Rental, Hiring and

Real Estate Services

Industry Insight

October 2022

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

2

Contents

Introduction ................................................................................ 3

Report coverage ........................................................................ 5

Executive summary .................................................................... 6

Industry outlook .......................................................................... 9

Workforce and skilling implications .......................................... 14

Education and training pipeline ................................................ 17

Workforce priorities .................................................................. 20

Collaborative response ............................................................ 22

Appendix A: Data methodology ............................................... 24

Appendix B: Victorian VET pipeline methodology ................... 27

Appendix C: Stakeholder engagement process ...................... 28

References ............................................................................... 29

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

3

Introduction

This report on the Rental, Hiring and Real Estate Services industry forms part of the 2022 Victorian

Skills Plan and outlines demand for occupations, education and training directed to meeting the

demand and current workforce issues facing the industry.

This report has been prepared by the Victorian Skills Authority (VSA). The VSA was formed in July

2021 in response to the review Future Skills for Victoria: Driving collaboration and innovation in post-

secondary education and training (known as the Macklin Review). The VSA is charged with preparing

an annual Victorian Skills Plan (the Skills Plan) to guide decision-making on skills and training, by the

Government, education and training providers, industry and communities.

The Victorian Skills Plan

The annual Skills Plan sets out Victoria’s skills needs for 2022 to 2025 by drawing on data, evidence

and insights from a range of system-wide and local sources.

The Government in conjunction with industry, communities and education and training partners brings

collaborative action through the Skills Plan which:

• defines skill needs with clear statements of required skills and capabilities (current and emerging)

• sets priorities for post-school education and training in Victoria

• communicates to the community the opportunities education and training can provide to offer

careers for individuals that also meet the workforce needs of industry

• aligns action across industry and government to support improved outcomes for all Victorians.

The Skills Plan consists of:

• a summary report – the Victorian Skills Plan

• the industry needs of the Victorian economy segmented into 13 insight reports, each comprising

like industries – of which this report is one

• profiles of industry and occupations in the regional areas of Victoria which outline priorities for

skills development – either as snapshots or Regional Skills Demand Profiles

• current employment and forecast demand to 2025 across Victoria – a user-driven dashboard.

About Industry Insight Reports

Each industry insight is based on robust research, qualitative and quantitative data collection and

analysis and extensive consultation with the Government’s Industry Advisory Groups, partners and

stakeholders over a period of six months. Each report sets out to:

• profile the industry outlook, taking into account sector trends and key drivers of demand

• detail the workforce and skilling implications of the industry based on forecasting

• set industry priorities in responding to current and future workforce challenges

• provide initial guidance for an education and training response to these challenges.

The industries reflected in each report are defined according to their classification within 1292.0 -

Australian and New Zealand Standard Industrial Classification (ANZSIC) 2006, prepared by the

Australian Bureau of Statistics. Occupations within industries have been defined using the Australian

and New Zealand Standard Classification of Occupations (ANZSCO).

Each industry insight contributes to the conclusions and recommendations of the Skills Plan, focusing

on actions for implementation over a three-year period.

The VSA acknowledges and extends sincere thanks to the individuals and organisations that

participated in the consultations and contributed to these materials.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

4

Using this report

This is a point-in-time report on the rental, hiring and real estate Services industry in Victoria and the

associated skills and workforce issues.

This report, along with the Skills Plan, has been prepared for industry and provider partners as a

summary of demand for occupations and workforce issues. In addition to being used by the Victorian

Government to consider responses, as a public document it is available to industry and education and

training partners to form actions and responses.

The report does not represent the full picture of workforce issues in the industry. Opportunities

associated with skills and workforce are longstanding. The information in the report, however, provides

the basis for ongoing work on skills demand and responses, including by the VSA and through the

Industry Advisory Groups.

Feedback

Feedback on this report, and others, is welcome and can be provided to

SkillsPlan@education.vic.gov.au. Feedback will contribute to developing insights and actions.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

5

Report coverage

This industry insight focuses on the rental, hiring and real estate services industry as defined under

ANZSIC and the occupations relevant to the industry, classified according to ANZSCO. It covers the

selling, renting, managing and buying of real estate. It also includes the rent and hiring of tangible and

intangible property such as bloodstock, cars and patents.

Statistics about an industry and its sub-sectors are collated by the Australian Bureau of Statistics

(ABS) from the activity of businesses. Each business is classified to an industry based on their primary

activities. Where an individual works for multiple businesses, their main job is used.

Industry classifications rarely encompass the full nature of the work (and therefore skills) associated

with a given industry. ABS definitions of industries or sectors may not align with the definitions used by

an industry association, while the allocation of businesses on primary activity can result in businesses

that perform similar services but with a different emphasis being classified across different industries.

Coverage in this report is limited to employment in the industry and sectors as defined by ABS, noting

some occupations are almost exclusively associated with an industry, such as real estate agents in

the rental, hiring and real estate services, while others, such as accountants and electricians, are

associated with many industries. Note, however, that occupational demand for Victoria as reflected in

the dashboard is the total of occupational demand for all industries.

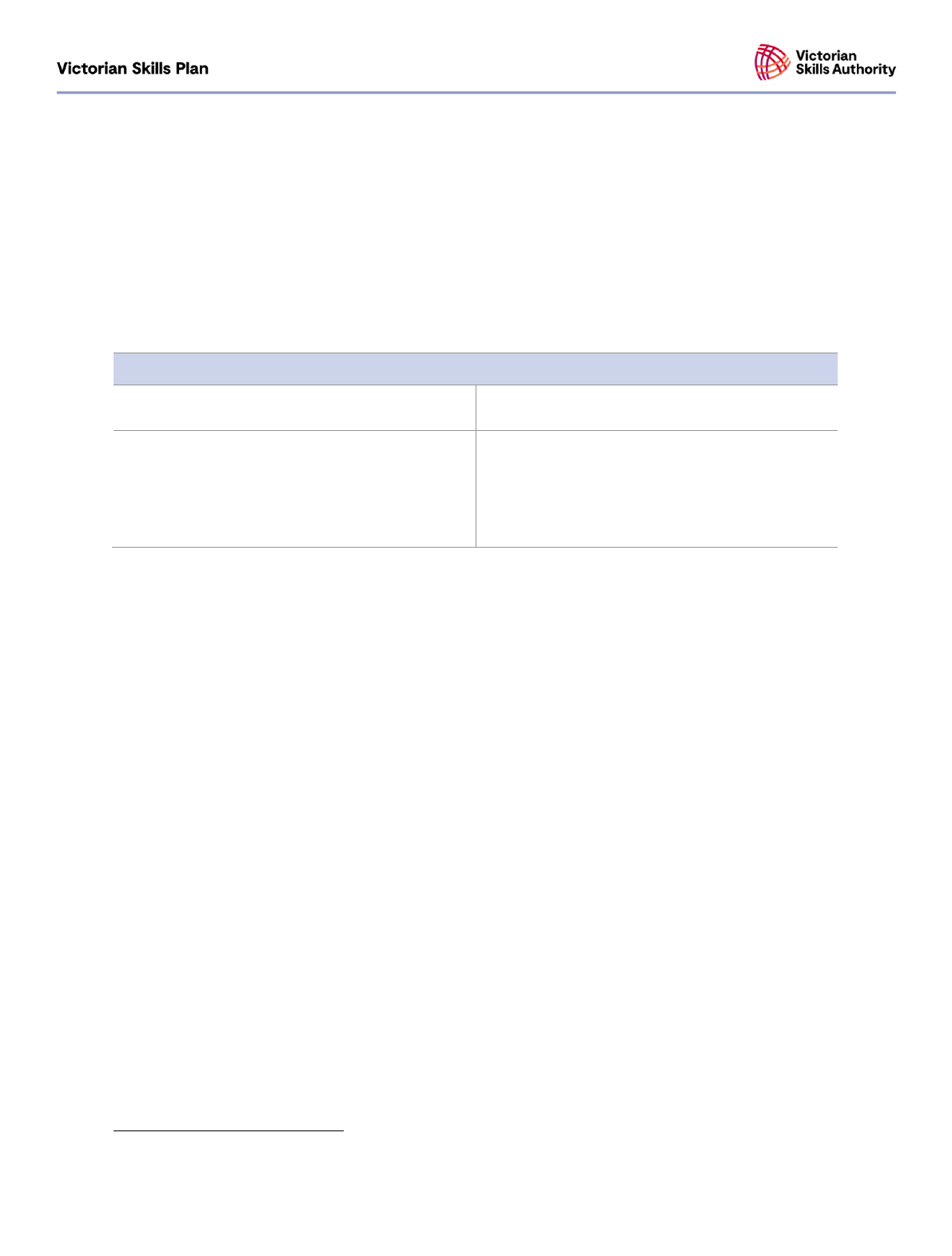

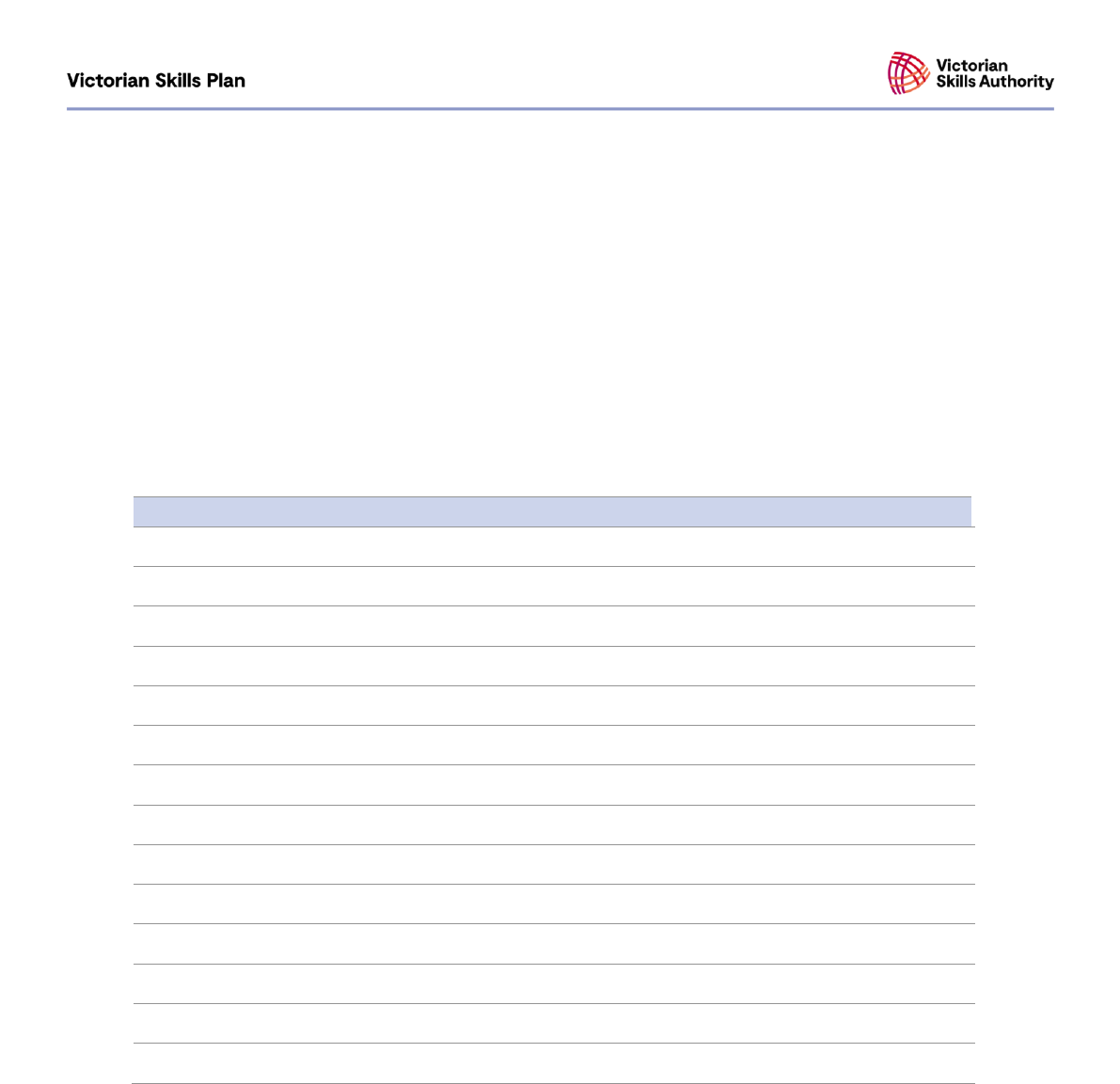

Table 1 sets out related activities that may occur within the rental, hiring and real estate services

industry but are reported formally under other industries. The relevant Industry Insight report is listed.

