Kai.Pan@MorganStanley.com

Chaitanya.Gohil@morganstanley.com

Nigel.Dally@morganstanley.com

Brian.Nowak@morganstanley.com

In-Line

MORGAN STANLEY & CO. LLC

Kai Pan

EQ UITY ANALYST

+1 212 761-8711

Chai Gohil

RESE AR CH ASSO CIATE

+1 212 761-1710

Nigel Dally

EQ UITY ANALYST

+1 212 761-4132

Brian Nowak, CFA

EQ UITY ANALYST

+1 212 761-3365

Insurance - Property & Casualty

North America

IndustryView

Insurance - Property & CasualtyInsurance - Property & Casualty

MONTH DD, YYYY HH:MM AM/PM GMT

North America Insight: Digital Disruption

in Small Business Insurance

InsurTech startups & new entrants are driving a digital disruption in

the ~$100b small business insurance mkt. We see 3 scenarios and

est. $17-33b mkt. opportunities to gain/lose by 2020. Incumbent

carriers & brokers must adapt, and investors should pay attention.

Digital disruption in ~$100b SBI market. Small business owner

demographics favor digital insurance. By 2020, more than 60% of US small

business will be owned by Millennials & Gen Xers, who prefer to manage

insurance digitally. In our recent survey, 38% of small businesses would buy

insurance online if they were starting out today. InsurTech startups are zeroing

in on this opportunity. And traditional carriers (incumbents & new entrants)

are positioning for changes in this large, profitable & fragmented marketplace.

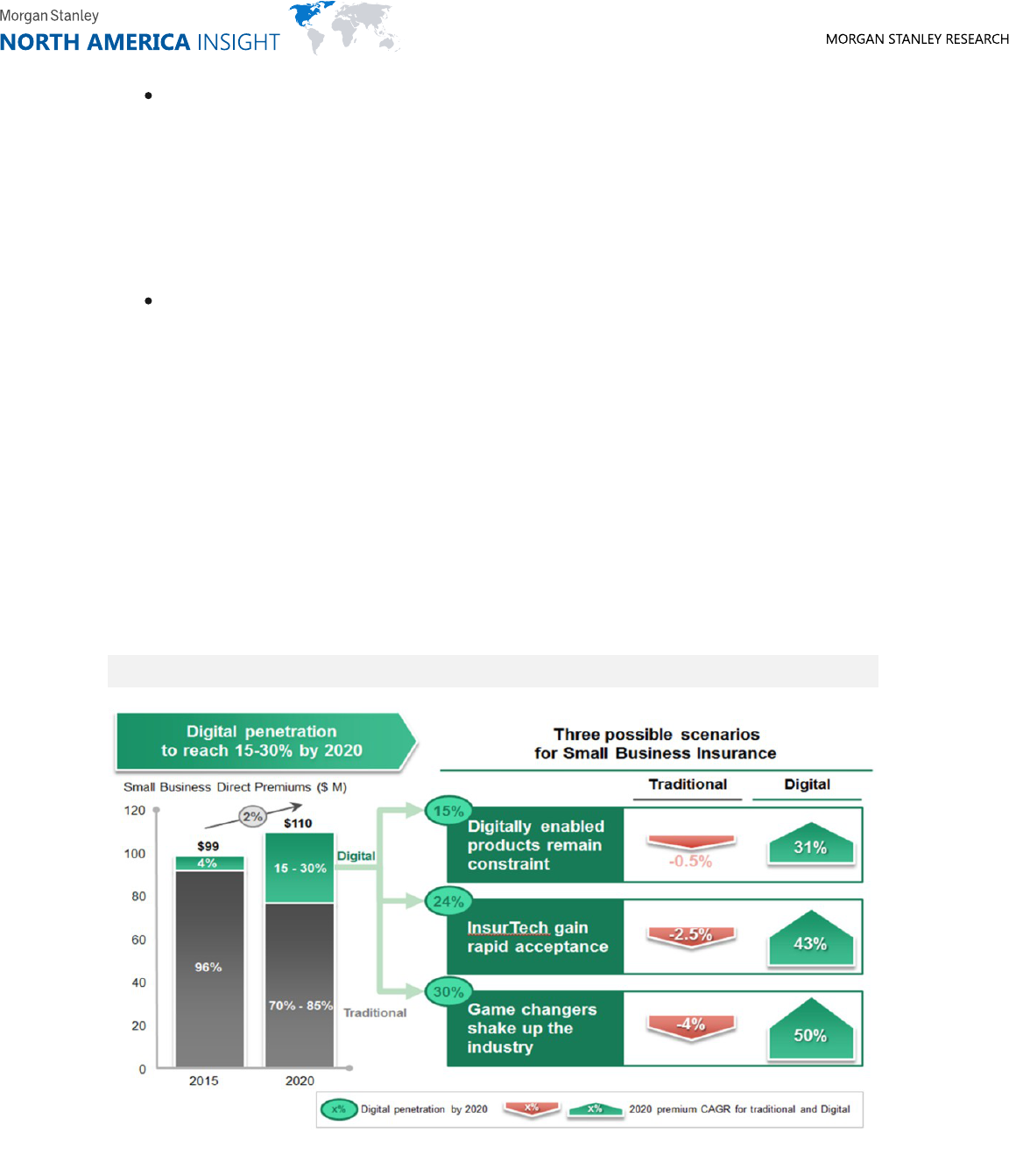

A $25b+ digital SBI market opportunity to gain (or lose). We see 3

scenarios with 15-30% digital SBI penetration by 2020, up from ~4% today.

This translates into a $17-33b market opportunity. In our most likely scenario,

we estimate ~24% of SBI, or ~$26b premiums, sold digitally by 2020, a ~46%

CAGR vs. ~2% for SBI market overall. The scenarios imply $3-8b operating

profit up for grabs for carriers and $400m-1b for brokers.

InsurTech & new entrants likely to drive changes. InsurTech companies

are poised to fill the needs of small businesses seeking simpler products that

are easy to understand & buy. E-brokers provide a consumer-friendly

experience. Aggregators give small businesses a quick look at options.

Adjacent players are cross-selling insurance. Technology enablers are assisting

incumbent carriers/brokers. Some non-incumbent insurers are taking

innovative, digital/direct approaches to SBI.

Incumbent carriers & brokers must adapt to changing landscape. In the

past 2 decades, the top 3 direct auto insurers gained 17% share, at the expense

of larger & smaller competitors. Given tech advances & the ubiquity of digital

offerings, the SBI shift should happen much faster. To address the opportunity,

insurers must adopt digital/direct distribution & improve customer experience.

Brokers face a more significant reinvention to embrace an omni-channel

approach & redefine their value proposition.

Who are the likely winners (and laggards)? Among our coverage, Hartford

(EW), Travelers (EW), Chubb (OW) & AIG (EW) have the most exposure in SBI.

We estimate each point of share gain could boost their earnings by 4-14%.

They have financial & technology resources but could be constrained by

channel conflict and inertia. Smaller insurers and brokers could face the

biggest challenges. In our broker coverage, Brown & Brown (UW) is most

exposed. New entrants (startups or traditional insurers) could be the biggest

beneficiaries in the digital transformation of SBI.

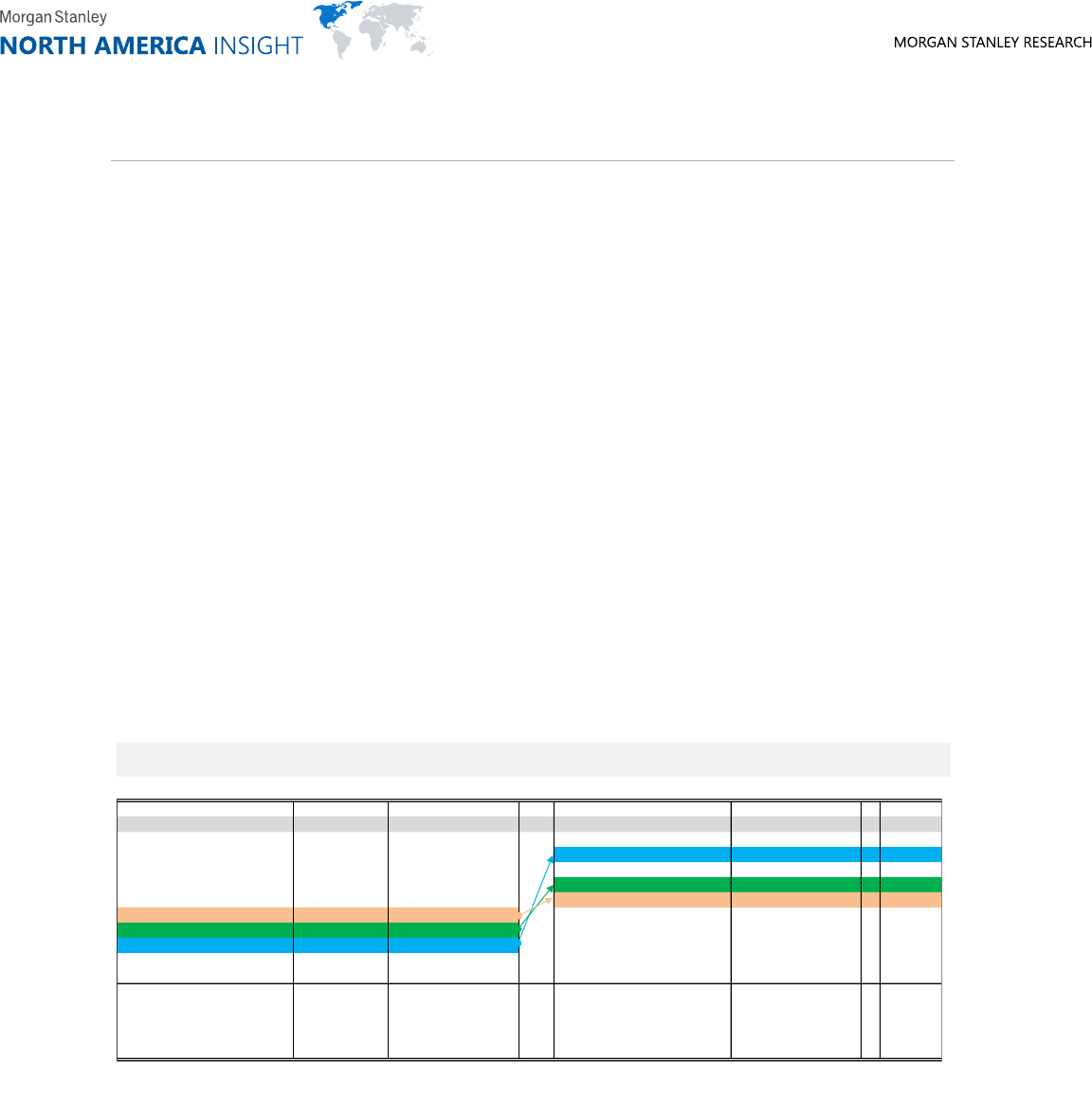

Exhibit 1:Exhibit 1: Three Scenarios for Digital SBI Market in 2020

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch

Morgan Stanley does and seeks to do business with

companies covered in Morgan Stanley Research. As a result,

investors should be aware that the firm may have a conflict

of interest that could affect the objectivity of Morgan

Stanley Research. Investors should consider Morgan

Stanley Research as only a single factor in making their

investment decision.

For analyst certification and other important disclosures,For analyst certification and other important disclosures,

refer to the Disclosure Section, located at the end of thisrefer to the Disclosure Section, located at the end of this

report.report.

Insurance - Property & Casualty

1

June 29, 2016 04:01 AM GMT

Executive SummaryExecutive Summary

We think the ~$100b small business insurance (SBI) market is in the early stages of a digital

disruption. Changing demographics of small business owners, increasing number of InsurTech startups, and

heightened focus of traditional carriers (both incumbents and new entrants) in this sizeable and profitable

market are catalysts for this secular trend.

Changes in the personal auto insurance market provide an important case study. Over the past two

decades, the top three direct underwriters (GEICO, Progressive, and USAA) collectively gained 17% market

share, at the expense of both larger and smaller competitors who are unable or unwilling to adapt the changing

consumer preference. Besides convenience, direct/digital distribution also lowers insurance costs which drives

consumer adoption as well. We believe the pace of digital adoption in the SBI market could be much faster as

the internet and mobile technologies are ubiquitous now.

A $25b+ digital SBI market opportunity to gain (or lose). We estimate 15-30% of SBI will be sold digitally

by 2020, up from ~4% today. This translates into a $17-33b premium market opportunity.

Demographics favor digital insurance solutions. By 2020, more than 60% of small business in the

US will be owned by Millennials and Gen Xers, two groups that prefer to purchase and manage

insurance digitally. According to our recent survey, 38% of small businesses would buy insurance

online if they were starting their businesses today.

There are unmet insurance needs of small businesses. Proprietors look for simpler products,

easier to understand and buy. "Mom and pop" agents have difficulty filling this demand as

commissions are too small and the investments too big.

InsurTech startups are zeroing in on this emerging opportunity. Backed by venture capital and

even traditional insurers, a growing number of startups are focusing on SBI, leveraging experiences

from personal auto and other financial services, including FinTech companies.

Traditional carriers are positioning for digital disruption. As SBI is a large (~$100b annual

premiums), profitable (~90% combined ratio), and fragmented market (none of top players has more

than 5% share), large incumbents are ramping up their digital efforts and new entrants are

expanding into SBI.

In the most likely scenario, we estimate ~24% digital SBI penetration by 2020, or ~$26b annual

premiums. This represents a ~46% CAGR vs. ~2% for SBI market overall.

Based on certain underwriting and operating margin assumptions, the digital SBI market could imply

$3-8b operating earnings for underwriters and $400m-1b for brokers.

