-

INSTRUCTIONS FOR FORM 2

SOLE PROPRIETORSHIP AND GENERAL PARTNERSHIPS

Business Personal Property Tax Return

General Information and Requirements

SDAT Business Personal Property

Maryland State Department of Assessments and Taxation, Business Services Unit

Business Personal Property Division, 301 West Preston Street Room 801, Baltimore Maryland 21201 1052

1)

WHO MUST FILE A RETURN

A Maryland personal property return (Form2) must be filed

by all sole proprietorships and general partnerships if they

possess (own, lease, rent, use or borrow) business personal

property or need a business license. A business which fails to

file this return will likely receive an estimated assessment.

Limited partnerships, limited liability companies and limited

liability partnerships that are registered with the

Department's Charter Division are required to file a Form 1.

2)

WHEN AND WHERE TO FILE

At the beginning of each year, the Department makes the

business personal property return available on its website. It

is the responsibility of the entity to obtain and file the return

on time. The due date for filing is April 15, of filing year.

Should April 15 fall on a weekend, the return will be due on

the Monday immediately following.

The Department encourages all customers to file

through the online portal, Maryland Business

Express (MBE) at

https://egov.maryland.gov/BusinessExpress/

If mailing your return please send to Department of

Assessments and Taxation, Personal Property

Division, P.O. Box 17052, Baltimore, MD 21297-

1052.

Amended returns or second filings are to be sent to

the Department of Assessments and Taxation,

Personal Property Division, 301 W. Preston Street,

Baltimore, MD 21201-2395.

3)

EXTENSION OF TIME TO FILE

The Department may grant a 2 month extension to file the

return.

All preparers and taxpayers with Internet access should use

the Department's website to ensure prompt and accurate

recording of an unlimited number of requests free of charge.

You will receive a confirmation number and a printed list as

proof of your submission. Always print and keep a copy of the

confirmation page. The Department will automatically accept

it as evidence of a valid approved extension in case there is

ever a problem.

You may request a 60 day extension of the filing deadline, at no

cost, by visiting http://pprextensions.dat.maryland.gov/

Extension requests must be made on or before April 15th.

Increased use of this site is anticipated as April 15

th

approaches so the Department suggests you apply for

extensions as soon as the site opens in December.

Please note that Department of Assessments and Taxation

does not accept paper extensions. No additional extension to

file will be allowed after the 2 months. Extensions approved

by the Internal Revenue Service or Maryland Comptroller of

the Treasury for income tax returns will not be accepted.

4)

FORMS

To ensure proper posting to your account always provide the

business name and your Department ID number. Please use

this number in all communications with the Department.

5)

MAILING ADDRESS CHANGES

Make necessary address corrections on the form and check

the address correction box on page 1 of the return.

6)

LATE FILING PENALTIES

A business which files an annual return postmarked after the

due date of April 15 of filing year (or June 15 if an extension is

approved) will receive an initial penalty of 1/10 of one

percent of the county assessment, plus interest at the rate of

two percent of the initial penalty amount for each thirty (30)

days or part thereof that the return is late. If returns are filed

late, you cannot pre-pay penalties at time of filing return.

They will be assessed at a later date.

7)

PERIOD COVERED

All returns shall cover the calendar year regardless of any

fiscal year. All information required in this return shall be

given as of January 1, except line items 2 and 4, which refer

to the twelve calendar months of prior year). There may be

times when supporting detail should be provided with the

return. Please see Form SD1, Supplemental Details.

Information supplied on the return and enclosures are not

open to public inspection.

8)

WHAT MUST BE REPORTED

Generally all tangible personal property owned, leased,

consigned or used by the business and located within the

Form 2 Instructions

Page 1 of 6

State of Maryland on January 1, must be reported. Property

not in use must still be reported. All fully depreciated and

expensed personal property must also be reported. Personal

property includes but is not limited to office and plant

furniture, machinery, equipment, tools, furnishings,

inventory, and all other property not considered part of the

real estate.

