[ ]

_ _ __

_ _ __

_ _ __

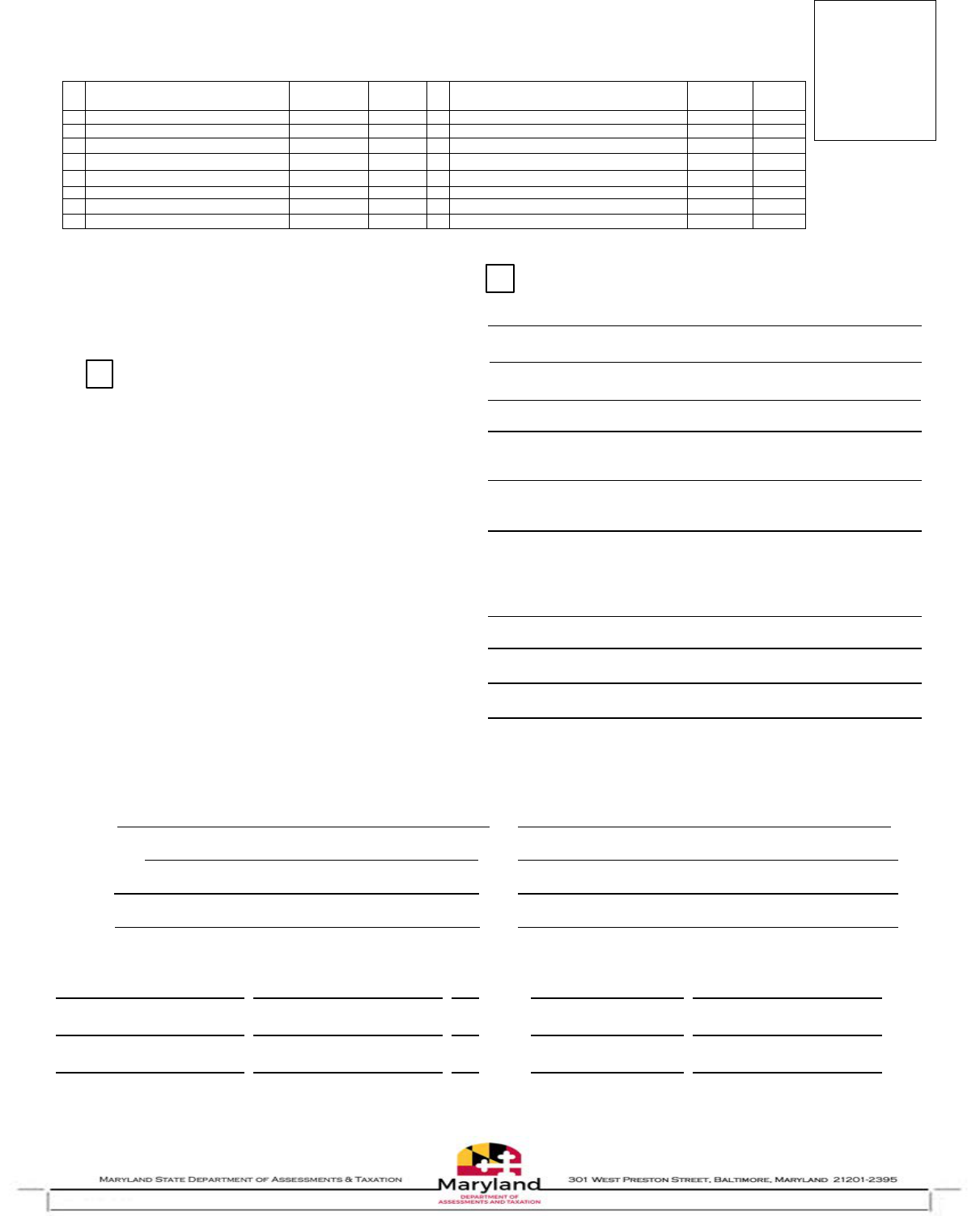

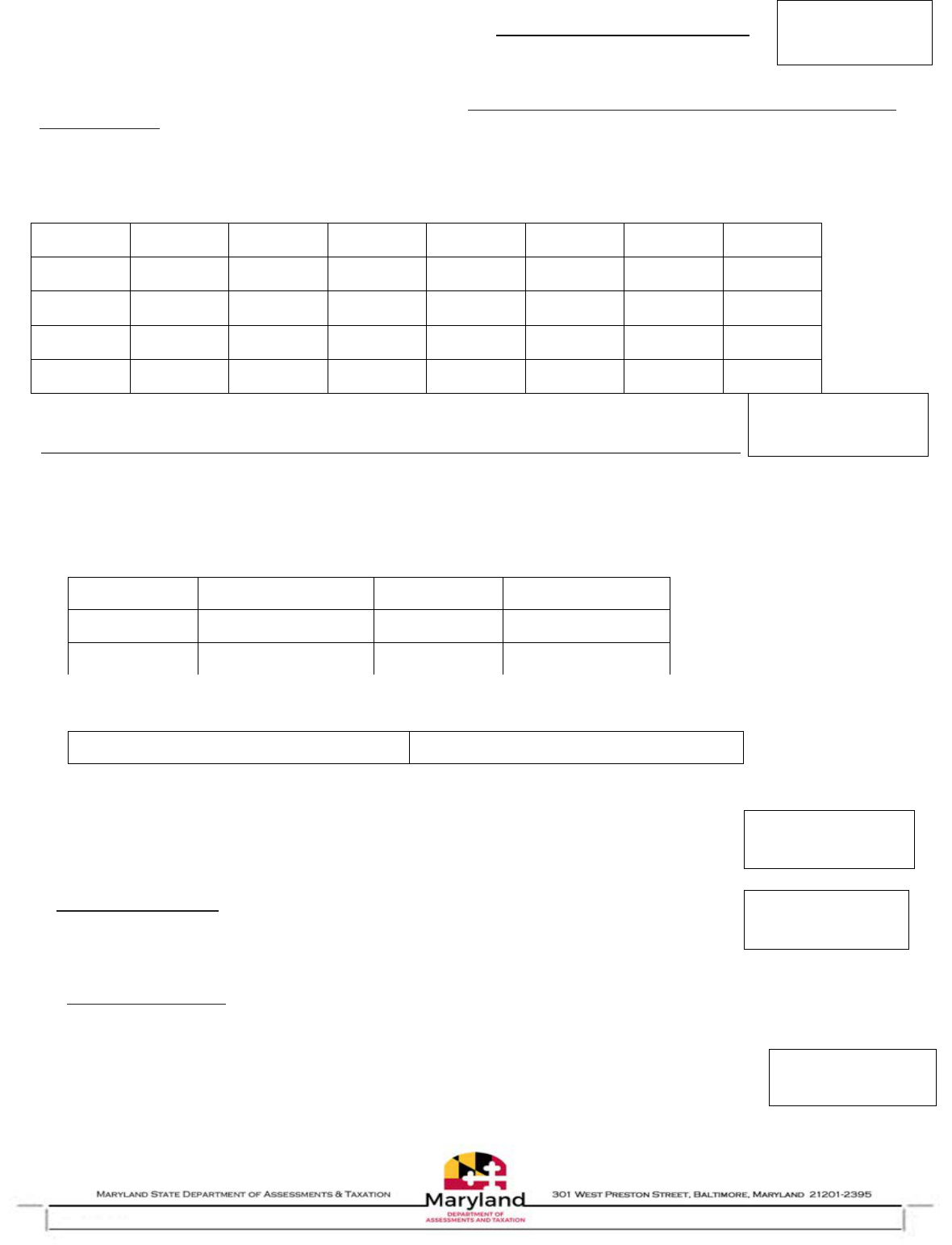

Type of Business

Check one business type below

Dept.ID

Prefix

Filing

Fee

Type of Business

Check one business type below

Dept. ID

Prefix

Filing

Fee

Domestic Stock Corporation

(D)

$300

Domestic Limited Liability Company

(W)

$300

Foreign Stock Corporation

(F)

$300

Foreign Limited Liability Company

(Z)

$300

Domestic Non Stock Corporation

(D)

-0-

Domestic Limited Partnership

(M)

$300

Foreign Non Stock Corporation

(F)

-0-

Foreign Limited Partnership

(P)

$300

Foreign Insurance Corporation

(F)

$300

Domestic Limited Liability Partnership

(A)

$300

Foreign Interstate Corporation

(F)

-0-

Foreign Limited Liability Partnership

(E)

$300

SDAT Certified Family Farm

(A,D,M,W)

$100

Domestic Statutory Trust

(B)

$300

Real Estate Investment Trust

(D)

$300

Foreign Statutory Trust

(S)

$300

SECTION I – ALL BUSINESS ENTITIES COMPLETE

NAME OF BUSINESS

MAILING ADDRESS

Check here if this is a change of mailing address.

