Annual Report and Personal Property Return as of January 1

st

Due by April 15

th

STATE OF MARYLAND, DEPARTMENT OF ASSESSMENTS AND TAXATION, PERSONAL PROPERTY DIVISION

P.O. Box 17052, Baltimore, Maryland 21297-1052 • www.dat.maryland.gov • (410) 767-1170 • (888) 246-5941 within Maryland

•

sdat.persprop@Maryland.gov

Name of Business

Mailing Address

FEDERAL EMPLOYER IDENTIFICATION NUMBER

MD DEPARTMENT ID NUMBER

DATE OF INCORPORATION OR FORMATION STATE OF INCORPORATION OR FORMATION

FEDERAL PRINCIPAL BUSINESS CODE

TRADING AS NAME

SECTION I

A. Is any business conducted in Maryland? ___________ Date began: ____________________________

(Yes or No)

B. Nature of business conducted in Maryland:________________________________________________

C. Does the business own, lease or use personal property located in Maryland? ______________ If No, skip SECTION II.

(Yes or No)

CHECK

ONE

ONLY CORPORATIONS COMPLETE ITEM D

D. Names and addresses of officers

and names of directors (type or print):

OFFICERS

Names Addresses

____________________________________________________

____________________________________________________

____________________________________________________

____________________________________________________

DIRECTORS

Names Names

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

Type or Print MD Department ID Number Here

ID

PREFIX

Check here

if this is a

change of

mailing address

Date Received

by Department

INCLUDE MD DEPARTMENT ID NUMBER ON CHECK

PLEASE STAPLE CHECK HERE

Filing

Fee

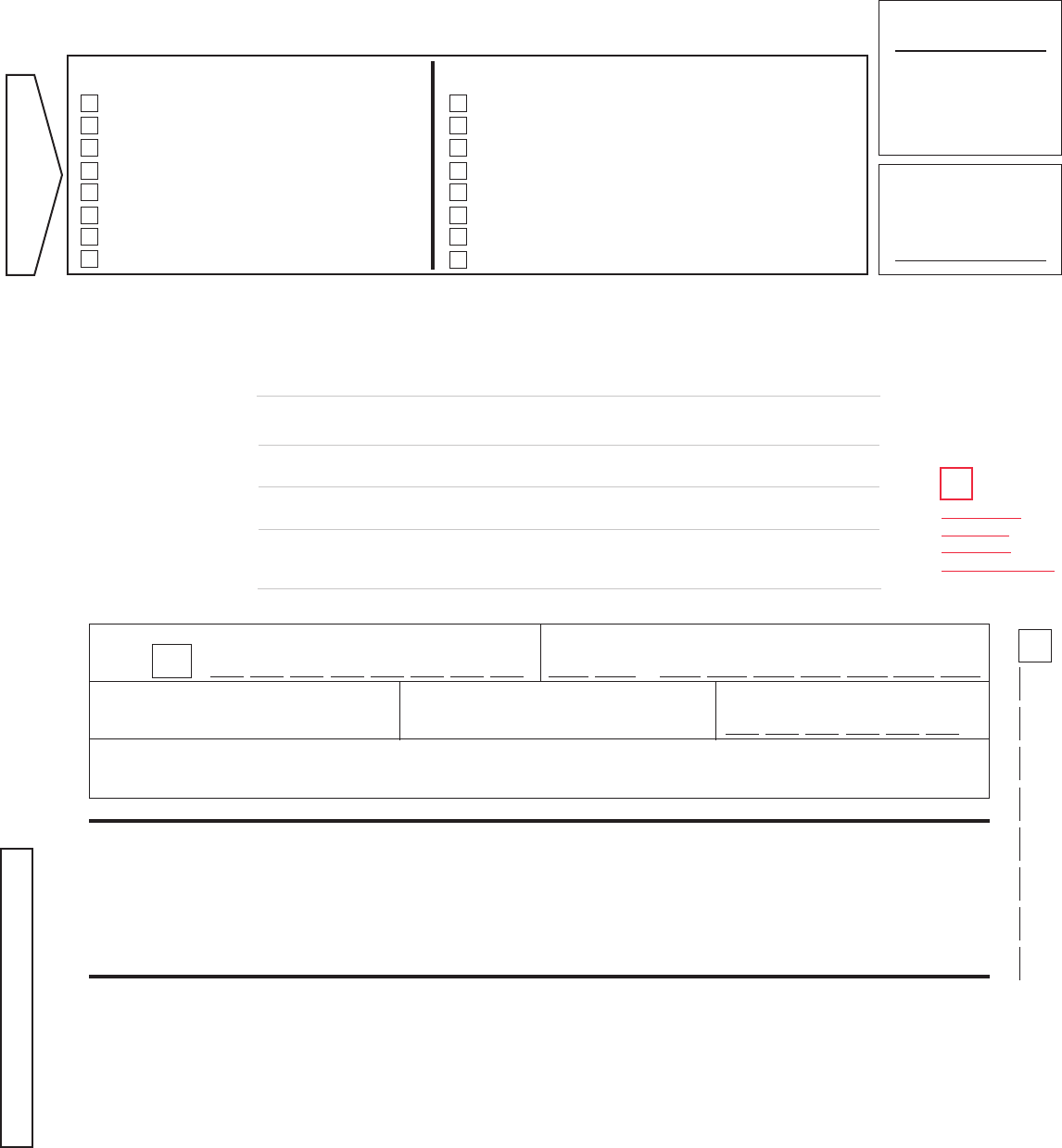

Dept. ID

Prefix

Filing

Fee

Domestic Stock Corporation

(W) $300

(Z) $300

(M) $300

(P) $300

(A) $300

(E) $300

(B) $300

Foreign Stock Corporation

Domestic Non-Stock Corporation

Foreign Non-Stock Corporation

Foreign Insurance Corporation

Foreign Interstate Corporation

SDAT Certified Family Farm

Real Estate Investment Trust

Type of Business

Domestic Limited Liability Company

Foreign Limited Liability Company

Domestic Limited Partnership

Foreign Limited Partnership

Domestic Limited Liability Partnership

Foreign Limited Liability Partnership

Domestic Statutory Trust

Foreign Statutory Trust

(S) $300

IMPORTANT REMINDERS

• Rules for 2015 personal property extensions:

Internet extension requests are due by April 15, 2015 and are free of charge.