Personal property in this State (other than operating property

of railroads and public utilities) falls into two subclasses:

Stock in business or inventory--goods held by a

taxpayer for sale and goods placed on consignment

to another for sale in the expectation of a quick

turnover. Stock in business does not include goods

manufactured by the taxpayer but held by the

taxpayer for purposes other than sale or goods

manufactured by the taxpayer but placed in

possession and control of another as in the case of

leased property. Stock in business is assessed at cost

or market value whichever is lower. LIFO method of

valuation is prohibited.

All other personal property includes all personal

property other than inventory and is assessed at full

cash value. Taxpayers shall report such property

which has been acquired by purchase at cost in the

year of acquisition. Taxpayers shall report such

property which has been acquired other than by

purchase (including property manufactured by the

taxpayer) at what the property would have sold for

in the year of acquisition. To assess "all other

personal property" the Department generally

applies a 10% rate of depreciation per annum to the

reported property. Exceptions to the 10% rate can

be found on the Depreciation Rate Chart. Normally,

property will not be depreciated below 25% of the

original cost.

All questions must be answered in full. If the reporting

taxpayer does not own the class of property covered by any

question, the word "none" or the figure "O” should be

written in the appropriate blank space. Estimated

assessments may be issued when questions remain

unanswered or the answers are incomplete, evasive or

unclear. Real property is not to be reported on the return.

9)

EXEMPTIONS

Property tax exemptions provided by statute shall be strictly

construed. Before an exemption can be obtained the

taxpayer must show affirmatively that the exemption is

clearly allowed.

Businesses may file amended returns to correct reporting

errors or claim missed exemptions (except for missed

manufacturing exemptions) within three years of the April 15

date that the return was originally due.

SDAT Business Personal Property

For manufacturing exemption requests, an application must

be submitted on or before September 1, of the initial

assessment year or within 6 months after the date of the first

assessment notice for the taxable year that includes the

manufacturing personal property in order to qualify for the

current tax year. Section 7-104 of the Tax- Property Article of

the Annotated Code of Maryland has been revised to include

the following subsection (d) that allows the owner of

manufacturing personal property to file an application within

6 months after the date of the first assessment notice for a

taxable year that includes the manufacturing personal

property. If the application is approved, the exemption shall

be granted for the taxable year. The exception to the

September 1 deadline is applicable to taxable years beginning

after June 30, 2009. No manufacturing exemption can be

granted unless a timely application is filed. Once filed, no

additional manufacturing applications are required in

subsequent years. Exemption applications can be found on

the website,

https://dat.maryland.gov/businesses/Pages/Business-

Personal-Property.aspx.

In addition, state law requires that certain types of personal

property be fully exempt throughout Maryland from any

assessment and taxation. These include aircraft, farming

implements, residential (non-business) property, most

registered vehicles, boats not more than 100 feet in length,

customized computer software, intangible personal property

(e.g., stocks, bonds, patents, goodwill, trademarks, etc.).

Businesses owning exempt personal property described

above should report the total cost of that property on Form

SD1, Supporting Detail.

Full or partial exemptions may apply depending on the

location of the property for: manufacturing/R&D machinery

and equipment, manufacturing/R&D inventory and

commercial inventory. Contact the Department's web site for

a complete listing of these exemptions.

The law specifically includes the following activities as part of

the manufacturing process: (1) the identification, design or

genetic engineering of biological materials for research or

manufacture; and (2) the design, development or creation of

computer software for sale, lease or license.

The personal property of certain home-based businesses is

exempt if: 1) it is owned by a sole proprietorship; 2) it is

located at the owner's principal residence; and 3) its total

original cost, including inventory and excluding licensed

vehicles, is less than $10,000. An initial return must be filed

to receive this exemption. Partnerships and other legal

entities are not eligible for this exemption.