PLEASE NOTE: This will not change your principal office address. You

must file a Resolution to Change a Principal OfficeAddress.

DEPARTMENT ID NUMBER

(Letter Prefix followed by 8-digits)

FEDERAL EMPLOYER IDENTIFICATION NUMBER

(9-digit number assigned by the IRS)

FEDERAL PRINCIPAL BUSINESS CODE

(If known, the 6-digit number on file with theIRS)

NATURE OF BUSINESS

TRADING AS NAME

EMAIL ADDRESS

ANNUAL REPORT

MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION

Business Services Unit, P.O. Box 17052, BALTIMORE, MARYLAND 21297-1052

2022

Form 1

Due April 15

th

Date Received

by Department

PLEASE CHECK HERE IF THIS IS AN AMENDED REPORT

Include an email to receive important reminders from the Department of Assessments and Taxation

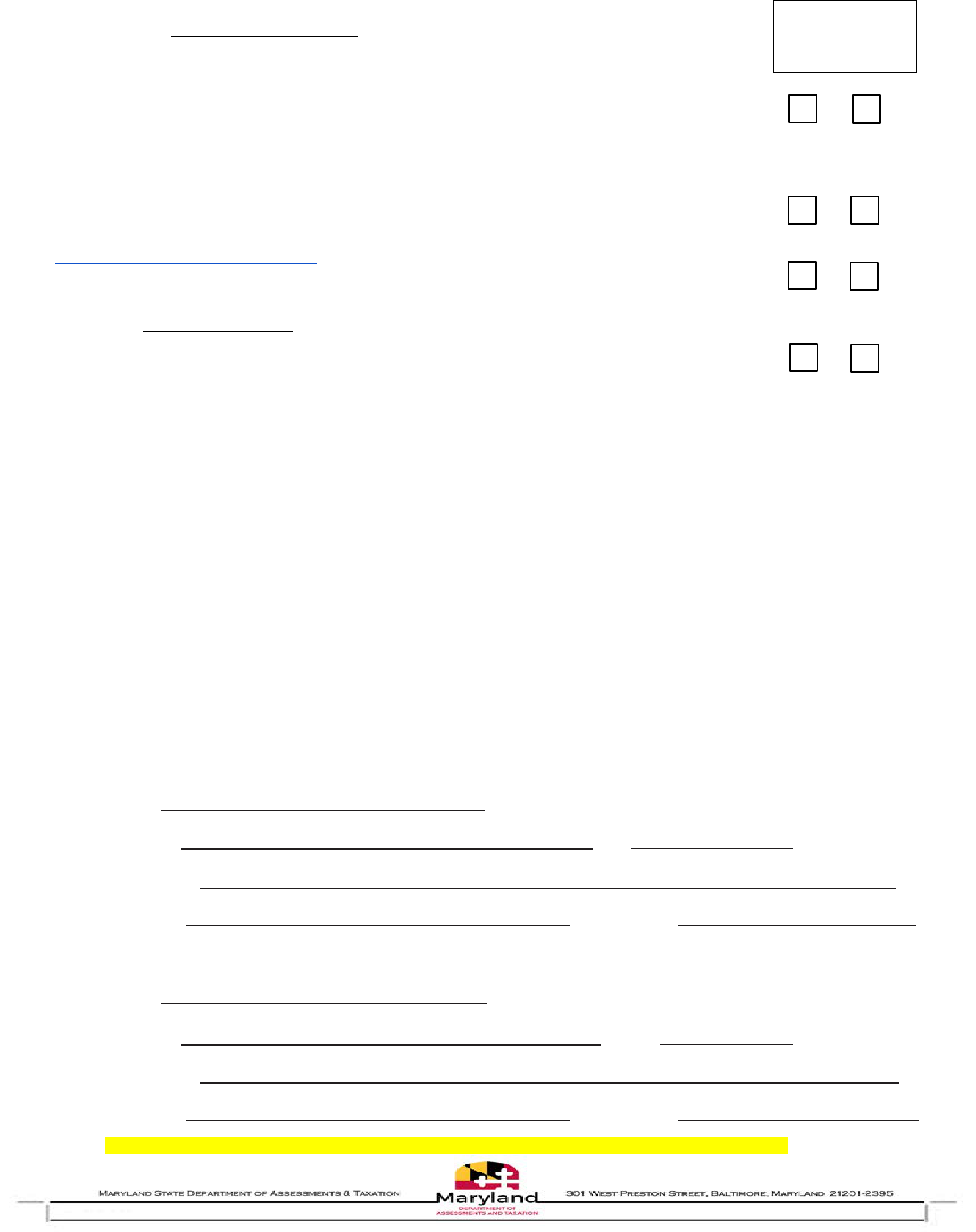

SECTION II - ONLY CORPORATE ENTITIES COMPLETE

A.

Corporate Officers (names and mailing addresses)

President

Vice President

Secretary

Treasurer

B.

Directors (names only)

_ _

_ _

_ _

*Required information for certain corporations, MD Code, Tax Property Article §11-101 - Please see instructions

*Total number of female directors

*

Total number of directors

Page 1 of 6 http://dat.maryland.gov

TPS_Form 1 Annual Report

Page 1 of 6 http://dat.maryland.gov

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

[ ]

Department ID #

2022

Form 1

SECTION III – ALL BUSINESS ENTITIES COMPLETE

Annual Report

A. Does the business own, lease, or use personal property located in Maryland?

Yes No

If you answered yes, but your entity* is exempt, or has been granted an exemption from business

personal property assessment by the Department. DO NOT complete the Personal Property

Tax Return.

For religious groups, charitable or educational organizations, the form SD-1 is optional.

B. Does the business require or maintain a trader’s (retail sales) or other license with a local unit of

Yes No

government?

"If you are unsure of whether this applies to you, please contact your county's Clerk of the Court

at https://www.courts.state.md.us/pia/clerks. Maryland Annotated Code, Business Regulation Article