Paper extension requests are due on or before March 16, 2015 and require a $20 processing fee for each entity.

•

The annual report f ling fee is $300 for most legal entities. Be sure to enclose the correct fee with the Form 1.

• Manufacturing/R&D application deadline is September 1, 2015. Exception for tax years beginning after June 30, 2009 - an

exemption application may be file within 6 months after the date of the firs assessment notice for the taxable year that

includes the manufacturing personal property. See instruction 11 for more information. A manufacturing exemption cannot be

granted unless a timely application is filed Once filed no additional applications are required in subsequent years.

• Entities requesting a revised assessment due to other missed exemptions (vehicles, software, charitable organizations, etc.) must fil that

request within three years of the April 15th date the return was originally due.

• Do not prepay late filin penalties or pay personal property taxes to this Department.

• Business entities that require a Trader’s License must

report commercial inventory on line item

.

• This return must be accompanied by Form 4A (Balance Sheet) or latest available balance sheet, and Form 4B (Depreciation Schedule), unless the

business does not own any personal property in Maryland. All information on pages 2 and 3 of this report and supporting schedules are held

conf dential by the Department and are not available for public inspection. Page 1 is public record (Tax-Property Article 2-212).

• If you discontinued business prior to January 1, 2015, notify the Department immediately, stating to whom and the date all personal property was

sold. If the business is sold on or after January 1, 2015 and before July 1, 2015

, submit statement of sale, including value of personal property, date

of sale, name and address of the buyer on or before October 1, 2015.

• File the pre-addressed return to ensure proper posting to your account.

• This return must be signed by an office or principal of the business.

• Make check for f ling fee payable to Department of Assessments and Taxation. Place the Department lD number on the check.

• Place the Department ID number on page 1 if the pre-addressed return is not used.

LATE FILING PENALTY

DO NOT PAY PENALTIES AT TIME OF FILING RETURN

• A business which f les an annual return postmarked after the due date of April 15, 2015 will receive an initial penalty of 1/10 of one percent of the

county assessment, plus interest at the rate of two percent of the initial penalty amount for each 30 days or part thereof that the return is late.

• Businesses which fail to f le this report will receive estimated assessments which will be twice the estimated value of the personal property owned.