Low Assessments Tax Property Article § 7-245 A person's

personal property is not subject to valuation or to property

tax if all of the person's personal property statewide had a

Form 2 Instructions

Page 2 of 6

SDAT Business Personal Property

total original cost less than $2500. This exemption shall take

effect July 1, 2018, and shall be applicable to all taxable years

beginning after December 31, 2018.

ROUNDING

Round cents to the nearest whole dollar. Fifty cents and

above should be rounded to the next highest dollar.

10)

AUDIT OF RETURN

All personal property assessments, and any information and

figures reported on the personal property return,

accompanying schedules and related documents are subject

to audit. As a result of such audits, the Department may issue

corrected assessments.

11)

TRANSFER OF PROPERTY

If a business transfers, sells, or disposes of all personal

property on or after January 1, and before July 1, it must

notify the Department in writing on or before October 1, of

the applicable assessment year. The notification must contain

an itemized description of the property involved, the date

and manner of transfer and name(s) and address of the new

owner(s) of the property, the consideration received, and a

copy of the sales agreement (if available). Upon proper

notification and compliance with Section 10-402 of the Tax

Property Article, the assessment shall be transferred to the

new owner(s). See Form 21.

12)

OUT OF BUSINESS

If a business discontinues operations or goes "out of

business" prior to January 1 of filing year, a return or letter of

explanation detailing the date the business ceased operations

and what happened to the property must be filed. Failure to

provide this information will result in an estimated

assessment being made against the business.

13)

AMENDED RETURNS

Amended returns can be filed to correct reporting errors or

claim a missed exemption (except for missed manufacturing

exemptions see item 9) within 3 years of the April 15 date

that the return was originally filed.

Amended returns must be accompanied by information

explaining why the amended return is being filed and

reconciling the differences with the original return. Write the

word "AMENDED" across the top of page 1 of the return.

14)

TRADER’S LICENSE

Sometimes businesses requiring a trader's license experience

problems in obtaining one. Most of these problems are the

result of one or more of the following five situations:

1)

Failure to file a personal property return (previous year).

2)

Failure to report commercial inventory on the personal

property return (previous year).

3)

Unpaid personal property taxes (previous year).

4)

Unpaid late filing penalty owed toSDAT.

5)

Failure to register with SDAT.

6)

"If you are unsure of whether this applies to you,

SPECIFIC INSTRUCTIONS FOR FORM 2

SOLE PROPRIETORSHIP AND GENERAL PARTNERSHIPS

please contact your county's Clerk of the Court

at https://www.courts.state.md.us/pia/clerks. Maryland

Annotated Code, Business Regulation Article §17-1808

allows counties and municipalities to adopt a Uniform

Trader's License Fee."

Form 2 Instructions

Page 3 of 6

SDAT Business Personal Property

SECTION I

1.

Check one: Sole Proprietorship (one owner) or

General Partnership (two or more owners)

2.

Provide the name of owner orowners.

3.

Provide the complete mailing address for the

business. If this is a new mailing address, check the

box to the left.

4.

Provide the SDAT Department ID number. To

obtain the Department ID, go to Maryland Business

Express,

http://egov.maryland.gov/BusinessExpress/EntitySea

rch The ID number is necessary to ensure proper

credit to the account.

5.

List federal employee ID# (FEIN). If none,

provide social security number of owner.

6.

List federal principal business code. It can be

found on IRS Schedule C or Form 1065.

7.

Provide the nature of business activity in

Maryland(e.g., restaurant, legal services,

construction,etc.)

8.

Total gross sales must include sales in Maryland

and sales by the Maryland location to out of state

purchasers as well as transfers from the Maryland

location of the reporting business to out of state

locations.

SECTION II

A.

Please provide the actual physical location of all

personal property in Maryland. P.O. Boxes are not

acceptable. Indicate if this is a change of location.

Only an individual who owns a business should

answer questions B and C

B.