§17- 1808 allows counties and municipalities to adopt a Uniform Trader's License Fee."

Yes No

C. Did the business have gross sales in Maryland?

If yes, $ total or amount of business transacted in MD.

D. Did the entity dispose, sell, or transfer ALL of its business personal property prior to January 1?

Yes No

If you answered yes, please complete form SD-1. Do not complete the Personal Property Tax Return.

If you answer "Yes" to questions A or B in Section Ill, and are not exempt as described in question A. please complete the

Business Personal Property Tax Return, (Form 1 Sections V through VII) and return it, along with this Annual Report to the

Department. The Personal Property Tax Return and important instructions can be found online at

https://dat.maryland.gov/Pages/sdatforms.aspx#BPP

If you answer "No" to the questions A and B in Section Ill, above you DO NOT need to complete the Personal Property Tax

Return. Please complete Section IV below, sign and return this Annual Report to the Department:

Department of Assessments and Taxation, Business Services Unit

P.O. Box 17052, Baltimore, Maryland 21297-1052

Questions? Contact Charter at 410-767-1340 • 888-246-5941 within Maryland • Email: sdat.charterhelp@maryland.gov

SECTION IV – ALL BUSINESS ENTITIES COMPLETE

By signing this form below, you declare, under the penalty of perjury, and pursuant to Tax-Property Article 1-201 of the

Annotated Code of Maryland, that this Annual Report, including any accompanying forms, schedules, and/or statements, has

been examined by you and, to the best of your knowledge and belief, is a true, correct, and complete Annual Report for the

Entity listed in Section I.

A. Corporate Officer or Principal of Entity:

PRINT NAME

X SIGNATURE DATE

MAILING ADDRESS

EMAIL ADDRESS PHONE NUMBER

B. Firm or Individual, other than taxpayer, preparing this Annual Report/Personal Property Tax Return:

PRINT NAME

X SIGNATURE _ DATE _

MAILING ADDRESS

EMAIL ADDRESS PHONE NUMBER

PLEASE BE SURE TO SIGN THIS ANNUAL REPORT TO AVOID REJECTION BY THE DEPARTMENT!

