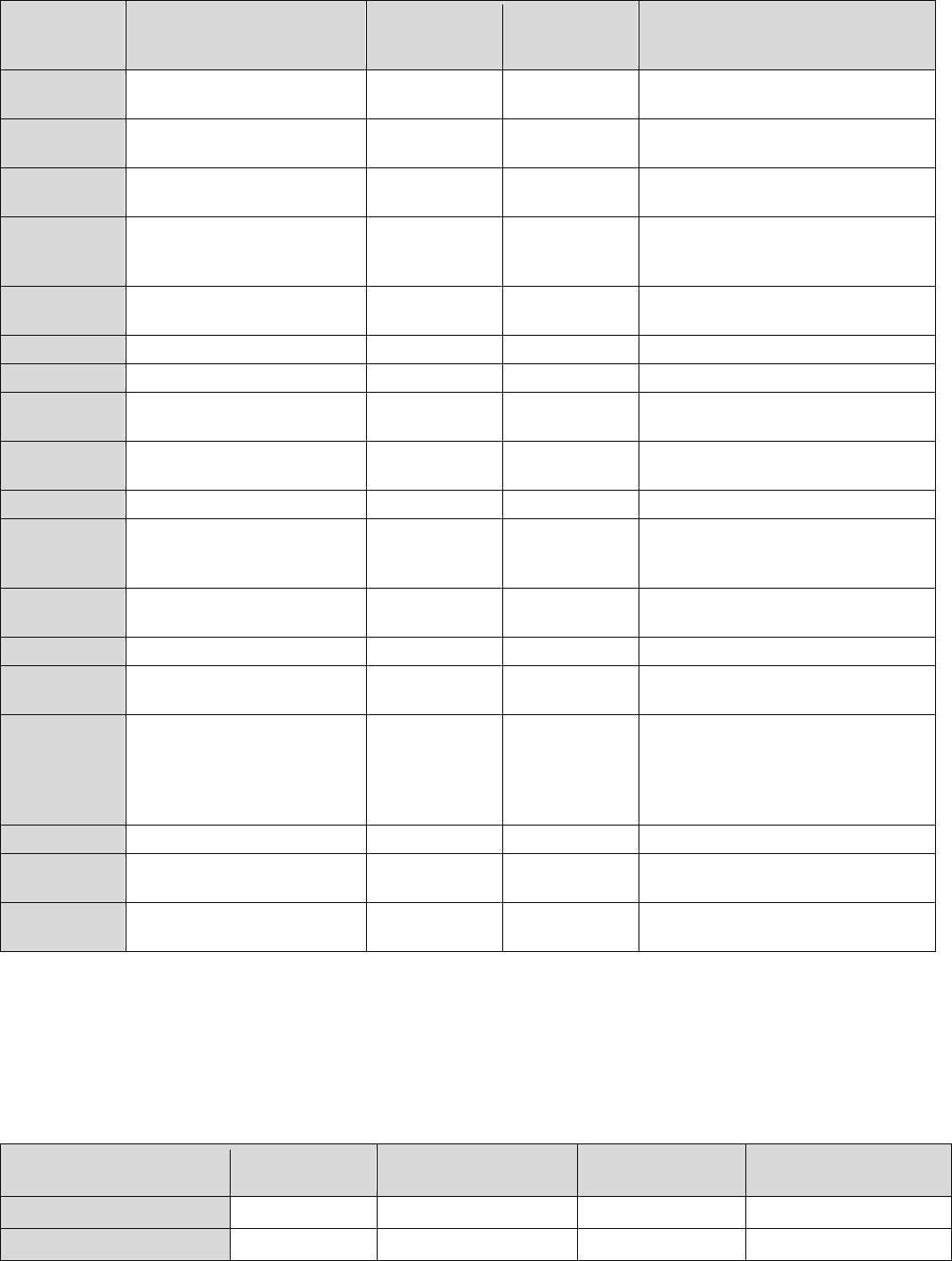

Jurisdiction

Available from

Must be

obtained prior

to entry

Required for

intrastate

movement

Cost

AB

Central Permit Office,

Vehicle Inspection

Stations

No Yes

Varies by distance, net weight for

3 days

AL

Transceiver, Cummins

(334) 242-2999

Yes Yes $20 for 7 days

AR

Port of Entry, Revenue

Offices, Wire Services

No Yes $33 for 72 hours

AZ

Port of Entry, Iowa

Regional Permit Center,

Instacom, Transceivers

No Yes

Varies based upon distance and

number of axles for 96 hours

BC

Port of Entry No No

1/12 of annual registration fee for

vehicle weight

CA

IRP Office, Field Offices Yes Yes

$45 power unit, $30 fuel tax permit

Both for 4 days

CO

Port of Entry No Yes

$60 to $80 depending on weight

for 72 hours

CT

IRP Section, Wire

Services

Yes Yes $15 for 72 hours

DC

For information call

(202) 727-7050

Yes

$50 for 6 days

DE

Wire Services, Permit

Agencies

Yes Yes $15 for 72 hours

FL

Wire Services

Yes

Yes

$30 for 10 days

GA

Permit Services

(888) 262-8306

Yes Yes $30 for 72 hours

IA

Iowa Regional Permit

Center and Vendor

Stations

Yes No $50 for 72 hours

ID

Port of Entry and Vendor

Stations

No, if currently

registered in

base

jurisdiction.

Yes, if not cur-

rently regis-

tered

No

$60 single unit, $120 combination

for 120 hours

Maximum 3 permits per vehicle

within a calendar year.

IL

Secretary of State

(Commercial & Truck

Division), Wire Service

Yes

$19 for 72 hours

14

Jurisdiction Available from

Must be ob-

tained prior

to entry

Required for

intrastate

movement

Cost

IN

IRP Office, Wire Services

Yes

Yes

$15 for 72 hours

KS

Ports of Entry,

Central Permit Office

No Yes $26 for 72 hours

KY

Kentucky Transportation

Cabinet

Yes Yes $40 for 10 days

LA

Permitting service

Yes

Yes

Varies

MA

Transceiver Services

Yes

Yes

$15 for 72 hours

MB

Permit Office

(204) 945-3961

Yes Yes

Truck - .9 X weight X distance Bus

- .083 X distance X passengers

MD

MVA Offices, Wire Services Yes Yes

$15 for 72 hours

ME

Wire Services, IRP Office

Yes

Yes

$25 for 72 hours

MI

Wire Services

Yes

Yes

$20 for 72 hours

MN

Prorate office

Yes

Yes

$26 for 120 hours

MO

Highway Reciprocity

Commission,

Transmitter Services

Yes Yes $10 for 72 hours

MS

Department of

Transportation

No Yes $25 for 72 hours

MT

IRP Office, Weight Stations No Yes

Varies based on GVW and miles

traveled

NB

NB DMV Yes Yes

$24 for unladen vehicle (unless

excluded by CAVR), $85 truck,

$169 truck tractor for 5 days.

NC

Weight Stations, IRP

Office, Wire Services

Yes Yes $15 for 10 days

ND

Port of Entry,

Highway Patrol Office

No No $20 for 72 hours

NE

Vendor Stations

Yes

No

$25 for 72 hours

NL

For information call

(709) 729-4953

$75 truck, $150 truck tractor for

various validation periods

NH

Permit Services

Yes

Yes

$15 for 72 hours

NJ

Wire Services

Yes

Yes

$25 for 72 hours

NM

Port of Entry No Yes

Varies upon mileage and vehicle

weight for 48 hours.

