Introduction

This update from the M&G Treasury & Investment Office

(T&IO) provides an insight into the characteristics of

the property portfolio within the PruFund range of

funds and the strength of the M&G Real Estate team

who T&IO work with to create, manage and monitor

underlying investments.

This update covers the PruFund Growth, Cautious and

Risk Managed Ranges. It doesn’t cover the PruFund

Planet Range.

We hope to highlight the key differentiators and

strengths including;

• Leveraging off the resource and expertise within

M&GReal Estate

• The global exposure to high quality assets

• Using segregated pools of assets or large scale

institutional funds to best capture opportunities

• Importance of active management

• Ability to invest in development projects

• The ongoing work to enhance the ‘environmental’

credentials of portfolios

PruFund Growth invests into over 160 property assets

globally. The majority are directly held assets or joint

ventures, although some exposures are via collectives/

indirect funds, which themselves invest in 100s of

underlying properties.

The M&G Real Estate team, who run the underlying

property funds within PruFunds, focus on income as the

principal driver of long-term return but also look to achieve

capital growth through exploitation of market mispricing,

sector allocation and individual asset allocation.

Characteristics of property portfolios

within the PruFund range of funds

Expertise – M&G Real Estate have decades of

experiencein buying, selling and managing properties,

which has helped to shape their investment approach.

This focuses in identifying fundamentally well located

assets that are underpinned by favourable structural

anddemographic trends

Global exposure – increased allocations to European

andAsian property market in recent years with UK still

thecore holding

Diversification – commercial property has provided

consistent risk adjusted returns to PruFund portfolios

over many years. The evolution of different strategies

in the UK and overseas, provides further diversification

through increased exposure to alternative sectors such

asresidential property and student housing assets

Scale – enables investment in large, high quality assets

and also the ability to invest in development projects like in

Edinburgh’s Haymarket and 40 Leadenhall in London

Active management – means the portfolios can evolve as

markets change, for example reducing exposure to smaller

retail assets in the UK has been a theme for several years

due to the challenge from online retail

Access to new opportunities – and the ability to offer

arange of innovative solutions, is supported by their

scale, experience, depth of knowledge and strong

industryexperience in the markets where they operate

Environmental Social Governance (ESG) – as a

responsible investor, M&G Real Estate aim to deliver

better outcomes for their investors and society. Promoting

environmental excellence; health, wellbeing and occupier

experience; and a positive contribution to society are their

core pillars of focus

Real assets – property offers an element of inflation

protection over the medium-to long term

Please note when clients invest in property funds there may be times when they can’t immediately access their

money as property can take a long time to sell.

The value of any investment (and any income taken from it) can go down as well as up so your customer might not

get back the amount they put in.

The views expressed in this document should not be taken as advice or a recommendation.

For UK financial advisers only, not approved for use by retail customers.

Asset class insight: Property

An in-depth review of the Property investments held in PruFund. These reviews are

updated every six months with the latest details available at the time of publishing.

Pru

part of M&G pie

2

Strategic Asset Allocation

(total fund level) for PruFund Growth

Fund Activity (commentary from M&G Real Estate as at 30.09.2023)

In the UK the fund completed the acquisition of a portfolio

of prime multi-let industrial estates in London and the

South East for a total £78.9m and an additional acquisition

to an existing shopping centre for a total of £3.4m.

In Europe, the fund received a further drawdown notice for

£16.6m from the M&G European Living Fund. The capital

was invested in the fund’s second purchase – a residential

asset in Dublin.

In terms of rent collection, the fund has achieved collection

rates of 96% for Q3 2023. Both industrial and office have

reported healthy collection of 97-98%; retail remains

lowest at 92.5%.