Table 1 | Scope of related industry activities and insights related industries

Activities

Industry insight

Automotive sales

Services

Streaming services

Professional, Financial and

Information Services

Farming of cattle and livestock

Agriculture, Forestry and Fishing

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

6

Executive summary

Industry outlook

The rental, hiring and real estate services industry impacts the livelihoods of most Victorians through

the buying, selling or hiring of property and equipment for personal and commercial purposes. Over

52,700 workers are employed in Victoria across real estate and other rental and leasing services.

1

Significant growth in the real estate market has occurred over the last few years, particularly for

residential properties. Despite COVID-19 impacting business operations, the industry is expected to

experience continued growth, albeit subject to market volatility. Key drivers include ongoing demand

for residential property underpinned by anticipated return to population growth, particularly in regional

areas.

Workforce and skilling implications

On average, across all industries total employment is expected to grow by an additional 211,900

workers to 2025, from 3,538,900 workers in 2022, an annual growth rate of 1.97 per cent

a

.

2

,

3

In

comparison between 2017 and 2020 employment grew by 2.68 per cent

b

annually.

4

In the rental, hiring and real estate services industry, employment is expected to grow by an additional

3,700 workers to 2025, from 52,700 workers in 2022, an annual growth rate of 2.43 per cent

c

which is

higher than the overall Victorian average across all industries.

5

,

6

In comparison between 2017 and

2020 employment across this industry experienced a decline of 0.31 per cent

d

.

7

Moderate workforce growth will be required to meet expected demand. By 2025, an estimated 5,600

new workers are needed.

8

This includes approximately 3,700 employment growth and replacement of

1,900 retirees.

9

,

10

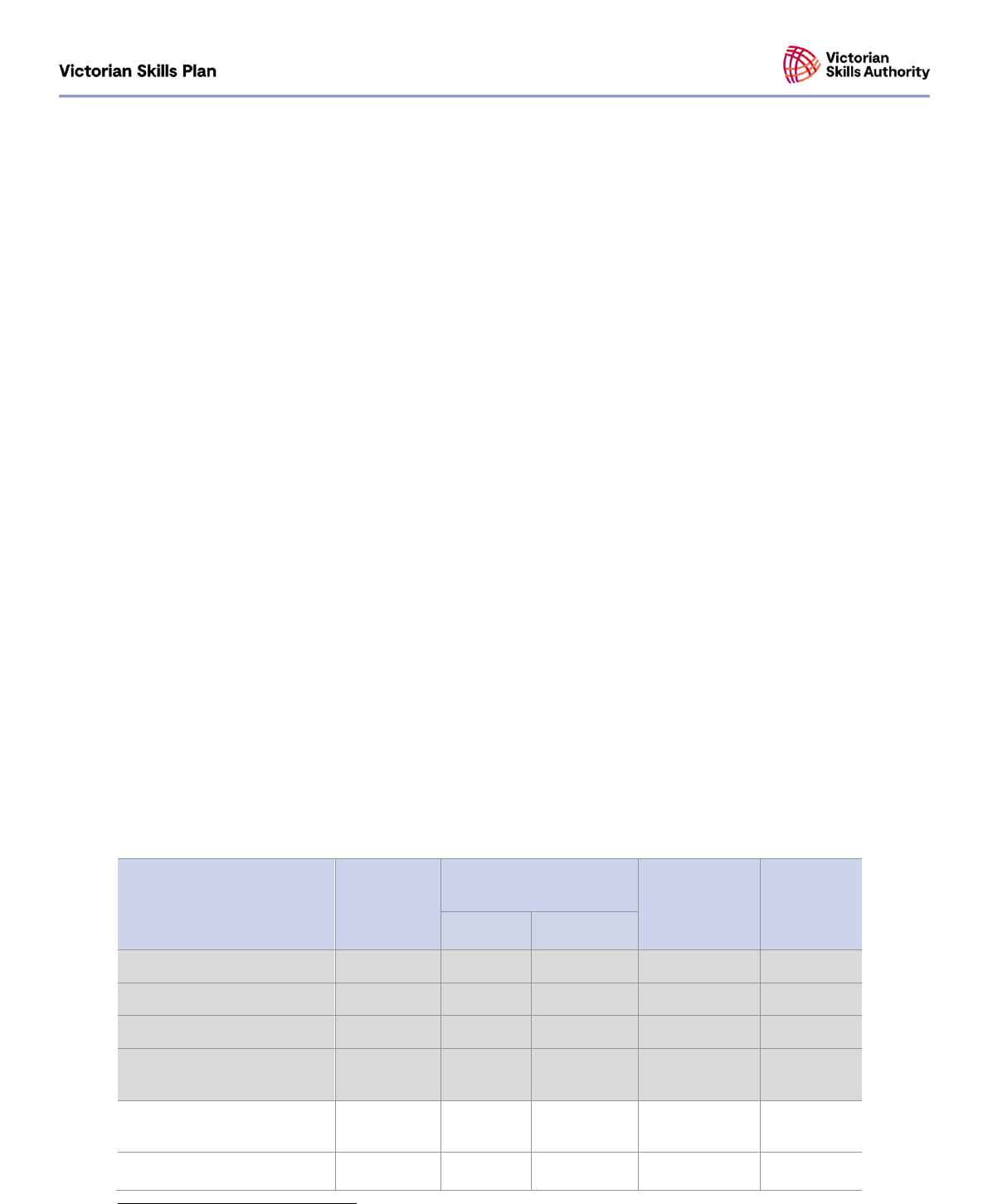

Table 2 identifies the top ten occupations in demand across the industry by 2025.

11

Of these, seven

occupations (highlighted in table) are expected to experience employment growth at a rate above the

overall Victorian average between 2022 and 2025.

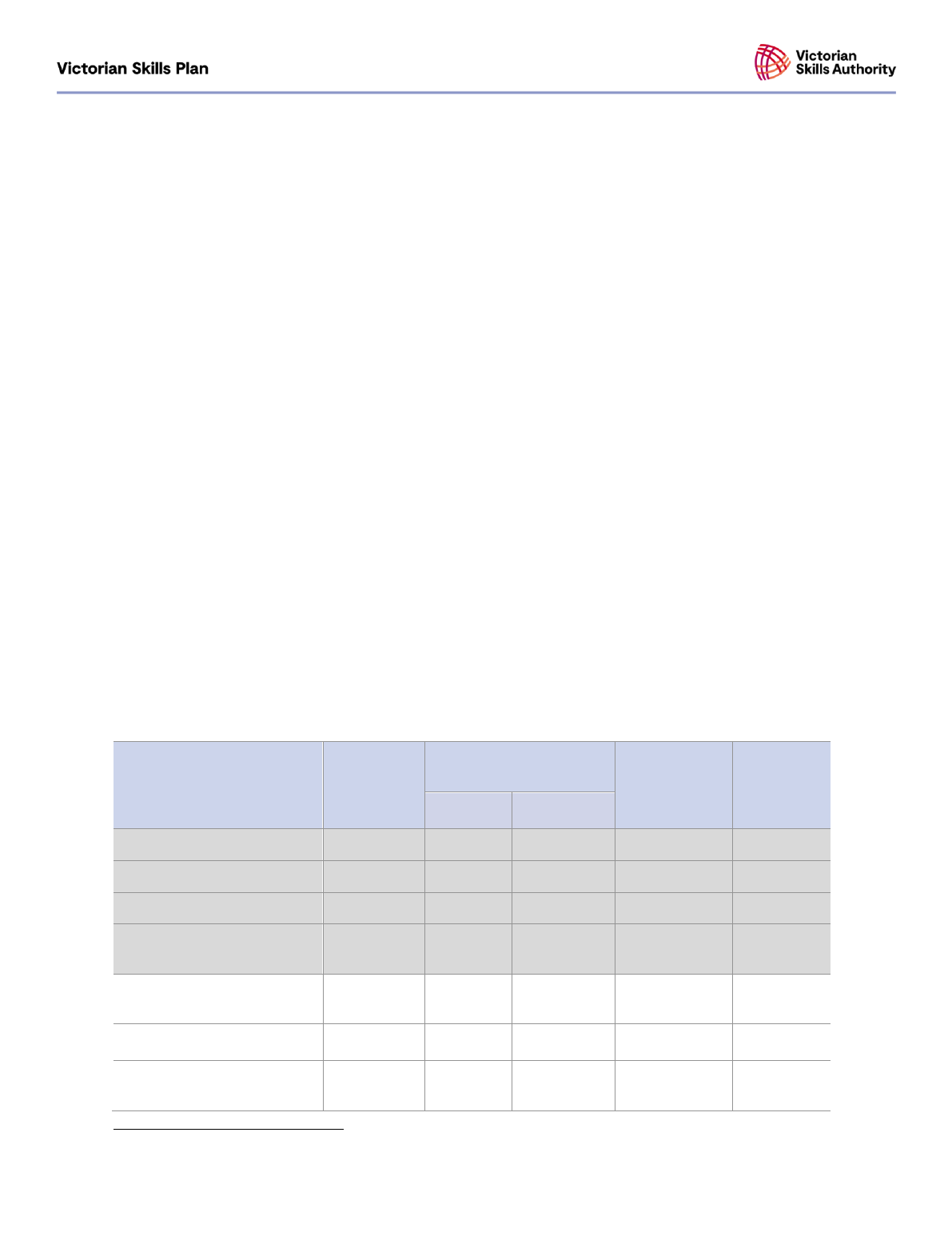

Table 2 | Occupations in demand in the rental, hiring and real estate services industry by

2025

e

,

12

,

13

Occupation

Current

employment

Employment growth

(2022−25)

Retirements

(2022−25)

New

workers

needed

(2022−25)

Number

Per cent

Real estate sales agents

17,850

1,800

2.6%

600

2,350

General clerks

3,200

200

3.4%

100

300

Land economists and valuers

2,100

150

3.2%

50

200

Other sales assistants and

salespersons

450

100

2.4%

50

150

Advertising and sales

managers

2,300

50

1.9%

50

100

Office managers

2,350

50

1.8%

50

100

a

3-year compound annual growth rate

b

Computed for 2017 to 2020 employment growth for pre-COVID comparison

c

3-year compound annual growth rate

d

Computed for 2017 to 2020 employment growth for pre-COVID comparison

e

Due to rounding, some totals may not correspond with the sum of the separate figures

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

7

Receptionists

2,900

Less than

50

0.5%

50

100

Contract, program and project

administrators

650

50

3.0%

Less than 50

50

Finance managers

1,200

50

3.3%

Less than 50

50

Financial investment advisers

and managers

650

50

3.7%

Less than 50

50

Legend

Above Victorian employment growth average between 2022 and 2025

Technological advancements that enable online inspections are driving demand for new jobs,

including online buyer’s advocates, data analysts and pricing analysts. In addition, regulatory reforms

across the industry drive a need for regulatory affairs specialists and regulatory compliance officers.

Industry has also identified changing skill needs. Workers will increasingly need to demonstrate an

understanding of ethics, compliance, and digital literacy. Property managers who work with vulnerable

clients will also need skills in empathy and engagement.

Meeting this demand will be challenging. Industry reports the need to upskill a large proportion of its

workforce to keep pace with regulatory reform, difficulty attracting workers to the industry and

challenges with retaining existing staff as all contributing to this challenge.

Workforce priorities

Two priorities are identified to address workforce and skilling needs for the rental hiring and real estate

services industry:

1. Adapt employment and education practices to align with the new minimum qualification for real

estate agents – to ensure workers are appropriately trained in emerging issues (such as changes

to rental laws) with sufficient practical experience.

2. Provide career advancement opportunities by developing specialised skills in the real estate sector,

such as auctioneering or valuation through further study – focus is required to upskill workers to

meet current and future demand in technical and leadership roles.