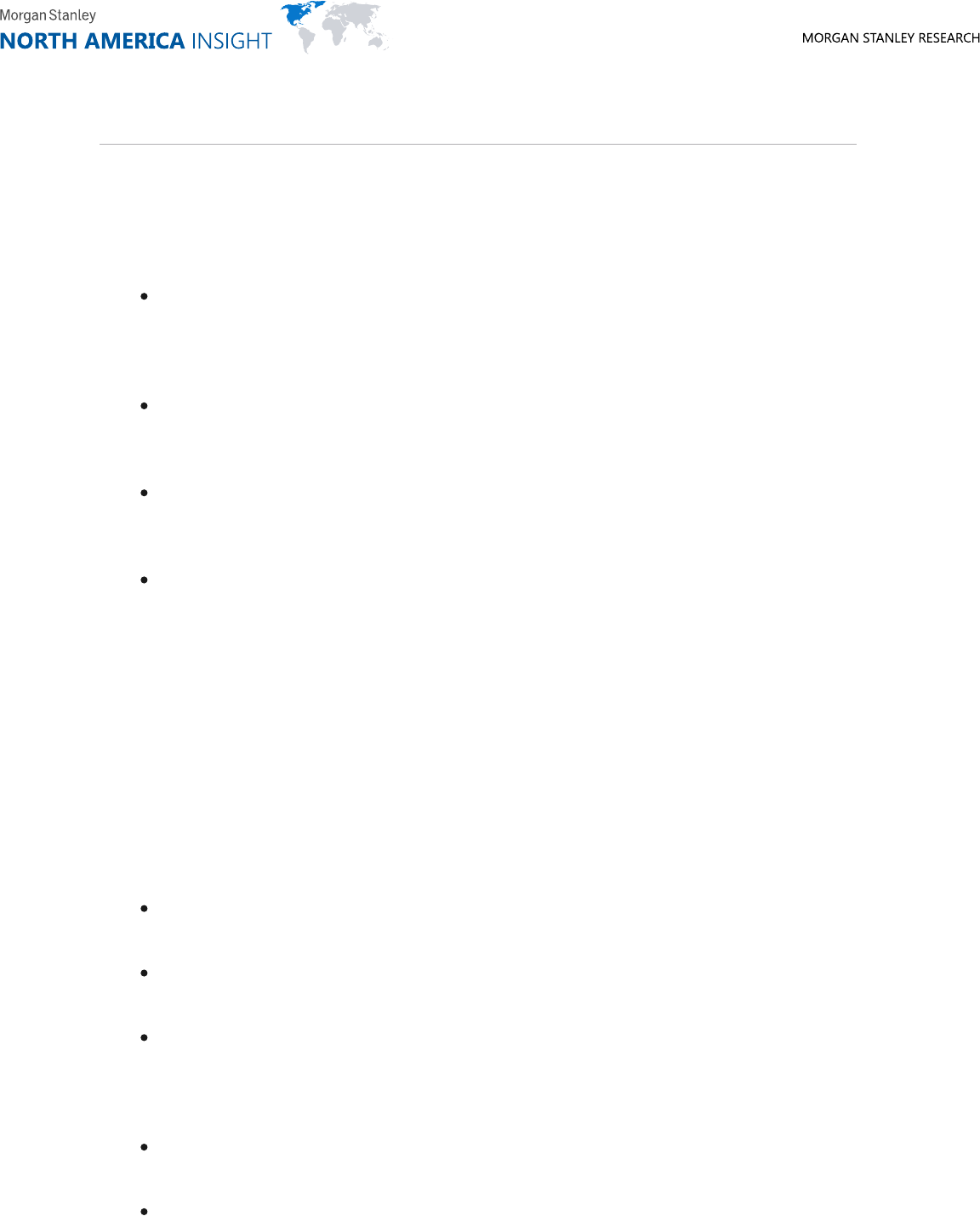

Among our coverage, Hartford (EW), Travelers (EW), Chubb (OW), and AIG (EW) have the most SBI

exposures (8-33% of total P&C premiums). We estimate one point market share gain could be 4-14%

accretive to earnings while one point market share loss could negatively impact earnings by 2-7%.

They have financial & technology resources but could be constrained by channel conflict and inertia.

Smaller regional insurers could struggle to maintain their market share as SBI market consolidates, if

they are not proactively adjusting their go-to market strategy.

Smaller agents/brokers could face the biggest challenges. Among our brokerage coverage, Brown &

Brown (UW) has the most SBI exposure.

Insurance - Property & Casualty

2

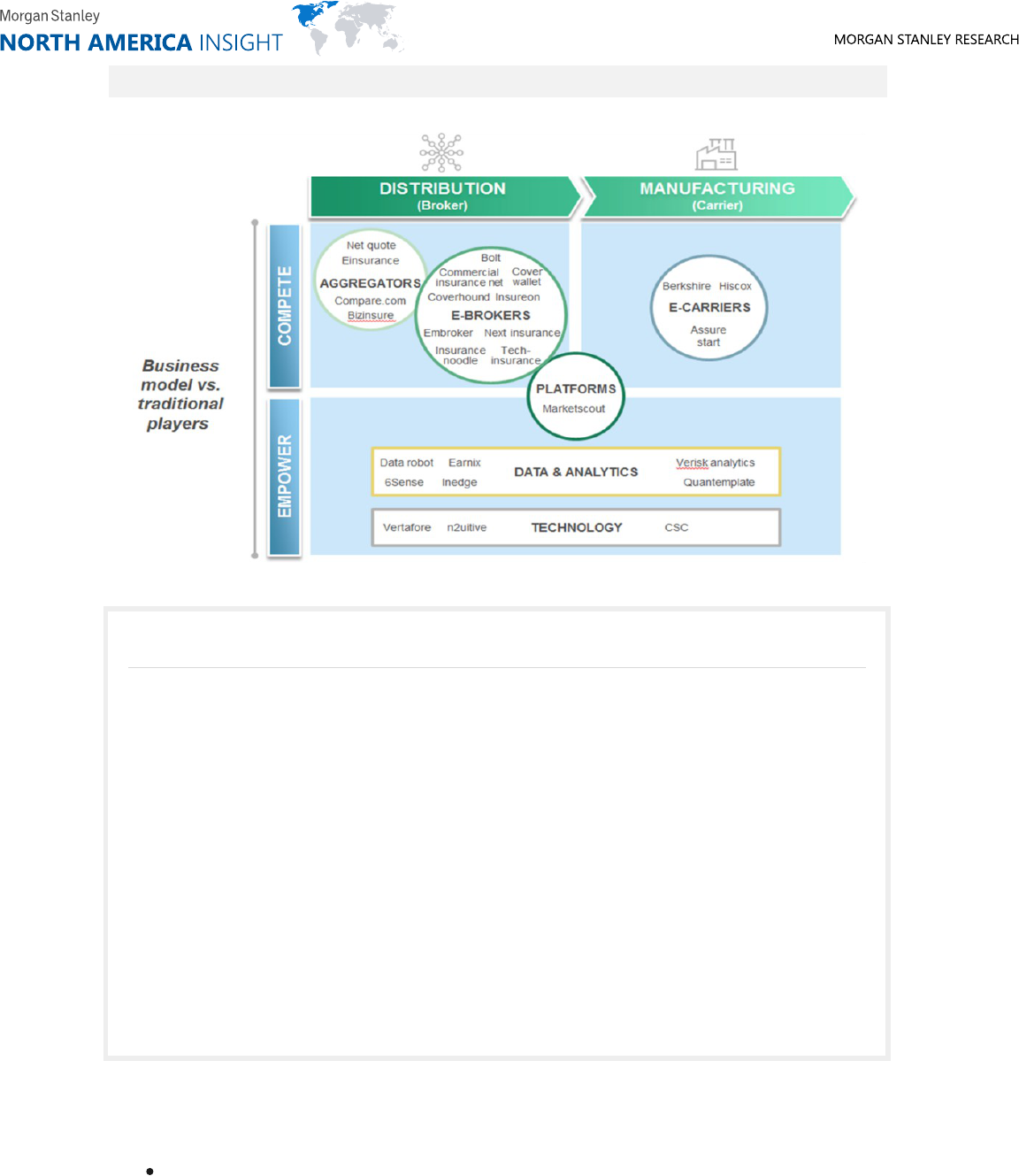

InsurTech and new entrants are likely to drive the disruption. InsurTech startups are focusing on

distribution: E-brokers (such as Embroker, Next Insurance, and CoverWallet) are providing consumer friendly

digital experience; Aggregators (like Compare.com and Einsurance) try to give small businesses a quick look at

their options; Adjacent players (such as Intuit, Justworks, and Zenefits) are cross-selling insurance;

Technology enablers (like MarketScout and QuanTemplate) are assisting incumbent carriers or brokers.

Traditional insurers are taking innovative, digital/direct approaches to SBI: Berkshire Hathaway plans to sell

worker's comp and BOP policies directly online; Hiscox offers SBI products directly from its website; American

Family invested in AssureStart, a direct writer of SBI; AIG, Hamilton Insurance Group, and Two Sigma plan to

establish a technology-driven platform in SBI. Most recently, Travelers announced a direct SBI online platform in

the UK. Incumbents must adapt to survive and thrive. Carriers need to adopt digital/direct distribution and

reduce product complexity. Brokers must embrace omni-channel distribution and redefine their value

proposition.

Larger brokers AON (EW), Marsh McLennan (EW), Willis Towers Watson (OW), and AJ Gallagher

(EW) among our coverage, while not immediately threatened by digital disruption in SBI, could face

increasing competition if smaller brokers have to move up to middle markets.

Digital disruption in SBI provides an opening for non-incumbents to gain a foothold — and share.

The biggest beneficiaries could be InsurTech companies — nothing but to gain share. However the

lack of data and underwriting expertise could impede or even doom some efforts.

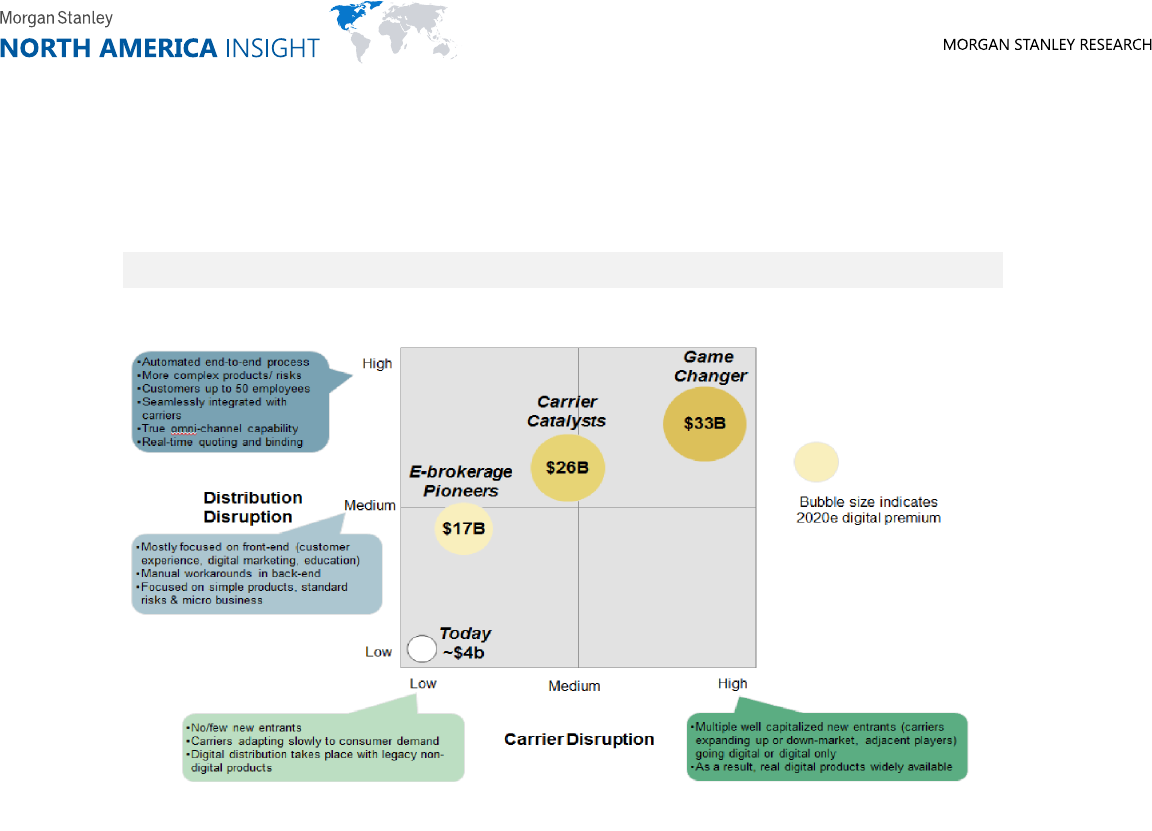

Exhibit 2:Exhibit 2: The SBI Market Is Poised for Strong Growth ($b)

Non SBI, $185

SBI, Not

digitally

underwritten,

$96

SBI, Digitally

Underwritten,

$4

2015

($285b Total Commercial Lines Market)

(4% of SBI)

Non SBI, $206

SBI, Not

digitally

underwritten,

$84

SBI, Digitally

Underwritten,

$26

2020

($316b Total Commercial Lines Market)

(24% of SBI)

So u rce: SNL a n d M o rgan Stan ley R esearch estimates

Exhibit 3:Exhibit 3: SBI Exposure ($m)