Asset Fund Name Investment Style Internally or

Externally managed

UK Property Life Fund Property Portfolio (Mixture of global

directly held assets, Core Balanced Collectives

and Sector Specialist Collectives)

Active Internal

Europe Property Life Fund Property Portfolio (Mixture of global

directly held assets, Core Balanced Collectives

and Sector Specialist Collectives)

Active Internal

North America Property Life Fund Property Portfolio (Mixture of global

directly held assets, Core Balanced Collectives

and Sector Specialist Collectives)

Active Internal (and

indirectly external)

Asia Property Life Fund Property Portfolio (Mixture of global

directly held assets, Core Balanced Collectives

and Sector Specialist Collectives)

Active Internal

(source T&IO and Pru Actuarial team as at 30.09.2023)

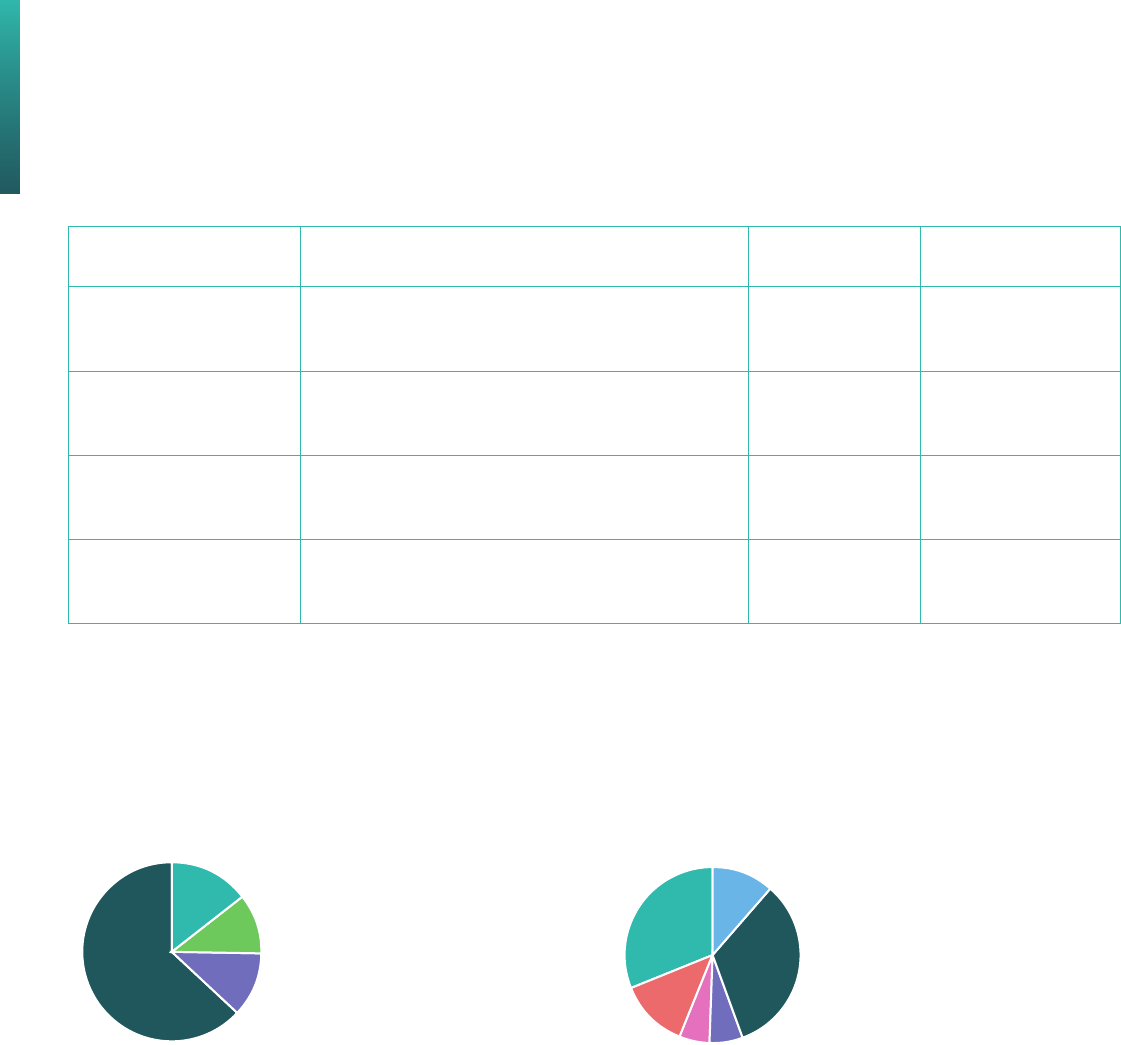

Regional Weights

Sector W

eights

■ Asia

■ North America

■ Europe

■ UK

■ Shopping Centre

■ Office

■ Retail Warehouse

■ Retail

■ Other

■ Industrial

14.5%

11.0%

11.7%

63.0%

11.6%

32.8%

6.2%

5.5%

12.9%

30.9%

PruFund Growth Summary

Regional W

eights

Sector Weights

■ Asia

■ North America

■ Europe

■ UK

■ Shopping Centre

■ Office

■ Retail Warehouse

■ Retail

■ Other

■ Industrial

14.5%

11.0%

11.7%

63.0%

11.6%

32.8%

6.2%

5.5%

12.9%

30.9%

(Source – M&G Real Estate % of global property portfolio as at 30.09.2023)