Education and training pipeline and workforce response

Pathways to employment in the rental, hiring and real estate services industry are split across higher

education and VET with 30.6 per cent of workers holding a degree or above as their highest level of

education and 36.3 per cent holding a VET level qualification as their highest level of education.

14

There were approximately 4,070 enrolments in relevant VET qualifications in 2020

f

and close to 1,150

equivalent full-time study load (EFSTL) in higher education in 2019.

15

,

16

The key entry point to the industry is the Certificate IV in Real Estate Practice, accounting for over

4,050 enrolments.

17

Graduates from VET courses provide an important source of workers to the

industry. While activity is high for the Certificate IV in Real Estate Practice, there is opportunity to

better respond to the identified priorities across the education pipeline.

Some industry representative indicated that the time taken to obtain the necessary qualifications is

challenging when real estate workers are needed quickly. New regulation requires students to have

f

VET enrolments related to the Rental, hiring and real estate services industry include only courses that are deemed as primary

pathways into this sector. Many of these courses serve multiple industries and the total enrolment numbers are reflective of this

broader pipeline. VET enrolments in courses that primarily feeds into other sectors but also support the Rental, hiring and real

estate services industry are included in the industry in which the course primarily supports.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

8

completed a prescribed number of units, before shadowing licensed operators. Removing barriers to

practical experience in line with policy and regulation is a key focus. Increased industry exposure can

ensure students learn from experienced practitioners with an up-to-date understanding of regulatory

requirements.

As the workforce builds, maintaining ethical and quality standards is vital. Qualifications focused on

auctioneering and valuing can cultivate the skills needed to meet industry demand. Further upskilling

workers through micro-credentials and short courses on their legislative and ethical obligations can

help maintain agent conduct.

Without consideration of policy, job design and the employee value proposition, the real estate

industry will continue to face recruitment and retention challenges. Flexible work arrangements,

funding and study leave can drive change.

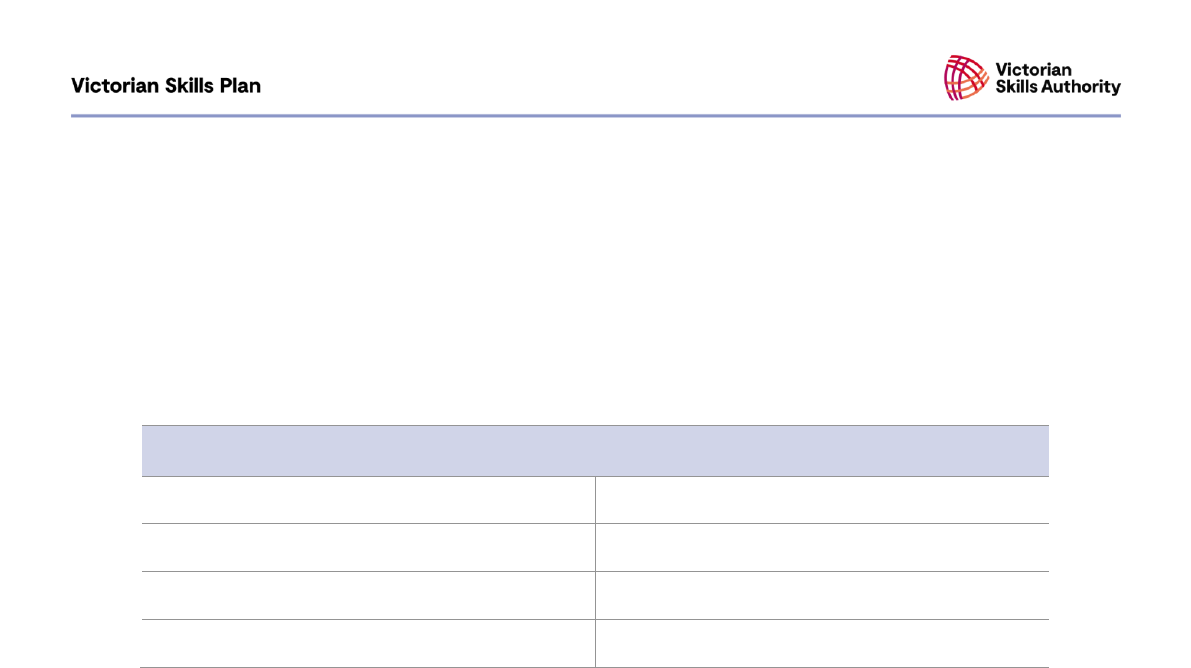

Table 3 highlights actions that could be adopted by education, industry, and government to meet

workforce demand.

Table 3 | Actions for consideration for education, industry, and government

• Increase practical experience opportunities for students seeking to become real estate agents.

• Facilitate specialisation with targeted education and training opportunities in areas such as

auctioneering and valuation.

• Ensure existing workforce practices and recruitment policies respond effectively to fluctuations in

demand across the industry and the time taken to train new agents.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

9

Industry outlook

The rental, hiring and real estate services industry is likely to fluctuate in

proportion to predicted volatility in the real estate market

The rental, hiring and real estate services industry, consisting of real estate and other rental and

leasing, plays a vital role in Victoria’s economy despite the relatively small size of its workforce.

The rental, hiring and real estate services industry employs 1.5 per cent of the total Victorian

workforce (52,700 workers).

18

Across the industry, approximately 47.8 per cent of workers are female,

similar to the Victorian average of 47.2 per cent.

19

Approximately 28.1 per cent of workers in the sector

are aged over 50, similar to the Victorian average across all sectors of 29 per cent.

20

The impacts of COVID-19 on the industry have been significant, varying by sector within the industry.

Demand and opportunity for digital delivery has increased in response to COVID-19 and was crucial in

facilitating online inspections and auctions when restrictions prevented gatherings at private

residences in 2020 and 2021.

21

Employment opportunities during this period were significantly

reduced but have rebounded in proportion to market fluctuations.

The rental, hiring and real estate services industry provides a wide range of sales and rental services

in the real estate sector, as well as hiring services for goods, equipment and other intangible assets in

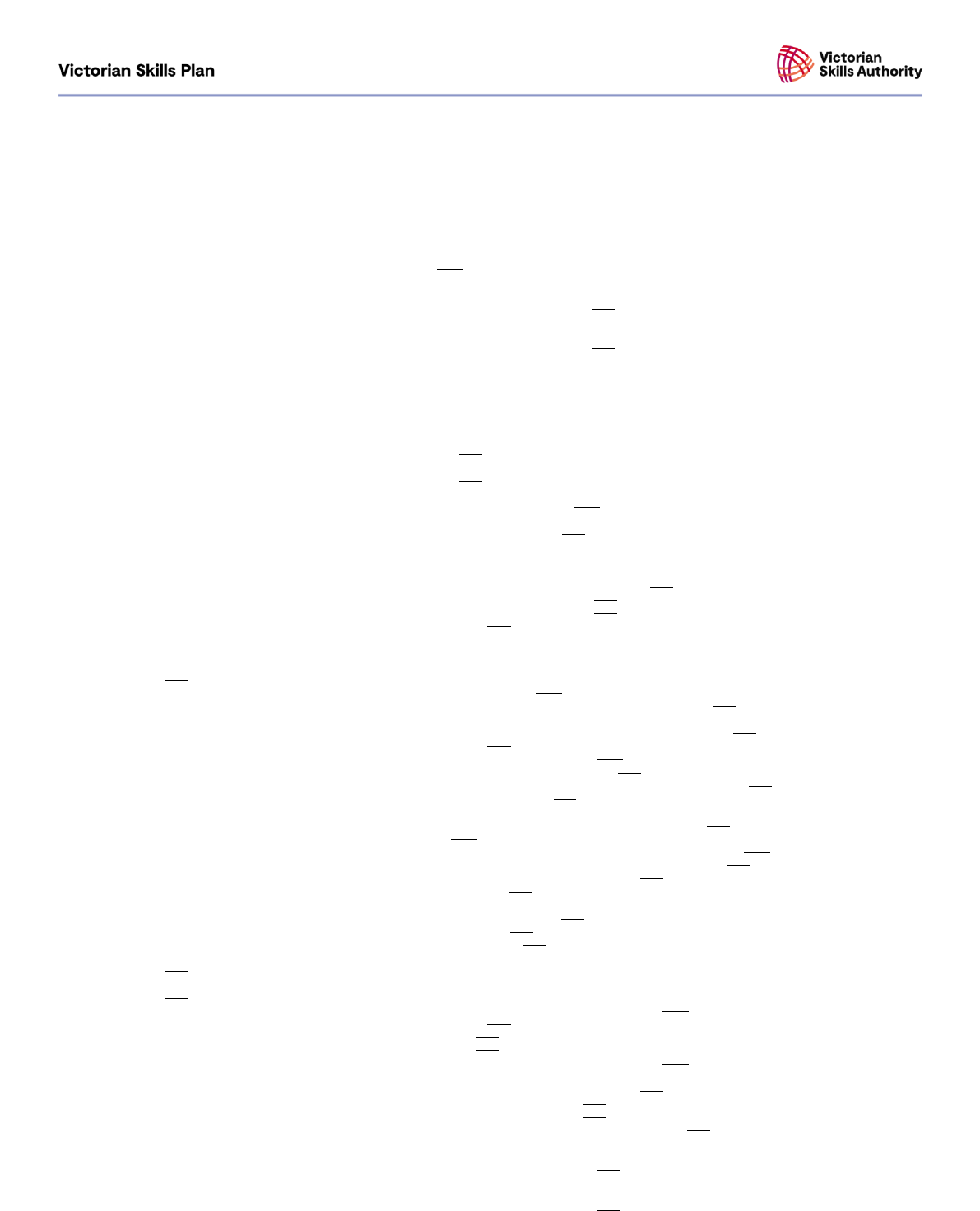

the other rental and leasing sector. The key sectors within the rental, hiring and real estate services

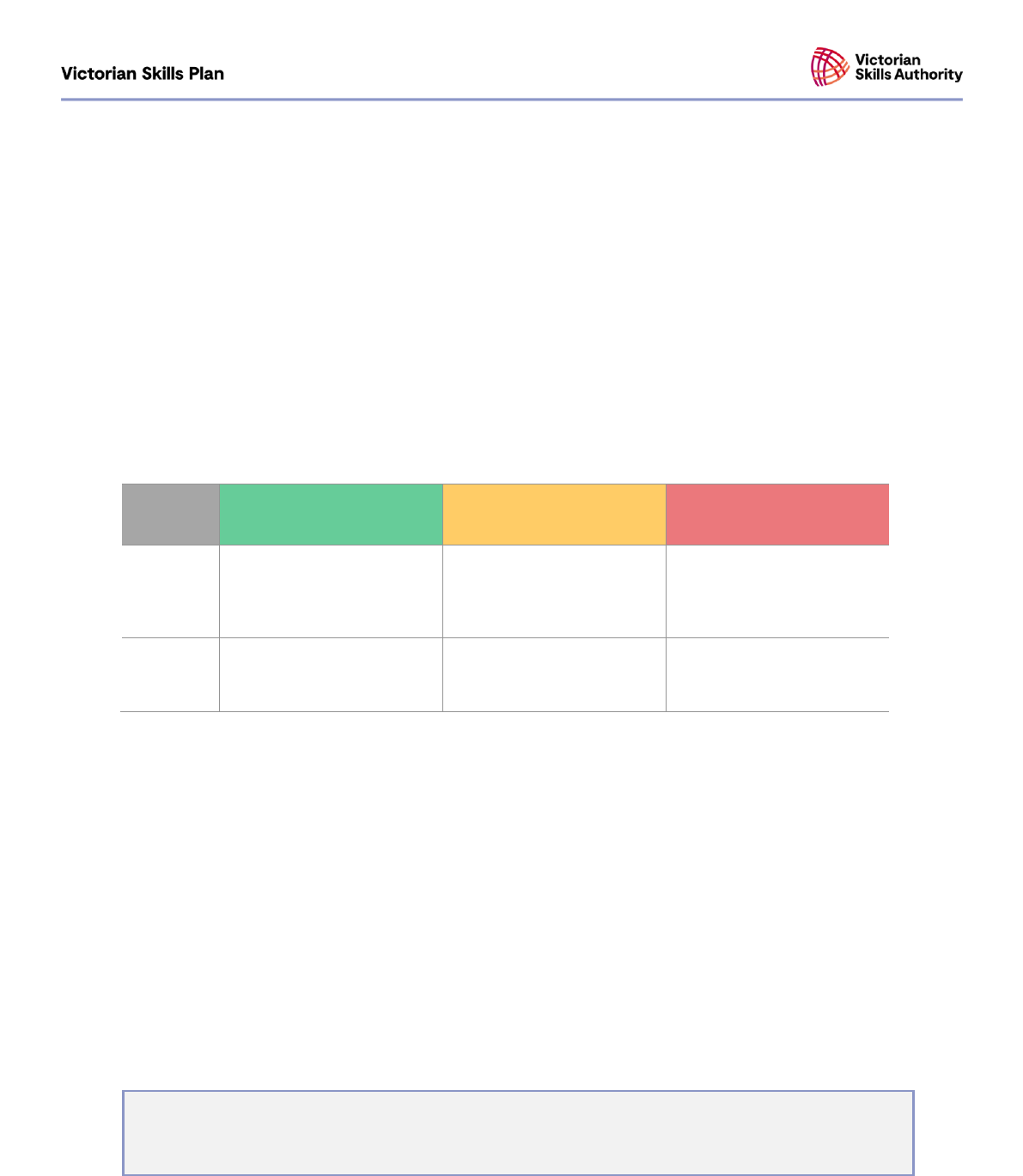

industry are shown in Figure 1.