NS

For information

call (902) 424-6300

Yes

$50 truck, $100 truck tractor for 30

days

NV

Motor Carrier Offices,

Vendor Stations, Wire

Yes No $5 + .15/mile for 24 hours

NY

Department of

Transportation , Wire

Services

Yes Yes $18.75 for 72 hours

OH

Wire Services

Yes

Yes

$15 for 72 hours

OK

Oklahoma Tax

Commission, Bonded Wire

Services,

Local Licensing Agencies

Yes Yes $22 for 72 hours

15

Jurisdiction Available from

Must be

obtained

prior to entry

Required for

intrastate

movement

Cost

ON

Ministry of Transportation Yes Yes

$75 truck, $132 truck tractor for 10

days

OR

Oregon Dept. of

Transportation Office

Yes Yes $43 for 10 days

PA

Wire Services, IRP Office Yes Yes

$15 for 72 hours

PE

Dept. of Transportation Yes Yes

$150 straight truck, $300 tractor

trailer for 5 days or 1 trip,

whichever comes first.

QC

Wire Service

800-463-4822

Yes Yes

$38 plus fees as requested for 10

days

RI

Permit Section - DMV

Yes

Yes

$25 for 72 hours

SC

Wire Services

Yes

Yes

$15 for 72 hours

SD

Port of Entry, Highway

Patrol

Yes Yes $15 for 72 hours

SK

By phone – 800-667-7575

or (306) 775-6969

Yes Yes

Varies by weight and distance for

a single trip

TN

Wire Services

Yes

Yes

$30 for 72 hours

TX

County tax Offices, Central

Permit Offices, Regional

Offices

Yes Yes $25 for 72 hours

UT

Port of Entry, some Motor

Vehicle offices

No Yes

$25 for 96 hours or $50 for a

combination

VA

Permit Services

Yes

Yes

$15 for 10 days

VT

Vermont Dept. of Motor

Vehicles

Yes Yes $15 for 72 hours

WA

Department of

Transportation

Vehicle License Agents

Yes Yes

$25 for 3 days (limit of 3 permits

for any one vehicle in any 30

consecutive days). Special Fuel

permits are $30.00 good for 5

days, unlimited purchases.

WI

Private Permit Services

Yes

Yes

$15 for 72 hours

WV

Wire Services

www.dmv.wv.gov

Yes Yes $34 for 10 day combination permit.

WY

Ports of Entry No Yes

$20 single unit, $40 combination

unit for 96 hours

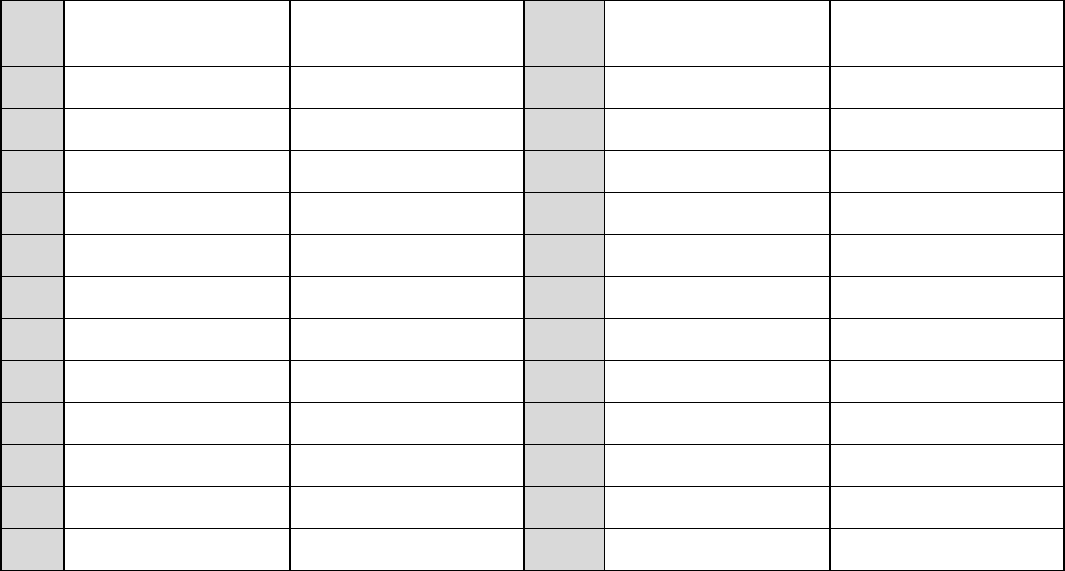

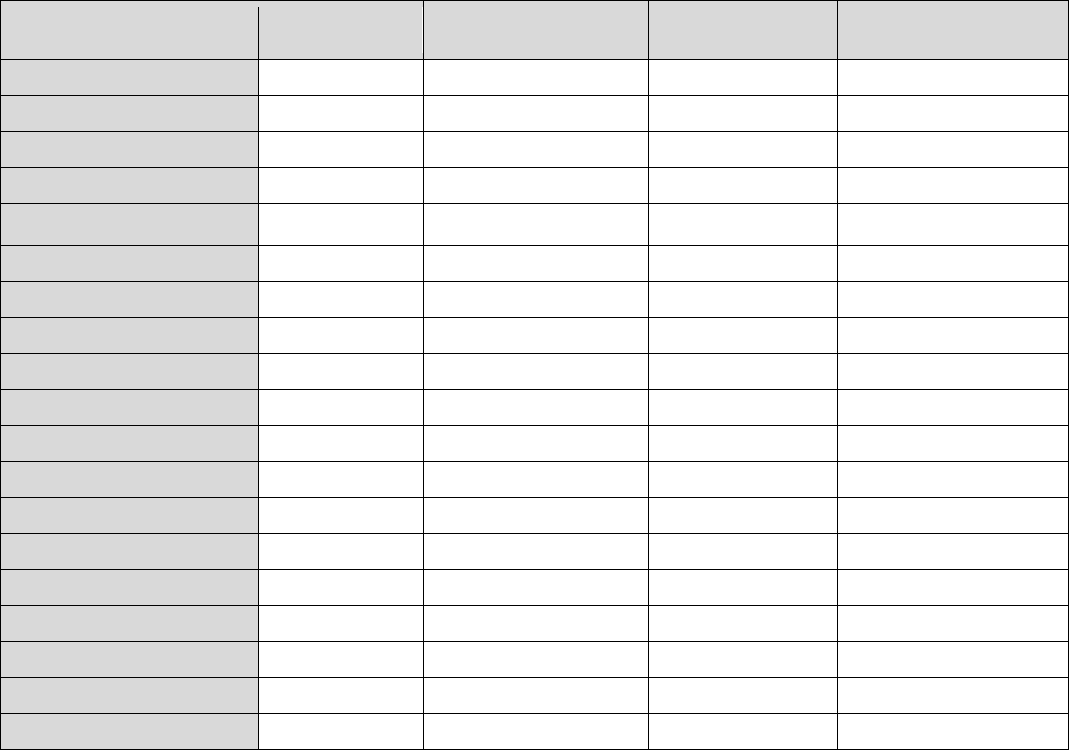

IRP Jurisdictional Registration Information

The following information was effective January 2021 updated information can be found at IRP, Inc. website or the

jurisdictional websites.

* Indicates that you must purchase a permit for weight over 80,000 lbs.

+ Does not allow weight decrease during the registration period.