TPS_Form 1 Annual Report

Page 2 of 6 http://dat.maryland.gov

[

[

_ _ _ _ _

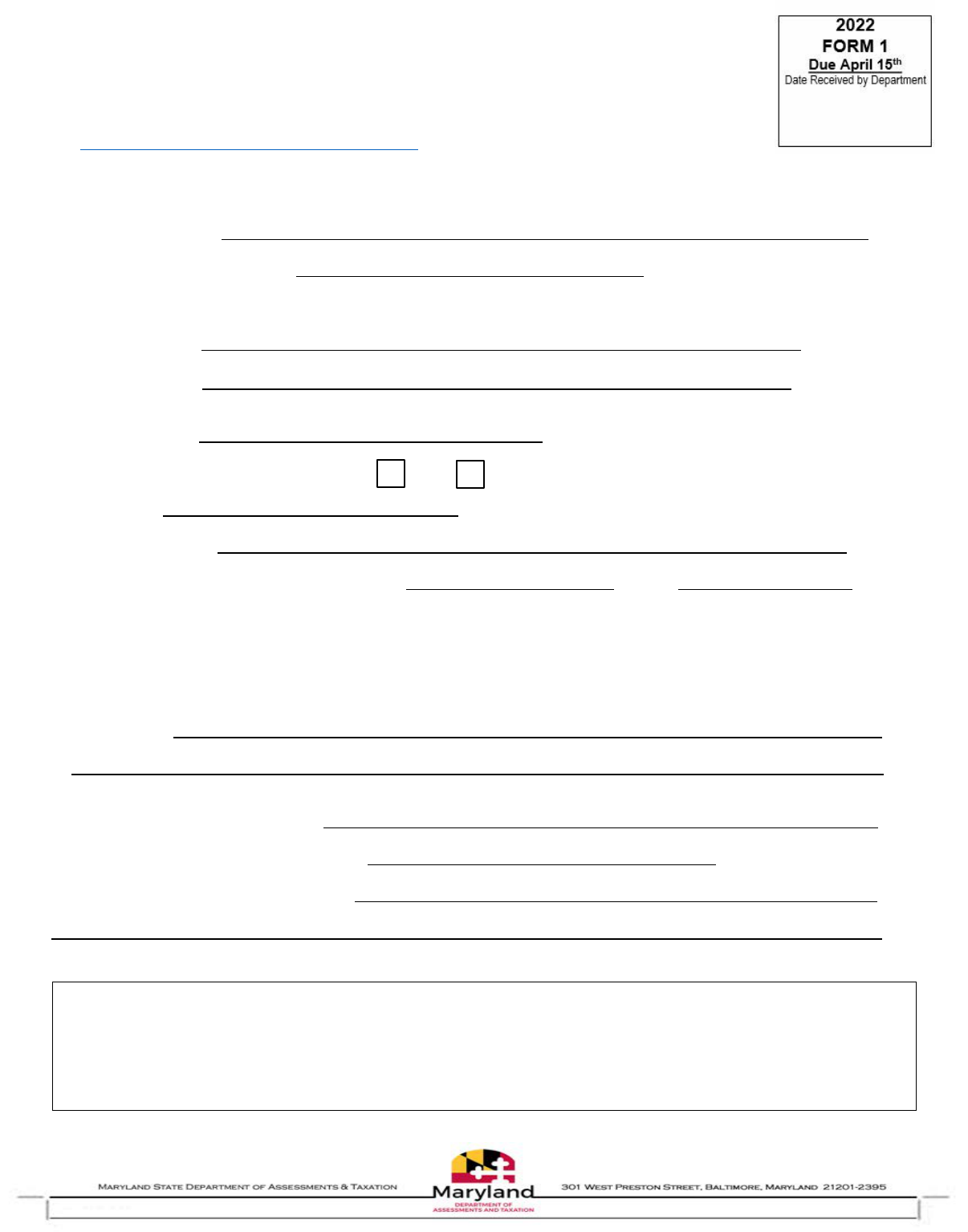

BUSINESS PERSONAL PROPERTY TAX RETURN

MARYLAND STATE DEPARTMENT OF ASSESSMENTS AND TAXATION, TAXPAYER SERVICES DIVISION

P.O. BOX 17052 Baltimore, Maryland 21297-1052; 410-767-1170 • 888-246-5941 within Maryland