Figure 1 | Key sectors within the rental, hiring and real estate services industry

22

Real estate

The real estate sector makes up the majority of the industry workforce (89.6 per cent).

23

The real

estate sector engages in property marketing and sales, auctioneering, insurance, financing,

settlements and conveyancing, maintenance and rental property management, business broking,

owner’s corporation management, valuation, and buyer advocacy.

24

The largest occupation in the

sector is real estate agents (28 per cent of the workforce). Real estate agents must be licensed and

are supported by property managers (who service the rental market), clerks and other administrative

staff. The sector does not include landlords who own and lease property without a third party.

The real estate sector, although a proportionately small part of the overall workforce, services a

market which is estimated to be worth $2.56 trillion in Victoria.

25

Victorian home values increased by

Real estate

Sales

Auctioneering

Rental property management

Conveyancing

Buyer advocacy

Valuation

Other rental and leasing

Vehicle and transport

equipment leasing

Farm animal and bloodstock

leasing

Other goods and equipment

leasing

Non-financial intangible assets

leasing

Despite strong growth in recent years, the real estate activity declined when remote inspections

and auctions were required during COVID-19 and remains volatile.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

10

15.9 per cent in 2020-21, making up more than a quarter of the total value of the nation’s residential

real estate.

26

This growth occurred against the backdrop of approximately 24 per cent workforce

growth in the real estate sector over the past five years. Despite strong growth in this market in recent

years, it remains volatile, and the industry suffered significantly during the COVID-19 pandemic as

inspections and auctions were conducted remotely.

27

More recently, increases in interest rates,

uncertainty about inflation, decreasing affordability and heavy media coverage has dampened buyer

enthusiasm and the overall downtrend in property markets and dwelling values is now becoming

apparent.

28

The real estate sector is concentrated in highly populated areas. For example, the Melbourne local

government area accounts for 17.8 per cent of the real estate workforce alone. Coastal areas in

southeast and southwest Melbourne also share a large proportion of the workforce.

29

Strong

population growth is projected for Greater Melbourne (5 million in 2018 to 9 million in 2056 – growth of

approximately 80 per cent),

30

however COVID-19 appears to be having an impact on this trend. There

was a net loss of ~22,600 people from Melbourne to the rest of Victoria from January 2020 to March

2021, the highest on record.

31

Victoria also lost ~18,100 people to other states and countries in this

period, a likely consequence of extended lockdowns. It is anticipated that Victoria’s population will

rebound, but concern over housing affordability and greater acceptance of remote working are likely to

drive growth in regional areas. Regional Victorian house prices grew at the fastest rate in 20 years

through 2021, with the median house price increasing 27 per cent to reach $565,000.

32

Separately, it may take time for the commercial real estate sub-sector to rebound from the impacts of

lockdowns, remote working arrangements and business closures caused by COVID-19.

Residential property management may recover more slowly than sales, given that some of the worst

impacts of COVID-19 have been on young people and low-middle income earners, who make up a

large proportion of the rental market.

33

However, recent evidence suggests that the market is

rebounding faster than anticipated. For example, vacancies in inner city Melbourne dwellings, the

region hardest hit by COVID-19, are half what they were in August 2021.

34

However, it is likely that

demand will continue to fluctuate with broader market conditions, as referenced above.

35

Other rental and leasing

This sector makes up a small proportion of the overall industry workforce (10.4 per cent).

36

The ‘other

rental and leasing’ sector comprises a range of smaller sub-sectors whereby businesses and

consumers hire out goods, stock, and other non-financial intangible property. This sector is diverse

and connects closely to sectors in other industries including agriculture, construction, and

manufacturing (i.e., those with a greater focus on sales). Industry shifts in the rental and leasing sub-

sector to date map to these adjacent industries.

The sector includes car rentals and other transport and equipment leasing (such as farming equipment

and vehicles), along with farm animal and bloodstock leasing (such as work horses and dairy cattle for

sharemilking). These sub-sectors are most closely connected to the agriculture industry.

The other rental and leasing sub-sector also includes the hiring of scaffolding, which is most frequently

used in the construction and manufacturing industries as new infrastructure is built and plants and

other facilities are shut down for maintenance.

Video and other media leasing has substantially contracted in the last decade due to the rising

popularity of online media and streaming services. As a result, there are very few video rental stores

remaining across Victoria.

Finally, the non-financial intangible assets sub-sector includes the leasing of brand names for

franchising, patents, and taxi licences, primarily used in the course of carrying out businesses in other

industries.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

11

The rental, hiring and real estate services industry will grow between

now and 2025

The rental, hiring and real estate service industry is expected to grow, driven by continuing growth in

the real estate market, particularly for residential properties, underpinned by population growth. The

industry outlook is broadly driven by a range of factors,

37

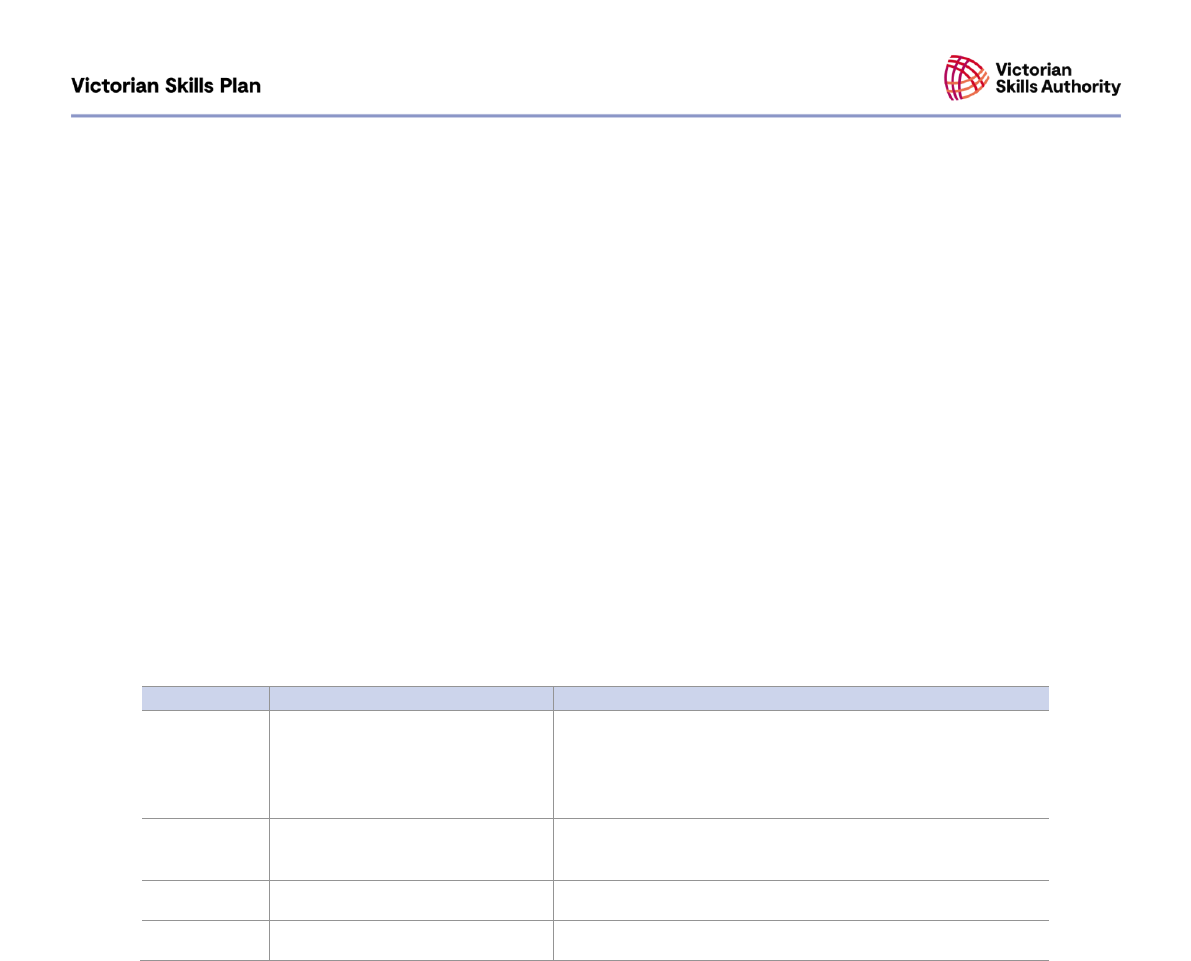

set out in Table 4.

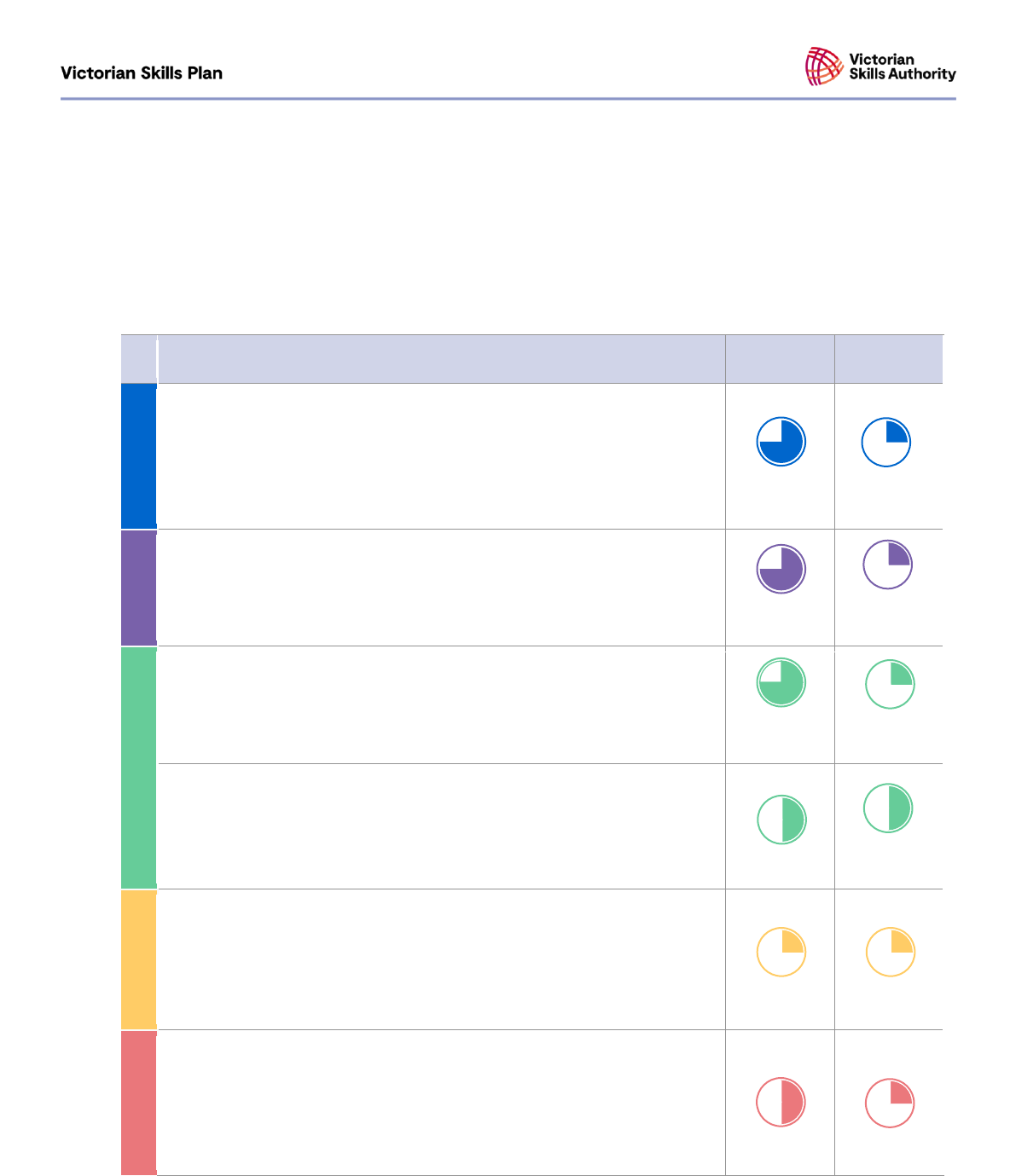

Table 4 | Drivers of demand in the rental, hiring and real estate services industry

Driver

Real estate

Other rental

and leasing

Policy

Changes in the regulatory environment, professional standards and public

scrutiny is providing greater protection for buyers and renters.