Jurisdiction

Registration

year

Maximum GW/CGW

(American Pounds)

Nonenforcement

grace period

Enforcement date

Alberta

Staggered

139,992

None

Monthly

Alabama * +

Staggered

80,000

None

Monthly

16

Jurisdiction

Registration

year

Maximum GW/CGW

(American Pounds)

Nonenforcement

grace period

Enforcement date

Arkansas *

Staggered

80,000

None

Monthly

Arizona *

Staggered

80,000

None

Quarterly

British Columbia *

Staggered

139,994

None

Monthly

California * +

Staggered

80,000

None

Monthly

Colorado *

Staggered

80,000

30 days

Monthly

Connecticut *

Staggered

None

None

Monthly

District of Columbia * +

Staggered

80,000

None

Quarterly

Delaware * +

Staggered

80,000

None

Monthly

Florida * +

Staggered

80,000

None

Monthly

Georgia * +

Staggered

80,000

None

Monthly

Iowa * +

Staggered

Unlimited

None

Monthly

Idaho *

Staggered

129,000

None

Monthly

Illinois * +

Apr - Mar

80,000

None

Apr 1

Indiana * +

Staggered

80,000

None

Monthly

Kansas * +

Jan - Dec

85,500

Mar 01

Mar 02

Kentucky *

Staggered

80,000

None

Monthly

Louisiana *

Staggered

88,000

None

Monthly

Massachusetts * +

Jul - Jun

Unlimited

None

Jul 01

Manitoba

Staggered

139,994

None

Monthly

Maryland *

Staggered

80,000

None

Quarterly

Maine *

Staggered

100,000

None

Monthly

Michigan *

Staggered

160,001

None

Monthly

Minnesota *

Mar - Feb

80,000

None

Mar 01

Missouri *

Staggered

80,000

None

Quarterly

Mississippi * +

Staggered

80,000

15 days

Monthly

Montana

Staggered

138,000

None

Quarterly

New Brunswick

Staggered

137,786

None

Monthly

North Carolina *

Staggered

80,000

– 15 days

Monthly

North Dakota +

Staggered

105,500

None

Quarterly

Nebraska * +

Jan - Dec

94,000

Jan 31

Feb 01

Newfoundland

Staggered

137,788

None

Monthly

New Hampshire *

Staggered

80,000

None

Monthly

New Jersey *

Staggered

80,000

None

Monthly

New Mexico * +

Staggered

86,400

None

Monthly

Nova Scotia

Staggered

137,788

None

Monthly

Nevada *

Jan - Dec

129,000

None

Jan 01

New York *

Staggered

195,000

None

Monthly

Ohio * +

Staggered

80,000

None

Monthly

17

Jurisdiction

Registration

year

Maximum GW/CGW

(American Pounds)

Nonenforcement

grace period

Enforcement date

Oklahoma * +

Staggered

90,000

60 days

Monthly

Ontario

Staggered

139,992

None

Monthly

Oregon *

Jan - Dec

105,500

Mar 15

Mar 16

Pennsylvania *

Jun - May

80,000

None

Jun 01

Prince Edward Island

Staggered

139,994

None

Monthly

Quebec +

Apr - Mar

Axle based

None

Apr 01

Rhode Island * +

Jun - May

80,000

None

Jun 01

South Carolina * +

Staggered

80,000

None

Monthly

South Dakota *

Staggered

195,000

None

Quarterly

Saskatchewan

Staggered

139,994

None

Monthly

Tennessee *

Staggered

80,000

None

Monthly

Texas * +

Staggered

80,000

5 working days

Monthly

Utah *

Staggered

80,000

None

Quarterly

Virginia *

Staggered

80,000

None

Monthly

Vermont *

Staggered

80,000

None

Monthly

Washington

Staggered

105,500

None

Monthly

Wisconsin * +

Staggered

80,000

None

Monthly

West Virginia * +

Jul - Jun

80,000

None

Jul 01

Wyoming * +

–Staggered

117,000

None

Quarterly

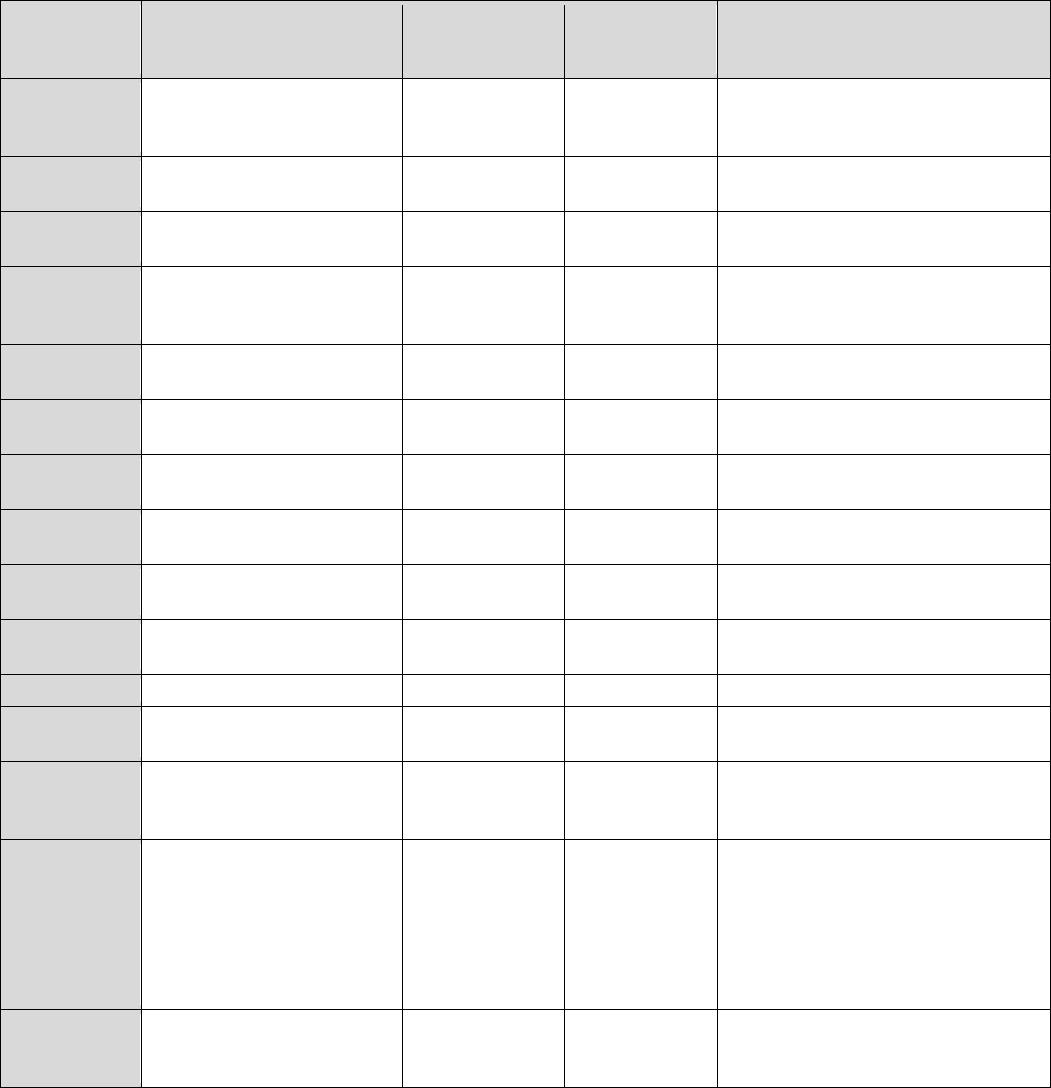

Washington Vehicle Registration Fees

Th

ere are two different license fee schedules located on the following pages. You will use one of the following schedules

when calculating Washington gross weight fees:

•

Schedule A

(Commercial) is for power units that

do not

run in combination with a trailing unit (TK, BU, RT,

LG).

•

Sche

dule B

(Combination) is for power units that

do

run in combination with trailing units (TR, TT, DT).