NOTE: BEFORE FILLING OUT THIS PERSONAL PROPERTY RETURN MAKE CERTAIN YOU HAVE

COMPLETED THE ANNUAL REPORT. A copy of the Annual Report form can be found online at

https://dat.maryland.gov/Pages/sdatforms.aspx#BPP

2022

FORM 1

Due April 15th

SECTION V - ALL BUSINESS ENTITIES COMPLETE

NAME OF BUSINESS

MD DEPARTMENT ID NUMBER

(Letter prefix and 8 digits)*

*Required to ensure the correct Departmental account is credited

A.

Mailing address

B.

Email address

C.

Is any business conducted in Maryland? Yes No

D.

Date began:

E.

Nature of business:

F.

If business operates on a fiscal year: Start date End date _

G.

Total Gross Sales, or amount of business transacted during prior year in Maryland: $

I

f you report Total Gross Sales in question G of Section V, but do not report any personal property in Section VI, please

explain how business is conducted without using personal property. If the business is using personal property of another

business entity, please provide the name and address of that business entity below.

H.

Explanation:

N

AME OF THE OTHER BUSINESS

MD DEPT. ID OF THE OTHER BUSINESS

LOCATION OF THE OTHER BUSINESS

REMARKS:

TPS_Form 1 Annual Report

Page 3 of 6 http://dat.maryland.gov

[

BUSINESS PERSONAL PROPERTY TAX RETURN OF DEPT ID#_

_

2022

Form 1

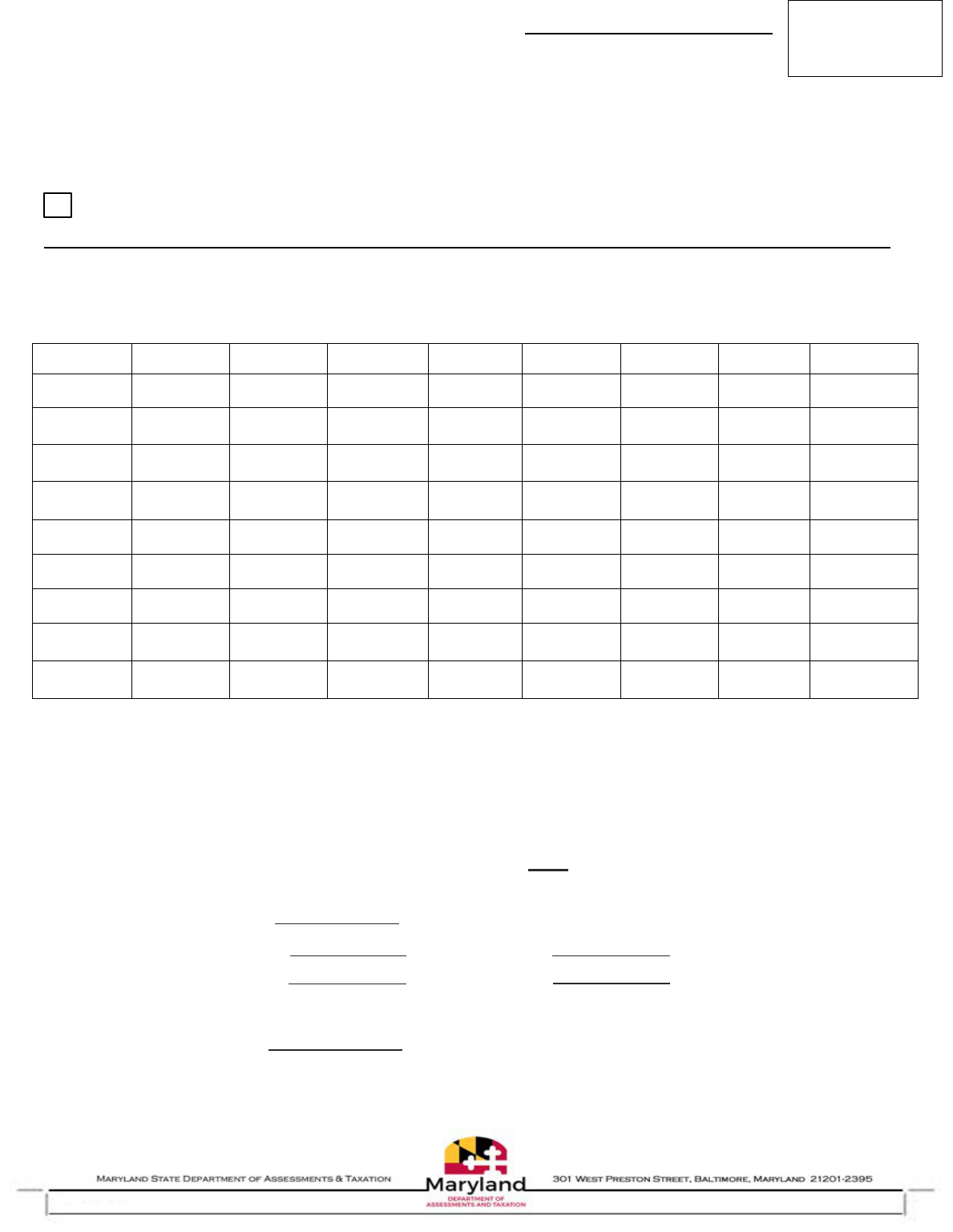

SECTION VI - ALL BUSINESS ENTITIES COMPLETE

A

. PR

OVIDE THE ACTUAL, PHYSICAL LOCATION OF ALL PERSONAL PROPERTY IN MARYLAN

D.

Show the exact physical location(s) of all personal property owned and used in the State of Maryland, including county, city or town,

and street address (PO Boxes are not acceptable). This assures proper distribution of assessments. If property is located in two or

more jurisdictions, provide a breakdown for each location by completing additional copies of Section VI (Pages 2 and 3 of Form 1). For

5 or more locations, please include the information per location in an electronic format (see Form 1 Instructions).

Check here if this is a change of location.

_