So u rce: SNL a n d M o rgan Stan ley R esearch

Insurance - Property & Casualty

3

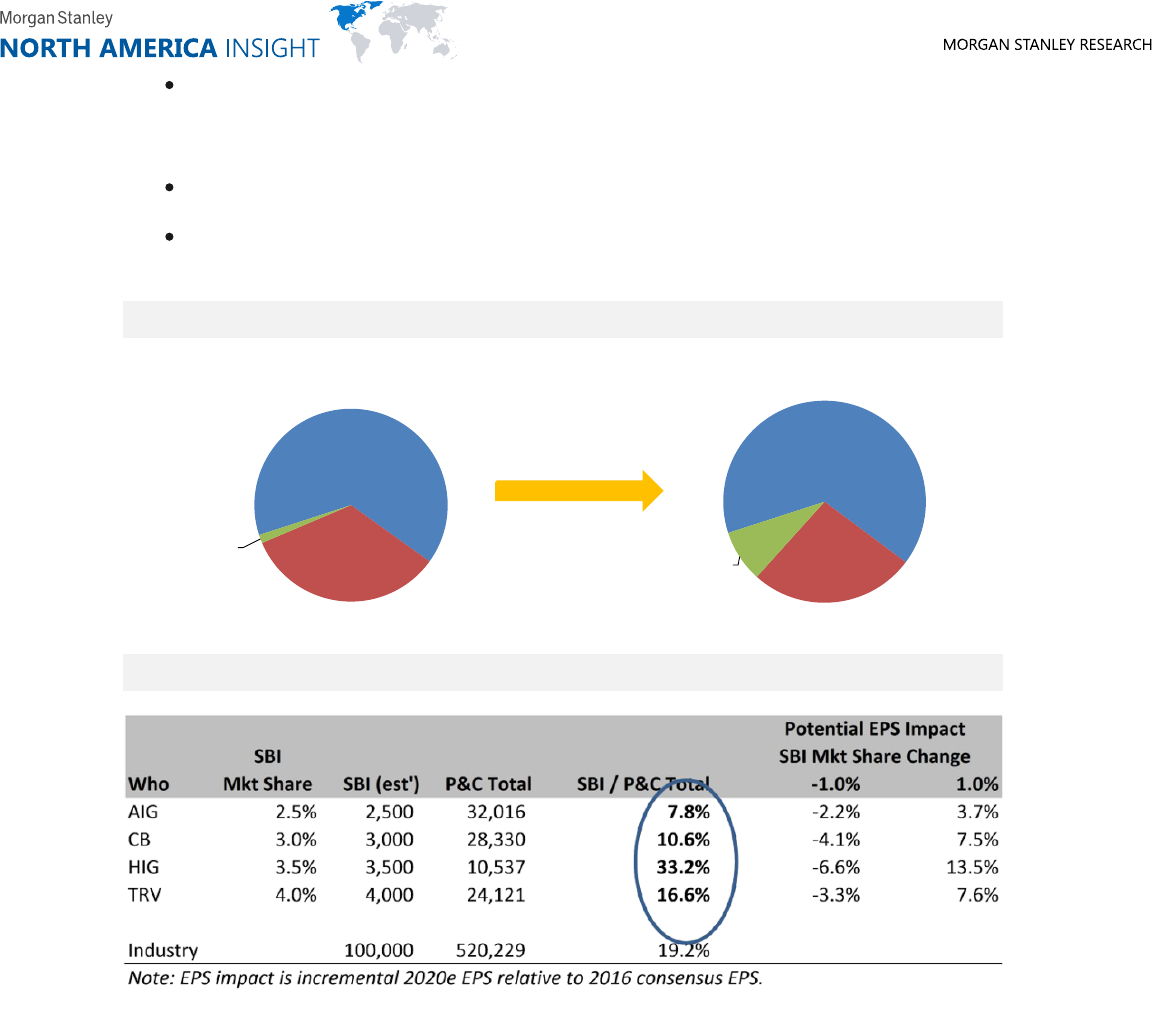

We outline three possible scenarios in the evolving SBI market for 2020. E-brokerage Pioneers scenario

(~15% digital SBI, or ~$17b premiums) contemplates startup e-brokers appealing to newly created small

businesses. Carrier Catalysts scenario (~24%, or ~$26b) assumes digital distribution platforms adopted by

major incumbent carriers. Game Changer scenario (~30%, or ~$33b) envisions a few dominant SBI carriers

also distribute directly online.

Exhibit 4:Exhibit 4: Three Scenarios for Digital SBI Market in 2020

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch

Insurance - Property & Casualty

4

The (Digital) Future of Small Business InsuranceThe (Digital) Future of Small Business Insurance

From music, photography, and video rental to travel agency, print media, and auto insurance, we have seen

waves of digital disruptions. We think small business insurance (SBI) could be the next frontier. How fast will

the digital breakthrough come? If US insurers are to increase their share of the attractive small business

market, they would do well to enhance their digital small business offering. There is every reason to believe that

small businesses will favor digital solutions for their insurance needs, and that a substantial advantage will go to

carriers and distributors that see what’s coming and get there first.

Because of the tight regulatory environment in which it operates and the low frequency of customer

interactions, insurance has lagged other industries in terms of digitization. Disruptive players haven’t yet

redrawn the landscape of insurance, thus giving customers a reason to alter their behavior or switch providers.

So far, personal insurance is the only area where digitization has taken place in a meaningful way. Small

business, however, won’t be far behind. The two types of insurance have a lot in common, and roughly two in

every five people who own a small business insurance policy look to get it from the same carrier they use for

personal insurance.

Exhibit 5:Exhibit 5: Waves of digital disruption - SB Insurance is next

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch

Insurance - Property & Casualty

5

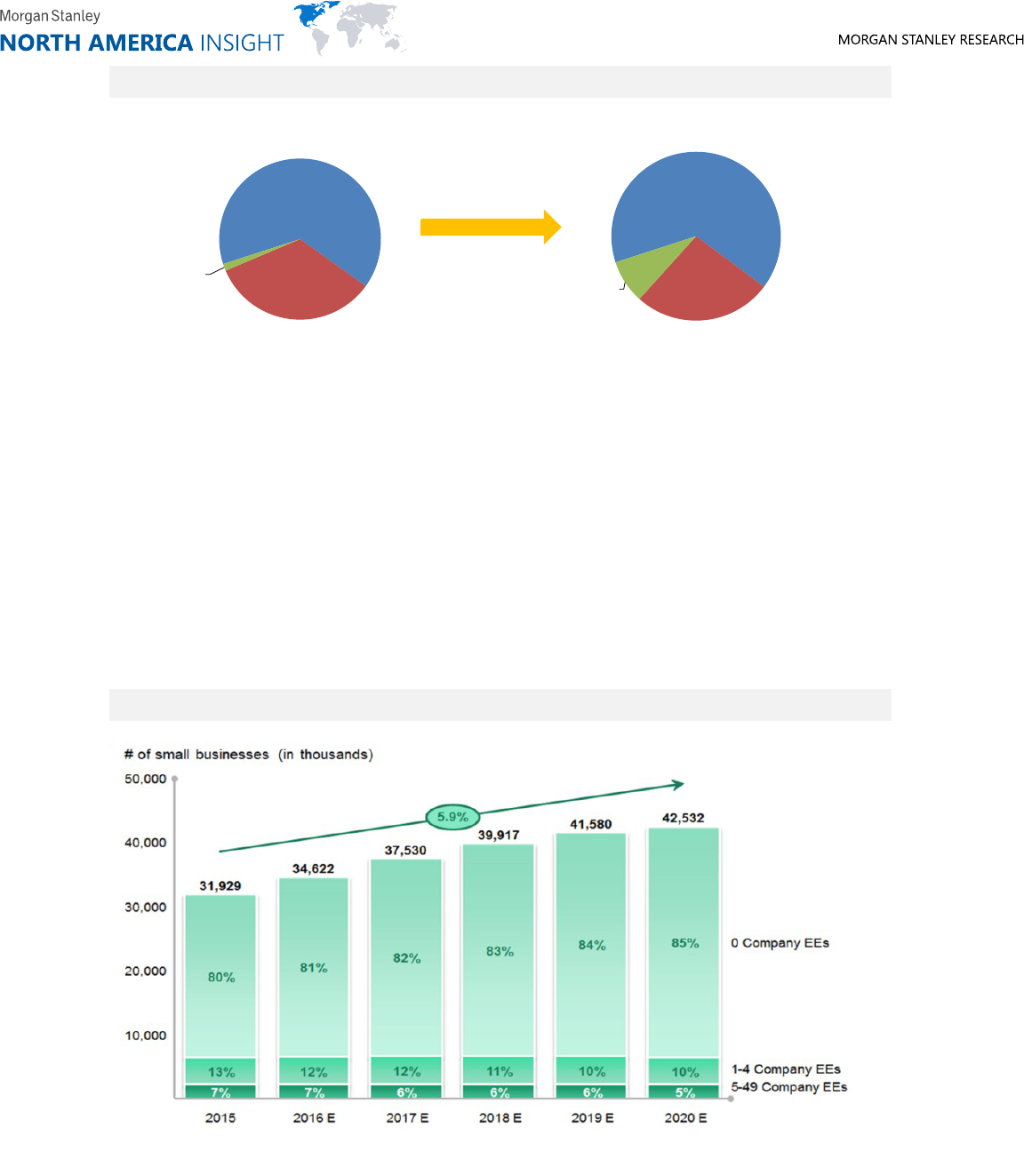

What makes it highly likely that small business insurance offerings will take on a more digital character — and

do so, we think, more quickly than many in the industry expect — is the changing composition of customers in

the segment. By 2020, more than 60% of small businesses in the US will be owned by Millennials and Gen Xers

— two groups that prefer to do as much as possible digitally. Small businesses come and go quickly, reflecting

the increase in the freelance economy and the ease with which many workers go back and forth between full-

time jobs and running their own single-person businesses or consultancies. These single-person businesses are

part of a surge in so-called “microbusinesses” (businesses with 0-4 employees), and are part of the reason why,

according to estimates by the Boston Consulting Group (BCG), roughly one in every four small US businesses

that will exist a year from now don’t exist today. The variable workload and intermittent risk exposure of small

businesses (not just microbusinesses) is ideal for a type of insurance that is more flexible than traditional

insurance. Digital solutions for purchasing and managing insurance products may be in the best position to fill

this segment’s needs.

It isn’t just those starting small businesses today and in the next few years who will create the demand for digital

insurance solutions. Plenty of existing US small businesses would jump at the chance to use digital channels for

purchase and management of insurance if convenient options existed. These businesses already make extensive

use of online and cloud technology for their business dealings. For instance, many use Intuit QuickBooks to

handle their taxes and financial reporting, Square to process mobile payments, and platforms like Zenefits to

manage their human resources needs.

Exhibit 6:Exhibit 6: Digital SBI Market Is Poised for Strong Growth ($b)

Non SBI, $185

SBI, Not

digitally

underwritten,

$96

SBI, Digitally

Underwritten,

$4

2015

($285b Total Commercial Lines Market)

(4% of SBI)

Non SBI, $206

SBI, Not

digitally

underwritten,

$84

SBI, Digitally

Underwritten,

$26

2020

($316b Total Commercial Lines Market)

(24% of SBI)

So u rce: SNL a n d M o rgan Stan ley R esearch estimates

Exhibit 7:Exhibit 7: Steady Growth Ahead for US Small Business

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch estimates

Insurance - Property & Casualty

6

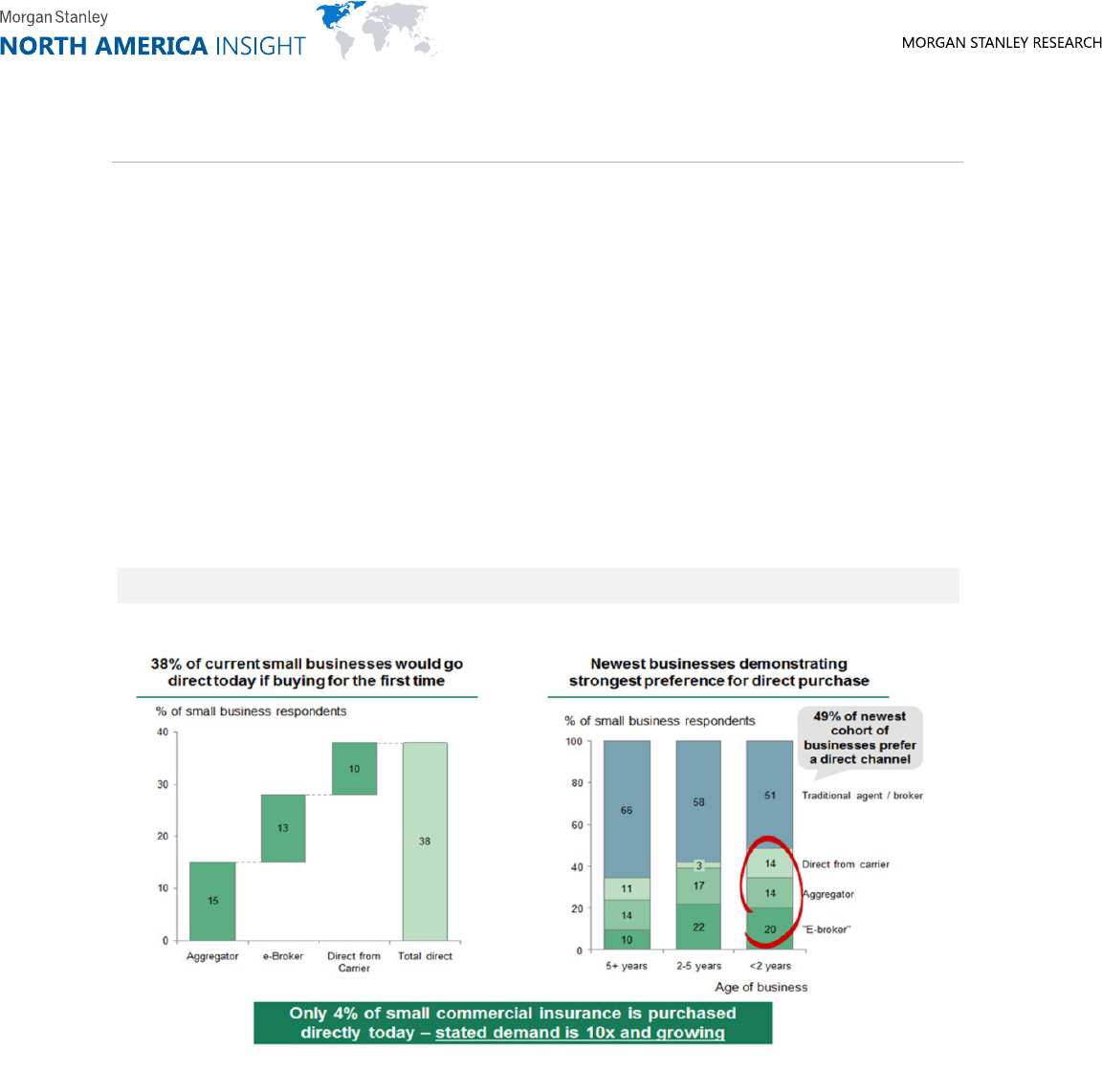

The interest in digital insurance solutions among existing small businesses came through clearly in an April

2016 survey conducted by BCG (see Appendix I for details). Thirty-eight percent of existing small business

owners said if they were starting their businesses today, they would want to buy their insurance directly online.