License fee

Fees are collected annually on all vehicles. Gross or combined gross vehicle weight (GVW or cGVW) is available only

for motor vehicles between 12,001 through a maximum of 105,500 pounds rounded up to even 2,000 pound increments.

i.e. 76,000, 78,000, 80,000, or 82,000, not 11,000, 13,000, 15,000; etc. Kilograms are not accepted.

• Si

ngle truck (TK), log truck (LG), road tractor (RT), bus (BU): These vehicle types use “Schedule A” regard-

less of GVW or cGVW. A single truck does not run in combination with a trailing unit. Also, a road tractor is

known as a mobile home toters.

• Tra

ctor (TR) and truck tractor (TT), dump truck (DT): These vehicles use “Schedule B” regardless of GVW

or cGVW. These are power units that haul in combination with a trailing unit.

• Bu

s (BU): Take the number of seats including the driver and multiply it by 150 pounds (average weight per law)

plus the unladen weight to get the cGVW. If this weight falls between weight brackets, use the next higher thou-

sand pound increment (even number). Example: 44,500 would round up to 46,000.

18

Fees and apporti

onment

•

Fees:

Choose the number of months remaining in the registration period (including the month of registration)

from the chart. The amount listed is the license fee charged at 100 percent.

•

Apportionment:

Multiply this amount by the Washington prorate percentage (found on your Washington cab

card) and round to the nearest cent. This is the License Fee amount to be charged.

•

Freight Fee:

This is calculated by taking the license fee and multiplying by 15%. See chart listed “Freight Fee”.

Vehicl

e safety inspection fee (VSIF)

1. The VSIF does not apply to (you must notify us of the specific vehicles and exemption that apply):

a. Motor vehicles owned and operated by farmers in the transportation of their own farm, orchard, or dairy

products, including livestock and plant or animal wastes, from point of production to market or disposal, or

supplies or commodities to be used on farm, orchard or dairy;

b. Commercial motor carriers subject to economic regulation under RCW 81.68 (auto transportation companies),

RCW 81.70 (passenger charter carriers), RCW 81.77 (solid waste collection companies), RCW 81.80 (motor

freight carriers); and

c. Vehicles exempt from registration by RCW 46.16A.080.

2. There is a $16 fee upon registration or renewal. This fee is refundable if the vehicle is renewed and then deleted

prior to the start of the vehicle registration period.

Transact

ion Fee

There is a $4.50 fee per vehicle for processing transactions (originals, renewals, and added vehicles).

Fili

ng Fee

There is a $4.50 fee per vehicle for processing transactions (originals, renewals, and added vehicles).

Cab Car

d Fee

There is a $2.00 fee per vehicle for cab cards.

For current fee information on the following tables, check the IRP Inc. website.