High

Low

Economic

Increasing house prices continue to outstrip wage growth. This may change with

projected increases in interest rates in 2022

38

that contribute to market volatility

and place pressure on individuals’ capacity to repay mortgages.

High

Low

Social

Population growth in regional areas is increasing amid continuing strong growth

in greater Melbourne, whereas populations in some rural areas are decreasing.

High

Low

Consumers are increasingly willing to share property, rather than own it, which in

the case of real estate reflects affordability issues.

Medium

Medium

Technological

Significant advancements in technology and digitisation, including Artificial

Intelligence (AR), Augmented Reality (AR) and Virtual Reality (VR) improve

products and processes for renting and selling.

Low

Low

Environmental

Climate change is likely to increase demand for property that is environmentally

sustainable and/or (in the case of real estate) located in lower risk areas for

natural disasters and other adverse environmental concerns (e.g., rising sea

levels).

Medium

Low

Drivers are impacting sectors differently across the industry over the next three to five years.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

12

Real estate

New rental laws from 2021 expand the rights and responsibilities of renters and rental providers,

making renting fairer and safer. This is likely to increase work demands for property managers as a

contact point between renters and landlords.

39

Similarly, new licensing requirements came into effect

for real estate agents in October 2020, introducing the Certificate IV in Real Estate Practice as the

minimum qualification.

40

Regulatory reform is likely to continue to affect the real estate sector. In

February 2022, the Victorian Government announced a review into underquoting laws, off-the-plan

sales and real estate agent conduct following complaints to Consumer Affairs Victoria.

41

On an economic level, house prices have consistently outstripped wage growth over the past 30

years.

42

House prices and rent in regional areas have increased in response to recent demand,

43

and

while they remain lower than in capital cities, they still threaten home affordability. However, interest

rates are now starting to rise and place downward pressure on prices.

44

The banking sector deferred repayments on home loans throughout COVID-19, reaching a peak in

June 2020 at 900,000 deferrals across Australia. However, this has shifted pressure to 2022 and

beyond for consumers to either repay or sell.

45

There was a surge in home auctions as lockdowns eased, with a 144 per cent increase in 2021

compared with 2020. December 2021 was the strongest performance for both auction volume and

sales in any quarter (a possible consequence of backlog from earlier in the year).

46

Population growth continues in regions of high amenity (tree- and sea-changer communities in Victoria

were growing 1.5 times faster than average population growth pre-COVID-19).

47

Growth is

underpinned by strategic housing projects in Armstrong Creek (Geelong),

48

Lucas (Ballarat),

49

and

Bendigo

50

– the largest housing developments in Victoria outside Melbourne. These three areas are

expected to account for half of Victoria’s regional growth to 2036.

51

A recovery in international

migration from COVID-19 will likely increase commercial and residential demand for real estate across

the State.

A greater acceptance of remote working driven by the COVID-19 pandemic is supporting more

permanent regional migration.

52

Flexibility in work models driven in part by the ‘sharing economy’

continues to grow, with Victorians engaging new ways of renting and swapping from rooms in private

homes and entire residences (Airbnb) to co-working spaces (WeWork).

53

New technologies that were introduced in the COVID-19 pandemic will continue to permit online

inspections, vendor advocacy, auctions and paperless transactions.

54

With effect from February 2021, the Victorian Minister for Planning has declared that certain high risk

external wall cladding products are prohibited for use in carrying out any building work in Victoria.

55

This may require construction work to be undertaken to remove the cladding for some property owners

and renters.

56

Other rental and leasing

Most significantly for other rental and leasing sectors, the ‘sharing economy’ continues to grow.

Victorians are engaging in new ways of renting and swapping including cars (e.g., Care Next Door,

FlexiCar) and equipment (OpenShed).

57

A global shortage of cars has more than doubled rental prices since 2019.

58

Rental companies will

continue to rectify the shortfall despite a severe global shortage of parts. For example, companies in

the vehicle and transport leasing sub-sector across Australia have bought more than 890,000 cars in

the past year.

59

Demand in the real estate sector will be driven by population growth, house prices relative to wage

growth and changes to the level of protection afforded to buyers and renters.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

13

An increasing number of Australians are travelling within the country, which has increased demand for

rental cars and is driven by greater household savings built during COVID-19 (and in lieu of overseas

holidays). On a local level, some consumer concern about surge prices on rideshare apps is driving

greater demand for taxi operators. In March 2022, 13cabs revealed that it was recruiting 4,000 drivers

to meet demand across Australia.

In November 2021, cattle prices hit an all-time high in Victoria after a year of strong growth consistent

with forecasts,

60

,

61

which may increase demand for bloodstock leasing (e.g., for sharemilking) in the

future.

62

Technological advancements in streaming platforms and online hosting continue to reshape how

consumers rent video and other media for entertainment and other purposes. This is likely to

accelerate a decline in the video and other media leasing sub-sector.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

14

Workforce and skilling implications

An estimated 5,600 new workers are required to meet projected demand

over the next 3 years

On average, across all industries total employment is expected to grow by an additional 211,900

workers to 2025, from 3,538,900 workers in 2022, an annual growth rate of 1.97 per cent

g

.

63

,

64

In

comparison between 2017 and 2020 employment grew by 2.68 per cent

h

annually.

65

In the rental, hiring and real estate services industry, employment is expected to grow by an additional

3,700 workers to 2025, from 52,700 workers in 2022, an annual growth rate of 2.43 per cent

i

which is

higher than the overall Victorian average across all industries.

66

,

67

In comparison between 2017 and

2020 employment across this industry experienced a decline of 0.31 per cent

j

.

68

The 5,600 new workers expected between 2022 and 2025.

69

comprises 3,700 in employment growth

and replacement of 1,900 retirees.

70

,

71

Growth will be concentrated in the real estate sector. Initially,

demand will focus on sales roles (e.g., real estate agents) but this is anticipated to shift towards

operations and management in later years as the workforce pipeline builds. However, workforce

numbers in the sector tend to be volatile, with large numbers of Agent’s Representatives recruited to

meet demand at critical points in the year.