The percentage saying this was significantly higher (49%) among those running newly formed businesses —

that is, businesses started in the last two years.

The holdup: a lack of strong digital offerings. Indeed, the real obstacle to growth in the digital part of the

small business insurance market isn’t the readiness of the customer base — it’s the absence of strong digital

products and propositions from suppliers. For the US small business insurance market to move toward more

digital solutions, carriers and distributors will have to take a new approach to the customer experience.

Imperatives for carriers in an era of digitally distributed insurance.

Imperatives for distributors in an era of digital insurance. If anything, the distribution side of the business

will have to undergo an even more dramatic reinvention than the carrier side if it is to remain relevant in an era

of digitally distributed insurance. Agents and brokers have to:

Reduce product complexity. Insurance continues to be a complicated product — full of legal

language, multiple coverage tiers and exemptions, and cumbersome claims processes — making it

confusing and difficult to use. Put another way, traditional insurance products are very different from

what one encounters elsewhere in the digital realm, where convenience and instant gratification are

the norm. To underwrite more premiums digitally, small business insurance providers will have to

develop simpler modular products, ones written in plain English and easy to understand and buy.

They are going to have to find ways to speed up the application process, with shorter forms that can

be prepopulated with existing data (such as small business’ financial statements or real estate

information). Finally, the coverage schemes and pricing are going to have to become more flexible to

better suit the needs of small business owners. This could involve usage-based or on-demand

models that provide coverage only if and when needed.

Improve customer service, particularly in claims. One of the big inconveniences of insurance is all the

manual steps that are required when the policyholder is making a claim. This has started to change in

personal insurance — people who have been in car accidents can often send pictures of their

damaged vehicles using smartphones — and business insurance has to follow suit. Another part of

improving customer service is ensuring that all claim-related transactions, such as appraisals,

eyewitness statements and other supporting documents, are immediately available to all parties at

the same time. In much the same way that a customer can track a package delivery on her

smartphone in real time, she should be able to see every update while her insurance claim is in

progress. At the same time, the technology shouldn’t be overused; there are interactions that are

better done person to person, such as when an injury has occurred.

One good thing about becoming customer centric in this way is that it won’t necessarily be costlier to

carriers. In fact, by making the right digital investments, carriers will be able to automate more

processes, enable self-service where appropriate and redeploy their human resources more

productively.

Embrace an omni-channel approach. In today’s world customers interact with their brokers and

carriers through many different channels: call centers, the Internet, email, mobile technology, and in-

person. Many customers prefer to go back and forth between channels, depending on the nature of

the interaction or their personal situation. To these customers, a good experience would be one in

which all of the channels were seamlessly integrated and had the same customer information at all

times. In other words, if the customer made changes to a policy online through the carrier’s website,

he would want his agent (when he spoke to the agent two days later) to be fully aware of the online

interaction and its outcome. This isn’t what happens currently. The status quo today is for agents to

try to “own” all interactions with the customer. This leads to a bad customer experience (if the

customer would rather change his address online and the agency doesn’t have that capability) and to

a poor use of the agent’s time (since the agent has to receive the change and manually feed it

Insurance - Property & Casualty

7

Change likelier to come from start-ups than incumbents. Despite the growing interest in digital insurance

solutions on the part of small businesses, incumbent carriers and distributors haven’t made a beeline to the

area. To incumbent carriers, the prospect of a full digital embrace at the small business level has its drawbacks.

On the sales front, the drawbacks include the channel conflicts that would result if the carriers moved

aggressively into a type of insurance that small businesses could buy directly online, bypassing existing brokers

and agents. On the technology front, the drawbacks include the complexity and cost associated with the legacy

systems that are supporting millions of existing small business accounts. In addition, designing and delivering a

digital customer experience would require significant new investment.

As part of this study, BCG and Morgan Stanley conducted interviews with two dozen major carriers and brokers

in the small business space. Many of these companies said they would prefer to keep an eye on the market and

be “fast followers” should the pace of the change accelerate dramatically. In the meantime, these companies said

they are content to make smaller bets, just enough (they hope) to evolve with the market.

This leaves a substantial opportunity for new entrants to be the catalyst of change, exactly as technology players

have been in other industries. And these “InsurTech” companies are coming, thanks to a substantial flow of

capital from both traditional venture firms and corporate venture arms. In the unmet customer needs, the high

margins (particularly on the distributor side), the market fragmentation, and the absence of any company with a

clearly superior digital strategy, the investors in InsurTech rightly see a major opportunity.

Where the new challengers are placing their bets. To date, the distribution part of the market has been the

focus of the most startup activity, specifically startups looking to displace existing agents and brokers. It might

seem unrealistic that a startup insurance broker could step in and disintermediate a company like HUB, Alliant,

or USI, which provide insurance brokerage services to businesses. But the mom and pop brokerage shops that

account for a large share of distribution to small businesses are an easier target. Startups like Embroker, Next

Insurance, and CoverWallet are using consumer-friendly digital interfaces, streamlined application processes

and the promise of faster claims-processing to win over small business customers who are willing to switch for

a better experience. (See sidebar, “Startup E-Broker Aims to Simplify Insurance-Buying Process.”)

through to the carrier). An omni-channel approach that gets past these limitations — allowing

customers to use any channel in a seamless way — will improve the customer experience and agent

productivity.

Redefine the value proposition of distribution. Brokers and agents have typically played their biggest

roles in the acquisition and renewal stages. They need to provide value at other points that matter to

customers — including risk prevention and claims handling. Another way to say this is that

distributors (despite the business model of receiving commissions from carriers) need to act as

though they have a direct fiduciary responsibility to clients. If they are to improve the value

proposition to the customer, agents and brokers will have to heavily leverage technology. Whether

they’ll be able to do this is a question. With many of their relationships not generating more than

$150 to $250 in annual commissions, smaller brokers and agencies don’t have the scale to make the

investment that’s required in digital.

Develop new marketing capabilities for customer acquisition and retention. In the past, traditional

agents and brokers acquired broker-of-record status by sitting down with small businesses and

presenting their pitches (the proverbial kitchen table conversation). The new generation of small

business owners (whether they are wine stores, six-person law firms, or physical therapy practices)

will be most easily engaged online. Most brokers can’t afford to buy search terms on Google, so

they’ll have to do their digital marketing in other ways, including through social media and other

online tools. Brokers may also want to look at doing the kind of affinity analysis that Amazon does.

The difference in this case would be that the “people who bought this also bought that” guidance

would be insurance-specific: the coverage, deductible levels, price points and carriers that

"businesses like yours" most commonly use.

Insurance - Property & Casualty

8

Startup E-Broker Aims to Simplify Insurance Buying ProcessStartup E-Broker Aims to Simplify Insurance Buying Process

Of the many characterizations that exist for insurance, “easy to use and understand” isn’t often one that

springs to mind. Yet this is exactly the position that CoverWallet, an e-broker launched in 2015, wants to

stake out for itself.

The New York-based firm uses infographic presentations to help small businesses figure out what kind

of insurance they might need and what they should expect to pay. Prospects can click on a type of policy

(general liability insurance or commercial auto, for instance) to find out what it is and why they would

need it. And if they want to receive a quote, instead of keying in all of their information (company name,

number of employees, company address, and so on), business owners can send PDFs of the first page of

existing insurance policies to CoverWallet and the company will use that information to fill out their

applications and access an insurance quote.

CoverWallet wants to be the broker of choice for companies with 25 or fewer employees and annual

insurance costs of less than $30,000. The founders are two MIT graduates looking to make customers of

people a lot like themselves: running small businesses, and without a lot of time to investigate insurance

options.

Alongside of these pure “e-brokers” are companies that are trying to move into insurance brokerage from a

different starting point with small businesses, in an attempt to further monetize those relationships. For

instance, upstart HR firms like Justworks or Zenefits are using the position they have with small businesses to

branch into insurance brokerage. Intuit has partnered with The Hartford to offer worker's compensation

insurance to small businesses that use Intuit’s software. Despite the threat they represent to smaller brokers,

partnerships like these could be a boon to incumbent carriers.

Another source of potential competition to brokers are aggregators like Compare.com and Einsurance. These

companies try to give small businesses a quick look at their options in areas like auto insurance and general

liability insurance. To the extent that their information is seen as thorough and trustworthy, they could erode the

position that mom-and-pop brokers have in the microbusiness market today.

After broker substitution, the next most promising InsurTech strategy is providing technology assistance to

incumbent carriers or brokers. For instance, MarketScout (which has been in business since 2000, making it one

of the older InsurTech companies) operates an exchange that allows individual brokers to pinpoint carriers that

have the exact type of coverage needed by small businesses. QuanTemplate (which got going in London in

2013, but now also has an office outside of New York) consolidates a massive amount of insurance industry

data, allowing agents, brokers and carriers to get a picture of what’s happening in terms of pricing and

underwriting trends.

There’s been much less activity from InsurTech firms, by contrast, to compete directly with carriers. This is a

function of significant barriers to entry, including reserve capital requirements, operational capital requirements

(including IT infrastructure), a lack of access to historical claims and underwriting performance data. Among the

exceptions — that is, insurers trying to replace US companies by offering a digitally-enabled experienced for

small businesses — is Hiscox, an insurer that got its start mostly in the UK and doesn’t have a big US

distribution network to upset in the first place. (See sidebar, “Direct Insurer That Started Overseas Stakes Out a

Position in US.”) And at least one of the would-be incumbent substitutes is a U.S. carrier with a well-known

brand in insurance: Geico-owner Berkshire Hathaway, which said last December that it would roll out workers

compensation and business owners policies that small businesses can purchase directly online. Other carriers

with small business capabilities outside of the U.S. might decide to enter the market with similar digital models.

Insurance - Property & Casualty

9

Direct Insurer That Started Overseas Stakes Out a Position in USDirect Insurer That Started Overseas Stakes Out a Position in US

In the US, Hiscox is trying to replicate the success it has enjoyed in the UK’s farther-along small business

insurance market. Hiscox’s digital insurance strategy is to go both direct to customers and through

digital intermediaries, including e-brokers. In the 40 US states in which it currently operates, it has stayed

under the radar to some extent by targeting companies with fewer than 10 employees, many of them

white-collar businesses in the technology, professional services, and health and beauty fields. As rapidly

as these businesses are popping up, they are still not sources of major revenue or profit for big

incumbent insurers. For now, Hiscox is a minor annoyance, something the big insurers swat away with

their tails.

Small companies entering markets with big competitors have always understood the need to provide

excellent customer service, and Hiscox is no exception. The company’s direct to customer offering is

multi-channel, combining online, call center and outbound mail. And with the intermediated part of its

business, Hiscox is positioning itself to work with just about every e-broker and InsurTech player in the

market. This is an ecosystem play that could serve it well in the long run.

Most likely models for digitally delivered insurance in next few years: Between now and 2020, we expect

three models of digital delivery to get at least some traction in the small business insurance market.

Exhibit 8:Exhibit 8: Where Ins Tech activity has focused so far

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch

E-brokerage model. This refers to the possibility that a broker — whether one that has come of age

in the Internet era or that has been around for decades — might create a platform designed to give

small businesses both choice and breadth of coverage. The idea of an e-broker is to do digitally what

brokers today do mostly offline, while vastly improving customer service, customer analytics and the

customer experience.

E-brokerage is likely to be the fastest model to evolve. There is a lot of incentive to create something

like this, and — in theory at least — there aren’t many barriers.

Insurance - Property & Casualty

10

Digital small commercial insurance in 2020: three scenarios. The share of small business insurance

premiums in the US that will be digitally underwritten ( in this context, digitally underwritten is defined as

having most purchase processes - shopping, application, quotation, and binding - conducted through online,

mobile, or call center channels) is certainly going to grow in the next few years from its current 4% level, but by

how much? Here are our stakes in the ground on that, accompanied by commentary on plausible ways for that

scenario to materialize.

Digital-direct model. Essentially, carriers marketing directly to customers through digital distribution.

There is nothing stopping this from happening other than the fact that the incumbent carriers that

are in a position to do it would be risking a lot and the carriers that can afford to take the risk aren’t

in a position to do it. Still, it’s inevitable that there will be more direct-digital offerings in the next few

years, as incumbents (especially incumbents that have seen positive responses to digital services in

their personal insurance lines) stick their toe in the water, and as new players build brand awareness.

An unexpectedly big investment by an incumbent in digitizing its small business offerings could

propel this model much faster than now seems likely.

Aggregator model. While there are many companies that would like to be the Google of insurance, a

lot stands in the way of this model — in which a specialized search engine would allow small

businesses to compare insurance products and would serve as a lead-generation engine for carriers

and agents. Among the biggest obstacles is the extent to which it would push carriers toward price

competition and product commoditization. Many carriers would prefer less transparency rather than

more, and are not going to make it easy for aggregation companies to locate the necessary

information. This won’t stop some would-be aggregators from trying, but our money isn’t on

aggregation as a game-changer in the small business insurance market three to five years from now.

Exhibit 9:Exhibit 9: Bet on growth or play in a declining segment

So u rce: The Bo sto n Co n su ltin g G ro u p an d M org a n Stan ley R esearch

Insurance - Property & Casualty

11

"E-brokerage Pioneers"

Digitally enabled products remain a

constraint

Conservative scenario ~15%

In this scenario, the growth of digital insurance is

predominantly a function of start-up e-brokers’ appeal

to newly created small businesses that don’t have any

preexisting broker or carrier relationships. A market

representation of this size in 2020 will mean large

brokers haven’t prioritized the small business

opportunity. It will also mean that incumbent carriers,

hoping to avoid channel conflicts with traditional

agents and brokers, have been slow to digitize their

products and processes. Aggregator models have

barely gotten off the ground and there have been no

disruptive plays in the carrier space.

"Carrier Catalysts"

InsurTech companies gain rapid

acceptance

Most likely scenario ~24%

This scenario, the most probable, in our view (and also

in line with the projections in BCG publication "Digital

Disruption in the US Small-Business Insurance Market"

on April 7, 2016), assumes that e-brokers gain

significant traction and that mid-market and large

brokers become increasingly interested in the small

business space — prompting rapid development of

distributor-enabling software and technology. The

scenario further assumes that two of these distributor

platforms get adopted by major incumbent carriers,

prompting other carriers to step up their digital

insurance initiatives. In this scenario, most carriers still

resist the idea of connecting to aggregator platforms.