2015

Form 1

continued

Page 4 of 4

DATE OF ASSESSMENT NOTIFICATION OFFICE USE ONLY

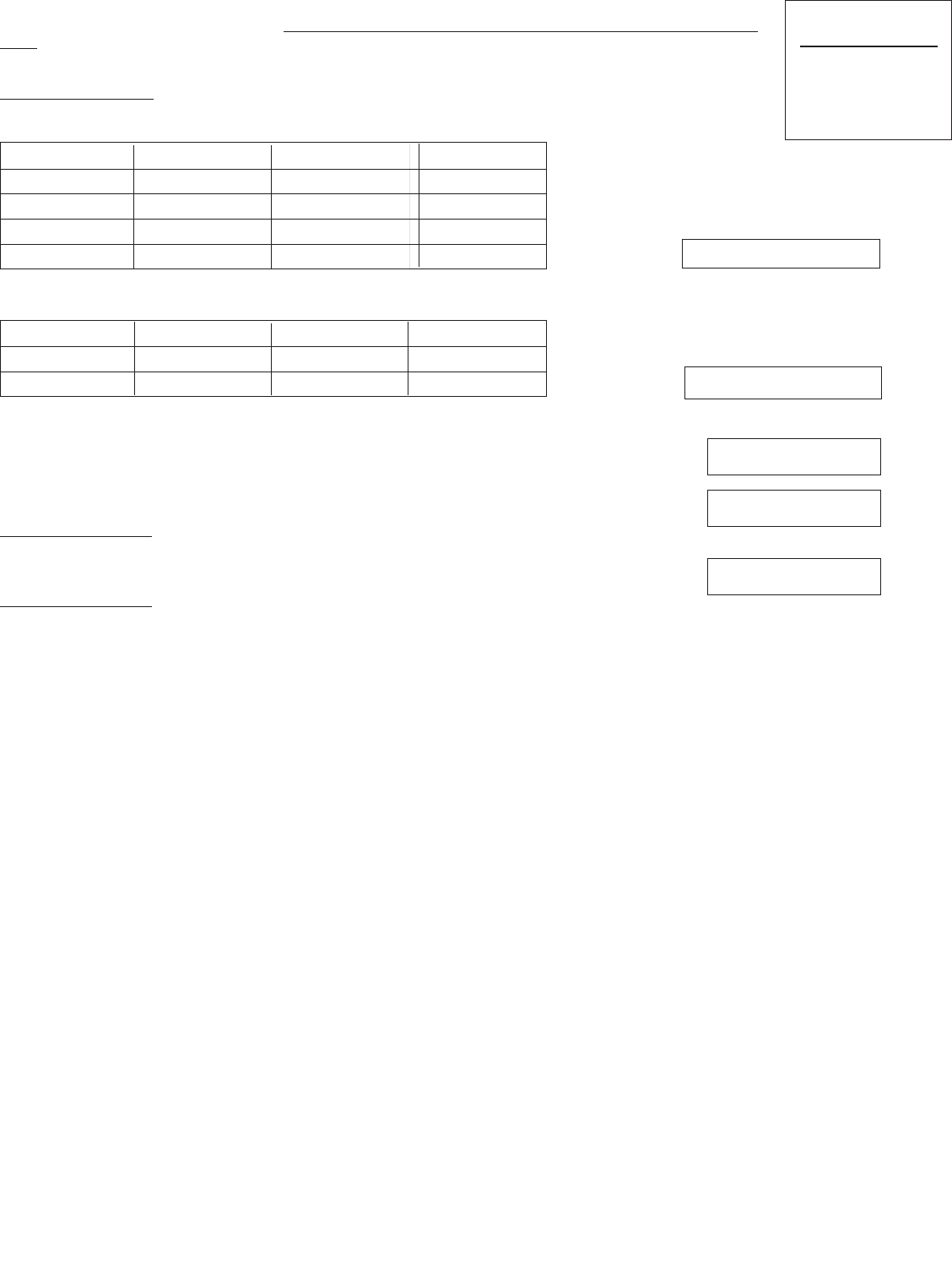

STANDARD DEPRECIATION RATE

Category A: 10% per annum*

All property not specificall listed below.

SPECIAL DEPRECIATION RATES

(The rates below apply only to the

items specif cally listed. Use Category A for other assets.)

Category B: 20% per annum*

Mainframe computers originally costing $500,000 or more.

Category C: 20% per annum*

Autos (unlicensed), bowling alley equipment, brain scanners, carwash

equipment, contractor’s heavy equipment (tractors, bulldozers), fax

machines, hotel, motel, hospital and nursing home furniture and f xtures

(room and lobby), MRI equipment, mobile telephones, model home

furnishings, music boxes, outdoor Christmas decorations, outdoor

theatre equipment, photocopy equipment, radio and T.V. transmitting

equipment, rental pagers, rental soda fountain equipment, self-service

laundry equipment, stevedore equipment, theatre seats, trucks

(unlicensed), vending machines, x-ray equipment.

Category D: 30% per annum**

Data processing equipment, canned software.

Category E:

33

1

⁄

3

% per annum*

Blinds, carpets, drapes, shades. The following applies to equipment

rental companies only: rental stereo and radio equipment, rental

televisions, rental video cassette recorders and rental DVDs and

video tapes.

Category F: 50% per annum*

Pinball machines, rental tuxedos, rental uniforms, video games.

Category G: 5% per annum*

Boats, ships, vessels, (over 100 feet).

Long-lived assets

Property determined by the Department to have an expected life in

excess of 10 years at the time of acquisition shall be depreciated at

an annual rate as determined by the Department.

* Subject to a minimum assessment of 25% of the original cost.