3

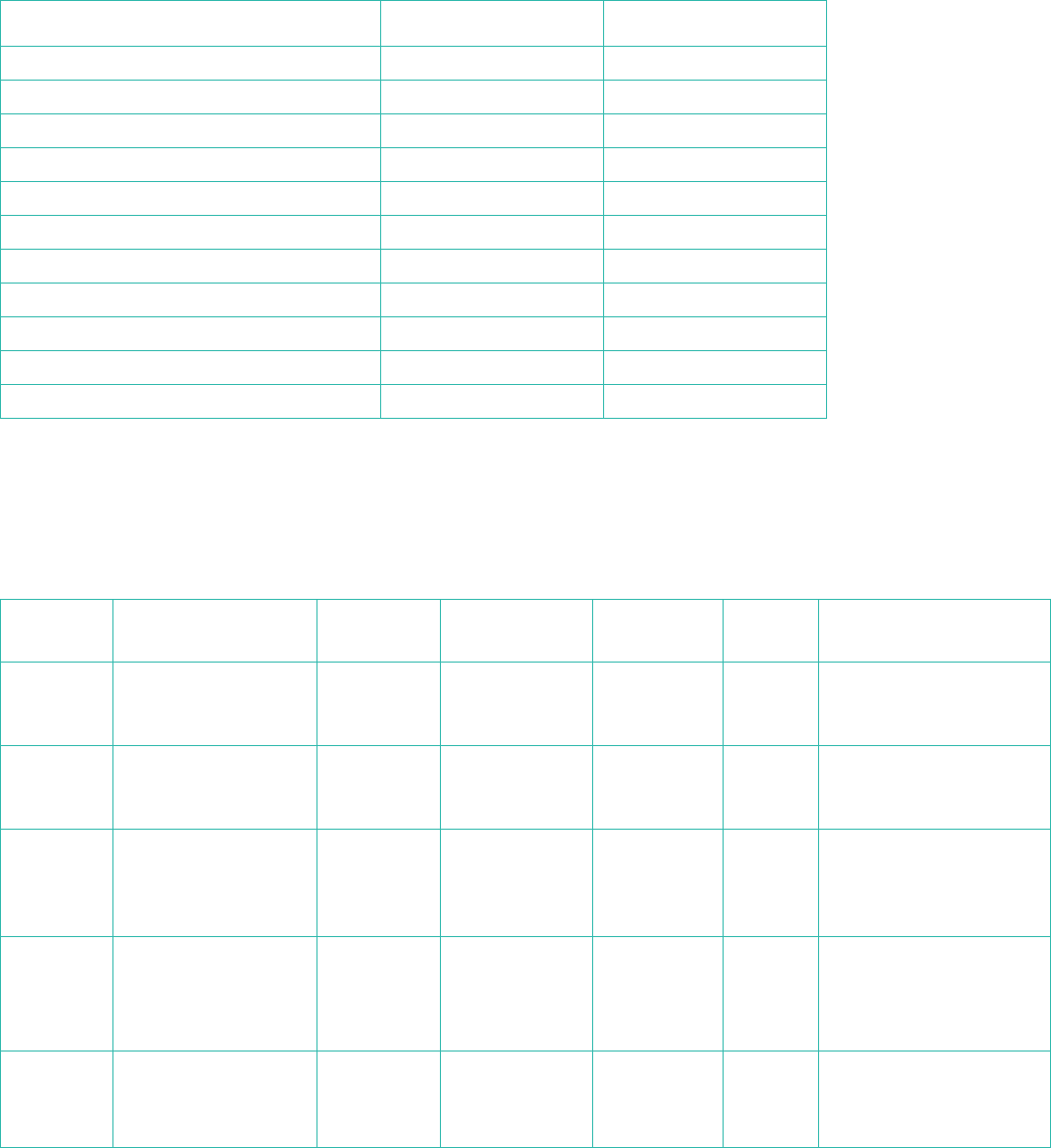

UK key statistics

KPI September 2023 June 2023

Asset Value £7.703bn £7.834bn

Number of assets 142 142

Average Lot Size £54.2m £55.2m

Value of largest holding 8.5% (40 Leadenhall) 8.1% (40 Leadenhall)

Value of largest tenant (% of rent roll) 6.9% (Ashurst) 6.9% (Ashurst)

Number of Developments 3 5

Development Exposure 10.2% 9.8%

Net Initial Yield 4.8% 4.7%

Net Equivalent Yield 6.8% 6.7%

Vacancy % of ERV 10.1% 10.0%

WAULT* (including breaks), years 7.4 7.7

(Source – M&G Real Estate as at 30.09.2023)

* weighted average unexpired lease expiry

Investment transactions

Acquisitions

Date Asset Sector Town Country Purchase

price, £m

Comment

03 Oct 22 Clarion Lion

Industrial Trust

Industrial US 69.5 1st Drawdown into the

Clarion LIT specialist US

industrial fund.

03 Jan 23 Clarion Lion

Industrial Trust

Industrial US 64.9 2nd Drawdown into the

Clarion LIT specialist US

industrial fund.

23 Nov 22 Macquaire

Goodman

Industrial Australia 9.8 Drawdown tranche

2 into the Macquaire

Goodman specialist

Australia industrial fund.

01 Apr 23 Project King Industrial UK 48.4 Purchase of prime

London and South

East multi-let

industry portfolio

03 Apr 23 ELIV Residential Europe 3.8 Drawdown into the

newly launched M&G

European Living Fund.

4

Date Asset Sector Town Country Purchase

price, £m

Comment

12 Jul 23 Project King Industrial UK 17.5 Purchase of prime

London and South

East multi-let

industry portfolio

28 Jul 23 CENTRAURUS

RETAIL PARK

Retail

Warehouse

UK 3.4 Purchase of 50% rest

of state

04 Aug 23 Project King Industrial UK 13.0 Purchase of prime

London and South

East multi-let

industry portfolio

29 Sep 23 ELIV Residential Europe 10.7 Drawdown into the

newly launched M&G

European Living Fund.