Address, include City or Town, County and Zip Code

1.

Please provide the original cost by year of acquisition for any furniture, fixtures, tools, machinery and/or

e

quipment not used for manufacturing or research & development

:

Year Acquired

A

B

C

D

E

F

G

Total Cost

2021

2020

2019

2018

2017

2016

2015

2014 & Prior

Totals

Describe property identified in B - G above: ___________________________________________________________________

2.

Commercial Inventory – Furnish amounts from your most recent Maryland Income Tax Return.

N

ote: Businesses that need a Trader’s License (Retail sales) must report commercial inventory her

e.

Average Monthly Inventory $

Opening Inventory date

Closing Inventory date

_

Amount $

Amount $

3.

Supplies Average Cost

$

4.

Manufacturing and/or Research and Development (R&D) Avg. Monthly Inventory $ ___________________

TP

S_Form 1 Annual Report

Page 4 of 6 http://dat.maryland.gov

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

opert

$$

2022

BUSINESS PERSONAL PROPERTY RETURN OF DEPT ID# _

Form 1

5.

Tools, machinery, and/or equipment used for manufacturing or research and development:

State the original cost of the property by year of acquisition. Include all fully depreciated property and property expensed

unde

r IRS rules. If this business is engaged in manufacturing / R&D, and is claiming such an exemption for the first time

,

a m

anufacturing / R&D exemption application must be submitted by September 1 or within 6 months after the date of th

e

f

irst assessment notice for the taxable year that includes the manufacturing / R&D property. Visit the websit

e

dat

.maryland.gov for an application and additional information. If the property is located in a taxable jurisdiction,

a

det

ailed schedule by depreciation category should be included to take advantage of higher depreciation allowances

.

Year

Acquired

A

C D

Year

Acquired

A

C D

2021

2017

2020

2016

2019

2015

2018

2014 & prior

Describe Property in C & D above:

Total Cost

$

6.