Carriers’ and distributors’ digital business is still coming

mostly from new companies that are relatively small in

size, though digital is starting to make inroads with

traditional customers and with companies in the ten to

50 employee range in lower-risk industries.

"Game Changer"

Game changers shake up the industry

Aggressive scenario ~30%

This represents the barbarians-break-through scenario.

It assumes that one or more of the leading small-

business carriers have built or acquired an e-broker and

are distributing directly to customers. In addition, both

a major foreign small business player and a technology

firm have entered the carrier space with disruptive

digital plays: new, simple products, predictive

underwriting, or a paradigm-changing digital claims

service. This is the only scenario in which aggregators

have caught on in any real way, though their success is

still limited to standardized products (business owner

policies, workers’ comp, commercial auto) in white-

collar industries. With the broader presence of digital

offerings, a significant number of existing policyholders

starts shifting to digital, encouraged, in some cases, by

incumbent carriers’ conversion initiatives.

Insurance - Property & Casualty

12

Investment Implications: A $25b+ Digital SBI Market OpportunityInvestment Implications: A $25b+ Digital SBI Market Opportunity

Digital disruption creates a $25b+ market opportunity in small business insurance. As the landscape of

small businesses changes, so too will the demand for digital solutions to meet the insurance needs. Quick

turnaround on quotes, easier to understand policy terms, and an ever-growing demand for direct channel

distribution will be just a few examples of what small business owners will expect. We estimate 15-30% of SBI

will be sold digitally by 2020, or $17-33b in annual premiums. This is a significant market to be gained (or lost).

For incumbent SBI carriers, they must invest in digital platforms to maintain or gain shares. For “mom & pop”

agencies focusing on SBI, they are facing a greater challenge. For insurance carries or brokers not competing in

SBI currently, they now have an opening to establish themselves. The biggest beneficiaries could be the

disruptors — InsurTech companies.

Learning from the past… The personal auto insurance market set the stage for what can happen when the

market is disrupted by new technology or distribution channels. With Berkshire Hathaway’s purchase of GEICO

in 1996, a disruption began as direct writers began what would become a significant market share shift. In the

last 2 decades, the top three direct underwriters (GEICO, Progressive, and USAA) collectively gained 16.5% of

personal auto market share, at the expense of other top-10 players (-9.4%) and smaller competitors (-7.1%).

Specifically, GEICO leaped from No. 8 to No. 2, Progressive jumped from No. 7 to No. 4, and USAA moved up

from No. 6 to No. 5. This translates into +11.1% premium CGAR for GEICO, +9.2% for Progressive, and +6.1%

for USAA vs. +3.2% for the personal auto industry. We note that each one point of market share is a ~$2b

business opportunity in the ~$200b personal auto market. GEICO alone grew premiums by almost $20b during

the period. Another example is the small business insurance market in the UK. (See sidebar, “UK Market Shows

How Fast Fortunes Can Change.”)

Exhibit 10:Exhibit 10: Direct Writers Gain Significant Market Share

Company 1996 2015 DWP Mkt Share Company DWP Mkt Share CAGR

State Farm Mutl Automobile Ins 1 1 23,348,417 21.4% State Farm Mutl Automobile Ins 36,553,861 18.3% 2.4%

Allstate Corp. 2 3 13,569,007 12.5% Berkshire Hathaway Inc. 22,805,195 11.4% 11.1%

Farmers Insurance Group 3 5 8,191,287 7.5% Allstate Corp. 20,036,973 10.0% 2.1%

Liberty Mutual 4 7 5,464,230 5.0% Progressive Corp. 17,502,500 8.8% 9.2%

Nationwide Mutual Group 5 8 5,099,323 4.7% USAA Insurance Group 10,539,707 5.3% 6.1%

USAA Insurance Group 6 5 3,415,913 3.1% Farmers Insurance Group of Cos 9,985,969 5.0% 1.0%

Progressive Corp. 7 4 3,277,616 3.0% Liberty Mutual 9,942,667 5.0% 3.2%

Berkshire Hathaway Inc. 8 2 3,078,433 2.8% Nationwide Mutual Group 7,468,708 3.7% 2.0%

Travelers Companies Inc. 9 10 2,456,823 2.3% American Family Insurance Grp 3,694,271 1.9% 3.5%

American Family Insurance Grp 10 9 1,924,188 1.8% Travelers Companies Inc. 3,377,404 1.7% 1.7%

Subtotal 69,825,238 64.1% 141,907,255 71.2% 3.8%

All Other 39,105,074 35.9% 57,466,713 28.8% 2.0%

Total Industry 108,930,312 100.0% 199,373,968 100.0% 3.2%

1996

2015

Rank

So u rce: SNL a n d M o rgan Stan ley R esearch

Insurance - Property & Casualty

13

UK Market Shows How Fast Fortunes Can ChangeUK Market Shows How Fast Fortunes Can Change

The UK market offers a glimpse of how quickly the small commercial market can move toward non-

intermediated insurance products including digital.

Between 2011 and 2014, the Direct Line Group, a former insurance division of the Royal Bank of

Scotland, increased its share of the UK’s small and medium enterprise insurance market from 2% to 7%

by focusing on simple products that customers could buy through whatever channel they chose,

including directly through their tablet computers or smartphones.

Other insurers that saw what was happening and jumped in with their own digital investments were able

to hang on to their market shares. For instance, Aviva’s introduction of an e-trading insurance platform

— enabled by an investment exceeding £50 million — allowed it to keep its almost one-third share of

the UK SME insurance market. Likewise, AXA’s rollout of its new direct digital channel allowed it to hold

onto its low- to mid-20s share of the UK SME market, while others who moved slowly saw their market

share erode.

In addition to showing how quickly traditional insurers can lose ground, the UK example dispels the myth

that brokers and agents can never be replaced. Upwards of a quarter of all small-business insurance in

the UK is now bought without the help of an intermediary. While the US and UK have different regulatory

frameworks, it remains a reminder that channel disruption is possible in insurance and can happen

quickly once it starts.

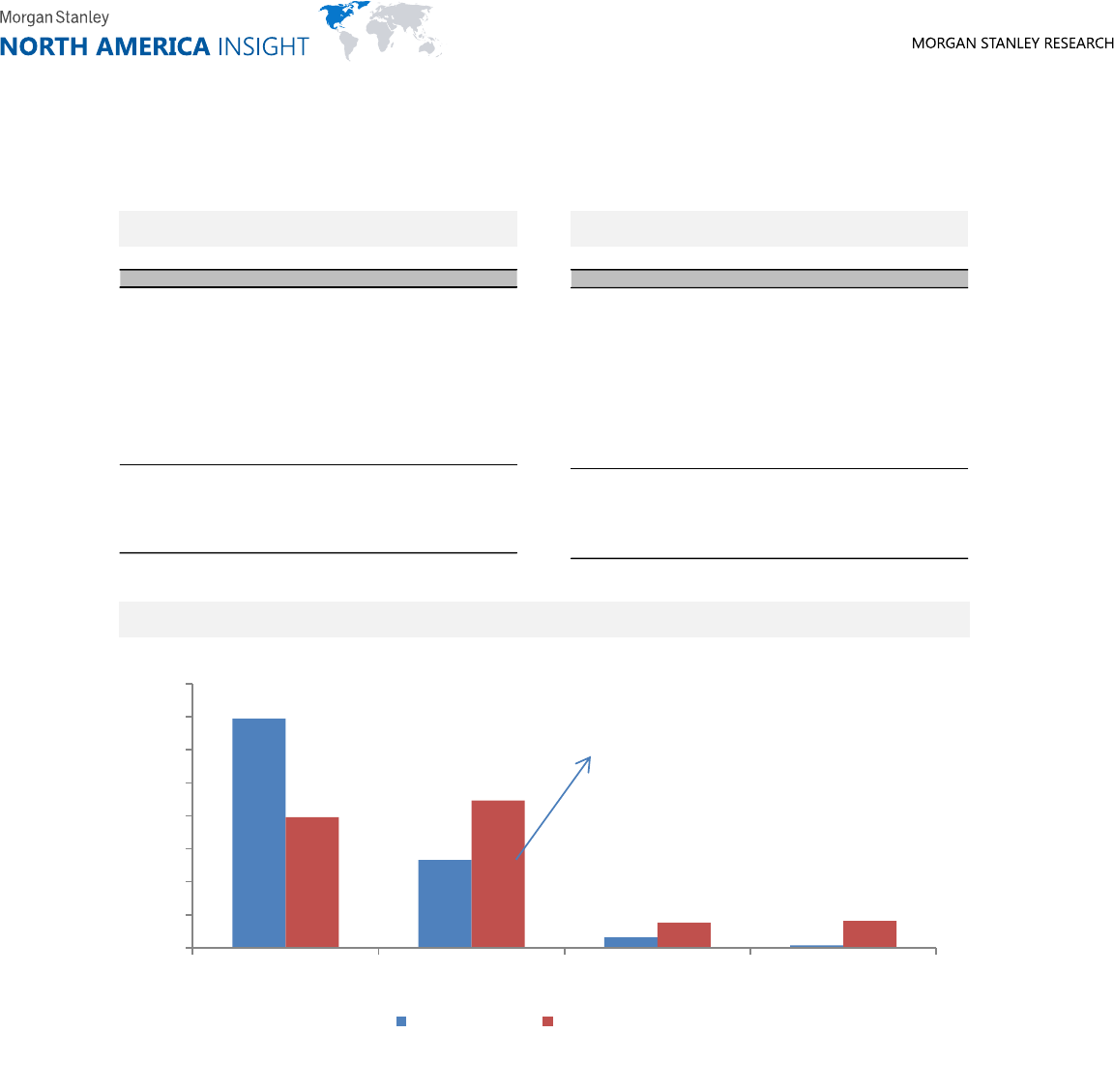

Small business insurance is a fragmented market in the US. US commercial lines is a ~$285b premium

market overall (across large/mid-market and SBI). Top-10 players account for ~39% of market share vs. ~71%

for top-10 insurers in personal auto. Since 1996, the top-10 players have actually ceded market shares (from

46% to 39%) to smaller underwriters. Eight insurers in top-10 in 1996 remained in the top league in 2015 and

only two of them gained shares (Chubb from 4.8% to 5.6% and Nationwide from 2.3% to 2.9%) during the

period.

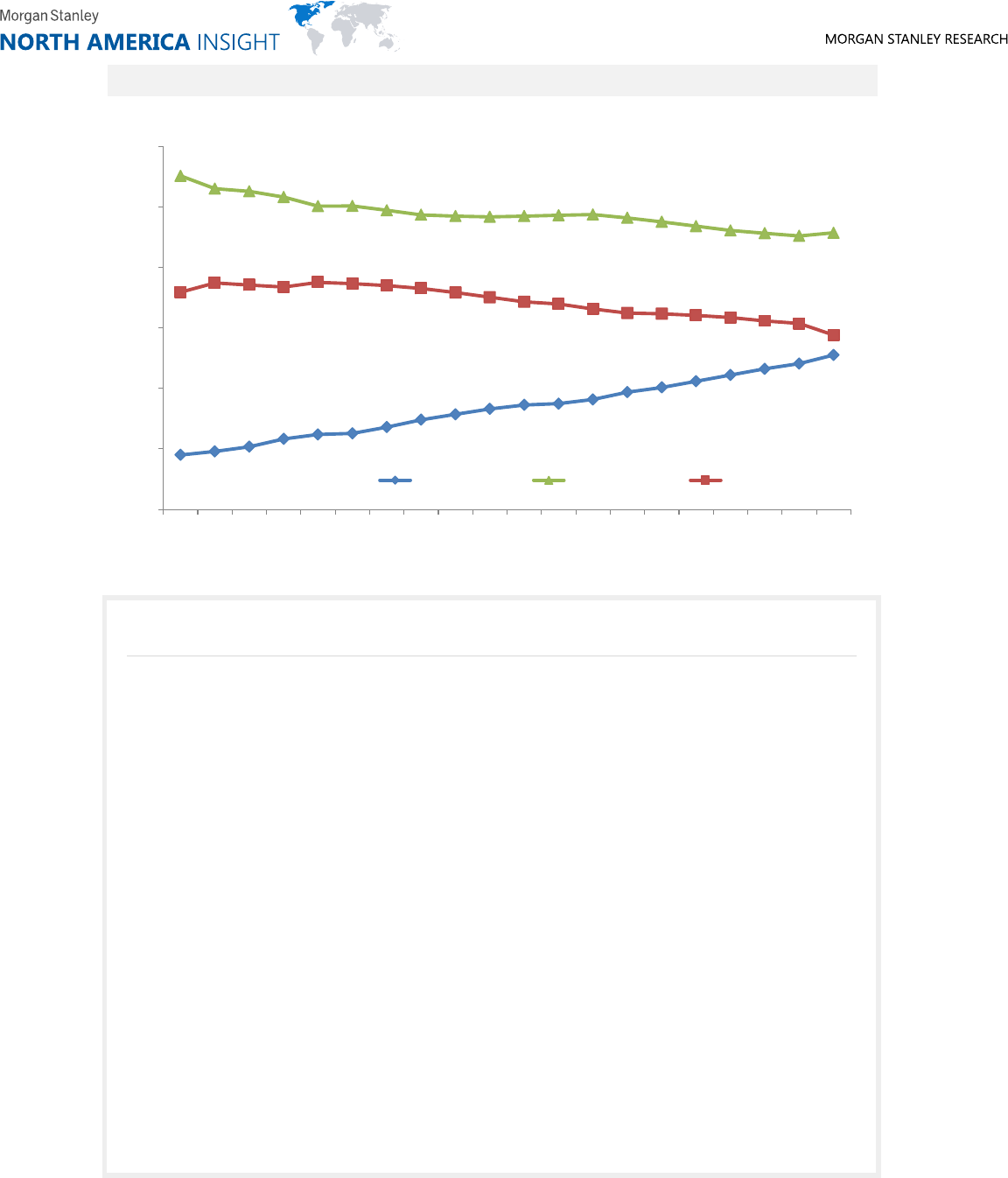

Exhibit 11:Exhibit 11: BRK + PGR + USAA Steady Mkt Share Gain

9.0%

9.6%

10.4%

11.7%

12.4%

12.6%

13.6%

14.8%

15.7%

16.6%

17.3%

17.5%

18.2%

19.4%

20.2%

21.2%

22.2%

23.2%

24.1%

25.5%

55.1%

53.0%

52.6%

51.6%

50.1%

50.1%

49.4%

48.7%

48.5%

48.3%

48.5%

48.6%

48.7%

48.2%

47.5%

46.8%

46.1%

45.6%

45.2%

45.7%

35.9%

37.4%

37.1%

36.7%

37.5%

37.3%

37.0%

36.5%

35.8%

35.1%

34.3%

33.9%

33.1%

32.4%

32.3%

32.0%

31.7%

31.2%

30.7%

28.8%

0%

10%

20%

30%

40%

50%

60%

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

BRK, PGR, USAA All Other Top-10 All Other

So u rce: SNL a n d M o rgan Stan ley R esearch

Insurance - Property & Casualty

14

We estimate SBI to account for ~$100b annual premiums or ~35% of overall commercial line market. It is even

more fragmented, with the top-10 players account for ~30% of market share and none garners more than 5%

of market share. Nationwide, State Farm, The Hartford, Liberty Mutual, Travelers, AIG, Cincinnati Financial,

Farmers, AmTrust, and Chubb are among the leading providers.