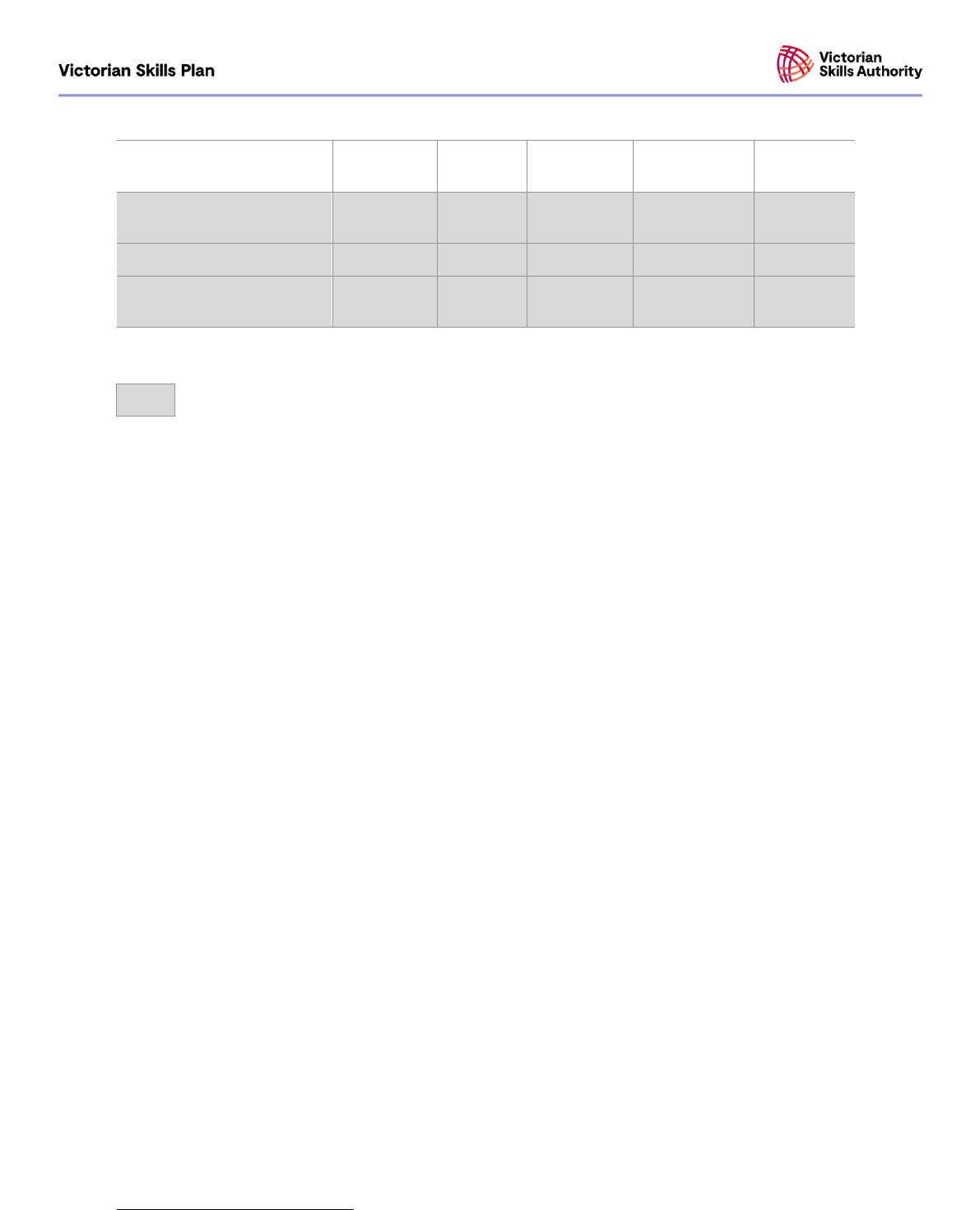

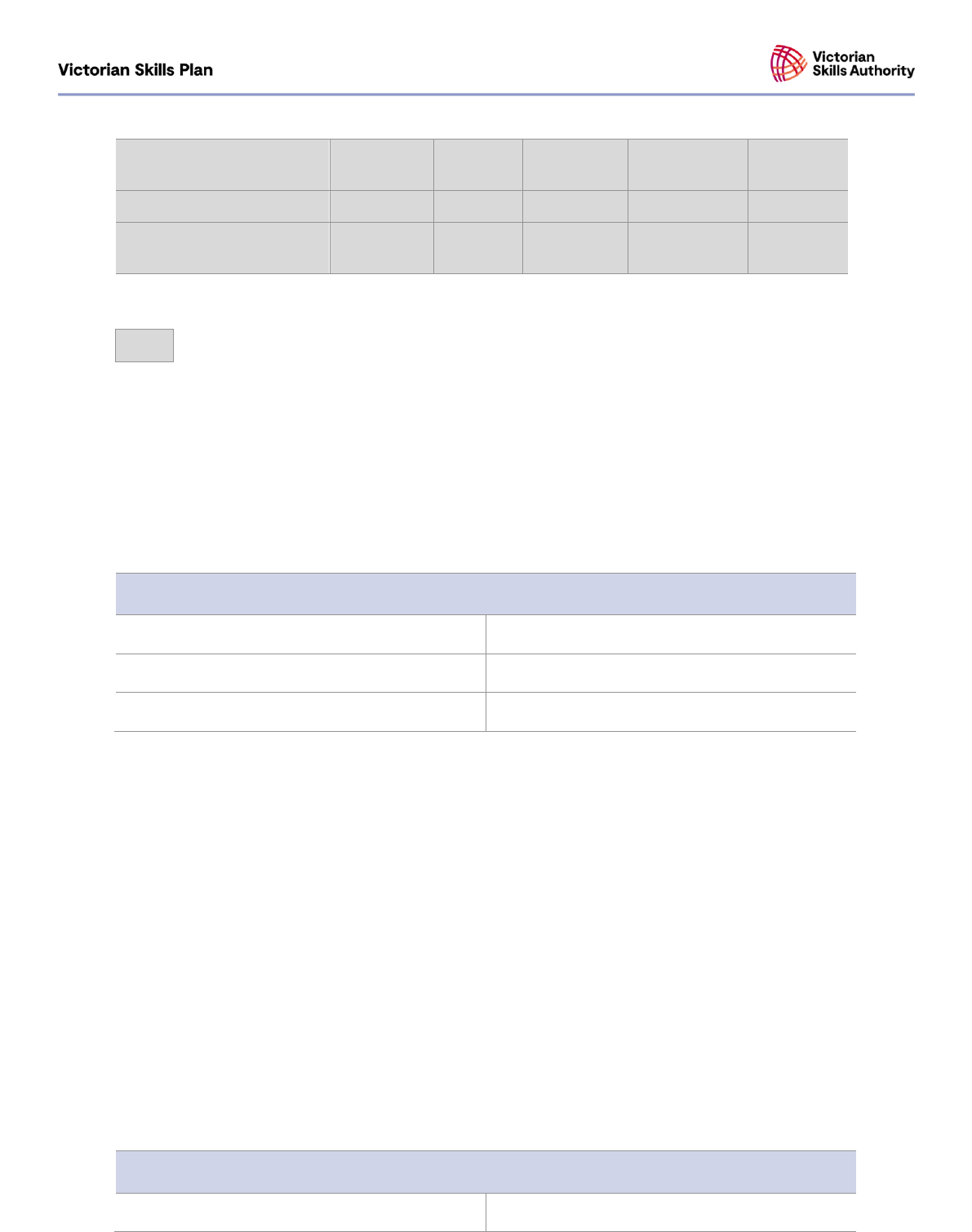

Table 5 identifies the top ten occupations in demand to 2025 based on employment growth and

replacing retirees.

72

Of these, seven occupations (highlighted in table) are expected to experience

employment growth at a rate above the overall Victorian average between 2022 and 2025. These

figures are estimates but it is important to note that they may be under-estimated as they do not

account for existing vacancies nor take account of changes in the rate of workers leaving the industry,

which stakeholders indicated appears to be higher than usual.

Table 5 | Occupations in demand for the rental, hiring and real estate industry to 2025

k

,

l73

,

74

Occupation

Current

employment

Employment growth

(2022−25)

Retirements

(2022−25)

New

workers

needed

(2022−25)

Number

Per cent

Real estate sales agents

17,850

1,800

2.6%

600

2,350

General clerks

3,200

200

3.4%

100

300

Land economists and valuers

2,100

150

3.2%

50

200

Other sales assistants and

salespersons

450

100

2.4%

50

150

Advertising and sales

managers

2,300

50

1.9%

50

100

Office managers

2,350

50

1.8%

50

100

Receptionists

2,900

Less than

50

0.5%

50

100

g

3-year compound annual growth rate

h

Computed for 2017 to 2020 employment growth for pre-COVID comparison

i

3-year compound annual growth rate

j

Computed for 2017 to 2020 employment growth for pre-COVID comparison

k

Due to rounding, some totals may not correspond with the sum of the separate figures

l

Supporting roles such as accountants have been excluded, as they are included in the Professional, Financial and Information

Services insight report.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

15

Contract, program and project

administrators

650

50

3.0%

Less than 50

50

Finance managers

1,200

50

3.3%

Less than 50

50

Financial investment advisers

and managers

650

50

3.7%

Less than 50

50

Legend

Above Victorian employment growth average between 2022 and 2025

Technological advancements that enable online inspections and auctions along with regulatory reform

are driving demand for the new and emerging jobs detailed in Table 6. The emphasis on regulatory

roles corresponds with ongoing concern about ethical compliance in the real estate sector. It will

become increasingly valuable for agencies to employ workers skilled in legal compliance. Emerging

occupations are defined as new, frequently advertised jobs which are substantially different to

occupations already defined in ANZSCO.

75

Table 6 | Emerging occupations in the rental, hiring and real estate services industry

76

Emerging occupations

• Data analysts

• Online buyer’s advocates

• Owner’s corporation managers

• Pricing analysts

• Regulatory affairs specialists

• Regulatory compliance officers

Skills shortages in the rental, hiring and real estate services industry

require more immediate rectification than occupational shortages

The rental, hiring and real estate industry has few occupations currently in shortage. A shortage exists

when employers are unable to fill or have considerable difficulty filling vacancies for an occupation at

current levels of remuneration and conditions of employment, and in reasonably accessible locations.

Where an occupation specialisation is in shortage, the occupation will be treated as in shortage.

The National Skills Commission’s Skills Priority List identifies no current occupational shortages in

rental, hiring and real estate services for Victoria.

77

However, consultation with industry as part of the

development of the Skills Plan indicated that shortages may exist in specific regions or occupations

such as general clerks and receptionists. Industry also highlighted demand for real estate agents may

drive shortages in the future (Table 7). This is underpinned by a requirement that real estate agents

need to have completed a Certificate IV in Real Estate Practice to perform full duties (e.g., conduct

inspections), which requires the existing workforce to provide supervision until employees are fully

qualified. Real estate agents that wish to open their own business are required to hold a Diploma of

Property (Agency Management) and have operated for at least one year.

Table 7 | Occupational shortages facing the rental, hiring and real estate services industry

78

Occupational shortages

• Clerks

• Real estate agents (possible in the future)

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

16

Regulatory reform and technological advancements are driving skills shortages among the existing

workforce. As described above, there is a growing emphasis on ethics, compliance and digital literacy.

Property managers who work with vulnerable renters who now receive more robust legal protection

before eviction will need skills in engagement and negotiation.

79

General skills that enable greater

career progression and enhance management of agencies are also in shortage.

A list of specific skills shortages across the rental, hiring and real estate services workforce is shown in

Table 8.

Table 8 | Skills shortages facing the rental, hiring and real estate services industry

80

Skills shortages

• Business management

• Digital capability

• Empathy and engagement (for vulnerable cohorts)

• Entrepreneurship

• Ethics and compliance

• Planning and organising

• Regulatory and legislative literacy

• Teamwork

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

17

Education and training pipeline

There were around 4,070 enrolments in rental, hiring and real estate services related VET

qualifications in 2020

m

and close to 1,150 relevant enrolments in Higher Education in 2019.

81

,

82

This

should translate to more than 4,200

n

graduating students entering the workforce each year with

relevant qualifications, suggesting a strong likelihood of meeting projected demand, although some

will seek employment in other industries. For further detail, see the collaborative response toward the

end of this report.

VET remains a vital pathway into the real estate sector

VET will continue as a significant channel of education supply to the rental, hiring and real estate

services workforce, with 36 per cent of workers holding a VET level qualification as their highest level

of education.

83

VET is likely to become a more vital pathway for workers in this industry amid recent

regulatory reforms to the real estate sector, requiring real estate agents (a top employing occupation)

to hold a Certificate IV in Real Estate Practice and accounts for almost all VET activity for the industry.

By contrast, VET is not a significant pathway for the other rental and leasing sector.

VET Activity

People enrol in VET courses for one of three main reasons:

•

to prepare for employment

•

to support current employment

•

to progress their careers within the industry.

This equates to training categorised as prior to employment; with employment (as an apprenticeship

or traineeship) and upskilling once qualified as shown in Table 9. The table shows the enrolments in

2020 VET courses on the Victorian Funded Course List (FCL) and the Victorian Funded Skill Set List

(FSSL)

84

,

85

related to this industry and against each category. The enrolment numbers are drawn from

Total VET Activity (TVA) which comprises enrolments supported by public funding or private

contribution.

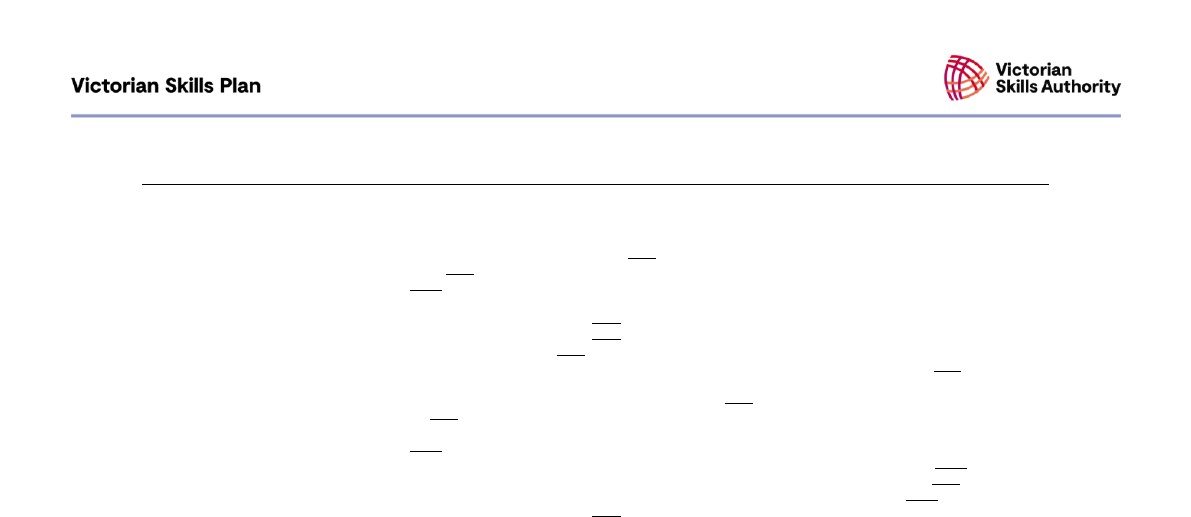

As part of preparing this report, industry representatives have provided their perspectives on the

purpose of these qualifications, which is summarised in Figure 2 and helps to read Table 9.

m

VET enrolments related to the Rental, hiring and real estate services industry include only courses that are deemed as primary pathways into

this sector. Many of these courses serve multiple industries and the total enrolment numbers are reflective of this broader pipeline. VET

enrolments in courses that primarily feeds into other sectors but also support the Rental, hiring and real estate services industry are included in the

industry in which the course primarily supports.

n

This number is determined by taking the total number of VET enrolments in courses undertaken prior to employment, combined with 1/3 of the

total number of HE enrolments in AQF 5-8 courses (as these courses are traditionally undertaken prior to employment and the average Bachelor

degree is three years, so only those in their final year of study will enter the workforce the following year).

In 2020, there were approximately 4,050 enrolments in Victoria in the Certificate IV in Real Estate

Practice, with the majority enrolled prior to commencing employment.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

18

Figure 2 | VET pipeline key

Table 9 | Victorian VET pipeline for rental, hiring and real estate services

o

Prior to employment

Qualifications (3,930 TVA enrolments 2020)

Certificate IV

3,930

Certificate IV in Real Estate Practice (Q,AT,EIR)

3,930

With employment (apprenticeship and traineeship)

Qualifications (121 TVA enrolments 2020)

Certificate IV

121

Certificate IV in Real Estate Practice (Q,EIR)

121

Upskilling once qualified

Qualifications (17 TVA enrolments 2020)

Diploma

17

Diploma of Property (Agency Management) (Q,EIR)

17

Note: Enrolment figures in the table above are as reported by NCVER, Total VET student and courses 2020: program

enrolment. There may be instances where program enrolments are not reported by providers to NCVER and therefore not

included in the enrolment figures in the total VET training activity data. Total VET activity for 2021 is expected to be released

in August 2022.