** Subject to a minimum assessment of 10% of the original cost.

DEPRECIATION RATE CHART FOR 2013 RETURNS

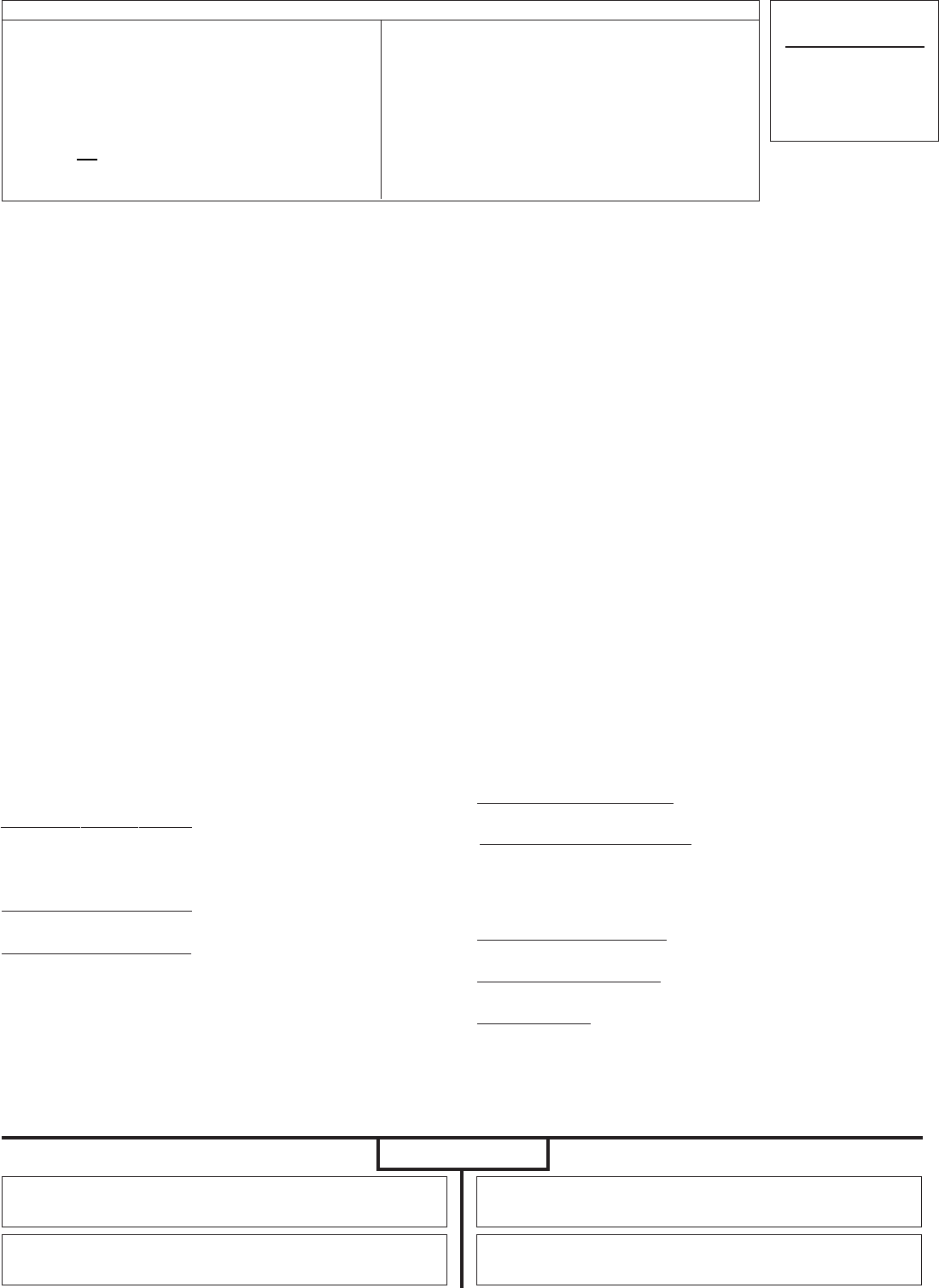

MAILING INSTRUCTIONS

Use the address below for:

• originally file 2015 personal property returns.

• originally file prior year returns.

State of Maryland

Department of Assessments & Taxation

Personal Property Division

PO Box 17052

Baltimore, Maryland 21297-1052

• Do not send Certifie Mail to this PO Box.

See box at right.

Use the address below for:

• US Postal Service Certifie Mail.

• all overnight delivery service mail.

• amended returns, correspondence, appeals,

applications, etc.

• late filin penalty payments.

State of Maryland

Department of Assessments & Taxation

Personal Property Division

301 W Preston St

Baltimore, Maryland 21201-2395

12/16

_

20__

Form 1

Page 1 of 4

Type of Business

Dept. ID

Prefix

(D) $300

(F) $300

(D) - 0 -

(F) - 0 -

(F) $300

(F) - 0 -

(A,D,M,W) $100

(D) $300

ID

PREFIX

E-mail Address

Note: Please include an e-mail address in order to receive important reminders from the Maryland Department of Assessments and Taxation.