Sizing up the small business insurance market opportunities in 3 scenarios. Using the 3 scenarios of

digital market share in SBI, we estimate ~$3-8b pretax profit potentially up for grabs for insurers by 2020. By

comparison, US P&C industry collectively earned $65b in 2015. We assume combined ratios of 86-94%, 3x

investment leverage, 3.4% investment yield, and 15%, 24%, and 30% of digital market share in 2020. For P&C

agents and brokers, there could be ~$400m to $1b operating income shifting hands. We assume 12.5%

commission rate and varying operating margins (20-25%).

Exhibit 12:Exhibit 12: Commercial Lines Mkt Share: 1996

Rank

Company DWP

Mkt Share

1

Travelers Companies Inc. 11,210,945

8.6%

2

American International Group 9,245,613

7.1%

3

Liberty Mutual 7,836,896

6.0%

4

CNA Financial Corp. 7,072,945

5.4%

5

Chubb Ltd. 6,207,807

4.8%

6

Zurich Insurance Group 4,856,584

3.7%

7

Hartford Financial Services 3,628,692

2.8%

8

Allianz Group 3,442,573

2.6%

9

State Farm Mutl Automobile Ins 3,420,093

2.6%

10

Nationwide Mutual Group 3,025,637

2.3%

Subtotal

59,947,784

46.0%

All Other 70,418,325

54.0%

Total Industry 130,366,109

100.0%

Source: SNL and Morgan Stanley Research

Exhibit 13:Exhibit 13: Commercial Lines Mkt Share: 2015

Rank

Company DWP

Mkt Share

1

Travelers Companies Inc. 16,214,165

5.7%

2

Chubb Ltd. 16,076,216

5.6%

3

American International Group 15,990,539

5.6%

4

Liberty Mutual 13,384,371

4.7%

5

Zurich Insurance Group 13,297,325

4.7%

6

CNA Financial Corp 8,880,641

3.1%

7

Nationwide Mutual Group 8,399,667

2.9%

8

Hartford Financial Services 7,455,552

2.6%

9

Berkshire Hathaway Inc. 6,980,214

2.4%

10

Tokio Marine Group 5,922,971

2.1%

Subtotal

112,601,660

39.4%

All Other 173,045,857

60.6%

Total Industry 285,647,517

100.0%

Source: SNL and Morgan Stanley Research

Exhibit 14:Exhibit 14: A Fragmented Commercial Insurance Market

70%

27%

3%

1%

40%

45%

8%

8%

0%

10%

20%

30%

40%

50%

60%

70%

80%

Top-10 Next 90 Next 100 All Other

Personal Auto Commercial Lines

42 of the 90

companies here are

publicly-traded

So u rce: SNL a n d M o rgan Stan ley R esearch

Insurance - Property & Casualty

15

Potential impact to our covered P&C companies: Among our coverage AIG, CB, HIG, and TRV are top small

business insurers. Given certain company specific assumptions, we calculate potential EPS impact under various

market share gain/loss and combined ratio combinations. We estimate each point of market share gain at 90%

combined ratio could be 4-8% accretive for AIG, CB, TRV, and ~14% for HIG. Conversely, market share loss

would have a negative impact on earnings.

Exhibit 15:Exhibit 15: Digital SBI Operating Income, P&C Underwriters

($mm)

Scenario E-brokerage Pioneers Carrier Catalysts Game Changer

Digitally Underwritten Premium, 2020 16,500 26,400 33,000

(% of small commercial insurance market) 15% 24% 30%

Combined Ratio 94% 90% 86%

Pretax Underwriting Gain 990 2,640 4,620

Investment Leverage 3.0x 3.0x 3.0x

Yield 3.4% 3.4% 3.4%

Pretax Net Investment Income 1,683 2,693 3,366

Total operating profit, 2020 2,673 5,333 7,986

Insurance Carrier Opportunities

So u rce: SNL, Th e Bo sto n Co n su ltin g G rou p, a n d M o rgan Stan ley R esearch

Exhibit 16:Exhibit 16: Digital SBI Operating Income, P&C Brokers

($mm)

Scenario E-brokerage Pioneers Carrier Catalysts Game Changer

Digitally Underwritten Premium, 2020 16,500 26,400 33,000

(% of small commercial insurance market) 15% 24% 30%

Commission Rate 12.5% 12.5% 12.5%

Broker Revenue 2,063 3,300 4,125

Operating Margin 20.0% 22.5% 25.0%

Total Operating Profit, 2020 413 743 1,031

Insurance Broker Opportunities

So u rce: SNL, Th e Bo sto n Co n su ltin g G rou p, a n d M o rgan Stan ley R esearch

Exhibit 17:Exhibit 17: Company-specific Assumptions

Assumption AIG CB HIG TRV

2015 SBI market share 2.5% 3.0% 3.5% 4.0%

Underwriting income tax rate 35.0% 16.0% 35.0% 35.0%

Investment leverage 3.0x 3.0x 3.0x 3.0x

Net investment income tax rate 25.0% 16.0% 23.0% 20.0%

2015 shares outstanding (mm) 1,324.5 328.8 403.4 314.2

2016 consensus EPS $4.01 $9.86 $3.91 $9.55

So u rce: SNL, Th o mso n Reu ters, Morg an Stan ley R esearch

Insurance - Property & Casualty

16

Exhibit 18:Exhibit 18: Potential EPS Impact for AIG

Incremental EPS in 2020 - AIG % of 2016 Consensus EPS - AIG

-2% -1% 0% 1% 2% -2% -1% 0% 1% 2%

86% ($0.25) ($0.11) $0.03 $0.17 $0.32 86% -6.1% -2.6% 0.9% 4.4% 7.9%

88% ($0.23) ($0.10) $0.03 $0.16 $0.29 88% -5.7% -2.4% 0.8% 4.0% 7.3%

90% ($0.21) ($0.09) $0.03 $0.15 $0.27 90% -5.2% -2.2% 0.7% 3.7% 6.6%

92% ($0.19) ($0.08) $0.03 $0.13 $0.24 92% -4.7% -2.0% 0.7% 3.3% 6.0%

94% ($0.17) ($0.07) $0.02 $0.12 $0.22 94% -4.2% -1.8% 0.6% 3.0% 5.4%

SBI Market Share Gain/Loss (over 5 years)

SBI Market Share Gain/Loss (over 5 years)

SBI C/R

SBI C/R

So u rce: SNL, Th o mso n Reu ters, Morg an Stan ley R esearch

Exhibit 19:Exhibit 19: Potential EPS Impact for CB

Incremental EPS in 2020 - CB % of 2016 Consensus EPS - CB

-2% -1% 0% 1% 2% -2% -1% 0% 1% 2%

86% ($1.17) ($0.48) $0.20 $0.89 $1.57 86% -11.9% -4.9% 2.1% 9.0% 16.0%

88% ($1.07) ($0.44) $0.19 $0.82 $1.44 88% -10.9% -4.5% 1.9% 8.3% 14.7%

90% ($0.98) ($0.40) $0.17 $0.74 $1.31 90% -9.9% -4.1% 1.7% 7.5% 13.3%

92% ($0.88) ($0.36) $0.15 $0.67 $1.18 92% -8.9% -3.7% 1.5% 6.8% 12.0%

94% ($0.78) ($0.32) $0.14 $0.60 $1.05 94% -7.9% -3.3% 1.4% 6.0% 10.7%

SBI Market Share Gain/Loss (over 5 years)

SBI Market Share Gain/Loss (over 5 years)

SBI C/R

SBI C/R

So u rce: SNL a n d M o rgan Stan ley R esearch

Exhibit 20:Exhibit 20: Potential EPS Impact for HIG

Incremental EPS in 2020 - Hartford % of 2016 Consensus EPS - HIG

-2% -1% 0% 1% 2% -2% -1% 0% 1% 2%

86% ($0.77) ($0.30) $0.16 $0.63 $1.09 86% -19.7% -7.8% 4.1% 16.0% 27.9%

88% ($0.71) ($0.28) $0.15 $0.58 $1.01 88% -18.2% -7.2% 3.8% 14.8% 25.8%

90% ($0.65) ($0.26) $0.14 $0.53 $0.92 90% -16.7% -6.6% 3.5% 13.5% 23.6%

92% ($0.59) ($0.23) $0.12 $0.48 $0.84 92% -15.1% -6.0% 3.2% 12.3% 21.5%

94% ($0.53) ($0.21) $0.11 $0.43 $0.76 94% -13.6% -5.4% 2.8% 11.1% 19.3%

SBI Market Share Gain/Loss (over 5 years)

SBI Market Share Gain/Loss (over 5 years)

SBI C/R

SBI C/R

So u rce: SNL a n d M o rgan Stan ley R esearch

Exhibit 21:Exhibit 21: Potential EPS Impact for TRV

Incremental EPS in 2020 - Travelers % of 2016 Consensus EPS - TRV

-2% -1% 0% 1% 2% -2% -1% 0% 1% 2%

86% ($0.98) ($0.37) $0.24 $0.85 $1.46 86% -10.2% -3.9% 2.5% 8.9% 15.3%

88% ($0.90) ($0.34) $0.22 $0.79 $1.35 88% -9.5% -3.6% 2.3% 8.2% 14.1%

90% ($0.83) ($0.31) $0.20 $0.72 $1.24 90% -8.7% -3.3% 2.1% 7.6% 13.0%

92% ($0.76) ($0.29) $0.19 $0.66 $1.13 92% -7.9% -3.0% 2.0% 6.9% 11.8%

94% ($0.68) ($0.26) $0.17 $0.59 $1.02 94% -7.2% -2.7% 1.8% 6.2% 10.7%

SBI Market Share Gain/Loss (over 5 years)

SBI Market Share Gain/Loss (over 5 years)

SBI C/R

SBI C/R

So u rce: SNL a n d M o rgan Stan ley R esearch

Insurance - Property & Casualty

17

A detailed example calculation supporting the Travelers EPS impact of $0.59 given a small commercial insurance

market share increase of 1% and a combined ratio of 94% is found below.

For distribution, mom & pop agents could face the biggest challenge. Among our broker coverage, BRO has the

most small commercial insurance exposure, while others (AON, MMC, WLTW, and AJG) are servicing

large/middle markets which are less susceptible to digital disruption.

Who are the likely winners (and laggards)? Winning the “digital revolution” in small business insurance will

require significant investments in leading-edge technology. But the willingness to do so is just as important.

How soon will investors see the impact? While there are some early movers in digital SBI market, we believe

we are still in the very early innings of this secular change. Given the significant investments and mindset

change needed, we expect the market share shift to occur over time. In personal auto, it took direct writers 20

years to gain 17% market share, or less than one point per year. However, the world is drastically different today

than it was in 1996 when the internet and mobile technologies were in their infancies. We think the pace of

technology adoption in the SBI market could be much faster. Assuming even a 20bps market share gain per

year over the next five years for individual carriers in the SBI space, we note that the EPS accretion could be 4-

14% for some of our covered carriers (assuming a 90% combined ratio).

Exhibit 22:Exhibit 22: Specific Calculation Example of TRV EPS Impact (1% market share gain and 94% combined ratio)

Item 2015 CAGR 2020 Change Notes

(1) SBI Industry Premium 100,000 2.1% 110,950 10,950 Industry is $100b market; grows 2.1%/yr

(2) TRV market share 4.0% 5.0% 1.0% TRV grows its SBI mkt share by 1 pt

(3) TRV premium 4,000 5,548 1,548 = (1) x (2)

(4) Combined ratio for SBI 94% 94% Assume for this example a 94% C/R

(5) Pretax underwriting gain 240 333 93 = (3) x [100% - (4)]

(6) After tax underwriting gain 156 216 60 Assume tax rate of 35%

(7) Investment leverage 3.0x Assume investment leverage of 3.0x

(8) Investment yield 3.4% Assume investment yield of 3.4%

(9) Pretax net investment income 158 = (3) x (7) x (8)

(10) After tax investment income 126 Assume tax rate of 20%

(11) 2015 Shares outstanding 314.2 Given

(12) EPS impact $0.59 = [(6) + (10)] / (11)

So u rce: SNL a n d M o rgan Stan ley R esearch

Large, national, incumbent carriers have the financial and technology resources but they could be

constrained by channel conflict (direct vs. agency) and corporate inertia.

Smaller regional players could struggle to maintain their market share as SBI market consolidates, if

they are not proactively adjusting their go-to market strategy.

Smaller agents could be the most negatively impacted, given their clients are most prone to move

digital while mom & pop agents lack financial and technology resources.

Larger brokers, while not immediately threatened by digital disruption in SBI, could face increasing

competition if mom & pop agencies have to move up to middle markets.

Digital disruption in SBI provides an opening for non-incumbents to establish a foothold and gain

share.

The biggest beneficiaries could be InsurTech companies — nothing but to gain share. However the

lack of data and underwriting expertise could impede or even doom some efforts.