Answer yes, if the location in number 3

aboveis the principal residence of the

business owner.

C.

Answer yes, if the total original cost of the

property, including inventory and excluding

licensed vehicles, is less than $10,000. If both

questions A and B are answered yes, the business

is exempt from personal property assessment and

taxation. Skip to signature line on page 3.

D.

Indicate whether business owns, uses or

leasesany personal property in Maryland.

E.

Answer yes, if the business requires a license to

operate with any county/town in Maryland.

F.

Indicate whether or not business is

conductedin Maryland. If yes, specify date

began.

G.

If the business operates on a fiscal year, provide

the start/ end dates. If it operates on a calendar

year, you may leave this item blank.

H.

Does the business own or use any property that is

fully depreciated and/or expensed? If yes, is it

reported on this return? If the business owns or uses

this type of property but does not report it on the

return, please comment in remarks section.

Form 2 Instructions

Page 4 of 6

I.

Has the business disposed of or transferred any assets in or

out of Maryland? If yes, please comment in remarks and/or

complete Form SD1 (SupplementalDetails).

SECTION III

LINE ITEM 1

1.

Furniture, fixtures, tools, machinery and equipment not

used for manufacturing or research and development.

Includes but is not limited to office furniture, fixtures and

equipment, factory equipment and machinery, shelves,signs,

counters, etc.

This form allows detailed reporting of property which falls

under the different rates of depreciation. All property is to be

reported under Category A unless specifically listed in

another category.

Refer to the Depreciation Rate Chart to determine where

property owned by the business should be reported (see

sample below). Property reported in columns B through G

requires a detailed description (e.g., Column C - Vending

Machines, Copiers, etc.). Failure to provide the required

detail will result in the reported property being assessed at

10% rate of depreciation.

This property shall be reported at original cost in the year of

acquisition without deduction of depreciation, investment

credit or trade-in of previously owned property. Include all

fully depreciated personal property and property expensed

under IRS Rules.