President

Vice President

Secretary

Treasurer

____________________________________________

____________________________________________

____________________________________________

____________________________________________

Enter

the

Year

17

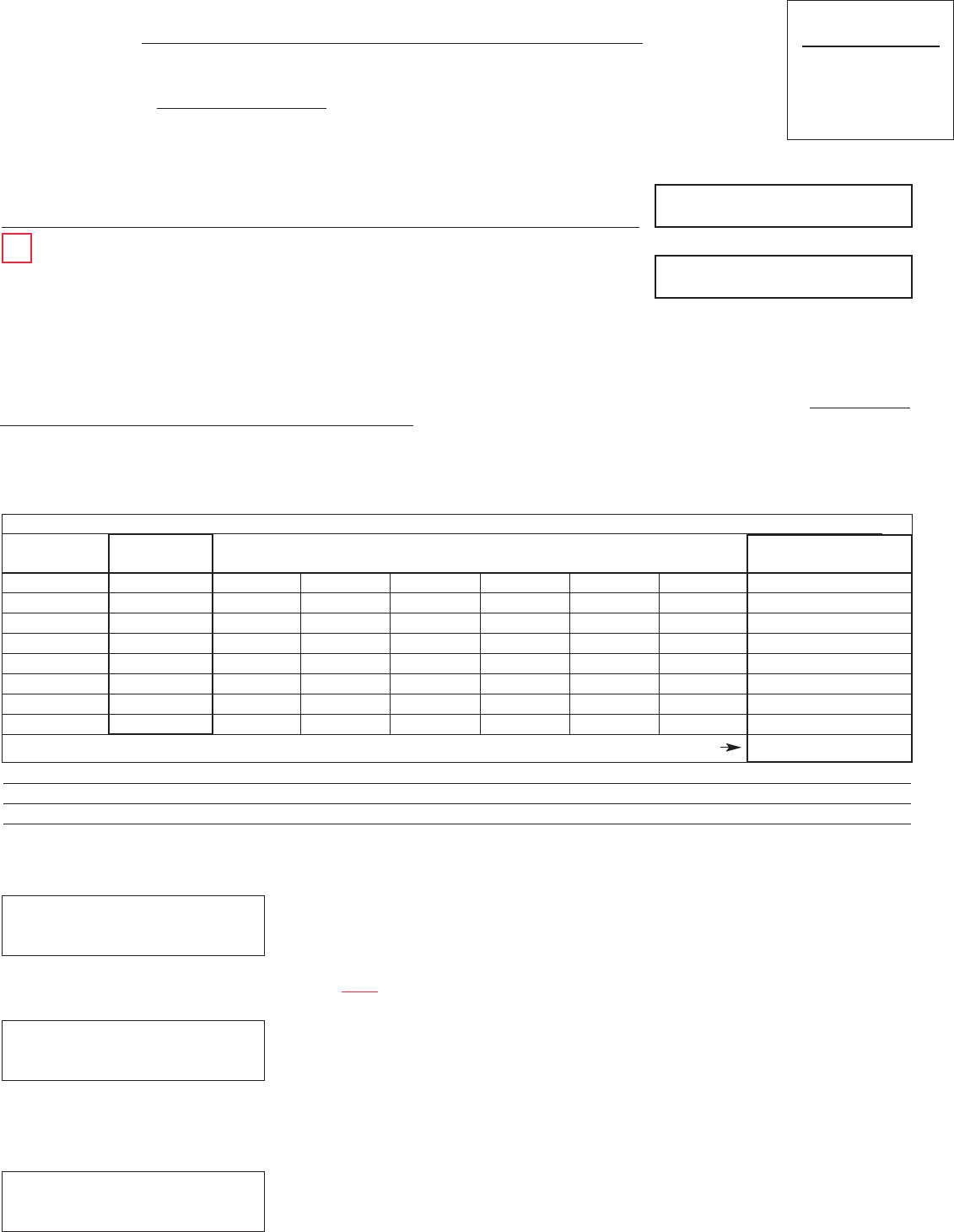

TOTAL COST COLUMNS A-G

ORIGINAL COST BY YEAR OF ACQUISITION

SPECIAL DEPRECIATION RATES (SEE PAGE 4)

ABCDE FGTOTAL COST

DESCRIBE B through G PROPERTY HERE:

20__

Form 1

continued

Page 2 of 4

BUSINESS TANGIBLE PERSONAL PROPERTY LOCATED IN MARYLAND

EACH QUESTION MUST BE ANSWERED—SEE INSTRUCTIONS

ROUND CENTS TO THE NEAREST WHOLE DOLLAR

(Incorporated Town)

SECTION II

A. IMPORTANT: Show the exact physical location(s) of all personal property owned and used in the State of Maryland,

including county, town, and street address (PO Boxes are not acceptable). This assures proper distribution of

assessments. If property is located in two or more jurisdictions, provide a breakdown for each location by

completing additional copies of Section II (Pages 2 and 3 of Form 1). For 5 or more locations,

please include the information per location in an electronic format (see Form 1 Instructions).

(Address, Number and Street) (Zip Code)

Check here if this location has changed from the prior year return.

Is the property located inside the limits of an incorporated town?

________________

(Yes or No)

Commercial Inventory. Furnish an average of 12 monthly inventory values taken in Maryland in prior year at cost or market value of

merchandise and stock in trade. Include products manufactured by the business and held for retail sale and inventory held on

consignment. (Do not include raw materials or supplies used in manufacturing.) Note: LIFO prohibited in computing inventory value.

Furnish from the latest Maryland Income Tax return:

Opening Inventory - Date _____________________

Closing Inventory - Date _____________________

Note: Businesses that need a Trader’s License must report commercial inventory here.

Supplies. Furnish the average cost of consumable items not held for sale (e.g., contractor’s supplies, office supplies, etc.)

Manufacturing/Research and Development (R&D) Inventory. Furnish an average of 12 monthly inventory values taken in Maryland

during prior year at cost or market value of raw materials, supplies, goods in process and finished products used in and resulting from

manufacturing/R&D by the business. (Do not include manufactured products held for retail sale.)

Furnish from the latest Maryland Income Tax return:

Opening Inventory - Date _____________________ Amount $ ________________________

Closing Inventory - Date ____________________ Amount $ ________________________

Average Commercial Inventory

Average Manufacturing/R&D Inventory

Average Cost

$

Furniture, fixtures, tools, machinery and equipment not used for manufacturing or research and development. State the original

cost of the property by year of acquisition and category of property as described in the Depreciation Rate Chart on page 4. Include all fully

depreciated property and property expensed under IRS rules.

Columns B through G require an explanation of the type of property being reported. Use the lines provided below. If additional space is needed,

provide a supplemental schedule. Failure to explain the type of property will result in the property being treated as Category A property

(see instructions for example).

2015

Form 1

continued

Page 3 of 4

Tools, machinery and equipment used for manufacturing or research and development: State the original

cost of the property by year of acquisition. Include all fully depreciated property and property expensed under IRS

rules. If this business is engaged in manufacturing / R&D, and is claiming such an exemption for the firs time, a

manufacturing / R&D exemption application must be submitted on or before September 1, 2015 before an

exemption can be granted. See instruction 11 for exception. Contact the Department or visit

www.dat.

maryland.gov for an application.

If the property is located in a taxable jurisdiction, a detailed schedule by depreciation category should be included to

take advantage of higher depreciation allowances.

Vehicles with Interchangeable Registration (dealer, recycler, f nance company, special mobile equipment, and transporter

plates) and unregistered vehicles should be reported here. See specifi instructions.

Non-farming livestock $ __________________________ $______________________________

(Book Value) (Market Value)

Other personal property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Total Cost $

File separate schedule giving a description of property, original cost and the date of acquisition.

Property owned by others and used or held by the business as lessee or otherwise. . . Total Cost $

File separate schedule

showing names and addresses of owners, lease number, description of property,

installation date and separate cost in each case.

Property owned by the business but used or held by others as lessee or otherwise.. . . Total Cost $

File separate schedule

showing names and addresses of lessees, lease number, description of property,

installation date and original cost by year of acquisition for each location. Schedule should group leases by county where the property

is located. Manufacturer lessors should submit the retail selling price of the property not the manufacturing cost.

SECTION III This Section must be completed.

A. Total Gross Sales, or amount of business transacted during 2014 in Maryland: $ ________________________________________

If the business has sales in Maryland and does not report any personal property, explain how the business is conducted without

personal property. If the business is using the personal property of another business, provide the name and address of that business.