Insurance - Property & Casualty

18

Searching for the next GEICO (or Google): InsurTech disruption could have profound investment

implications. Among our coverage, AIG, CB, HIG, and TRV are top small business insurers. We estimate each

point of market share gain in small commercial insurance could boost their earnings by 4-14%. Mom & pop

agents could face the biggest challenge. Among our broker coverage, BRO has the most small commercial

insurance exposure while others are servicing large/middle markets which are less susceptible to digital

disruption. New entrants (either startups or traditional insurers) could be the biggest winners in the digital

transformation of small business insurance. InsurTech companies are learning from technology disruptors (see

sidebar). Some traditional insurers are taking innovative, digital/direct approaches to SBI market as well,

including recent examples of:

There are still many unanswered questions: Will pricing fall with lower distribution cost? Will lower pricing

increase demand? Will technology play important roles in not just distribution but also underwriting? One thing

is for sure — digital disruption in small business insurance is already happening.

Learning from Technology DisruptorsLearning from Technology Disruptors

Internet giant Google entered into auto insurance market through an model of Google Compare.

However the lack of participation from large carriers doomed this year-long experiment. We think

Google gained additional insights in this venture to better serve its core search business, with insurance

among the highest pay per click. Internet powerhouses, like Google, Apple, Amazon, and Facebook, all

possess brand and data analytics which could make them powerful competitors (or partners) in

insurance marketplace.

Customer experience is the key to a digital marketplace model. Insurance buyers, especially in small

business insurance, have unmet needs in product simplicity and shopping experience. InsurTech

companies or even traditional insurers and brokers could learn from other successful digital marketplace

models. Positive customer experience benefits from (1) more selections, (2) customer reviews, (3) price

comparison, (4) frictionless purchase process, (5) step changes (selling adjacent products/services), and

(6) sharing (who bought what).

Most InsurTech startups are focusing on distribution. The relationship with insurance carriers is vital to

their success. They could learn from other internet verticals such as online travel agencies.

Berkshire Hathaway’s recently formed unit to sell workers’ compensation and BOP policies directly

over the internet.

American Family Group’s investment in start-up firm AssureStart, which sells small business

insurance through direct writers.

Hiscox offers small business insurance product directly from its website.

AIG, Hamilton Insurance Group, and Two Sigma plan to establish a technology-driven platform

targeting SBI.

Travelers announced a direct SBI online platform in the UK.

Insurance - Property & Casualty

19

Appendix I: Small Business Insurance SurveyAppendix I: Small Business Insurance Survey

In conjunction with this research report, BCG conducted a survey of US-based small commercial insurance

decision-makers in April of 2016. The synthesized survey results represent 517 total survey respondents who

met the following three criteria: (1) Company size: Non-employers to 49 employees, (2) Company purchases

commercial insurance, and (3) Respondent is the primary decision-maker or equally shares decision-making

responsibility for this purchase.

Our respondents represent a wide range of small businesses across multiple firmographics including company

size, industry and firm age: (1) Company size: 39% of respondents are microbusinesses with <5 employees, 21%

with 5-9 employees, 13% with 10-19 employees and 27% with 20-49 employees, (2) Our top five industries

(Professional and specialty services, Contractors and construction, Retail, Healthcare, Real estate) represent 55%

of survey respondents – largely in line with US Census Bureau firm counts for same industries, and (3) 25% of

the respondents represent businesses that have been founded in the last five years.

Key takeaways:

Exhibit 23:Exhibit 23: Demand for an insurance digital solution already significantly exceeds a high quality solution

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

20

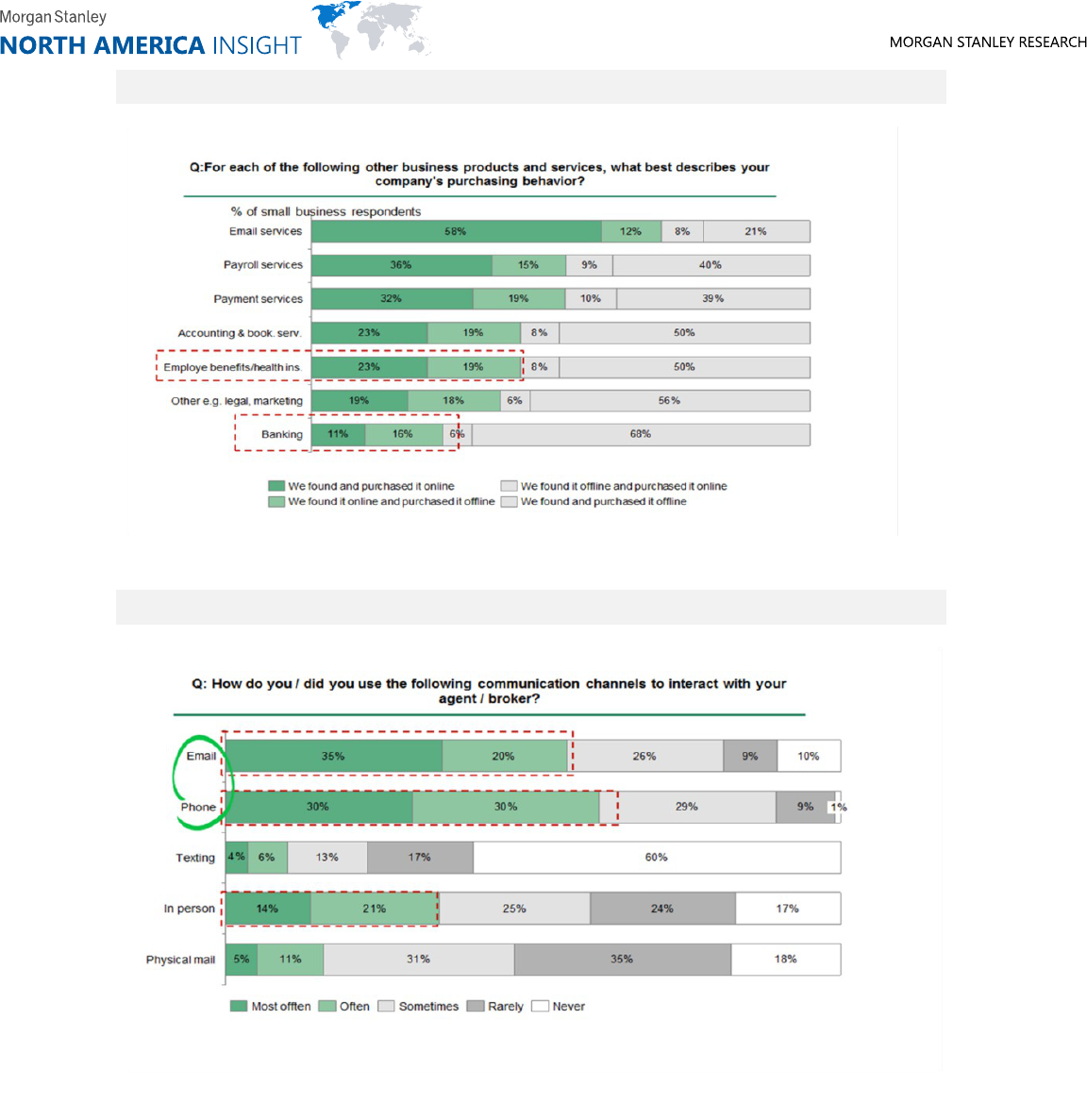

Exhibit 24:Exhibit 24: Small business owners already leverage digital for many day to day operations.

So u rce: The Bo sto n Co n su ltin g G ro u p

Exhibit 25:Exhibit 25: … and are already using digital channels to communicate with carriers, agents, and brokers.

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

21

Exhibit 26:Exhibit 26: Although face to face interaction and local presence are still important criteria in selecting

agents/brokers.

So u rce: The Bo sto n Co n su ltin g G ro u p

Exhibit 27:Exhibit 27: … Small businesses interested in buying direct place more importance in price, expertise, and

brand.

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

22

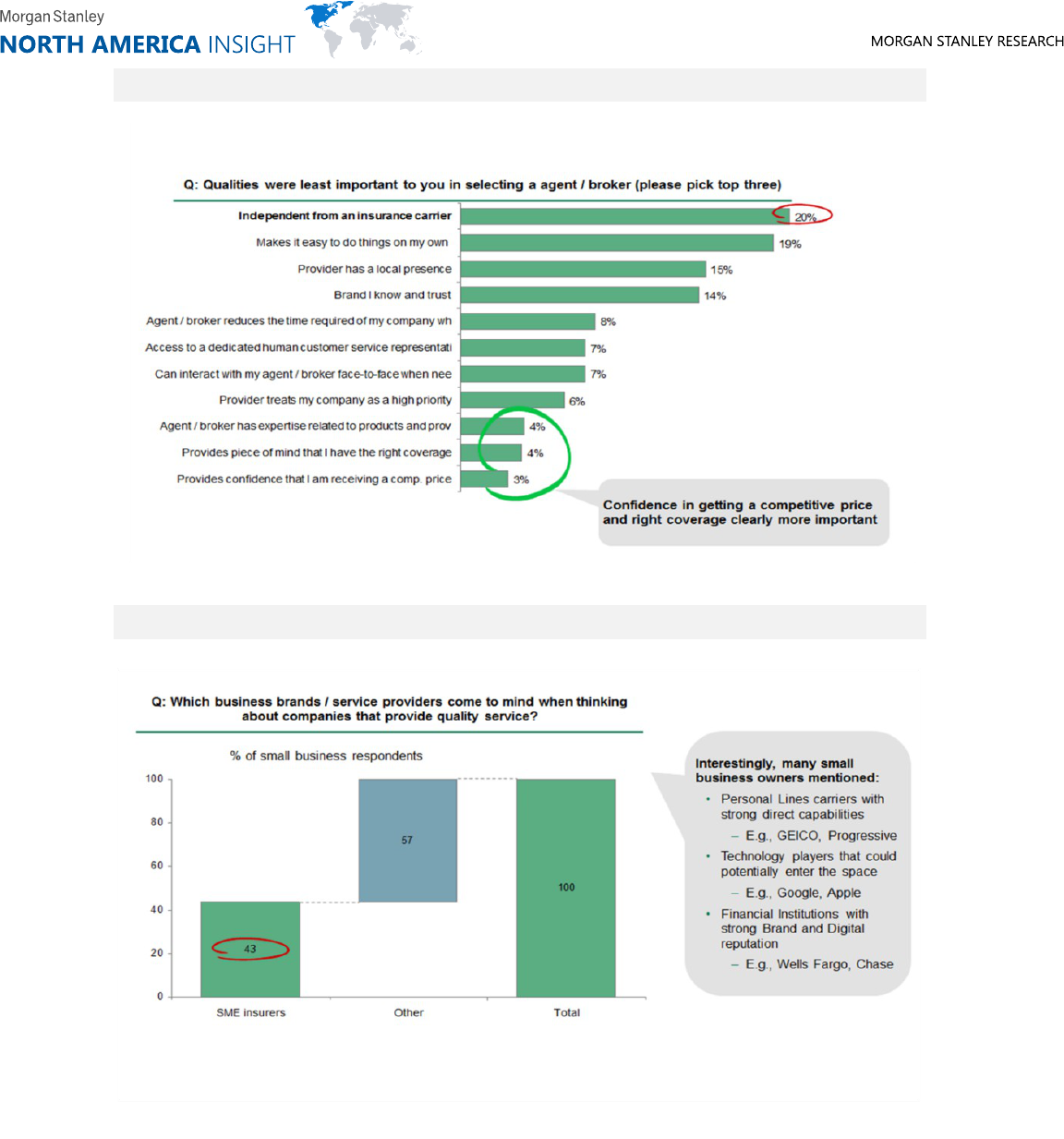

Exhibit 28:Exhibit 28: Independence from carrier is not considered an important criteria in agent/broker selection.

So u rce: The Bo sto n Co n su ltin g G ro u p

Exhibit 29:Exhibit 29: We found low association of carriers with quality of service.

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

23

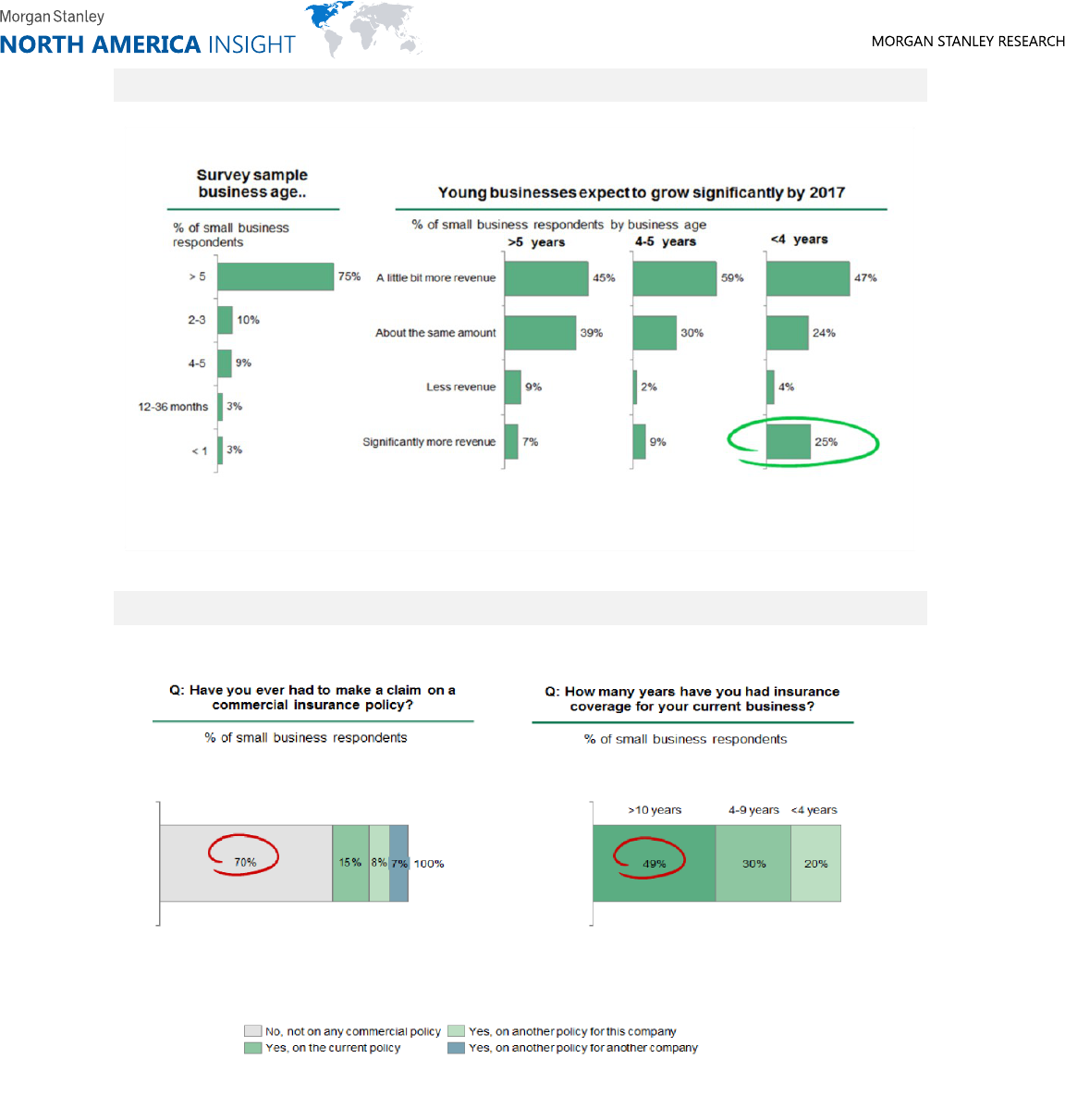

Exhibit 30:Exhibit 30: Significantly more optimism among young businesses.