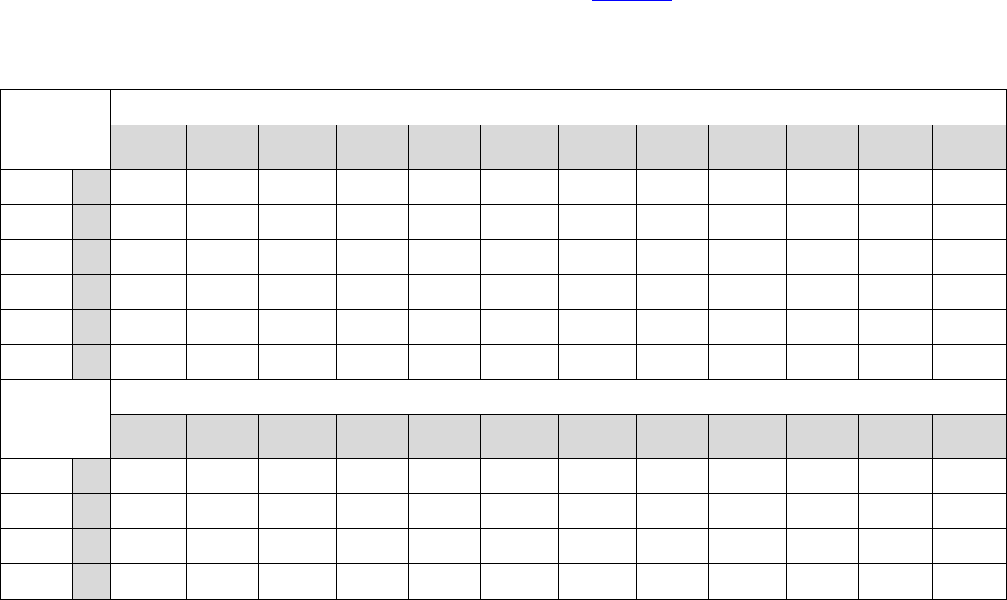

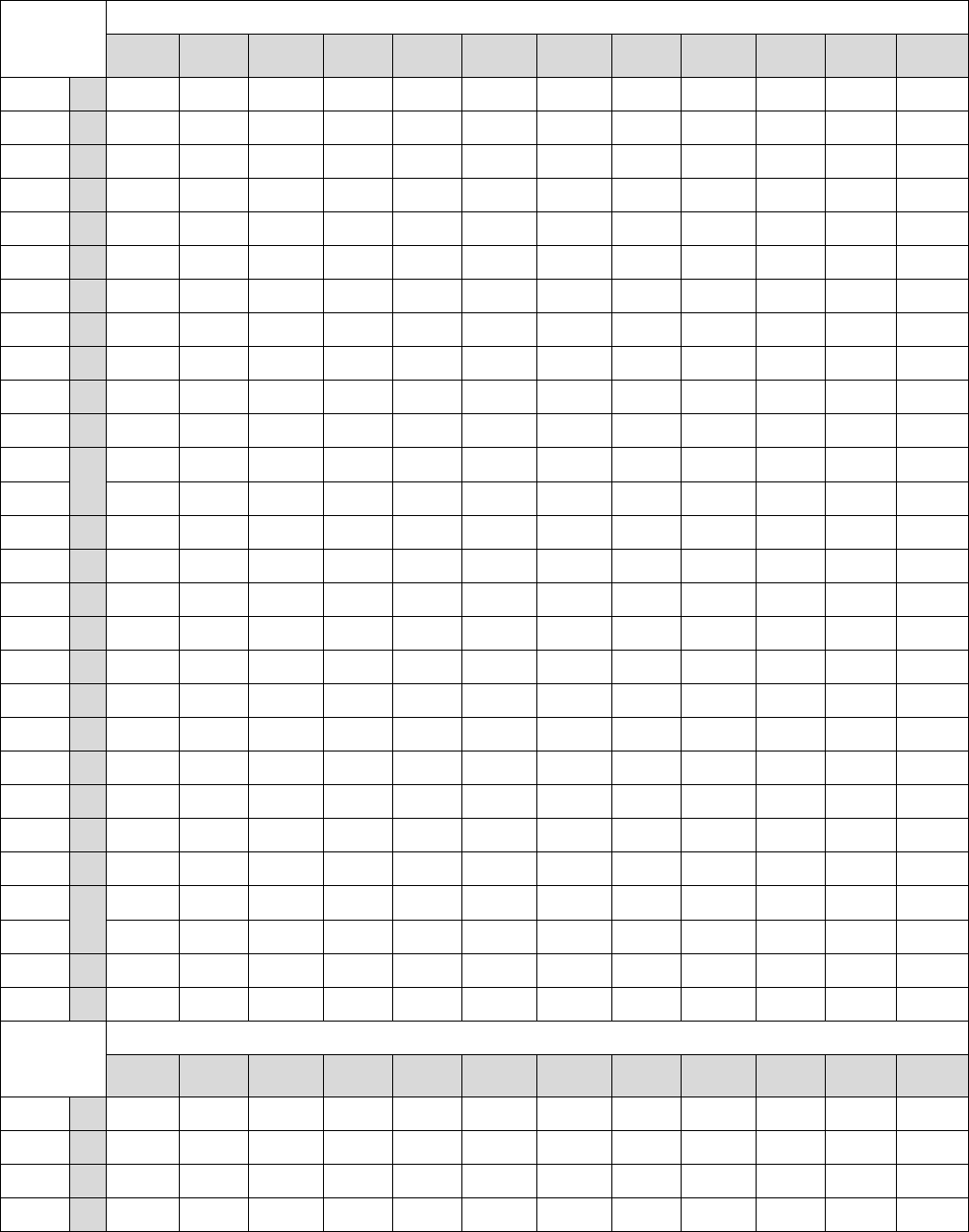

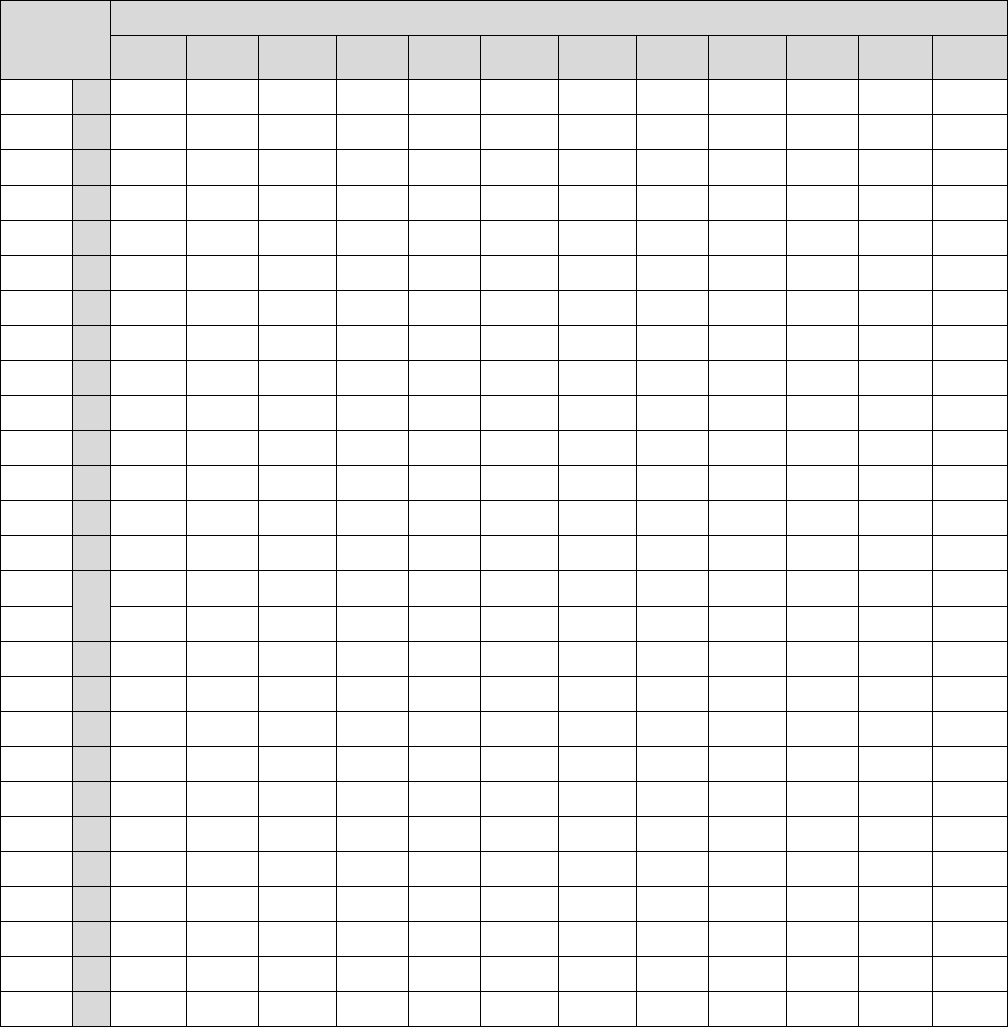

State of Washington - License Fees (Gross Weight)