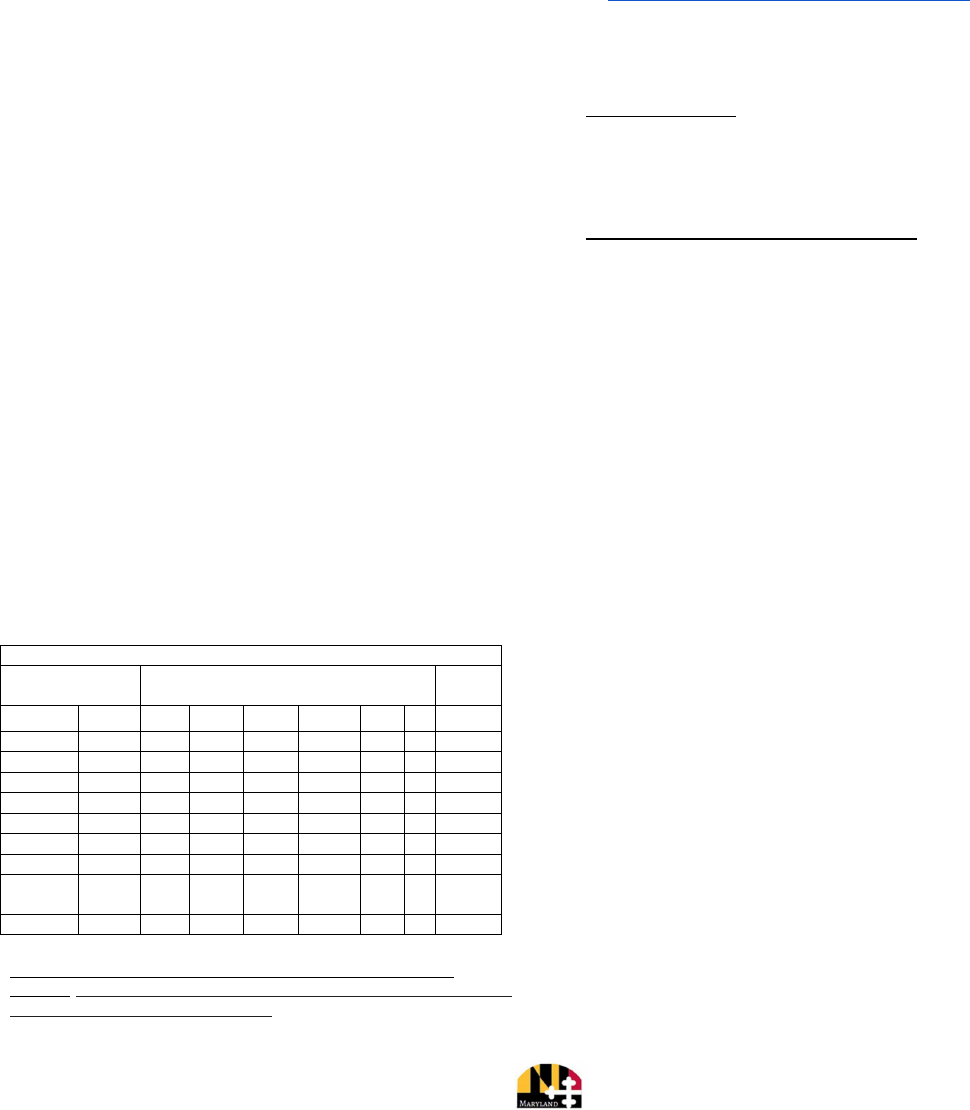

EXAMPLE

Property reported on this line item should be placed under

the proper depreciation rate column by the year of

acquisition. An example of the correct method of filling out

this section is provided for reference. Property reported in

categories B through G require an explanation on the lines

provided below the box. If additional space is needed to show

the necessary detail, attach a supplemental schedule.

ORIGINAL COST BY YEAR OF ACQUISITION

SPECIAL DEPRECIATION RATES B-G (See

chart)

TOTAL

COST

A

B

C

D

E

F

G

2014

2013

1150

12800

13,750

2012

3104

8400

11,504

2011

1500

5261

6,761

2010

2009

2500

2,500

2008

9127

500

9,627

2007 &

prior

Totals

14881

3000

5261

21200

44,142

SDAT Business Personal Property

LINE ITEM 2

Commercial Inventory is merchandise and stock in trade

available for sale. This includes manufactured products sold

at retail by the manufacturer. An average of twelve (12)

monthly inventories should be reported including two (2)

physical inventories. Book inventories may be used for

months when physical inventories were not taken. Values are

to be reported at cost or market value. The LIFO method is

prohibited in computing values. If there are multiple locations

of inventory in Maryland they must be reported by each

location. Businesses that need a Trader's License must

report commercial inventory.

"If you are unsure of whether this applies to you, please

contact your county's Clerk of the Court

at https://www.courts.state.md.us/pia/clerks. Maryland

Annotated Code, Business Regulation Article §17-1808

allows counties and municipalities to adopt a Uniform

Trader's License Fee."

Rental equipment including but not limited to video tapes,

stereos, televisions, tools, appliances and furniture is not

considered commercial inventory. These assets must be

reported in Part B item.

Leased property and off rent equipment are not considered

commercial inventory and should be reported on a separate

schedule showing the names and addresses of lessees, lease

numbers, description of property, installation date and

original cost by year of acquisition for each location. Schedule

should group leases by county where the property is located.

LINE ITEM 3

Supplies. Supplies are consumable items not held for sale

(e.g., contractor's supplies, office supplies, etc.). Report the

average cost.