Vehicles with interchangeable Registration and/or Unregistered vehicles: (dealer, recycler, finance company,

sp

ecial mobile equipment, and transporter plates) and unregistered vehicles should be reported here. See specifi

c

i

nstructio

ns

Year Acquired

Original Cost

Year Acquired

Original Cost

2021 2019

2020

2018 & prior

Total Cost

$

7.

Non-farming livestock:

8.

Other personal property:

F

ile separate schedule giving a description of property, original cost and the date of acquisition

.

9.

Property owned by others and used or held by the business or lessee or otherwise:

File separate schedule showing names and addresses of owners, lease number, description of

pr

operty installation date and separate cost in each cas

e.

Book Value $

Market Value $

Total Cost

$

10.

Property owned by the business, used by others

as lessee or otherwise:

File separate schedule showing names and addresses of lessees, lease number, description of property,

i

nstallation date and original cost by year of acquisition for each location. Schedule should grou

p

l

eases by county where the property is located. Manufacturer lessors should submit the retail sellin

g

pr

ice of the property not the manufacturing cost. For additional information regarding separat

e

sch

edules please see Form 1 instructions at https//dat.maryland.

gov

Total Cost

$

Total Cost

$

TPS_Form 1 Annual Report

Page 5 of 6 http://dat.maryland.gov

0

0

[

[

[

[

2022

BUSINESS PERSONAL PROPERTY RETURN OF DEPT ID#

Form 1

SECTION VII

-

ALL BUSINESS ENTITIES COMPLETE

A.

If this is the business’ first Maryland personal property return, state whether or not it succeeds an established business

and

give nam

e:

B.

Does the business own any fully depreciated and/or expensed personal property located in Maryland? Yes No

If yes, is that property reported on this return? Yes No

C.

If the business transfers assets in or out of Maryland, or disposes of assets ($200,000 or more or 50% of the total

pr

operty) during the prior year, complete Form SD-1. For additional details see Form 1 instructions

at

ht

tps//dat.maryland.go

v

X Taxpayer’s Signature/Date Print Name Phone Number & E-mail Address

X Preparer’s Signature/Date Phone Number & Email Address

Name and Address of Preparer

Mail the completed return to:

DEPARTMENT OF ASSESSMENTS AND TAXATION

Business Services Unit

P.O. BOX 17052

Baltimore, Maryland 21297-1052

If you have questions contact the Personal Property Division

Telephone: 410-767-1170,

Toll free within Maryland 888-246-5941

Email: SDAT.PersProp@Maryland.gov

DEPRECIATION RATE CHART FOR PERSONAL PROPERTY

STANDARD DEPRECIATION RATE

Category D: 30% per annum**

Data processing equipment and other computer based equipment,

Category A: 10% per annum*

canned software.

All property not specifically listed below.

Category E: 33 11/3% per annum*

SPECIAL DEPRECIATION RATES

Blinds, carpets, drapes, shades. The following applies to

(The rates below apply only to the items specifically listed. Use

equipment rental companies only: rental stereo and radio

Category A for other assets.) equipment, rental televisions, rental video cassette recorders

and rental DVDs and video tapes.

Category B: 20% per annum*

Mainframe computers originally costing $500,000 or more.

Category F: 50% per annum*

Pinball machines, rental tuxedos, rental uniforms, video

Category C: 20% per annum*

games.

Autos (unlicensed), bowling alley equipment, brain scanners,

carwash equipment, contractor’s heavy equipment (tractors,

Category G: 5% per annum*

bulldozers), fax machines, hotel, motel, hospital and nursing Boats, ships, vessels, (over 100 feet).

home furniture and fixtures (room and lobby), MRI equipment,

mobile telephones, model home furnishings, music boxes, Long-lived assets

outdoor Christmas decorations, outdoor theatre equipment,

Property determined by the Department to have an expected

photocopy equipment, radio and T.V. transmitting equipment,

life in excess of 10 years at the time of acquisition shall be

rental pagers, rental soda fountain equipment, self-service

depreciated at an annual rate as determined by the

laundry equipment, stevedore equipment, theatre seats, trucks

Department.

(unlicensed), vending machines, x-ray equipment.

* Subject to a minimum assessment of 25% of the original cost.

** Subject to a minimum assessment of 10% of the original cost.

TP

S_Form 1 Annual Report

Page 6 of 6 http://dat.maryland.gov