________________________________________________________________________________________________________

________________________________________________________________________________________________________

B. If the business operates on a fisca year, state beginning and ending dates: ____________________________________________

C. If this is the business’ firs Maryland personal property return, state whether or not it succeeds an established business and

give name: _______________________________________________________________________________________________

D. Does the business own any fully depreciated and/or expensed personal property located in Maryland?

yes no

If yes, is that property reported on this return?

yes no

E. Does the submitted balance sheet or depreciation schedule ref ect personal property located outside of Maryland?

yes no

If yes, reconcile it with this return.

F. Has the business disposed of assets or transferred assets in or out of Maryland during 2014?

yes no If yes, complete

Form 4C (Disposal and Transfer Reconciliation).

• PLEASE READ “IMPORTANT REMINDERS” ON PAGE 4 BEFORE SIGNING •

I declare under the penalties of perjury, pursuant to Tax-Property Article 1-201 of the Annotated Code of Maryland, that this

return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and

belief is a true, correct and complete return.

_______________________________________ __________________________________________________

NAME OF FIRM, OTHER THAN TAXPAYER, PREPARING THIS RETURN PRINT OR TYPE NAME OF CORPORATE OFFICER OR PRINCIPAL OF OTHER ENTITY TITLE

XX

_______________________________________ __________________________________________________

SIGNATURE OF PREPARER DATE SIGNATURE OF CORPORATE OFFICER OR PRINCIPAL DATE

( ) ( )

_______________________________________ __________________________________________________

PREPARER’S PHONE NUMBER E-MAIL ADDRESS BUSINESS PHONE NUMBER E-MAIL ADDRESS

TOTAL COST $

TOTAL COST $

2014

2013

2012

2011 and prior

ORIGINAL COST BY YEAR OF ACQUISITION

2014

2013

2012

2011

2010

2009

2008

2007 and prior

ORIGINAL COST BY YEAR OF ACQUISITION

See top of page 4 for correct mailing address

Year

Acquired

& prior

(County)

Amount $ ________________________

Amount $ ________________________

$

$

17

2016

2015

2014

2013

2012

20

20

2011

0

0

0

0

0

0

0

0

0

2014

2013

2012

2011

2010

2009

2008

2007 and prior

TOTAL COST COLUMNS A-G

ORIGINAL COST BY YEAR OF ACQUISITION

SPECIAL DEPRECIATION RATES (SEE PAGE 4)

ABCDEFGTOTAL COST

DESCRIBE B through G PROPERTY HERE:

2015

Form 1

continued

Page 2 of 4

BUSINESS TANGIBLE PERSONAL PROPERTY LOCATED IN MARYLAND

EACH QUESTION MUST BE ANSWERED—SEE INSTRUCTIONS

ROUND CENTS TO THE NEAREST WHOLE DOLLAR

(County)

(Incorporated Town)

SECTION II

A. IMPORTANT: Show exact location of all personal property owned and used in the State of Maryland,

including county, town, and street address (PO Boxes are not acceptable). This assures proper distribution

of assessments. If property is located in two or more jurisdictions, provide breakdown by locations by

completing additional copies of Section II for each location.

(Address, Number and Street) (Zip Code)

Check here if this location has changed from the 2014 return.

Is the property located inside the limits of an incorporated town? ________________

(Yes or No)

Furniture, f xtures, tools, machinery and equipment not used for manufacturing or research and development. State the original

cost of the property by year of acquisition and category of property as described in the Depreciation Rate Chart on page 4. Include all fully

depreciated property and property expensed under IRS rules.

Columns B through G require an explanation of the type of property being reported. Use the lines provided below. If additional space is needed,

provide a supplemental schedule. Failure to explain the type of property will result in the property being treated as Category A property (see

instructions for example). Refer to the 2015 Depreciation Rate Chart on page 4 for computer equipment rates for categories B and D.

Commercial Inventory. Furnish an average of 12 monthly inventory values taken in Maryland during 2014 at cost or market value of

merchandise and stock in trade. Include products manufactured by the business and held for retail sale and inventory held on

consignment. (Do not include raw materials or supplies used in manufacturing.) Note: LIFO prohibited in computing inventory value.

Furnish from the latest Maryland Income Tax return:

Opening Inventory - date _____________________ amount $ _________________________

Closing Inventory - date _____________________ amount $ _________________________

Note: Businesses that need a Trader’s License must

report commercial inventory here.

Supplies. Furnish the average cost of consumable items not held for sale (e.g., contractor’s supplies, offic supplies, etc.).

Manufacturing/Research and Development (R&D) Inventory. Furnish an average of 12 monthly inventory values taken in Maryland

during 2014 at cost or market value of raw materials, supplies, goods in process and f nished products used in and resulting from

manufacturing/R&D by the business. (Do not include manufactured products held for retail sale.)

Furnish from the latest Maryland Income Tax return:

Opening Inventory - date _____________________ amount $ _________________________

Closing Inventory - date _____________________ amount $ _________________________

Average Commercial Inventory

$

Average Manufacturing/R&D Inventory

$

Average Cost

$

Note: If all of the personal property of this business is located entirely in the following exempt counties: Frederick, Garrett, Kent, Queen

Anne’s, or Talbot, you may be eligible to skip the remainder of Section

II. Refer to Specif c Instructions, Section II, A for more information.

20__

Form 1

continued

Page 3 of 4

Tools, machinery and equipment used for manufacturing or research and development: State the original

cost of the property by year of acquisition. Include all fully depreciated property and property expensed under IRS

rules. If this business is engaged in manufacturing / R&D, and is claiming such an exemption for the first time, a

manufacturing / R&D exemption application must be submitted within 6 months after the date of the

first assessment notice for the taxable year that includes the manufacturing / R&D property. Visit

www.dat.maryland.gov for an application.