Higher education is not a significant pathway into the industry but offers

targeted qualifications

Higher education also provides a pathway into the rental, hiring and real estate services industry, with

31 per cent of workers holding a degree or above as their highest level of education.

86

Activity is

concentrated in a small number of targeted qualifications that support the real estate sector. The other

rental and leasing sub-sectors do not rely significantly on these qualifications.

Occupations in the industry that are relevant to higher education qualifications are projected to grow

over the next five years.

87

These qualifications provide workers with opportunities to deepen their

o

VET courses can support a range of occupations across a range of industries, and occupations can also support a range of

industries. To present the likely VET trained employment pipeline by industry, enrolments for a course have been assigned to

the most common industry in which people seek employment.

1.

‘AT’

indicates a classroom-based course is also available as an apprenticeship or traineeship

option

2.

‘Q’

indicates industry values the course as a qualification

3.

‘SS’

indicates industry values the course as a skill set

4.

‘EIR’

indicates it is an Endorsed Industry Requirement as noted by industry

5.

‘OL’

indicates the course leads to an Occupational License as noted by industry

Note: Industry has not provided feedback on all qualifications and where indicated; each value

assignment can be reviewed in the future.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

19

understanding of the real estate sector and equip students with skills relevant to operating their own

agencies.

In 2019, there were close to 1,150 equivalent full-time study load (EFTSL)

p

enrolments across real

estate related courses delivered by Victorian universities.

88

The rental, hiring and real estate services

industry pipeline in the higher education system is shown in Table 10. Only courses with more than

100 EFTSL are included. Noting many of these courses serve multiple industries, the total EFTSL

numbers are reflective of this broader pipeline.

Table 10 | Higher education pipeline for rental, hiring and real estate services in Victoria, high

enrolment courses with EFTSL over 100

89q

Other Management and Commerce (1,146 EFTSL, Victoria, 2019)

Australian Qualification Framework 9+ (e.g.,

Master and above) (337 EFTSL)

AQF 5-8 (e.g., Diploma, Bachelor, Hons) (809

EFTSL)

• Master of Property (337)

•

Bachelor of Property and Real Estate (347)

•

Bachelor of Applied Science (Property and

Valuation) (Hons) (246)

•

Bachelor of Property and Real Estate/Bachelor of

Commerce (216)

p

Equivalent full-time student load (EFTSL) is the measure used to determine a student's study-load. The University sets a unit

value for each of its courses. One EFTSL is the amount of student load determined by the University to be equal to a full-time

load at 100 percent intensity for one student for one year.

q

A course may be allocated to different narrow field of educations by different higher education providers based on the primary

purpose of the course. Higher education enrolments reported against a course under a specified narrow field of education

reflect only the portion of enrolment allocated to the narrow field of education and are not reflective of the total enrolment for the

course.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

20

Workforce priorities

Key workforce priorities centre on improving quality pathways to

employment and increasing specialised micro-credentials

The rental, hiring and real estate services industry needs to ensure that its workforce has the skills it

requires to meet industry needs. The workforce needs to keep pace with regulatory reform. The

number of public complaints that are being made against workers in the real estate sector for non-

compliance with new and existing laws (e.g., underquoting) suggests this is a concern.

Key challenges exist to address the supply and skill of workers. Some challenges extend beyond the

remit of the Skills Plan, such as industry awards and remuneration. Other challenges focus on fewer

than required individuals choosing to enter the industry and difficulty retaining existing workers.

Two key priorities for the industry are identified. Responsibility for delivering on these priorities lies

with many stakeholders, however education and training has a key role to play.

Adapt employment and education practices to align with the new minimum

qualification for real estate agents

The Certificate IV in Real Estate Practice is the new minimum qualification for real estate agents.

Agents’ representatives are also required to complete 18 units of competency before becoming

licensed. As required by Victoria’s Business Licensing Authority, an employee of a real estate agency

cannot attend an auction or open house inspection in an active capacity without either a real estate

agent or agent’s representative licence. This creates a barrier to obtaining practical experience and

employment through a traineeship pathway – previously, fewer units were required for completion to

become licensed as an agent’s representative and attend on-site inspections and auctions.

Strategic workforce planning will be required to ensure that the workforce pipeline matches demand

and keeps pace with market fluctuations. The industry can also explore opportunities to align learner

experience with employment practices within the remit of the new regulations. Practical work

experience is essential to ensure that learners are job ready. The industry is challenged to provide this

to learners that may increasingly opt for a classroom-based pathway that is less time-consuming.

The industry can also focus on cultivating a robust understanding of regulatory requirements and

compliance with professional development opportunities, informed by recent changes to rental laws

and an increasing number of complaints regarding agent conduct and underquoting in Victoria.

Table 11 | Issues to address to align with new regulations

• Regulatory changes that pose new barriers to obtaining practical experience and employment for

new employees that have not yet achieved the Certificate IV in Real Estate Practice.

• Responding to changing regulatory requirements that lift expectations for agent conduct.

Provide career advancement opportunities by developing specialised skills in the real

estate sector, such as auctioneering or valuation through further study

Workers encounter a diverse range of roles once they complete entry-level training. Some of these

roles require specialised skills, such as auctioneering and valuation. Senior roles require business

management and human resources skills across the industry. The industry therefore needs to build

specialised skills for workers in the real estate sector to meet current and future role demands. Advice

provided through industry engagement with the Victorian Skills Authority can help identify where

existing courses and units may be of value to do this. Career advancement opportunities will also

increase retention, address skills shortages, and meet future demand.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

21

Table 12 | Issues to address to provide career advancement opportunities

• High level of churn in entry-level workforce.

• Growing demand for specialised roles in the real estate sector.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

22

Collaborative response

The education and training response can better align with industry needs

and regulatory reform

The education and training response has a key role to play in helping to address the two key

workforce issues for the industry:

1. Adapt employment and education practices to align with the new minimum qualification for real

estate agents

2. Provide career advancement opportunities by developing specialised skills in the real estate sector,

such as auctioneering or valuation through further study.

The education and training system has a key role to play in addressing these workforce priorities.

The education and training response will be critical to ensure regulatory reform is upheld whilst

ensuring industry continues to have the skilled workforce it needs to meet demand. As described

above, recent changes to regulation prevent students from shadowing fully licensed operators until

they have completed a prescribed number of units. Consultation highlighted that this compromises

job-readiness and encourages students to obtain a classroom-based qualification as soon as possible.

A possible area of focus is to improve practical experience for current and future workers, in line with

new regulations.

The education and training response can also support qualified workers to advance their skill set

through micro-credentials, short courses and full qualifications to keep pace with market fluctuations

and changing skill demands. For example, the system could explore introducing a sector-specific short

course or promote existing small business qualifications, such as a Certificate IV in Entrepreneurship

and New Business.

90

Similarly, specific training or qualifications for auctioneering and valuing could

assist in cultivating the right skills to match industry demands.

91

Industry partnerships can assist in

ensuring content is practical and relevant. These opportunities also give workers avenues for career

advancement, increasing attraction and retention.

The regulatory context of the real estate sector and ongoing concern regarding agent conduct

highlights the importance of workers having the skills and knowledge required to uphold their

legislative and ethical obligations. The education and training response can focus on continuing

professional development opportunities that actively engender ethical practices. This can benefit from

increased industry exposure for students.

There are opportunities to improve how industry develops capability and

meets workforce demand

The education and training response alone cannot deliver on the two workforce priorities to improve

how the rental, hiring and real estate services industry attracts and manages talent. It is critical that

the system works together with government and industry to support the training and skilling

requirements necessary to meet future demand and deliver a coordinated response.

Consultation revealed that some providers are now offering the course over four to six weeks with

students able to obtain a licence to operate as an agent’s representative or real estate agent with no

practical experience. This is inconsistent with the intent of regulatory reform and risks unethical

practice. Industry can consider offering or simulating practical experience for students to learn from

experienced practitioners and ensure they are job-ready within the scope of the new regulations.

The rental, hiring and real estate services industry can focus on adapting to new regulations and

developing specialised skills to meet workforce demand.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

23

Industry can also maximise the new entry pathway for real estate agents and focus on both protecting

the quality of the pathway and removing barriers to practical experience where possible. Both industry

and the education and training response can be alert to the risk that private providers will offer courses

inconsistent with the intent of regulatory reforms. Industry also has a role in ensuring that any practical

experience is facilitated by supervisors with an up-to-date understanding of regulatory requirements.

Given the barriers and time to entry for new real estate agents, industry will also need to revisit job

design and existing recruitment and retention policies and practices to ensure that its workforce can

meet fluctuating demand. Industry plays a significant role in giving the existing workforce the space,

time, and opportunity to cultivate specialised skills and to ensure that employees are supported to

grow their careers. Flexible work arrangements, funding and study leave will assist to achieve this

objective.

Actions for consideration for education, industry, and government

• Increase practical experience opportunities for students seeking to become real estate agents.

• Facilitate specialisation with targeted education and training opportunities in areas such as

auctioneering and valuation.

• Ensure existing workforce practices and recruitment policies respond effectively to fluctuations

in demand across the industry and the time taken to train new agents.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

24

Appendix A: Data methodology

VSA Employment Model overview

The VSA Employment Model produces estimates of:

• projected employment growth between 2022 and 2025

• projected retirements between 2022 and 2025

• projected total new workers needed between 2022 and 2025.

Table 13 further defines the model outputs and identifies the primary source for each output.

Table 13 | Employment model outputs

All outputs are modelled at the occupation, industry and region level:

• occupations are defined by 4-digit occupation unit groups in the Australian and New Zealand

Standard Classification of Occupations (ANZSCO)

• industries are defined by 1-digit industry divisions in the Australian and New Zealand Standard

Industrial Classification (ANZSIC)

• regions are defined by the nine Regional Partnerships of Victoria as outlined by the Victorian

Department of Jobs, Precincts and Regions.

Benchmark data from the NSC give estimates of projected employment growth. Using an approach

called iterative proportional fitting, the detailed occupation, industry and region breakdowns are

generated by applying the distribution of employment in ABS Census and other data to the benchmark

projections.

The model was developed by the VSA with the support of Nous and Deloitte Access Economics

(DAE). The sections further below describe how the key outputs were modelled.

Employment growth, 2022-25

Source: VSA and Nous (2022), modelling of NSC (2022) Employment Projections

This modelling takes the NSC Employment Projections as the benchmark data for 2022-25 and breaks

it down into occupation by industry by region tables.

Employment growth

2022-25

Retirements

2022-25

New workers needed

2022-25

Definition

Change in the number of

workers employed from 2022

to 2025

Workers expected to

permanently leave the

workforce from 2022 to 2025

Workers needed from 2022 to

2025 to meet demand from

growing employment and to

replace retirees

Primary

source

Benchmarked to the NSC

Employment Projections

Derived from retirement rates

from Australian Census

Longitudinal Dataset

The sum of employment

growth and retirements

The VSA Employment Model gives a best estimate of employment by industry, occupation and

region. It provides an indication but does not, and cannot, tell the full story of the region’s economy.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

25

The benchmark data sources provide ‘control totals’ for occupation, industry and region breakdowns

independently. However, they do not provide the interaction between each of the variables. For

example, they do not give the breakdown of occupations within industries.

Iterative proportion fitting uses a detailed ‘seed’ data table with the necessary breakdowns from a

representative dataset and scales that distribution to control totals in the new dataset. Over many

iterations, the seed data is transformed to sum up to the occupation, industry and region control totals.

The seed data comes from the ABS Census 2016. The control totals for occupation and industry come

from the NSC's Employment Projections, and the control totals for region come from the NSC’s Small

Area Labour Markets data. Table 14 describes the inputs in detail.

The modelling results in:

• industry and occupation projections that align with the NSC Employment Projections

• regional data that matches the distribution across NSC Small Area Labour Markets

• industry by occupation by region data tables that approximate the distribution within the ABS

Census 2016.