License fee and credit chart for power types TK, BU, RT, LG –

Schedule A

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

12,000

$

81.00

74.25

67.50

60.75

54.00

47.25

40.50

33.75

27.00

20.25

13.50

6.75

14,000

$

88.00

80.67

73.33

66.00

58.67

51.33

44.00

36.67

29.33

22.00

14.67

7.33

16,000

$

100.00

91.67

83.33

75.00

66.67

58.33

50.00

41.67

33.33

25.00

16.67

8.33

18,000

$

152.00

139.33

126.67

114.00

101.33

88.67

76.00

63.33

50.67

38.00

25.33

12.67

20,000

$

169.00

154.92

140.83

126.75

112.67

98.58

84.50

70.42

56.33

42.25

28.17

14.08

22,000

$

183.00

167.75

152.50

137.25

122.00

106.75

91.50

76.25

61.00

45.75

30.50

15.25

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

24,000

$

198.00

181.50

165.00

148.50

132.00

115.50

99.00

82.50

66.00

49.50

33.00

16.50

26,000

$

209.00

191.58

174.17

156.75

139.33

121.92

104.50

87.08

69.67

52.25

34.83

17.42

28,000

$

247.00

226.42

205.83

185.25

164.67

144.08

123.50

102.92

82.33

61.75

41.17

20.58

30,000

$

285.00

261.25

237.50

213.75

190.00

166.25

142.50

118.75

95.00

71.25

47.50

23.75

19

32,000

$

344.00

315.33

286.67

258.00

229.33

200.67

172.00

143.33

114.67

86.00

57.33

28.67

34,000

$

366.00

335.50

305.00

274.50

244.00

213.50

183.00

152.50

122.00

91.50

61.00

30.50

36,000

$

397.00

363.92

330.83

297.75

264.67

231.58

198.50

165.42

132.33

99.25

66.17

33.08

38,000

$

436.00

399.67

363.33

327.00

290.67

254.33

218.00

181.67

145.33

109.00

72.67

36.33

40,000

$

499.00

457.42

415.83

374.25

332.67

291.08

249.50

207.92

166.33

124.75

83.17

41.58

42,000

$

519.00

475.75

432.50

389.25

346.00

302.75

259.50

216.25

173.00

129.75

86.50

43.25

44,000

$

530.00

485.83

441.67

397.50

353.33

309.17

265.00

220.83

176.67

132.50

88.33

44.17

46,000

$

570.00

522.50

475.00

427.50

380.00

332.50

285.00

237.50

190.00

142.50

95.00

47.50

48,000

$

594.00

544.50

495.00

445.50

396.00

346.50

297.00

247.50

198.00

148.50

99.00

49.50

50,000

$

645.00

591.25

537.50

483.75

430.00

375.25

322.50

268.75

215.00

161.25

107.50

53.75

52,000

$

678.00

621.50

565.00

508.50

452.00

395.50

339.00

282.50

226.00

169.50

113.00

56.50

54,000

$

732.00

671.00

610.00

549.00

488.00

427.00

366.00

305.00

244.00

183.00

122.00

61.00

56,000

$

773.00

708.58

644.17

579.75

515.33

450.92

386.50

322.08

257.67

193.25

128.83

64.42

58,000

$

804.00

737.00

670.00

603.00

536.00

469.00

402.00

335.00

268.00

201.00

134.00

67.00

60,000

$

857.00

785.58

714.17

642.75

571.33

499.92

428.50

357.08

285.67

214.25

142.83

71.42

62,000

$

919.00

842.42

765.83

689.25

612.67

536.08

459.50

382.92

306.33

229.75

153.17

76.58

64,000

$

939.00

860.75

782.50

704.25

626.00

547.75

469.50

391.25

313.00

234.75

156.50

78.25

66,000

$

1046.00

958.83

871.67

784.50

697.33

610.17

523.00

435.83

348.67

261.50

174.33

87.17

68,000

$

1091.00

1000.08

909.17

818.25

727.33

636.42

545.50

454.58

363.67

272.75

181.83

90.92

70,000

$

1175.00

1077.08

979.17

881.25

783.33

685.42

587.50

489.58

391.67

293.75

195.83

97.92

72,000

$

1257.00

1152.25

1047.50

942.75

838.00

733.25

628.50

523.75

419.00

314.25

209.50

104.75

74,000

$

1366.00

1252.17

1138.33

1024.50

910.67

796.83

683.00

569.17

455.33

341.50

227.67

113.83

76,000

$

1,476.00

1353.00

1230.00

1107.00

984.00

861.00

738.00

615.00

492.00

369.00

246.00

123.00

78,000

$

1612.00

1477.67

1343.33

1209.00

1074.67

940.33

806.00

671.67

537.33

403.00

268.67

134.33

80,000

$

1740.00

1595.00

1450.00

1305.00

1160.00

1015.00

870.00

725.00

580.00

435.00

290.00

145.00

82,000

$

1861.00

1705.92

1550.83

1395.75

1240.67

1085.58

930.50

775.42

620.33

465.25

310.17

155.08

84,000

$

1981.00

1815.92

1650.83

1485.75

1320.67

1155.58

990.50

825.42

660.33

495.25

330.17

165.08

86,000

$

2102.00

1926.83

1751.67

1576.50

1401.33

1226.17

1051.00

875.83

700.67

525.50

350.33

175.17

88,000

$

2223.00

2037.75

1852.50

1667.25

1482.00

1296.75

1111.50

926.25

741.00

555.75

370.50

185.25

90,000

$

2344.00

2148.67

1953.33

1758.00

1562.67

1367.33

1172.00

976.67

781.33

586.00

390.67

195.33

92,000

$

2464.00

2258.67

2053.33

1848.00

1642.67

1437.33

1232.00

1026.67

821.33

616.00

410.67

205.33

94,000

$

2585.00

2369.58

2154.17

1938.75

1723.33

1507.92

1292.50

1077.08

861.67

646.25

430.83

215.42

96,000

$

2706.00

2480.50

2255.00

2029.50

1804.00

1578.50

1353.00

1127.50

902.00

676.50

451.00

225.50

98,000

$

2827.00

2591.42

2355.83

2120.25

1884.67

1649.08

1413.50

1177.92

942.33

706.75

471.17

235.58

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

100,000

$

2947.00

2701.42

2455.83

2210.25

1964.67

1719.08

1473.50

1227.92

982.33

736.75

491.17

245.58

102,000

$

3068.00

2812.33

2556.67

2301.00

2045.33

1789.67

1534.00

1278.33

1022.67

767.00

511.33

255.67

104,000

$

3189.00

2923.25

2657.50

2391.75

2126.00

1860.25

1594.50

1328.75

1063.00

797.25

531.50

265.75

105,500

$

3310.00

3034.17

2758.33

2482.50

2206.67

1930.83

1655.00

1379.17

1103.33

827.50

551.67

275.83

20

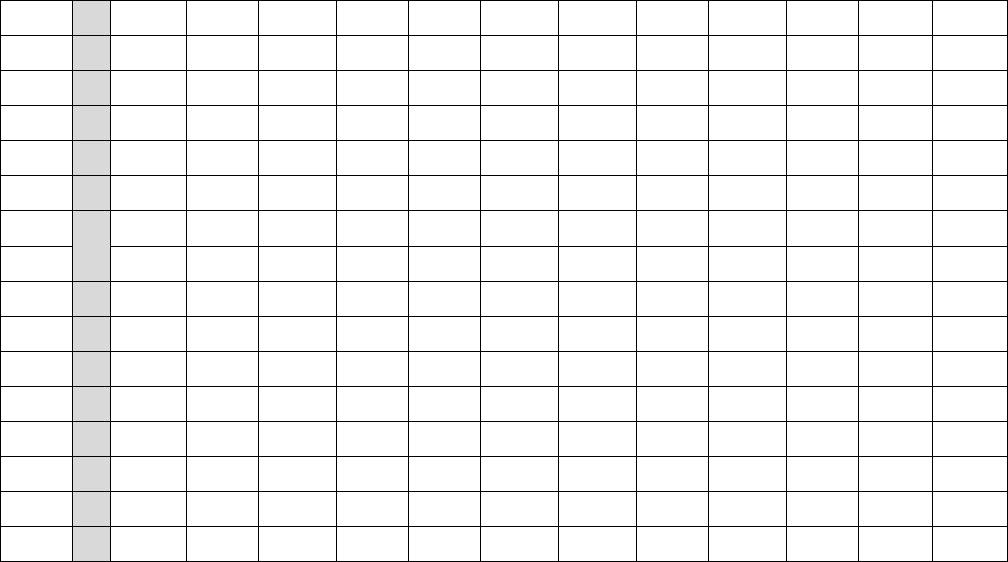

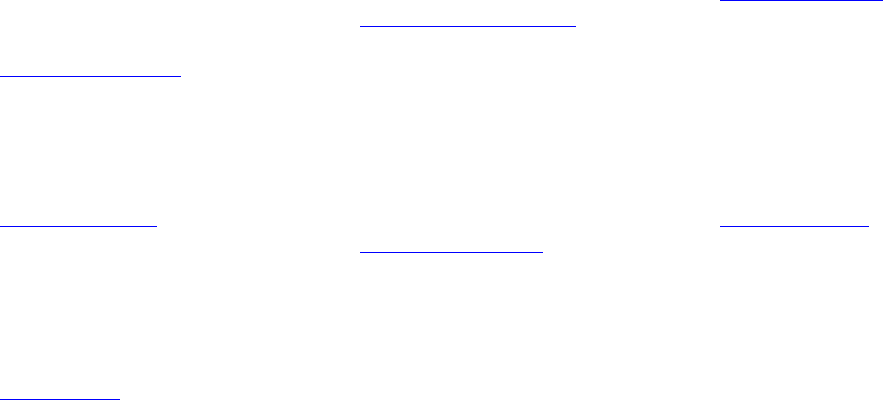

State of Washing

ton - License Fees (Combined Gross Weight)