If the property is located in a taxable jurisdiction, a detailed schedule by depreciation category should be included

to take advantage of higher depreciation allowances.

(Book Value) (Market Value)

Other personal property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . TOTAL COST

$

$

File separate schedule giving a description of property, original cost and the date of acquisition.

Property owned by others and used or held by the business as lessee or otherwise. . .TOTAL COST

File separate schedule showing names and addresses of owners, lease number, description of property,

installation date and separate cost in each case.

Property owned by the business but used or held by others as lessee or otherwise.. . . TOTAL COST

File separate schedule showing names and addresses of lessees, lease number, description of property,

installation date and original cost by year of acquisition for each location. Schedule should group leases by county where

the property is located. Manufacturer lessors should submit the retail selling price of the property not the manufacturing cost.

SECTION III This Section must be completed.

A. Total Gross Sales, or amount of business transacted during prior year in Maryland: $ ____________________________________

If the business has sales in Maryland and does not report any personal property, explain how the business is conducted without

personal property. If the business is using the personal property of another business, provide the name and address of that business.

________________________________________________________________________________________________________

________________________________________________________________________________________________________

B. If the business operates on a fiscal year, state beginning and ending dates: ____________________________________________

C. If this is the business’ first Maryland personal property return, state whether or not it succeeds an established business and

give name: _______________________________________________________________________________________________

D. Does the business own any fully depreciated and/or expensed personal property located in Maryland? yes no

If yes, is that property reported on this return? yes no

E. Does the submitted balance sheet or depreciation schedule reflect personal property located outside of Maryland? yes no

If yes, reconcile it with this return.

F. Has the business disposed of assets or transferred assets in or out of Maryland during the prior year? yes no

If yes, complete Form 4C (Disposal and Transfer Reconciliation).

• PLEASE READ “IMPORTANT REMINDERS” ON PAGE 4 BEFORE SIGNING

•

I declare under the penalties of perjury, pursuant to Tax-Property Article 1-201 of the Annotated Code of Maryland, that

this

return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge

and belief is a true, correct and complete return.

_______________________________________

NAME OF FIRM, OTHER THAN TAXPAYER, PREPARING THIS RETURN

_______________________________________

X

SIGNATURE OF PREPARER DATE

_________________ _____________________

PREPARER’S PHONE NUMBER E-MAIL ADDRESS

__________________________________________________

PRINT OR TYPE NAME OF CORPORATE OFFICER OR PRINCIPAL OF OTHER ENTITY TITLE

X

__________________________________________________

SIGNATURE OF CORPORATE OFFICER OR PRINCIPAL DATE

____________________ _____________________________

BUSINESS PHONE NUMBER E-MAIL ADDRESS

TOTAL COST $

TOTAL COST $

Year Acquired Original Cost

See top of page 4 for the correct mailing address.

& prior

Non-farming livestock $ __________________________ $______________________________

& prior

Vehicles with Interchangeable Registration (dealer, recycler, finance company, special mobile equipment, and transporter

plates) and unregistered vehicles should be reported here. See specific instructions.

Original Cost

Year Acquired

Year Acquired

Original Cost Year Acquired Original Cost

$

17

2015

2016

2012

2011

2014

2014

20

2013

20

0

2016

2015

2013

0

STATE OF MARYLAND, DEPARTMENT OF ASSESSMENTS AND TAXATION, PERSONAL PROPERTY DIVISION

301 West Preston Street, Room 801, Baltimore, Maryland 21201-2395 • www.dat.maryland.gov • (410) 767-1170 • (888) 246-5941 within Maryland

Personal Property Return As of January 1, 2015 Due April 15, 2015

Make

Address

Corrections

Here

Name of

Business

Mailing

Address

DEPARTMENT ID NUMBER FEDERAL EMPLOYER IDENTIFICATION NUMBER

ID#

PREFIX

DATE OF INCORPORATION OR FORMATION STATE OF INCORPORATION OR FORMATION FEDERAL PRINCIPAL BUSINESS CODE

TRADING AS NAME

SECTION I

A. Is any business conducted in Maryland? ___________ Date began: ____________________________

(Yes or No)

B. Nature of business conducted in Maryland:________________________________________________

C. Does the business own, lease or use personal property located in Maryland? ______________ If No, skip SECTION

II.

(Yes or No)

CHECK

ONE

ONLY CORPORATIONS COMPLETE ITEM D

D. Names and addresses of officer and names of directors (type or print):

OFFICERS

Names Addresses

President_____________________________________________ ____________________________________________________

Vice-President ________________________________________ ____________________________________________________

Secretary ____________________________________________ ____________________________________________________

Treasurer ____________________________________________ ____________________________________________________

DIRECTORS

Names Names

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

____________________________________________________ ____________________________________________________

Type or Print Department ID Number Here

ID # PREFIX

Please check here if you want personal property

forms mailed to you next year.