Table 14 | Data sources used to model employment growth from 2022 to 2025

Type

Data

Source

Seed

Employment x

3-digit industry (ANZSIC3) x

4-digit occupation (ANZSCO4) x

Statistical Area Level 2 (SA2)

ABS, Census of Population and Housing, place of usual

residence data

Control total

Employment x SA2

NSC, Small Area Labour Markets, ‘SALM smoothed SA2

Datafiles (ASGS 2016) - March quarter 2022’.

Control total

Employment x ANZSIC1

NSC, Employment Projections, 2020-25

Control total

Employment x ANZSCO4

NSC, Employment Projections, 2021-26

Notes:

1. Following the modelling, SA2 data is aggregated up to Regional Partnership region. Where an SA2 spans multiple regions,

the estimates have been apportioned based on geographic area.

2. The NSC industry projection is often not available until some months after the occupation projections. As at May 2022,

there were no 2021 to 2026 ANZSIC1 by state forecasts available. The previous release of 2020 to 2025 ANZSIC1 by

state forecasts were used and scaled up to match the Australian total employment numbers in the ANZSCO4 forecasts.

Retirements, 2022-25

Source: VSA, Deloitte Access Economics (DAE) and Nous (2022), Retirement projections 2022-2025

Retirements are estimated by applying occupation-specific retirement rates to the employment

projections.

Using the Australian Census Longitudinal Dataset, an estimate of the size of the labour force aged 50

and over in 2016 was taken and compared to the size of the labour force aged 45 and over in 2011.

After adjusting for migration, the gap is an estimate of retirements between 2011 and 2016. The

relative age structures of occupations in the Census 2011 were then used to estimate retirements at

the detailed occupation level (ANZSCO4).

The outputs were used to estimate an occupation-specific retirement rate, calculated as:

Retirement rate = retirements between periods t and t+1 / employment at t

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

26

The retirement rates were applied to the employment projections to estimate the number of

retirements between 2022 and 2025 at the region (Regional Partnerships), industry (ANZSIC1) and

occupation (ANZSCO4) level.

New workers needed, 2022-25

New workers needed is the simple sum of employment growth and retirements. It is calculated at the

region (Regional Partnerships), industry (ANZSIC1) and occupation (ANZSCO4) level.

New workers needed is an estimate of demand for workers to join an industry, occupation or

region. In this model, demand comes from growth in employment (as business, government and other

employers expand their operations) and the need to replace retirees who leave the workforce.

r

New workers needed is not an estimate of skills shortage. In the VSA Employment Model,

demand is always met by supply of new workers who enter the work force from study, unemployment,

migration, a change in industry or occupation, or other avenues.

This means that the VSA Employment Model is not suitable for identifying current or future skill

shortages. The Victorian Skills Plan draws on the National Skills Commission’s Skills Priority List and

stakeholder feedback to identify skills shortages within industries and across Victoria.

r

This will generally underestimate demand as it does not account for the need to replace workers who leave a job for other

reasons, such as switching occupations or migrating out of Victoria.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

27

Appendix B: Victorian VET pipeline methodology

Enrolment numbers

Sources:

National Centre for Vocational Education Research (NCVER) (2021), Total VET students and courses

2020, available here.

Victorian Department of Education and Training (2022), Funded Course List, available here.

Victorian Department of Education and Training (2022), Funded Skill Set List, available here.

The Victorian VET pipeline table estimates the number of enrolments in each qualification and skill set

for the 2020 academic year in Victoria. The NCVER total VET students and courses is used as the

dataset. Only courses on the Victorian Funded Course List (FCL) and the Victorian Funded Skill Set

List (FSSL) are included.

The following steps were taken to develop the table:

3. Each course was reviewed by IAG members and allocated to only one of three main reasons for

studying: to prepare for employment; to support current employment (apprenticeship or

traineeship); and to progress their career. Each course is then listed under their respective

allocation.

4. The numbers of students who enrolled in that course in 2020 is then noted in the VET pipeline

table.

5. For courses that provide an apprenticeship and traineeship option and a classroom-based

option, these courses are duplicated twice in the table, with enrolment numbers split across the

other two options: the number of apprentice and trainee enrolments are reported under the header

‘with employment (apprenticeship and traineeship); the number of classroom-based enrolments is

shown under the purpose for completing the classroom-based option (either to prepare for

enrolment or to progress their career). An (‘

AT’

) is noted next to these duplicated classroom-based

courses to indicate they are also delivered as an apprenticeship or traineeship.

6. Where industry has provided feedback on the value of qualification or skill set, a (

‘Q’

) indicates it is

valued as a qualification, while a (

‘SS’

) indicates it is valued as a skill set. A (

‘EIR’

) indicates it is an

Endorsed Industry Requirement and (

‘OL’

) indicates it is an Occupational License. Industry has not

provided feedback on all qualifications and where indicated; and each value assignment can be

reviewed in the future.

7. Numbers are then totalled in their respective headers above. For the purpose of the Skills Plan, the

number of enrolments ‘prior to employment’ is a key focus for industry as it indicates how many

students are being trained but are not yet employed.

The 2020 enrolment figures are a best estimate of the pipeline of workers for industry to draw on.

The 2020 figures were the latest dataset available from the NCVER at the time of developing the

Skills Plan and will be updated in future iterations of this document. They intend to provide an

indication of the pipeline but do not and cannot tell the full story of workforce supply. Factors such

as completion rates and the COVID-19 pandemic during 2020 are also likely to impact the

availability of the future workforce.

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

28

Appendix C: Stakeholder engagement process

Stakeholder engagements allowed VSA to test, update and validate the content of the rental, hiring

and real estate services industry insight report. Stakeholders from organisations in government,

education and industry were engaged to provide input to the report and the Skills Plan more broadly.

Specifically, stakeholders provided insight on economic outlook, workforce and skilling challenges and

an education and training response across three rounds of consultations. Engagements guided initial

thinking and research, as well as opportunities to test and revise the insights. We would like to thank

the following organisations for their participation in the stakeholder engagement process. Table 15

lists the organisations involved.

Table 15 | Consultation participants

Organisation

Australasian Security Industry Association Ltd

Australian Digital and Telecommunications Industry Association

Australian Education Union - Victoria

Australian Industry Group

Australian Services Union

Bendigo Kangan Institute

Box Hill Institute

Building Designers Association Victoria

Business Services Industry Advisory Group

Communications and Information Technology Industry Training Co (CITT)

Facility Management Association (FMA)

Print and Visual Communication Association - Victoria

Real Estate Institute of Victoria

Victorian Chamber of Commerce and Industry

Industry Insight | Rental, Hiring and Real Estate Services | October 2022

29

References

1

Australian Bureau of Statistics (ABS) (2008), Australian and New Zealand Standard Industrial Classification (ANZSIC), 2006 (Revision 1.0)

Division L – Rental, Hiring and Real Estate Services, available here.

2

VSA and Nous (2022), modelling of NSC (2022) Employment Projections.

3

VSA and Nous (2022), modelling based on Australian Bureau of Statistics, Labour Force, February 2022.

4

ABS (February 2022), Labour Force Quarterly, Employment by industry (Victoria), available here.

5

VSA and Nous (2022), modelling of NSC (2022) Employment Projections.

6

VSA and Nous (2022), modelling based on Australian Bureau of Statistics, Labour Force, February 2022.

7

ABS (February 2022), Labour Force Quarterly, Employment by industry (Victoria), available here.

8

Victorian Skills Authority (VSA) and Nous (2022), modelling of NSC (2022) Employment Projections.

9

VSA and Nous (2022), modelling of NSC (2022) Employment Projections.

10

VSA, Deloitte Access Economics (DAE) and Nous (2022), Retirement projections 2022-2025.

11

VSA and Nous (2022), modelling of NSC (2022) Employment Projections.

12

VSA and Nous (2022), modelling of NSC (2022) Employment Projections.

13

VSA and Nous (2022), modelling based on Australian Bureau of Statistics, Labour Force, February 2022.

14

ABS Census (2016), Education attainment by industry (Victoria).

15

NCVER (2021), Total VET students and courses 2020, available here.

16

Department of Education, Skills and Employment (2021), Selected Higher Education Statistics – 2019 Student data, available here.

17

NCVER (2021), Total VET students and courses 2020, available here.

18

VSA and Nous, 2022 modelling based on ABS Labour Force, Australia, February 2022.

19

ABS (February 2022), Labour Force Quarterly, Employment by sex (Victoria), available here.

20

ABS Census (2016), Employment by age group (Victoria).

21

Australian Industry and Skills Committee (AISC) (2022), Property Services, available here.

22

ABS (2008), Australian and New Zealand Standard Industrial Classification (ANZSIC), 2006 (Revision 1.0) Division L – Rental, Hiring and Real

Estate Services, available here.

23

VSA and Nous, 2022 modelling based on ABS Labour Force, Australia, February 2022.

24

Victorian Skills Commissioner (VSC) (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

25

DiNuzzo, R (2021), Victoria’s $2.56 trillion real estate market, Realestate.com.au, available here.

26

DiNuzzo, R (2021), Victoria’s $2.56 trillion real estate market, Realestate.com.au, available here.

27

VSC (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

28

Propertyupdate.com.au, 30 August 2022. Available here

29

VSC (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

30

Victorian Department of Environment, Land, Water and Planning Victoria (2019), Victoria in Future 2019, Population Projections 2016 - 2056,

available here.

31

ABS (March 2021), Regional internal migration estimates, provisional, available here.

32

Kelly, M (2022), Freedom frenzy drives record Victorian regional price rises, Australian Financial Review, available here.

33

VSC (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

34

Carbines, S (2022), Melbourne rental market: Renters’ fresh struggle as conditions shift’, Realestate.com.au, available here.

35

VSC (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

36

ABS (February 2022), Labour Force Quarterly, Employment by industry (Victoria), available here.

37

PESTLE ANALYSIS (2022), The PESTLE Framework Explained: 6 Important Factors, available here.

38

Mizen, R (2022), Rate hike expectations firmly in 2022, but how high can they go?, Australian Financial Review, available here.

39

Consumer Affairs Victoria (2021), Guide to rental law changes in Victoria, available here.

40

Engage Victoria (2020), Review of real estate education regulations, available here.

41

Redman, E (2022), Blight on the industry: Victorian property underquoting laws set for review, The Age, available here.

42

Reserve Bank of Australia (2022), Household Sector, available here.

43

Victorian Department of Families, Fairness and Housing (2022), Rental Report statistics – March quarter 2022, available here.

44

Marsh, S (2022), What will happen to property prices when interest rates rise? Here’s what the experts say, available here.

45

Australian Banking Association (2021), Banking by the numbers and COVID-19 Timelines, available here.

46

REIV (2022), Victorian real estate market closes 2021 on a high, available here.

47

Rural Councils Victoria (2021), Demographic Destiny, available here.

48

City of Greater Geelong (2021), Armstrong Creek – Whole of Growth Area, available here.

49

Integra Group (2020), Thriving Community of Lucas Set to Grow, available here.

50

City of Greater Bendigo (2018), Greater Bendigo Housing Strategy, available here.

51

Victorian Department of Environment, Land, Water and Planning Victoria (2019), Victoria in Future 2019, Population Projections 2016 - 2056,

available here.

52

E Koehn and J Irvine (2021), The five-day office week is dead, long live the hybrid model, says productivity boss, Sydney Morning Herald,

available here.

53

Kennedy, J & et al (2017), Mapping the Melbourne Sharing Economy, University of Melbourne, available here.

54

VSC (2020), Sector Snapshot: Victoria’s Real Estate Sector, available here.

55

Victorian Building Authority (2022), Combustible Cladding, available here.

56

Victorian Building Authority (2022), Combustible Cladding, available here.

57

Kennedy, J & et al (2017), Mapping the Melbourne Sharing Economy, University of Melbourne, available here.

58

Wolfe, N (2021), The great summer Australian roadtrip struggling as car rental prices soar, available here.

59

Wolfe, N (2021), The great summer Australian roadtrip struggling as car rental prices soar, available here.

60

Meat & Livestock Australia (2021), Industry Projections 2021, Australian Cattle, available here.

61

Meat & Livestock Australia (2021), Industry Projections 2021, Australian Cattle, available here.

62

Brann, M (2021), Australian cattle price hits record highs off the back of November rain, ABC News, available here.