LINE ITEM 4

Manufacturing/R&D Inventory is raw materials, supplies,

goods in process and finished products used in and resulting

from manufacturing by the business. Include manufactured

products sold at retail by the manufacturer under line item,

commercial inventory. An average of twelve (12) monthly

inventories should be reported including two (2) physical

inventories. Book inventories may be used for months when

physical inventories were not taken. Values are to be

reported at cost or market value. The LIFO method is

prohibited in computing values. If there are multiple locations

of inventory in Maryland they must be reported by each

location.

Describe property identified in B - G above: Category D2011 Personal

Computer;

CategoryE-2012,2013 Rental DVDs and Video Tapes, 2008 Vending Machine;

Category C

- 2009 Copier $2,000, Fax $500

Form 2 Instructions

Page 5 of 6

SDAT Business Personal Property

INFORMATION AND ASSISTANCE

General questions regarding valuation and assessment

procedures : 410-767-1170, Toll Free within Maryland: 1-

888-246-5941 Maryland Relay Service - 1-800-735-2258

TT/VOICE

(Maryland Relay Service for speech and hearing impairment) Email:

Online Services: Filing Extensions, Online Filing & Forms:

https://dat.maryland.gov

Form 2 Instructions

Page 6 of 6

LINE ITEM 5

Tools, machinery and equipment used for

manufacturing or research and development. Answer this

question in detail even though such property may by law or

resolution be exempt. Reporting property on this line item is

not a substitute for a manufacturing application. If exemption

is claimed for the first time, a manufacturing/research &

development exemption application must be submitted on or

before September 1 of filing year before the exemption can

be granted, or within 6 months after the date of the first

assessment notice for the taxable year that includes the

manufacturing personal property in order to qualify for the

current tax year. Section 7-104 of the Tax-Property Article of

the Annotated Code of Maryland has been revised to include

subsection (d) that allows the owner of manufacturing

personal property to file an application within 6 months after

the date of the first assessment notice for a taxable year that

includes the manufacturing personal property. If the

application is approved, the exemption shall be granted for

the taxable year. The exception to the September 1 deadline

is applicable to taxable years beginning after June 30, 2009.

No manufacturing exemption can be granted unless a timely

application is filed. Once filed, no additional manufacturing

applications are required in subsequent years. Contact the

Department or visit our web site at www.dat.maryland.gov to

obtain an application. This property shall be reported at

original cost in the year of acquisition without deduction of

depreciation, investment credit or trade-in of previously

owned property. Include all fully depreciated personal

property and property expensed under IRS rules.

For manufacturing the primary test for exemption requires

substantially transforming, or a substantial step in the

process of substantially transforming tangible personal

property into a new and different article by use of labor or

machinery. The term manufacturing does not include

products mainly intellectual, artistic or clerical in nature,

services, public utility services, or property used primarily in

administration, management, sales, storage, shipping,

receiving or any other non-manufacturing activity.

Research and development means basic and applied research

in the sciences and engineering, and the design, development

and governmentally required pre-market testing of

prototypes, products, and processes. Research and

development activities are exempt whether or not the

company has a product for sale.

The following activities do not constitute research and

development: market research; research in social sciences,

psychology, or other nontechnical activities; routine product

testing; service activities; sales; or research and development

of a public utility.

6.

Vehicles: Itemize motor vehicles with Interchangeable

Registrations and vehicles that are unregistered (unlicensed).

Vehicles registered in Maryland and classified A-P are

exempt

SDAT Business Personal Property

and should not be reported on the Personal Property Tax

return. Vehicles registered outside Maryland may also be

exempt. Exempt vehicles include those registered in another

taxing jurisdiction and of a classification (A-P) described in

Title 13, Subtitle 9, Part II of the Maryland Transportation

Article.

Interchangeable Registrations include: dealer plates (Class

1A, 1B, 1C); recycler plates (Class 2); finance company plates

(Class 3); special mobile equipment plates (Class 4); and

transporter plates (Class 5).