So u rce: The Bo sto n Co n su ltin g G ro u p

Exhibit 31:Exhibit 31: 70% of respondents have not had a claim despite of 50% holding insurance over 10 years.

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

24

Appendix II: InsurTech Company ProfilesAppendix II: InsurTech Company Profiles

Exhibit 32:Exhibit 32: Select InsurTech Company Profiles

Startup Startup Launch Desription

Compare.com 2013

Price comparison website for auto, health, home, life and small business insurance

Bizinsure 2012

Focuses on combining knowledgeable, licensed human support with the simplicity and affordability of technology, allowing

consumers to compare multiple top rated business insurance quotes within minutes, and buy with the company online or

over the phone.

Einsurance 1999

Price comparison website for auto, health, home, life and small business insurance

Netquote 1989

Focuses on providing consumers with a free, simple, and effective way to fulfill insurance shopping needs. NetQuote

operates a web-based business through which local insurance agents and national insurance companies purchase high

quality leads of consumers in the market for competitively priced insurance policies. NetQuote's website enable consumers

to receive multiple insurance quotes in all 50 states from the Company's network of independent local insurance agents and

local representatives from its national insurance partners.

Bolt 2000

e-agent focused on delivering a better way for small businesses and individuals to choose and buy their insurance coverage.

Company bets on a combination of expertise, customer service, and online platform to help customers efficiently determine

which carrier and product are a good fit for the customers.

Coverwallet 2015

e-broker that leverages data, design and technology to deliver a better experience for small business owners. Its

assessment system to help small businesses identify their insurance needs and find a policy that fits their budget. The use of

consumer-friendly online technologies (e.g., automatic risk analysis, document management, benchmarking and data

analytics, intelligent data driven risk and insurance assessments, coverage recommendations, peer risk comparisons and

claims support) makes the process of obtaining a quote a lot simpler and faster for small business owners.

Coverhound 2010

Online platform for comparing and purchasing insurance, built to deliver fast, accurate and actionable rates from leading US

carriers based on clients specific needs. Company is dedicated to providing the best in class customer experience from

leading U.S. property and casualty carriers.

Embroker 2015

Cloud-based risk and insurance management platform that uses the company's own software, data and predictive analytics

to help businesses buy all types of commercial insurance. Focused on a broader spectrum of business insurance with

emphasis on efficiency, transparency, and empowerment

Insurance noodle 2000

Small business insurance wholesaler (mostly focused on white collar industries) that allows independent agents to find

insurance products quickly and easily by using state-of-the-art technology. It also plays in personal lines.

Insureon 1997

Online small business insurance agency that provides coverage for more than 175,000 small businesses. It both serves

retail clients directly and supports leading top-five banks, brokerages, and insurance companies in delivering their small

commercial business.

Just works 2013

Payroll management and benefits solution provider for small businesses. The dashboard allows companies to make it easy

to fill out forms such as the I-9 and offers direct deposit and processes payments for contractors (a free service), salaried

employees and hourly workers. On the platform, companies can also offer full medical, dental and vision coverage and

process payments, files required taxes, files for workers' comp and handle other legalities for its users.

Next Insurance 2016

Online small businesses insurance platform focused on creating a process that's online, transparent, fast and complete by

partnering with carriers that provide a digitally underwritten small business products.

DataRobot 2016

Data and Analytics company that helps users build better predictive models faster in the cloud. DataRobot is designed to be

a co-pilot by building and testing hundreds of models to find the best match for your data. Its platform integrates with R and

Python, allowing users to code, train and test models on its platform to see how they compare.

Earnix 2001

Integrated Pricing and Customer Analytics software that empowers financial services companies to predict customer risk and

demand and their impact on business performance, enabling the alignment of product offerings with changing market

dynamics. Banks and insurers rely on Earnix solutions to improve deposit, loan, and insurance policy offerings

Inedge 1994

Analytics solution provider specialized in the Insurance industry. Company focuses on helping clients gather and understand

large amounts of data from various sources to make real-time decisions in a more cost-effective, efficient, and reliable

manner by providing proprietary software accelerators and applications for a decreased implementation time, costs, and

risks.

Quantemplate 2011

Insurance reporting and analytics software built for the complex, collaborative world of the wholesale reinsurance markets to

enables importing, analysing, modelling, reporting and utilization of data. Through QuanTemplate, underwriters and brokers

can conduct all operational activities required to trade in the insurance market, while optimising their risk in realtime.

Verisk 1971

Provider of information about risk to professionals in insurance, healthcare, mortgage, government, and risk management.

Using advanced technologies to collect and analyze billions of records, Verisk Analytics draws on vast industry expertise and

unique proprietary data sets to provide predictive analytics and decision-support solutions in fraud prevention, actuarial

science, insurance coverages, fire protection, catastrophe and weather risk, data management, and many other fields.

6sense 2013

Predictive analytics platform that helps B2B marketing and sales leaders by combining robust data science and machine

learning with a "Buyer Intent Network" that captures time-based, structured and unstructured behavioral data from

thousands of sources. Company focuses on helping businesses identify prospects in new markets and verticals – or find

buyers with a need for products in new market categories

Platforms

Marketscout 2000

MarketScout is an insurance exchange with over 35,000 users (mostly independent retail agents) who use MarketScout to

access specialists that help insurance agents and their clients to secure insurance quotes that best fit their needs (i.e. from

Best of Class companies) by providing research support and serving as a third party advisor.

CSC 1959

Global provider of information technology (IT) services and solutions that focuses on enabling insurers to grow digitally while

simultaneously transforming their existing IT environment, for improved efficiency and speed to market.

N2uitive 2006

Claims software that helps improve decision support, advance best practices, and facilitate robust collaboration across your

entire organization.

Vertafore 1969

Largest technology provider for the insurance industry in the US, offers broad and adaptable technology solutions for carriers

and agents.

Aggregators

E-brokers

Data &

Analytics

Technology

So u rce: The Bo sto n Co n su ltin g G ro u p

Insurance - Property & Casualty

25

Valuation Methodology and Risks to Price Targets

AIG.N

Our $63 PT is based on sum-of-the-parts valuation. We estimate valuations of $26, $17, and $20 per share,

respectively, for non-life, life & other assets (including DTA). Our PT implies ~0.95x 1Q17e BVPS (ex. AOCI and

DTA), given ~9% ROE potential in 2017. We see +15% upside to our PT from current levels, but considerable

execution risks keep us on the sideline. Upside risks: better underwriting improvement, higher investment

income, top-line growth acceleration, lower than expected cat losses, favorable reserve development, and

stronger capital management. Downside risks: unable to execute on financial goals, large losses from

catastrophes or adverse reserve development, equity market volatilities, investment losses, non-bank SIFI

limiting capital deployment ability.

AJG.N

Our $48 price target is based on sum-of-parts valuation, valuing Core business at 19x NTMe EPS or 11x

EV/EBITDA and Clean coal at 5x EPS. Slowing economic growth and pricing pressure will lower organic growth

to ~3%, limiting margin expansion. Tuck-in acquisitions on a global platform along with top line growth and

margin expansion should drive ~11% CAGR in 2016-17e. Downside risks include: M&A execution, P&C pricing

declines, economic downturn, Clean coal business disappoints. Upside risks include: Faster top-line growth,

better margin, improving economy.

AON.N

Our $100 price target is based on 15x NTMe P/E and 11x EV/EBITDA, in line with peers, assuming low single

digit organic growth in risk segment, margins rising and buybacks continue. Healthcare exchange growth

continues and pushes valuation above historical average. Downside risks include: M&A, P&C pricing under

pressure, Economic slowdown, Healthcare exchange adoption slows. Upside risks include: Faster organic growth

(in Risk or HR, especially Healthcare Exchanges) drives higher margin expansion.

BRO.N

Our $30 price target is based on 17x NTM EPS and 9x EV/EBITDA, below 10-year averages, but above brokers

peers with faster EPS growth trajectory. Pricing headwinds and people/technology investments would pressure

margins near-term. We see better relative value in other brokers. Upside risks include: faster organic growth;

better margins; accretive acquisitions, and larger share repurchases.

CB.N

Our $136 price target is based on 1.3x 1Q17e BVPS, which is a blended valuation considering legacy Chubb

accounts for ~ 40% of the combined business post acquisition. We expect combined valuation to re-rate higher

from historical ACE average ~1.2x. More stable earnings and higher growth potential could support higher

valuation than peer averages ~1.2x. Risks include: Integration risk; declining P&C pricing; underwriting margin

deterioration; global growth and F/X headwinds; investment portfolio losses; large catastrophes or adverse

development.

HIG.N

We value the stock using a SOTP approach, where we value each division on a price to book basis based on peer

multiples. This method of analysis leads us to a fair value of $47. As this implies upside in-line with what we see

at its peers, we are reiterating our Equal-weight rating on the stock. Risks include execution challenges

associated with its restructuring actions, reserve developments in workers compensation, and any delays in

extracting capital from the Talcott operations.

Insurance - Property & Casualty

26

MMC.N

Our $63 price target is based on 18x NTM EPS and 11.5x EV/EBITDA, modestly above MMC historical averages.

We estimate ~13% EPS CAGR into 2018 driven by +4% organic growth, ~130bps margin expansion and strong

capital management. Improving economies and decelerating P&C pricing drive low single digit organic top-line

growth. Upside risks include: less than expected F/X headwinds, better organic growth and margin expansion,

larger share buybacks. Downside risks include: global economic slowdown, sharply declining P&C pricing

impacting organic growth, poorly executed M&A.

TRV.N

Our $110 price target is based on 1.25x 1Q17e BVPS, a slight premium to its historical averages. We estimate

2016-17e ROE of ~11-12% driven by stable core underwriting margins along with continued reserve releases,

share buybacks and steady investment income. Downside risks include: Margin deterioration, catastrophe

losses, investment losses, reserve charges, and dilutive M&A. Upside risks include: Better investment income,

top-line growth acceleration, continued low cat losses, continued reserve releases at current levels and higher

buybacks.

WLTW.O

Our $135 price target is based on 17x NTMe P/E, in line with historical averages. Twin expense drivers of

operational improvement at Willis and, merger synergies and tax savings should drive ~15% EPS CAGR in

2016-18e. Valuation expands toward global peers. Risks include: Integration issues; Decelerating P&C pricing or

global economic uncertainties hurt organic growth; Inability to execute on current cost saving plan.

Insurance - Property & Casualty

27

Boston Consulting Group Disclosures

The information provided herein was prepared by Morgan Stanley & Co. LLC ("Morgan Stanley") and The

Boston Consulting Group (BCG). It is not investment research, though it may refer to a Morgan Stanley research

report or the views of a Morgan Stanley research analyst. This communication does not constitute a complete

fundamental analysis of any companies mentioned. Unless indicated, all views expressed herein are the views of

the authors and may differ from or conflict with those of Morgan Stanley’s research department. This article

does not constitute investment advice or recommendations and is not a solicitation or an offer to purchase or

sell securities. The information contained herein is only as good as of the date and time of publication; we do not

undertake to advise of any changes in the opinions or information contained herein. Morgan Stanley and BCG

expressly prohibit the use of any portion of this report, whether by reference, by incorporation, or otherwise, in

any prospectus, IPO materials, or other filings with the SEC or other financial supervisory authorities or any

public materials on which any investment decisions might be based, and to the fullest extent permitted by law,

BCG shall have no, and hereby disclaims all, liability whatsoever to any recipient, and all recipients hereby waive

any rights or claims with regard to the report, including the accuracy or completeness thereof. Receipt and

review of the report shall be deemed agreement with, and consideration for, the foregoing.

Insurance - Property & Casualty

28

Disclosure Section

The information and opinions in Morgan Stanley Research were prepared by Morgan Stanley & Co. LLC, and/or Morgan Stanley C.T.V.M. S.A., and/or

Morgan Stanley Mexico, Casa de Bolsa, S.A. de C.V., and/or Morgan Stanley Canada Limited. As used in this disclosure section, "Morgan Stanley"

includes Morgan Stanley & Co. LLC, Morgan Stanley C.T.V.M. S.A., Morgan Stanley Mexico, Casa de Bolsa, S.A. de C.V., Morgan Stanley Canada

Limited and their affiliates as necessary.

For important disclosures, stock price charts and equity rating histories regarding companies that are the subject of this report, please see the Morgan

Stanley Research Disclosure Website at www.morganstanley.com/researchdisclosures, or contact your investment representative or Morgan Stanley

Research at 1585 Broadway, (Attention: Research Management), New York, NY, 10036 USA.

For valuation methodology and risks associated with any recommendation, rating or price target referenced in this research report, please contact the Client