Check here

if this is a

change of

address

Date Received

by Department

INCLUDE DEPARTMENT ID NUMBER ON CHECK

PLEASE STAPLE CHECK HERE

ID # Filing ID # Filing

Type of Business Prefi Fee Type of Business Prefi Fee

Domestic Stock Corporation (D) $300 Domestic Limited Liability Company (W) $300

Foreign Stock Corporation (F) $300 Foreign Limited Liability Company (Z) $300

Domestic Non-Stock Corporation (D) - 0 - Domestic Limited Partnership (M) $300

Foreign Non-Stock Corporation (F) - 0 - Foreign Limited Partnership (P) $300

Foreign Insurance Corporation (F) $300 Domestic Limited Liability Partnership (A) $300

Foreign Interstate Corporation (F) - 0 - Foreign Limited Liability Partnership (E) $300

SDAT Certif ed Family Farm (A,D,M,W) $100 Domestic Statutory Trust (B) $300

Real Estate Investment Trust (D) $300 Foreign Statutory Trust (S) $300

IMPORTANT REMINDERS

• Rules for personal property extensions:

o Internet extension requests are due by April 15

th

and are free of charge. The on-line extension request is available beginning February 1

st

at

www.dat.maryland.gov.

o Paper extension requests (Form AT3-71) are due on or before March 15

th

and require a $20 processing fee for each Department ID Number.

• The annual report filing fee is $300 for most legal entities. Be sure to enclose the correct fee with the Form 1. The check should note the

Department ID Number and be payable to Department of Assessments and Taxation.

• Manufacturing/R&D exemption application must be filed within 6 months after the date of the first assessment notice for the taxable year

that includes the manufacturing personal property. See instruction 11 for more information. A manufacturing exemption cannot

be granted unless a timely application is filed. Once filed, no additional applications are required in subsequent years.

• Entities requesting a revised assessment due to other missed exemptions (vehicles, software, charitable organizations, etc.) must file that request

within three years of the April 15

th

date the return was originally due.

• Do not prepay late filing penalties or pay personal property taxes to this Department.

• Business entities that require a Trader’s License must report commercial inventory in Section II Line Item 2. If commercial inventory is

located in two or more jurisdictions, provide a breakdown for each location.

• This return must be accompanied by Form 4A (Balance Sheet) or latest available balance sheet, and Form 4B (Depreciation Schedule),

unless the business does not own any personal property in Maryland. All information on pages 2 and 3 of this report and supporting schedules are

held confidential by the Department and are not available for public inspection. Page 1 is public record (Tax-Property Article 2-212).

• If you discontinued business prior to January 1

st

, notify the Department in writing prior to the April 15

th

filing deadline, stating to whom and the date

all personal property was sold.

• If the business is sold on or after January 1

st

and before July 1

st

, submit Form AT3-45 (available at www.dat.maryland.gov) along with the

statement of sale, including the value of personal property, date of sale, name and address of the buyer. This must be in our office no later than

October 1

st

of the same year.

• To ensure proper posting to your account, please include your Department ID Number on your return and in all communications with the Department.

• This return must be signed by an officer or principal of the business.

• Place the Department ID Number on page 1.

LATE FILING PENALTY

DO NOT

PAY PENALTIES AT TIME OF FILING RETURN

• A business which files an annual return postmarked after the due date of April 15

th

will receive an initial penalty of 1/10 of one percent of the county

assessment, plus interest at the rate of two percent of the initial penalty amount for each 30 days or part thereof that the return is late.

• Businesses which fail to file this report will receive estimated assessments which will be twice the estimated value of the personal property owned.

20__

Form 1

continued

Page 4 of 4

DATE OF ASSESSMENT NOTIFICATION OFFICE USE ONLY

STANDARD DEPRECIATION RATE

Category A: 10% per annum*

All property not specifically listed below.

SPECIAL DEPRECIATION RATES (The rates below apply only to

the items specifically listed. Use Category A for other assets.)

Category B: 20% per annum*

Mainframe computers originally costing $500,000 or more.

Category C: 20% per annum*

Autos (unlicensed), bowling alley equipment, brain scanners,

carwash equipment, contractor’s heavy equipment (tractors,

bulldozers), fax machines, hotel, motel, hospital and nursing home

furniture and fixtures (room and lobby), MRI equipment, mobile

telephones, model home furnishings, music boxes, outdoor

Christmas decorations, outdoor theatre equipment, photocopy

equipment, radio and T.V. transmitting equipment, rental

pagers, rental soda fountain equipment, self-service laundry

equipment, stevedore equipment, theatre seats, trucks

(unlicensed), vending machines, x-ray equipment.

Category D: 30% per annum**

Data processing equipment, canned software.

Category E: 33 11/3% per annum*

Blinds, carpets, drapes, shades. The following applies to

equipment rental companies only: rental stereo and radio

equipment, rental televisions, rental video cassette recorders and

rental DVDs and video tapes.

Category F: 50% per annum*

Pinball machines, rental tuxedos, rental uniforms, video games.

Category G: 5% per annum*

Boats, ships, vessels, (over 100 feet).

Long-lived assets

Property determined by the Department to have an expected life in

excess of 10 years at the time of acquisition shall be depreciated at

an annual rate as determined by the Department.

* Subject to a minimum assessment of 25% of the original cost.

** Subject to a minimum assessment of 10% of the original cost.

DEPRECIATION RATE CHART FOR PERSONAL PROPERTY

MAILING INSTRUCTIONS

For Initially Filed Returns Use the Address Below:

State of Maryland

Department of Assessments & Taxation

Personal Property Division

PO Box 17052

Baltimore, Maryland 21297-1052

Note: Do not send Certified Mail to this PO Box.

See the box to the right.

Use the Address Below for the Following Items Only:

• US Postal Service Certified Mail

• All overnight delivery service mail

• Amended returns, correspondence, appeals,

applications, etc.

• Late filing penalty payments

State of Maryland

Department of Assessments & Taxation

Personal Property Division

301 W Preston St

Baltimore, Maryland 21201-2395

10/14

_

2015

Form 1

Page 1 of 4

This form was printed from the DAT website.

17