Total

Acquisitions

241.0

Disposals

Date Asset Sector Town Country Purchase

price, £m

Comment

31 Mar 23 WARRINGTON 389,

WARRINGTON

Industrial WARRINGTON UK 22.1 Sale of secondary

distribution

warehouse

26 Jan 23 BYRON HOUSE,

LONDON

Office London UK 45.4 Sale of multi-let under

performing office

09 Feb 23 SITE 2 CRIBBS

CAUSEWAY

Retail

Warehouse

Bristol UK 22.1 Sale of small

development site

31 Mar 23 CBRE Retail

France/Belgium

Shopping

centre

Europe 0.3 Final fund

liquidation

proceeds

06 Apr 23 London Square Office UK 38.0 Sale of secondary South

East office campus

31 May 23 Project King Industrial UK 30.0 Sale of

secondary multi-let

industrial portfolio

22 Jun 23 59/61 Church Streey Standard

Retail

Liverpool UK 1.4 Sale of non-core high

street retail asset

26 Jun 23 LF INTEREST IN ST

EDWARD HOMES

Residential UK 74.9 Distribution from build

to sell strategy

01 Aug 23 LF Investment

in PRELP

Other UK 45.0 Redemption from

investment in PRELP*

Total

Disposals

279.2

*Prudential Real Estate Limited Partnership

5

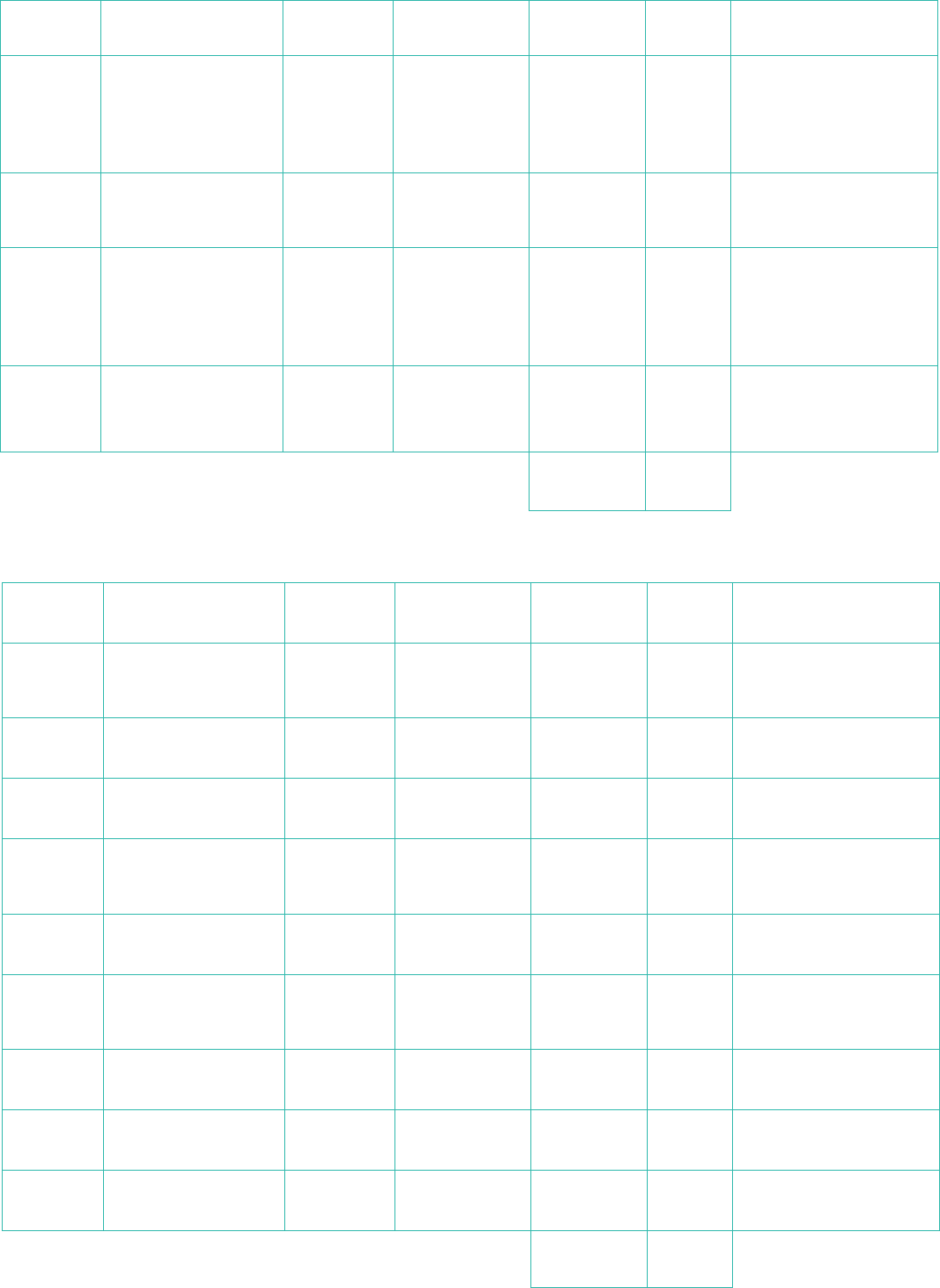

Strategic Asset Allocation

(total fund level) for PruFund Cautious

The following data is in relation to the Prudential Real Estate Limited Partnership (PRELP) which is how PruFund

Cautious gains exposure to the UK Property market. PruFund Cautious gains its European property exposure via the

M&G European Property Fund (MEP), Asian property exposure via the M&G Asian Property Fund (MAP) and has some

direct property exposure to the North American property market. The below provides insight into the PRELP collective

investment vehicle.

Asset Fund Name Investment

Style

Internally or

Externally managed

UK Property Prudential Real Estate Limited Partnership (PRELP) Active Internal

Europe Property M&G European Property Fund (Core-Balanced Collective) Active Internal

North America

Property

Morgan Stanley Prime (Core-Balanced Collective)

Directly held assets

Active External

Internal

Asia Property M&G Asia Property Fund (Core-Balanced Collective)

Sector Specialist Collectives within Prudential Australian

Property Trust

Active Internal

(Source T&IO and Pru Actuarial team as at 30.09.2023)

PruFund Cautious UK Property

Fund Activity (commentary from M&G Real Estate as at 30.09.2023)

Total return for Q3 2023 was negative this was largely driven by under performance of office assets, but we expect

these assets to lead to improved returns and portfolio quality on completion during 2024.

In terms of rent collection figures for 2023 Q2 stands at 99% and Q3 2023 has also attained 99%, 6 weeks after the quarter

day. Work continues to secure payments of outstanding rental and service charge liabilities notably in the retail sector.