License fee and credit chart for power types TR, TT, DT - Schedule B

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

12,000

$

81.00

74.25

67.50

60.75

54.00

47.25

40.50

33.75

27.00

20.25

13.50

6.75

14,000

$

88.00

80.67

73.33

66.00

58.67

51.33

44.00

36.67

29.33

22.00

14.67

7.33

16,000

$

100.00

91.67

83.33

75.00

66.67

58.33

50.00

41.67

33.33

25.00

16.67

8.33

18,000

$

152.00

139.33

126.67

114.00

101.33

88.67

76.00

63.33

50.67

38.00

25.33

12.67

20,000

$

169.00

154.92

140.83

126.75

112.67

98.58

84.50

70.42

56.33

42.25

28.17

14.08

22,000

$

183.00

167.75

152.50

137.25

122.00

106.75

91.50

76.25

61.00

45.75

30.50

15.25

24,000

$

198.00

181.50

165.00

148.50

132.00

115.50

99.00

82.50

66.00

49.50

33.00

16.50

26,000

$

209.00

191.58

174.17

156.75

139.33

121.92

104.50

87.08

69.67

52.25

34.83

17.42

28,000

$

247.00

226.42

205.83

185.25

164.67

144.08

123.50

102.92

82.33

61.75

41.17

20.58

30,000

$

285.00

261.25

237.50

213.75

190.00

166.25

142.50

118.75

95.00

71.25

47.50

23.75

32,000

$

344.00

315.33

286.67

258.00

229.33

200.67

172.00

143.33

114.67

86.00

57.33

28.67

34,000

$

366.00

335.50

305.00

274.50

244.00

213.50

183.00

152.50

122.00

91.50

61.00

30.50

36,000

$

397.00

363.92

330.83

297.75

264.67

231.58

198.50

165.42

132.33

99.25

66.17

33.08

38,000

$

436.00

399.67

363.33

327.00

290.67

254.33

218.00

181.67

145.33

109.00

72.67

36.33

40,000

$

499.00

457.42

415.83

374.25

332.67

291.08

249.50

207.92

166.33

124.75

83.17

41.58

42,000

$

609.00

558.25

507.50

456.75

406.00

355.25

304.50

253.75

203.00

152.25

101.50

50.75

44,000

$

620.00

568.33

516.67

465.00

413.33

361.67

310.00

258.33

206.67

155.00

103.33

51.67

46,000

$

660.00

605.00

550.00

495.00

440.00

385.00

330.00

275.00

220.00

165.00

110.00

55.00

48,000

$

684.00

627.00

570.00

513.00

456.00

399.00

342.00

285.00

228.00

171.00

114.00

57.00

50,000

$

735.00

673.75

612.50

551.25

490.00

428.75

367.50

306.25

245.00

183.75

122.50

61.25

52,000

$

768.00

704.00

640.00

576.00

512.00

448.00

384.00

320.00

256.00

192.00

128.00

64.00

54,000

$

822.00

753.50

685.00

616.50

548.00

479.50

411.00

342.50

274.00

205.50

137.00

68.50

56,000

$

863.00

791.08

719.17

647.25

575.33

503.42

431.50

359.58

287.67

215.75

143.83

71.92

58,000

$

894.00

819.50

745.00

670.50

596.00

521.50

447.00

372.50

298.00

223.50

149.00

74.50

60,000

$

947.00

868.08

789.17

710.25

631.33

552.42

473.50

394.58

315.67

236.75

157.83

78.92

62,000

$

1009.00

924.92

840.83

756.75

672..67

588.58

504.50

420.42

336.33

252.25

168.17

84.08

64,000

$

1029.00

943.25

857.50

771.75

686.00

600.25

514.50

428.75

343.00

257.25

171.50

85.75

66,000

$

1136.00

1041.33

946.67

852.00

757.33

662.67

568.00

473.33

378.67

284.00

189.33

94.67

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

68,000

$

1181.00

1082.58

984.17

885.75

787.33

688.92

590.50

492.08

393.67

295.25

196.83

98.42

70,000

$

1265.00

1159.58

1054.17

948.75

843.33

737.92

632.50

527.08

421.67

316.25

210.83

105.42

72,000

$

1347.00

1234.75

1122.50

1010.25

898.00

785.75

673.50

561.25

449.00

336.75

224.50

112.25

74,000

$

1456.00

1334.67

1213.33

1092.00

970.67

849.33

728.00

606.67

485.33

364.00

242.67

121.33

21

76,000

$

1566.00

1435.50

1305.00

1174.50

1044.00

913.50

783.00

652.50

522.00

391.50

261.00

130.50

78,000

$

1702.00

1560.17

1418.33

1276.50

1134.67

992.83

851.00

709.17

567.33

425.50

283.67

141.83

80,000

$

1830.00

1677.50

1525.00

1372.50

1220.00

1067.50

915.00

762.50

610.00

457.50

305.00

152.50

82,000

$

1951.00

1788.42

1625.83

1463.25

1300.67

1138.08

975.50

812.92

650.33

487.75

325.17

162.58

84,000

$

2071.00

1898.42

1725.83

1553.25

1380.67

1208.08

1035.50

862.92

690.33

517.75

345.17

172.58

86,000

$

2192.00

2009.33

1826.67

1644.00

1461.33

1278.67

1096.00

913.33

730.67

548.00

365.33

182.67

88,000

$

2313.00

2120.25

1927.50

1734.75

1542.00

1349.25

1156.50

963.75

771.00

578.25

385.50

192.75

90,000

$

2434.00

2231.17

2028.33

1825.50

1622.67

1419.83

1217.00

1014.17

811.33

608.50

405.67

202.83

92,000

$

2554.00

2341.17

2128.33

1915.50

1702.67

1489.83

1277.00

1064.17

851.33

638.50

425.67

212.83

94,000

$

2675.00

2452.08

2229.17

2006.25

1783.33

1560.42

1337.50

1114.58

891.67

668.75

445.83

222.92

96,000

$

2796.00

2563.00

2330.00

2097.00

1864.00

1631.00

1398.00

1165.00

932.00

699.00

466.00