This property shall be reported at original cost in the year of

acquisition without deduction or depreciation, investment

credit, or trade-in of previously owned property. Include all

fully depreciated personal property and property expensed

under IRS rules.

Motor vehicles with Interchangeable Registrations and

unregistered/unlicensed vehicles are not exempt and will be

assessed as Category C property at 20% depreciation per

annum (subject to a minimum assessment of 25% of the

original cost).

7.

Non-farming Livestock: Report book value andmarket

value.

8.

Other Tangible Personal Property: Include other tangible

personal property not reported elsewhere on this return.

Report total cost on the return and supply a separate

schedule including a description, the original acquisition cost,

and the date of acquisition of the property. Please see

additional instruction under Other Personal Property

Assessment Exemptions.

9.

Property Owned by Others and Used or Held by the

Business: All property that is not owned by the businessbut

is held by the business as lessee, on consignment, or

otherwise must be reported.

File separate schedule showing names and addresses

of owners, lease number, description of property,

installation date and separate cost in each cost.

10.

Property Owned by the Business and Used or Held by

Others: All property that is owned by the business but is

held by others as consignee, lessee or otherwise must be

reported.

All leased property must be reported, including

manufacturing equipment, and property leased to taxexempt

organizations.

Manufacturer lessors shall report property which has been

acquired other than by purchase at the retail selling price in

the year the property was manufactured (including property

manufactured by a business for its own use). Manufacturing

lessors may not report this property using the cost of

manufacture.

Form 2 Instructions

Page 7 of 6

SDAT Business Personal Property

A separate schedule showing the names and addresses of

lessees, lease numbers, description of property, installation

date and original cost by year of acquisition for each

location must be supplied. Provide the physical street

address of lessees. Post Office Box numbers are not

acceptable.

Excel schedules of leasing data may be submitted.

Verify that the entity name and ID number are

prominent on the schedule. Schedule may be filed

electronically and submitted to

sdat.persprop@maryland.gov

SIGNATURE AND DATE

The return must be signed by an owner or partner. This

signature must be an original not a copy. The date should

reflect the date the return was signed by the owner or

partner and sent to the Department. Please include

requested phone number and E-mail address to assist us in

resolving potential discrepancies.

DEPRECIATION RATE CHART

STANDARD DEPRECIATION RATE

Category A: 10% per annum*

All property not specifically listed below.

SPECIAL DEPRECIATION RATES (The rates below apply only to the items specifically listed. Use Category A for other assets.)

Category B: 20% per annum*

Mainframe computers originally costing $500,000 or more.

Category C: 20% per annum*

Autos (unlicensed), bowling alley equipment, brain scanners, car wash equipment, contractor's heavy equipment (tractors,

bulldozers), fax machines, hotel, motel, hospital and nursing home furniture and fixtures (room and lobby), MRI equipment,

mobile telephones, model home furnishings, music boxes, outdoor Christmas decorations, outdoor theatre equipment,

photocopy equipment, radio and T.V. transmitting equipment, rental pagers, rental soda fountain equipment, self-service

laundry equipment, stevedore equipment, theatre seats, trucks (unlicensed), vending machines, x-ray equipment.

Category D: 30% per annum**

Data processing equipment and other computer based equipment, canned software.

Category E: 331I3% per annum*

Blinds, carpets, drapes, shades. The following applies to equipment rental companies only: rental stereo and radio

equipment, rental televisions, rental video cassette recorders and rental DVDs and video tapes.

Category F: 50% per annum*

Pinball machines, rental tuxedos, rental uniforms, video games.

Category G: 5% per annum*

Boats, ships, vessels, (over 100 feet).

Long-lived assets

Property determined by the Department to have an expected life in excess of 10 years at the time of acquisition shall be

depreciated at an annual rate as determined by the Department.

* Subject to a minimum assessment of 25% of the original cost.

** Subject to a minimum assessment of 10% of the original cost.

Form 2 Instructions

Page 8 of 6