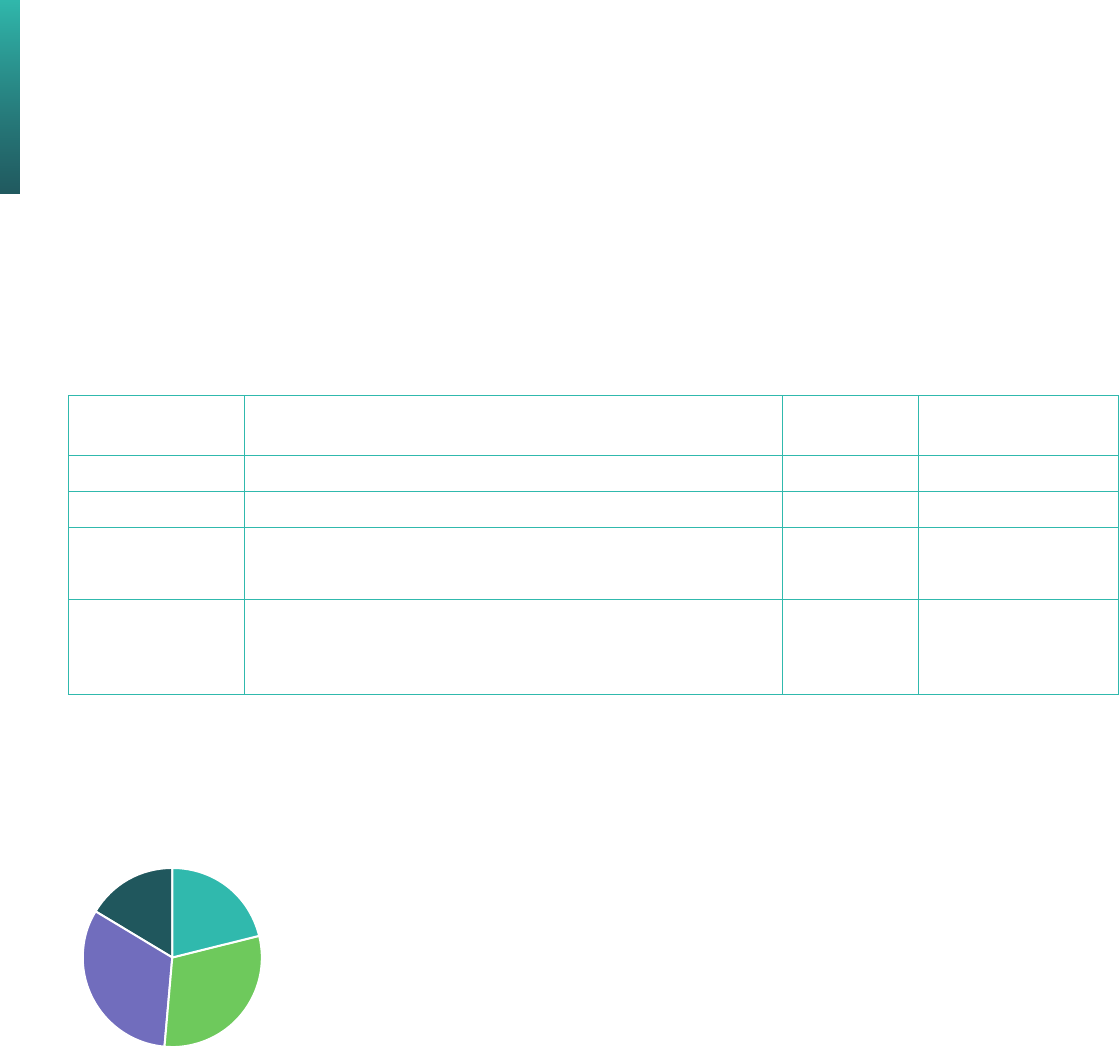

Sector weights (PRELP)

■ Retail

■ Office

■ Industrial

■ Residential and

alternatives

21.0%

30.0%

32.0%

16.0%

6

UK Key Statistics

September 2023 June 2023

Net Asset Value £977.1m £990.1m

Number of assets 43 43

Average lot size £22.0m £22.1m

Value of largest holding 9.5% (Tottenham Ct Rd) 8.7% (Tottenham

Ct Rd)

Value of largest tenant

(% of rent roll)

6.8% (Sainsburys) 7.0% (Sainsburys)

Number of developments 2 2

Development exposure 13.3% 12.0%

Net Initial Yield 4.1% 4.0%

Net Equivalent Yield 5.8% 5.7%

Vacancy of ERV 8.0% 8.8%

WAULT* (inc. breaks), years 11.3 % 12.0%

(Source – M&G Real Estate as at 30.09.2023)

* weighted average unexpired lease expiry

Investment transactions, last 12 months

Disposals

Date Asset Sector Town Purchase

price, £m

Comment

09 Mar 23 Dial House, 2

Burston Road

Office London 11.00 Disposal of vacant office

asset given excess levels of

development exposure

05 May 23 Pets at Home Industrial Stoke on Trent 7.00 Mitigating void and

development exposure

Total Disposals 18.00

Want to know a bit more about the M&G Real Estate team?

M&G Real Estate is recognised as one of the world’s leading property investors. They invest across all sectors with a

portfolio that spans 29 countries. They are the specialist property manager for M&G and are responsible for managing

the property investments within PruFunds.

Globally, M&G Real Estate manage more than £37.4 billion assets* on behalf of clients, providing a range of funds and

bespoke solutions for PruFunds, including segregated mandates and pooled investment funds.

* as of 30.09.2023, source M&G Real Estate.

7

Environmental, Social and Governance

M&G Real Estate are a responsible investor, whose goal is

to deliver better outcomes for their investors and society.