233.00

98,000

$

2917.00

2673.92

2430.83

2187.75

1944.67

1701.58

1458.50

1215.42

972.33

729.25

486.17

243.08

100,000

$

3037.00

2783.92

2530.83

2277.75

2024.67

1771.58

1518.50

1265.42

1012.33

759.25

506.17

253.08

102,000

$

3158.00

2894.83

2631.67

2368.50

2105.33

1842.17

1579.00

1315.83

1052.67

789.50

526.33

263.17

104,000

$

3279.00

3005.75

2732.50

2459.25

2186.00

1912.75

1639.50

1366.25

1093.00

819.75

546.50

273.25

105,500

$

3400.00

3116.67

2833.33

2550.00

2266.67

1983.33

1700.00

1416.67

1133.33

850.00

566.67

283.33

22

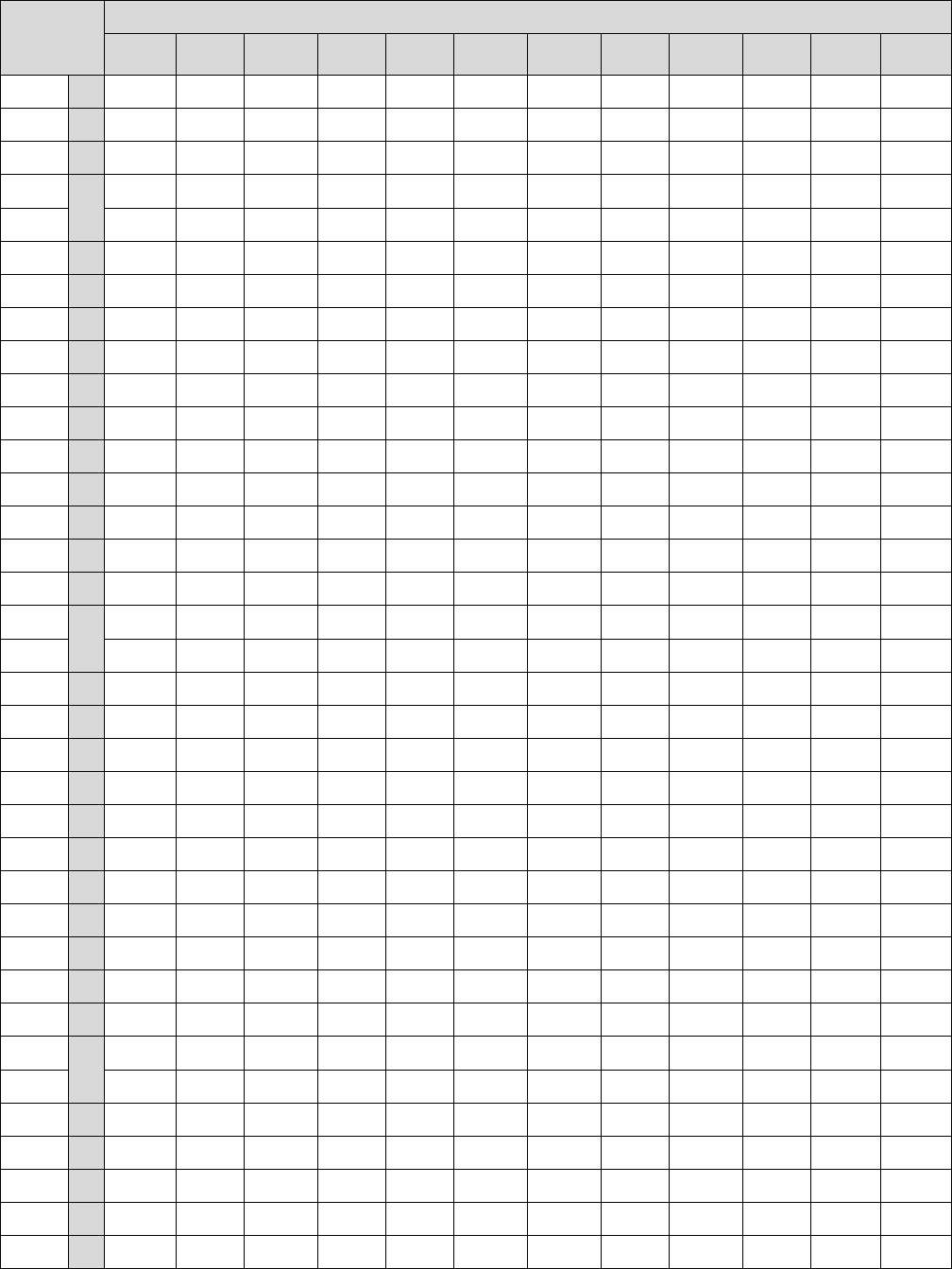

State of Washington – Freight Fee (Gross Weight)

License fee and credit chart for power types TK, BU, RT, LG - Schedule A - FRT

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

12,000

$

12.00

11.00

10.00

9.00

8.00

7.00

6.00

5.00

4.00

3.00

2.00

1.00

14,000

$

13.00

11.92

10.83

9.75

8.67

7.58

6.50

5.42

4.33

3.25

2.17

1.08

16,000

$

15.00

13.75

12.50

11.25

10.00

8.75

7.50

6.25

5.00

3.75

2.50

1.25

18,000

$

23.00

21.08

19.17

17.25

15.33

13.42

11.50

9.58

7.67

5.75

3.83

1.92

20,000

$

25.00

22.92

20.83

18.75

16.67

14.58

12.50

10.42

8.33

6.25

4.17

2.08

22,000

$

27.00

24.75

22.50

20.25

18.00

15.75

13.50

11.25

9.00

6.75

4.50

2.25

24,000

$

30.00

27.50

25.00

22.50

20.00

17.50

15.00

12.50

10.00

7.50

5.00

2.50

26,000

$

31.00

28.42

25.83

23.25

20.67

18.08

15.50

12.92

10.33

7.75

5.17

2.58

28,000

$

37.00

33.92

30.83

27.75

24.67

21.58

18.50

15.42

12.33

9.25

6.17

3.08

30,000

$

43.00

39.42

35.83

32.25

28.67

25.08

21.50

17.92

14.33

10.75

7.17

3.58

32,000

$

52.00

47.67

43.33

39.00

34.67

30.33

26.00

21.67

17.33

13.00

8.67

4.33

34,000

$

55.00

50.42

45.83

41.25

36.67

32.08

27.50

22.92

18.33

13.75

9.17

4.58

36,000

$

60.00

55.00

50.00

45.00

40.00

35.00

30.00

25.00

20.00

15.00

10.00

5.00

38,000

$

65.00

59.58

54.17

48.75

43.33

37.92

32.50

27.08

21.67

16.25

10.83

5.42

40,000

$

75.00

68.75

62.50

56.25

50.00

43.75

37.50

31.25

25.00

18.75

12.50

6.25

42,000

$

78.00

71.50

65.00

58.50

52.00

45.50

39.00

32.50

26.00

19.50

13.00

6.50

44,000

$

80.00

73.33

66.67

60.00

53.33

46.67

40.00

33.33

26.67

20.00

13.33

6.67

46,000

$

86.00

78.83

71.67

64.50

57.33

50.17

43.00

35.83

28.67

21.50

14.33

7.17

48,000

$

89.00

81.58

74.17

66.75

59.33

51.92

44.50

37.08

29.67

22.25

14.83

7.42

50,000

$

97.00

88.92

80.83

72.75

64.67

56.58

48.50

40.42

32.33

24.25

16.17

8.08

52,000

$

102.00

93.50

85.00

76.50

68.00

59.50

51.00

42.50

34.00

25.50

17.00

8.50

54,000

$

110.00

100.83

91.67

82.50

73.33

64.17

55.00

45.83

36.67

27.50

18.33

9.17

56,000

$

116.00

106.33

96.67

87.00

77.33

67.67

58.00

48.33

38.67

29.00

19.33

9.67

58,000

$

121.00

110.92

100.83

90.75

80.67

70.58

60.50

50.42

40.33

30.25

20.17

10.08

60,000

$

129.00

118.25

107.50

96.75

86.00

75.25

64.50

53.75

43.00

32.25

21.50

10.75

62,000

$

138.00

126.50

115.00

103.50

92.00

80.50

69.00

57.50

46.00

34.50

23.00

11.50

64,000

$

141.00

129.25

117.50

105.75

94.00

82.25

70.50

58.75

47.00

35.25

23.50

11.75

66,000

$

157.00

143.92

130.83

117.75

104.67

91.58

78.50

65.42

52.33

39.25

26.17

13.08

68,000

$

164.00

150.33

136.67

123.00

109.33

95.67

82.00

68.33

54.67

41.00

27.33

13.67

70,000

$

176.00

161.33

146.67

132.00

117.33

102.67

88.00

73.33

58.67

44.00

29.33

14.67

72,000

$

189.00

173.25

157.50

141.75

126.00

110.25

94.50

78.75

63.00

47.25

31.50

15.75

74,000

$

205.00

187.92

170.83

153.75

136.67

119.58

102.50

85.42

68.33

51.25

34.17

17.08

76,000

$

221.00

202.58

184.17

165.75

147.33

128.92

110.50

92.08

73.67

55.25

36.83

18.42

78,000

$

242.00

221.83

201.67

181.50

161.33

141.17

121.00

100.83

80.67

60.50

40.33

20.17

80,000

$

261.00

239.25

217.50

195.75

174.00

152.25

130.50

108.75

87.00

65.25

43.50

21.75

82,000

$

279.00

255.75

232.50

209.25

186.00

162.75

139.50

116.25

93.00

69.75

46.50

23.25

23

GVW or

CGVW in

pounds

Number of months remaining in registration period (Including month of registration)

12

11

10

9

8

7

6

5

4

3

2

1

84,000

$

297.00

272.25

247.50

222.75

198.00

173.25

148.50

123.75

99.00

74.25

49.50

24.75

86,000

$

315.00

288.75

262.50

236.25

210.00

183.75

157.50

131.25

105.00

78.75

52.50

26.25

88,000

$

333.00

305.25

277.50

249.75

222.00

194.25

166.50

138.75

111.00

83.25

55.50

27.75

90,000

$

352.00

322.67

293.33

264.00