By driving environmental improvements and increasing the

operational efficiency of their buildings, M&G Real Estate

are committed to achieving net zero carbon emissions

across their global real estate portfolio by 2050. Over

40% of their global asset portfolio (by value) has a green

building certification, and they continue to drive asset

certification to provide independent verification of their

assets sustainability credentials.

In regards to PruFunds, M&G Real Estate are aware that

caution should be applied towards those assets which

fail to meet or keep up with Minimum Energy Efficiency

Standards (MEES), which could become ‘stranded’ –

unlettable and unviable for investors. It is clear that ESG

remains at the forefront of investors’ thinking and the

ability to reshape and future-proof portfolios in line with

these themes will be an important driver of performance

going forward.

A good example of ESG at play within our property

portfolio is the development of an office campus

for Surbana Jurong, one of Asia’s largest urban and

infrastructure consulting firms. The campus was designed

as a ‘holistic green building’ ensuring it is environmentally

less impactful, highly energy, water and resource efficient

and enhances the wellness and productivity of occupants.

The project is one of the first to achieve a Platinum (Super

Low Energy) rating under Singapore’s BCA Green Mark

Programme for environmentally sustainable buildings and

was funded through the M&G Asian Property Fund that is

held within PruFunds.

Summary

Despite recent turbulence in the financial markets, the

property outlook is one of cautious optimism as central

banks have stabilised the situation and the contagion

risk looks managed. Investors caution led to declines

in transaction activity across the world, particularly in

Europe & the Americas.

We continue to see yields adjust as investors go through

a period of price discovery, placing downwards pressure

on valuations. That said the UK remains much further

ahead in its price correction and has started to show signs

of a moderation in the pace of capital decline as a result.

Asia Pacific continues to see the least impact from

the recent occupier and investor caution and will likely

maintain its relative outperformance, underpinned by

relatively lower inflation and a stronger economic outlook.

There are increasing signs that occupiers are becoming

more cautious about taking space, particularly in the office

sector, although well-located core stock with strong ESG

credentials continues to attract demand and should prove

more resilient in the face of economic headwinds.

Challenges prevail for property at the moment but it

is important to remember that much of the portfolio

is of a very high quality, diversified and long-term

investments that we feel will generate good returns

over a multi-year period.

As active managers M&G Real Estate continue to invest

in, and complete new projects. A recent example being

the development of 40 Leadenhall in London’s financial

district. This project taps into modern occupier demands

and is set to be the largest office development in the City

of London in 2024. Designed to be green in use, not just in

design, it will be among the UK’s first buildings to achieve

the NABERS certification – an energy efficient standard that

measures how a building’s designed to operate as well as

how it performs in use.

The scheme is now 70% pre-let before it’s completion this

year and indicates that tenant demand for quality (Grade A)

office space continues to be bouyant.

‘Prudential’ is a trading name of Prudential Distribution Limited. Prudential Distribution Limited is registered in Scotland. Registered office at 5 Central Way,

Kildean Business Park, Stirling FK8 1FT. Registered number SC212640. Authorised and regulated by the Financial Conduct Authority.

GENM100060312 02/2024_WEB

The information in this document has been provided by M&GReal Estate Limited, a part of the M&Gplc group.

Prudential Distribution Limited is part of the same corporate group as the Prudential Assurance Company. The

Prudential Assurance Company and Prudential Distribution Limited are direct/indirect subsidiaries of M&Gplc,

acompany incorporated in the United Kingdom.

Any opinions expressed are present opinions reflecting current market conditions, they are subject to change without

notice and involve a number of assumptions which may not prove valid.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all

investors and you should ensure you understand the risk profile of the products or services you plan to purchase.

M&G plc does not offer investment advice or make recommendations regarding investments. Opinions are subject to

change without notice.

The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may

get back less than the original amount invested and past performance information is not a guide to future performance.

‘M&G Treasury and Investment Office (T&IO)’ includes the team formally known as Prudential Portfolio Management Group

(PPMG). Prudential Portfolio Management Group Limited, is registered in England and Wales, registered number 2448335.